Post Reply

81-100 of 170

Post Reply

81-100 of 170

mine vested @ 0.075 since Jan....long way to recovery

Today higher volume is a good sign.

Being impatient. I have vested 200 lots @ 0.05. Hehe.....

Pray hard that the return will be rewarding on the long term basis. Cross my fingers..

yet another disappointing day for me ! but never give up ! Try again tomorrow, till I get it at 0.045 before it U-TURN ok.call me if u want to sell ok, we can do it offline.

| MAP Tech |

Symbol:

CU7 |

Currency:

Singapore Dollar |

| Last: |

0.045 |

No Change |

Vol (K): 461.0 |

| Trading |

| Updated Time |

23-Mar 12:04 |

| Open |

0.045 |

High |

0.045 |

Low |

0.045 |

| Prev Close |

0.045 |

Buy |

- |

Sell |

- |

| Volume(K) |

461.0 |

Buy Vol(K) |

- |

Sell Vol(K) |

- |

| 52 Wk High |

0.27 |

52 Wk Low |

0.04 |

52 Wk Avg Vol |

4358.645 |

| All Time High |

0.72 |

All Time Low |

0.04 |

|

|

| Comments |

Near 52 wk low |

*Reporting Currency in USD

Important: ShareJunction obtains our finance data from a third party. Check financial year before use. EPS values are recorded up to two decimal points.

| Financials |

| Date Updated |

26 Feb 2010 |

Financial Year |

31 Dec 2008 |

Current Year Profit

(After Tax) $'000,000 |

8.998 |

Previous Year Profit

(After Tax) $'000,000 |

9.033 |

| Net Asset Per Share |

0.03 |

Turnover $'000,000 |

164.95 |

Current Year EPS

(After Interest and Tax) |

0.0 |

Previous Year EPS

(After Interest and Tax) |

0.0 |

| PE Ratio (After Tax) |

0.0 |

Times Covered |

0.0 |

| Price (at update time) |

0.045 |

Dividend Yield |

0.4 |

*Technical Analysis Information is updated Daily

| Technicals |

| RSI |

43.87 |

Williams %R |

-50.0 |

| Comments (RSI) |

No Info |

Comments (W%R) |

No Info |

i am patiently waiting to collect at 0.045 !!! why no one selling to me, pls !!!

sorry, not sure. techcomp not under my radar. expect movement on map soon as Q1 result out end apr. just watch out...

HOW does MAPTech cOmpare tO TECHCOMP ?

cheapest and one of best bets among the tech ctrs, broadway, etc.

thanks for sharing. start accummulating now !!! and get ready for rally...

yes, have to be patience on this one.

If things turn up well, it maybe a multi-baggers.

this counter need to hold long

| MAP TECH: Riding on biomedical boom (not just HDD) |

|

|

| Written by Sim Kih |

| Sunday, 07 March 2010 |

MOST INVESTORS know MAP Tech to be a HDD recovery play whose key customer is global giant Western Digital, but there is an unnoticed gem in its stable of component making units – its plastic injection-molding factory (MAP Plastics) in Singapore.

Using its precision manufacturing techology, MAP Plastics is riding on the growth in Singapore’s burgeoning biomedical sciences sector.

Last year, Singapore’s bio-medical manufacturing output increased 11.5% year-on-year.

Singapore’s medical technology manufacturing output in 2008 was close to S$3 billion, and the Economic Development Board is targeting to increase this to S$5 billion by 2015.

Strong demand is why capacity utilization at MAP Plastics is as high as 85% even after its latest million-dollar clean room was completed in December last year.

MAP Plastics senior manager Tommy Ong, 50, has first-hand experience in the technical aspects of his business and brings practical insights now into marketing. Photo by Leong Chan Teik

The Singapore operation now operates a total of 57 injection moulding machines, and designs and fabricates about 150 molds a year.

Its operations in Suzhou serves mobile phone, display optics and electronic industries, but the focus is changing to the biomedical sector.

The trend of manufacturers moving to China to cut cost is reversing: there are those moving factories back to Singapore, according to the managing director of MAP Plastics, Mr Loy Chit See, when NextInsight visited the factory.

These are usually high tech companies who have encountered difficulties in China in protecting their intellectual property rights and quality.

From test tube caps, cannular wings to surgical drills, MAP Plastics' components are used in a myriad of medical operations. Photo by Sim Kih

Global leaders that have set up manufacturing, R&D and headquarters function in Singapore include Applied Biosystems (AB), Affymetrix, Alcon, Baxter International, Becton Dickinson, Bio-Rad, Ciba Vision, Thermo Fisher Scientific, Fluidigm, Edwards Lifesciences, Hoya Healthcare, Hill-Rom, Illumina, Qiagen, Japan Medical Supply (JMS), Medtronic and Siemens Medical Instruments.

