Oil and Gas: Looking beyond the volatility

By Low Pei Han

YTD, the FTSE Oil and Gas index has generally tracked the broader market, though there have been instances of a divergence in performance. Besides the exploration and production segment garnering more investor interest, we are increasingly positive on the OSV segment, while prospects of the rig market remain bright, underpinned by the sustained high oil price environment. Still, the relatively high-beta O& G sector is very much sensitive to macroeconomic events. The possibility of increasing capital flows from Asia to the US remains, and investors may want to look beyond the short term volatility and focus on the positive longer-term growth prospects of the sector. Maintain Overweight with a one-year horizon, with Ezion Holdings [BUY, FV: S$2.90], Keppel Corp [BUY, FV: S$12.53] and Sembcorp Marine [BUY, FV: S$5.64] as our preferred picks. For investors seeking less volatility in terms of earnings but with O& G exposure, Sembcorp Industries [BUY, FV: S$6.48] is a worthy candidate.

Broader sector in-line with divergent individual stock performance

In the latest results season, companies in the sector reported mostly in-line results, with some disappointing the market. The exploration and production (E& P) sector has garnered more investor interest, but it is imperative that the companies deliver in terms of value to shareholders going forward, or the interest in this sub-sector may start to dwindle.

Increasingly positive on the OSV segment rig market remains strong

Looking ahead, we are increasingly positive on the offshore support vessel segment, which has seen improving charter rates and vessel utilisation levels. The rig market remains strong in terms of demand for high spec rigs, as reflected by the firm day rates and healthy enquiry levels. Activity in the sector as a whole will be underpinned by the sustained high oil price environment.

Volatility due to macroeconomic events focus on longer-term prospects

Despite robust industry fundamentals, the relatively high-beta oil and gas sector is very much sensitive to macroeconomic news. As a cyclical sector, it also remains vulnerable to concerns of a recession or liquidity squeezes. However, the sector would also be among the first to benefit should there be clearer signs of the global economy finding its footing. The possibility of increasing capital flows away from Asia to the US remains a concern and investors may want to look beyond short term volatility and focus on the positive longer-term growth prospects of the oil and gas sector. MaintainOverweight with a one-year horizon.

Preferred picks

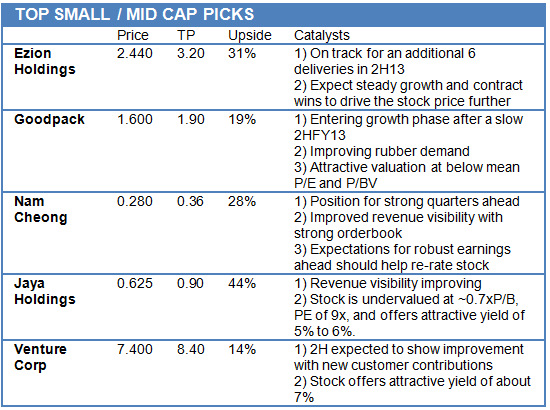

We look for companies with promising earnings growth and visibility, and sufficient financial strength to weather near term headwinds, given the still-fragile state of the global economy. These would include Ezion Holdings [BUY, FV: S$2.90], Keppel Corp [BUY, FV: S$12.53] and Sembcorp Marine [BUY, FV: S$5.64]. For investors seeking less volatility in terms of earnings but with exposure to the oil and gas sector, Sembcorp Industries [BUY, FV: S$6.48] would be a worthy candidate.

analyst ( Date: 18-Jul-2013 11:04) Posted:

|

this stock bo liao leiiiiiiiii, only secure small $ contract must request for trading halt ...sigh

if secure $ 1 bil contract must request for suspension lor ?

M1 very steady.

stay a short while only below 3.20.

iluvboost ( Date: 21-Aug-2013 18:29) Posted:

|

Ezion wins $62.7 mil contract to provide service rig

Offshore services company Ezion Holdings has won a contract to provide a service rig for an oil major to support its oil and gas activities in the Middle East.

The charter deal is worth about US$49.1 million ($62.7 million) over four years, said Ezion.

To fulfil the contract, Ezion said it will form a joint venture with Kim Seng Holdings through its subsidiary, Scott & English, to acquire and own the service rig.

The project will be funded through internal resources and bank loans.

The rig is expected to be deployed to the Middle East around the middle of next year after its refurbishment and upgrading, Ezion said.

...last: $2.24...

GorgeousOng ( Date: 21-Aug-2013 18:18) Posted:

|

iluvboost ( Date: 21-Aug-2013 11:58) Posted:

|

Hi Gorgeous , be careful if 238 breaks. its the last strong support.

Ezion is marked by cfd shortists, if the treasury rates continue go up , high geared companies will fall the most.

(PS: i never short)

GorgeousOng ( Date: 20-Aug-2013 15:09) Posted:

|

DBS Vickers:

I just went to have my cheese cake n coffee.......come back......so fast got shoot down......

GorgeousOng ( Date: 12-Aug-2013 13:52) Posted:

|

Dear Friends,

We did mentioned in our previous article covering this stock that we need to pay attention to the momentum of the stock after it drops. The momentum will tell us how strong the stock is.

Our last article on Ezion titled:

< Singapore Stock Tip: Ezion- The mark of a good stock is one that comes back up strongly after a few days weakness>

http://www.danielloh.com/2013/07/singapore-stock-tip-ezion-mark-of-good.html

We mentioned that we set the 2nd target price of $2.45-$2.50 for short to mid term play. Today it reached our target and we are liquidating our position as we feel there might be a short term resistance in this region.

Once it consolidates, we shall see again. If it goes up, let it be.

For those who have not entered, you are late on the bus, avoid going in.

Regards

Daniel

www.danielloh.com

Ezion's 2Q13 recurring net profit rose 90% y-o-y and 28% qo-

q to US$36.2m, driven by contributions of additional

liftboats and jackups, as well as offshore logistics vessels with

the commencement of the three LNG projects in Australia.

Bottomline is ahead of our expectation of c.US$30m. The

outperformance came from better than expected margins

and JV income, as well as higher other income from

management fees for vessels under JV. We will fine tune our

numbers after results briefing this morning to factor in the

stronger performance, and also higher interest expense in the

light of management's move to swap to fixed rate. Maintain

BUY.

Ezion is also proposing a bonus issue of new shares on the

basis of one (1) new share for every five (5) existing shares

held.

do not alert shortists yah!

broadfeet ( Date: 07-Aug-2013 09:29) Posted:

|