STI >3,600

pharoah88 ( Date: 08-Mar-2010 16:32) Posted:

|

STI 2900

iPunter ( Date: 06-Mar-2010 17:07) Posted:

|

Last update: 08-03-2010 16:01

Hang Seng Index 21196.87 +408.90 +1.97%

http://www.hsi.com.hk/HSI-Net/HSI-Net

| Symbol | Name | Last Trade | Change | Related Info |

|---|---|---|---|---|

| ^AORD | All Ordinaries | N/A | 0.00 (0.00%) | Components, Chart, More |

| ^SSEC | Shanghai Composite | 3,053.23 |

Chart, More | |

| ^HSI | Hang Seng | 21,196.87 |

Components, Chart, More | |

| ^BSESN | BSE 30 | 17,116.43 |

Chart, More | |

| ^JKSE | Jakarta Composite | 2,617.53 |

Components, Chart, More | |

| ^KLSE | KLSE Composite | 1,323.96 |

Components, Chart, More | |

| ^N225 | Nikkei 225 | 10,585.92 |

Chart, More | |

| ^NZ50 | NZSE 50 | 3,222.81 |

Components, Chart, More | |

| ^STI | Straits Times | 2,834.19 |

Components, Chart, More | |

| ^KS11 | Seoul Composite | 1,660.04 |

Components, Chart, More | |

| ^TWII | Taiwan Weighted | 7,762.27 |

Chart |

STI 2825 now! (^_^ ) (^_^ ) (^_^ )

Hahaha...

Read more, lose more... hehehe...

Blastoff ( Date: 05-Mar-2010 22:02) Posted:

|

Stocks set for rally at open

By CNNMoney.com staffMarch 5, 2010: 8:44 AM ETNEW YORK (CNNMoney.com) -- U.S. stocks were poised for early gains Friday, as investors reacted to the government's better-than-expected employment report.

Dow Jones industrial average, S&P 500 and Nasdaq 100 futures were higher, doubling their gains following the employment report.

Futures measure current index values against perceived future performance and can offer an indication of how markets will open when trading begins in New York.

Wall Street finished Thursday's session higher, but trading was choppy as investors took a wait-and-see attitude before the monthly jobs report.

U.S. futures were trading higher even before the employment report was released. Philip Isherwood, equities strategist at Evolution Securities in London, said prior to the report that U.S. futures were trading higher on expectations of good news concerning the job market, their confidence fueled by Thursday's report that unemployment claims were on the decline.

"Initial claims yesterday afternoon [London time] suggested that it may not be as bad as people thought," he said.

Isherwood also said futures were benefiting from signs of stability in Europe, as the European Union worked towards forging a rescue package with Greece.

"Some of that political risk, in terms of markets, has been eased," he said.

Jobs: The Labor Department announced that the economy lost 36,000 jobs in February and the unemployment rate was unchanged at 9.7%.

A consensus of economists surveyed by Briefing.com had expected the report to show the economy lost 63,000 jobs last month and for the unemployment rate to tick higher to 9.8%.

On Thursday, the House amended a $15 billion Senate bill before passing it, once again delaying efforts to pass legislation to spur job creation. The amendments mean the Senate must again approve the bill if President Obama is to sign it into law. The Senate won't take up the legislation again until next week.

World markets: European markets rose in midday trading. Britain's FTSE 100 and Germany's DAX rose 0.4% and France's CAC 40 gained 0.7%.

Asian shares ended the session with gains. Japan's Nikkei surged 2.2% and the Hang Seng in Hong Kong rallied 1%.

Cash and bonds: The dollar was higher against the yen, the euro and the pound.

Gold and oil: The price of gold fell $1.30 per ounce to $1,131.80. The price of oil rose 93 cents a barrel to $81.13.

Asia unlikely to face sovereign debt issues can safely spend to spur recovery

By Desmond Wong, Channel NewsAsia | Posted: 05 March 2010 1942 hrs

|

||||||

City skyscrapers in Singapore (file pic) |

||||||

SINGAPORE: Asia is unlikely to face the sovereign debt difficulties seen in Europe. According to analysts, countries in this region can be expected to continue spending in order to support the economic recovery.

With GDP growth for the region expected to rise, they said Asian economies will have a sizeable buffer to support fiscal stimulus.

The fiscal troubles of Greece have put the spotlight on runaway government spending.

But observers said Asian countries are unlikely to face the problem of an unsustainable sovereign debt.