Other component makers that support both consumer electronics that are also supporting the medical sector, include Fischer Tech, Beyonics and Medtecs.

MAP Plastics was part of a stable of plastic injection-molding factories bought by MAP Technology in Aug 2008 as part of its strategy to diversify out of precision stamping and die cutting for the HDD sector.

Unlike the cyclical consumer electronics industry, the medical device sector is highly defensive and stable, said Mr Tommy Ong, senior manager of MAP Plastics.

Product life cycle is extremely long – as high as 20 to 30 years. This is due to the high reliance by physicians on data documenting the efficacy of a specific medical device.

Microplates made by Map Plastics (above) are high precision plastic devices in hot demand due to the current interest in protein research. Photo by Sim Kih

In contrast, the life cycle of consumer electronic gadgets such as hand phones could be as short as 12-18 months.

Other than diversification, the plastic injection-molding business is also better margin-wise – FY08 margins were 16.5%, compared to consolidated segment margins of 7.7%, according to MAP's annual report.

MAP Plastics contributed $14 million in revenues for FY09, or 9% of the group's revenue.

MAP Tech generated group revenues of US$157.2 million for FY09 and a net loss of US$24.3 million.

The loss arose mainly from once-off matters such as an impairment of goodwill when it closed down a factory in Malaysia (making components for printers) from its plastic injection molding acquisition.

MAP Plastics was acquired from Jurong Tech in 2H08.

|

It all depend on their foresight on this stock.

Different ppl think differently.

look like someone not able to hold long.

HDD PLAYERS had a tough time in the earlier part of 2009, but the sector has been recovering.

My loading, i'm still holding onto it.

The coming 1st qtr financial results (this year) from Maptech maybe better. And that makes me hold on to it.

That my opinion n i maybe wrong. Anyway judge by yourself.

| MAP TECH: Challenging FY09 dents P&L |

|

|

| Written by Sim Kih |

| Friday, 19 February 2010 |

HDD PLAYERS had a tough time in the earlier part of 2009, but the sector has been showing recovery.

To HDD component maker MAP Tech, the difficult year 2009 is a time for thorough write offs and provisions, and the company looks forward to a fresh start in 2010.

The group generated operational profits of US$1.6 million during 4Q09, but reversed an outstanding tax credit arising from the provision of doubtful trade debt. This resulted in the bottom line loss of US$2.3 million.

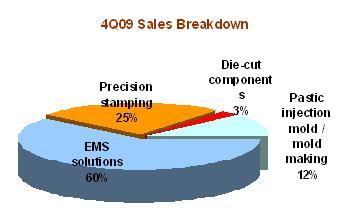

Precision stamping sales doubled to US$11.5 million (up 94.1%) in Q4, but group revenues declined by 5.3% to US$45.7 million mainly due to a contraction in EMS solutions and plastic injection molding sales, which fell 20.5% and 14.9% respectively.

The decline in revenue from EMS solution division was largely due to changes in EMS product mix and a high base arising from the one-off LCD business in 4Q08.

The decline in revenue from plastic injection molding division mainly arose from the cessation of its Malaysian operations due to the relocation of its major customer.

Gross margin declined 0.9 of a percentage point (4Q2009: 10.5%; 4Q2008: 11.4%).

General, administration and other expenses increased by 68% to US$1.9 million, mainly due to the impairment of fixed assets and full redemption of outstanding operating lease liabilities relating to the Malaysian plant which had ceased operations.

Additional provision was also made in respect of trade debts arising from past transactions entered into with Jurong Technologies, which is under judicial management.

Cash and cash equivalents were a healthy US$30.9 million as at 31 December 2009.

This includes US$5.0 million from the company’s recent rights issue exercise, intended for diversification, mergers and acquisitions.

The stock last closed at 5 cents.

MAP last closed at 5 cents.

MAP 4Q09 sales segment breakdown.

|

I sold all my holding, real loss of about Sgd. 250K, switching to others penny stock, which I have paper loss of about 600K!

kennethkkl27 ( Date: 23-Feb-2010 16:55) Posted:

BUY? HOLD? SELL?

|

|

This is REAL SELLING and NOT an ABORPTION INDUCTION.

jackjames ( Date: 23-Feb-2010 16:46) Posted:

| 16:37:31 |

0.045 |

1,243,000 |

Sell Down |

| 16:37:19 |

0.045 |

1,371,000 |

Sell Down |

| 16:37:17 |

0.045 |

800,000 |

Sell Down |

| 16:37:17 |

0.045 |

250,000 |

Sell Down |

| 16:37:16 |

0.045 |

500,000 |

Sell Down |

| 16:37:15 |

0.045 |

500,000 |

Sell Down |

| 16:37:13 |

0.045 |

5,318,000 |

Sell Down |

| 16:35:34 |

0.045 |

4,000,000 |

Sell Down |

waaa..... 0.04 coming ? |

|