This, despite massive stimulus measures by governments in the region to prop up the economy even for countries with high debt ratios.

P.K. Basu, chief economist, Research Department, Daiwa Capital Markets Singapore, said: "In Japan for instance, there is a great amount of public debt. Public debt to GDP ratio is about 170 per cent. But all of it is owed to Japanese lenders and therefore is not going to cause a sovereign debt crisis."

They note that in comparison, Greece owes money to external debtors which cannot be rolled over through issuance of more currency without permission from the European Central Bank.

Experts added that Asian economies have the advantage of growth potential to offset any government spending.

Bernard Lee, visiting associate professor (Practices), SMU, Sim Kee Boon Institute for Financial Economics, said: "In Asia, this is still one region where we are seeing the creation and accumulation of wealth, India which is still very much a growth country. It has a pool of engineering talent, especially in software, and its foreign reserves are at about 10 per cent of its GDP."

With seven of the top ten economies hosting the largest foreign reserves China, Japan, Taiwan, India, South Korea, Hong Kong and Singapore situated in Asia, experts said the region also has a substantial fiscal buffer.

And observers said the big question now is not how Asian governments manage their finances but how economies can be restructured to take into compensate for the slow growth in consumer Western economies.

China and India stand as clear alternatives but must be cultivated carefully to maximise their limited consumer capacities. - CNA/vm

niuyear ( Date: 05-Mar-2010 10:28) Posted:

|

""The number of Americans filing new claims for unemployment fell to 469,000 last week from a revised 498,000 the previous week. Economists surveyed by Briefing.com thought claims would fall to 470,000. ""

P/s - Amercian got problem with their maths is it? Every week unemployment number either increase or decrease, dunno how to count properly. We are just a number in their palms. :)

STI commencing of MACRO RALLY on MARCH onward!

tradersgx ( Date: 05-Mar-2010 09:16) Posted:

|

STI 2784.00 now , if +16, may Breakout 2800 today! (", )

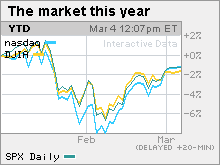

Dow positive for 2010

by Alexandra Twin, senior writerMarch 4, 2010: 4:18 PM ETNEW YORK (CNNMoney.com) -- Stocks ended a volatile session higher Thursday as investors welcomed improved retail sales and a report showing the pace of job losses is slowing, ahead of Friday's big government employment report.

The Dow Jones industrial average (INDU) gained 47 points, or 0.5%, according to early tallies. The S&P 500 index (SPX) added 4 points or 0.4% and the Nasdaq composite (COMP) gained 11 points or 0.5%.

The strong dollar dragged on dollar-traded commodities as well as on shares of companies that do a lot of business overseas, and therefore benefit from a weaker dollar.

Wall Street ended little changed Wednesday as investors remained cautious over the jobs outlook and the strength of the recovery. That caution remained in place Thursday.

"We had some good news this morning with the jobs numbers and the retail sales, but I think the market is really waiting for tomorrow," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

The government releases the February jobs report before the start of trading Friday. The payrolls number is expected to show that employers cut 65,000 jobs in February, after cutting 20,000 in the previous month. The unemployment rate, generated by a separate survey, is expected to have risen to 9.8% from 9.7% in the previous month.

"Unless the actual payrolls number is way off base, you're not going to see a big stock market reaction beyond the early morning," said Kiddoo.

But the report overall is key for the direction of the stock market beyond just Friday's session, he said, as investors look for signs that an economic recovery has legs.

Jobs: Ahead of Friday's big non-farm payrolls report, investors digested the government's weekly tallies.

The number of Americans filing new claims for unemployment fell to 469,000 last week from a revised 498,000 the previous week. Economists surveyed by Briefing.com thought claims would fall to 470,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4.5 million from a revised 4.634 million in the previous week. Economists thought claims would only drop to 4.6 million.

On Wednesday, reports from payroll services firm ADP and outplacement firm Challenger, Gray & Christmas showed the pace of job cuts is slowing as the labor market begins to stabilize.

Home sales slump: The January pending home sales index plunged 7.6% -- far worse than expected -- as brutal storms on the east coast kept potential buyers on the sidelines.

The report from the National Association of Realtors was a surprise to economists, who were expecting sales to rise 1%, on average, after rising a revised 0.8% in December.

Retail sales rise: Despite massive snow storms, shoppers picked up the pace in February, boosting total retail sales by 4%, according to sales tracker Thomson Reuters.

It was the sixth month in a row that same-store sales rose and the best monthly gains since November 2007, a month before the official start of the recession. Same-store sales is a retail industry metric that refers to sales that have been open for a year or more.

Among the standouts, clothing chain Abercrombie & Fitch (ANF) reported that same-store sales rose 5% versus forecasts for a decline of 6.1%. Shares rallied 14%.

Factory orders: Factory orders climbed 1.7% in January, just shy of forecasts for a rise of 1.8%, the Commerce Department reported. Orders rose a revised 1.5% in the previous month.

Citigroup: Company CEO Vikram Pandit thanked taxpayers for the $45 billion in aid his company received during the height of the financial crisis, as part of his testimony before a Congressional panel. Citi (C, Fortune 500) shares gained 2%.

World Markets: In overseas trading, European markets were little changed after the European Central Bank held its benchmark interest rate steady at 1% and the Bank of England held its rate steady at 0.5%. Both decisions were in line with expectations.

The London FTSE and the German DAX were barely changed and the French CAC 40 gained 0.1%.

Asian markets ended lower, although the Japanese Nikkei rose 0.3%.

The dollar and commodities: The dollar gained versus the euro and the yen, pressuring dollar-traded commodities.

U.S. light crude oil for April delivery fell 66 cents to settle at $80.21 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery lost $11.30 to settle at $1,132.60 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.60% from 3.61% late Wednesday. Treasury prices and yields move in opposite directions.

U.S. initial jobless claims fall 29,000 to 469,000

WASHINGTON (MarketWatch) - The number of people filing for initial unemployment benefits declined by 29,000 in the week ending Feb. 27 to a seasonally adjusted 469,000, the Labor Department reported Thursday. Initial claims had risen sharply the previous two weeks, in part because of administrative backlogs, extreme weather and the holiday. The four-week average of initial claims - a better gauge of the trend than the volatile weekly number - fell by 3,500 to 470,750. The number of people receiving regular state jobless benefits declined by 134,000 to a seasonally adjusted 4.5 million. The total number of people receiving benefits of any kind rose by 145,000 to 11.5 million, not seasonally adjusted

Weak open seen for stocks

By CNNMoney.com staffMarch 4, 2010: 7:21 AM ETNEW YORK (CNNMoney.com) -- U.S. stocks were expected to open lower Thursday as investors brace for key employment data.

Dow Jones industrial average, S&P 500 and Nasdaq 100 futures were slightly lower.

Futures measure current index values against perceived future performance and can offer an indication of how markets will open when trading begins in New York.

U.S. stocks posted mild losses Wednesday. The major indexes gave up gains as investors expressed uncertainty about the economic outlook.

Mark Luschini, chief investment strategist for Janney Montgomery Scott, said that investors are "sitting on their hands in anticipation" of the monthly payrolls report, due on Friday.

"I think the tomorrow's jobs report is going to give some direction as to which way the market may break," he said. "Yesterday's ADP report, which showed modest job losses, is going to whet investors' appetite for what tomorrow's figures will look like."

As for Thursday, Luschini said the weekly jobless report will offer investors a taste of what to expect from payrolls, and will be the prime factor in influencing trading.

Economy: A report on weekly jobless claims is scheduled for release at 8:30 a.m. ET. Initial jobless claims are expected to have totaled 470,000 in the week ended Feb. 27, according to a Briefing,com consensus of economists' forecasts. That would be down from the prior week's 495,000.

Individual retailers were releasing their February sales reports, giving investors the latest look at the health of consumer spending.

After the bell, the government is also due to issue reports on monthly factory orders and pending home sales for January. Factory orders are expected to have increased by 1.8% and pending home sales are forecast to increase by 1%, according to the Briefing.com consensus.

Companies: Citigroup (C, Fortune 500) CEO Vikram Pandit will testify before the Congressional panel charged with overseeing the government's bank bailout.

World markets: European markets were lower at midday after the Bank of England kept interest rates at historic lows. Asian stocks tumbled, as Japan's Nikkei lost 1% and the Hang Seng in Hong Kong shed 1.4%.

Cash and bonds: The dollar rose against the euro and the pound but slipped versus the yen. The price of the 10-year note dropped, pushing up the yield to 3.61%.

Oil and gold: The price of oil edged up 13 cents to $81 a barrel. The price of gold dipped $3 an ounce to $1,140.30.

iT iS very NiCE tO kEEp these repOrts here fOr cOntinuOus reference.

Thanks