aiyo sg mkt beri boh been tsui leh

MARKET HIGHLIGHTS AHEAD: UOB

? This is the Thanksgiving holiday week (Thursday, 28 Nov) in the US so the US financial markets are likely to be a bit quiet especially after Wednesday but it will be a big week for US retailers with Black Friday looming. (Note that Black Friday is the Friday following Thanksgiving Day in the US, often regarded as the beginning of the Christmas shopping season.)

? Key data event this week in Asia is Bank of Thailand?s rate decision on Wed afternoon, which is expected to stay unchanged at 2.5%. Other than that, three sets of 3Q GDP reports will be out in Asia, including Philippines on Thur morning. On Fri, Taiwan will be reporting on its final reading at 5pm and India?s will be out at 8pm.

? This is the Thanksgiving holiday week (Thursday, 28 Nov) in the US so the US financial markets are likely to be a bit quiet especially after Wednesday but it will be a big week for US retailers with Black Friday looming. (Note that Black Friday is the Friday following Thanksgiving Day in the US, often regarded as the beginning of the Christmas shopping season.)

? Key data event this week in Asia is Bank of Thailand?s rate decision on Wed afternoon, which is expected to stay unchanged at 2.5%. Other than that, three sets of 3Q GDP reports will be out in Asia, including Philippines on Thur morning. On Fri, Taiwan will be reporting on its final reading at 5pm and India?s will be out at 8pm.

STI OUTLOOK: DBS VICKERS

STI ? 3150 support despite last week?s decline, 3290 view intact but delayed beyond this year-end

The current relative underperformance in the STI could be due to South-East Asian equities falling out of favour among investors as this region is seen as having a higher risk when the FED starts to taper QE. The penny stocks rout over the past 2 months and the year end lull period provides a further drag....

But we continue to see the prospect of the index higher towards 3290 despite STI?s 29pt decline last week. The likelihood of this happening though looks to be delayed beyond the year-end lull period.

The short-term support levels for the index are 3150 and 3100. With the STI currently trading closer to 13.12x (-0.5SD) FY14F PE at c.3100, GDP forecasted to improve next, there is not much more that the STI can dip if the rest of the world continues to stay firm. Unless global equities slip into a correction, we expect the first support level at 3150 to hold.

STI ? 3150 support despite last week?s decline, 3290 view intact but delayed beyond this year-end

The current relative underperformance in the STI could be due to South-East Asian equities falling out of favour among investors as this region is seen as having a higher risk when the FED starts to taper QE. The penny stocks rout over the past 2 months and the year end lull period provides a further drag....

But we continue to see the prospect of the index higher towards 3290 despite STI?s 29pt decline last week. The likelihood of this happening though looks to be delayed beyond the year-end lull period.

The short-term support levels for the index are 3150 and 3100. With the STI currently trading closer to 13.12x (-0.5SD) FY14F PE at c.3100, GDP forecasted to improve next, there is not much more that the STI can dip if the rest of the world continues to stay firm. Unless global equities slip into a correction, we expect the first support level at 3150 to hold.

It is the fact that small cap counters can be manipulated and it is nothing new. It can be both ways " up" and " down" so swing with the news and now being push " down" when many will come join to push those stocks in " news" down... so can this be right too ?? !!

I have few friend that used them will ask them to terminate their services.... i believed PAP will give us an answer ....the act by goldman has destroyed our sg market sentiment.... goldman has to be punished....

Octavia ( Date: 24-Nov-2013 14:25) Posted:

|

Wall Street-Fighter enjoying Green Huat Kueh dinner with family.

If you guys think that you have any lead that cause the trio px to collapse,by all means send an email with your supporting evidence to MAS/SGX or to the NE director Ng.Yr whinning here will not change anything or help the broader market.

risktaker ( Date: 23-Nov-2013 18:07) Posted:

|

STI lebeng wan. The 3 stooges pain not over yet. BBs all run road liao.

tanglinboy ( Date: 24-Nov-2013 10:47) Posted:

|

Next week chiong! Dow above 16,000

Emmm....CEO Pan, when can I have my big big bonus ler? I did quite well right?

Cheers!!!

Peter_Pan ( Date: 23-Nov-2013 20:56) Posted:

|

Wall Street-Fighter simply luvs our Green Huat Kueh...we are running out of stocks soon...Chinatown Street not much left to makan...jin tao tiar...

Fck off la goldman knn...... ur big but ur terrible...

Octavia ( Date: 23-Nov-2013 15:51) Posted:

|

Einhorn: " Fed Policy Is A Headwind To The Economy"

http://www.zerohedge.com/news/2013-11-21/einhorn-fed-policy-headwind-economy

Goldman Sachs?s Top Ten Macro Themes for 2014

Horse year is a bad year for stock market. Goat year will be better.

risktaker ( Date: 22-Nov-2013 11:12) Posted:

|

I don't know what to say.......... Lol

https://www.youtube.com/watch?v=NUgn-Kzgkxw

risktaker ( Date: 22-Nov-2013 11:12) Posted:

|

Dow Caps Longest Winning Streak Since 2011 on Jobs, Retail Sales

Click the chart for more data on this year's bull market.

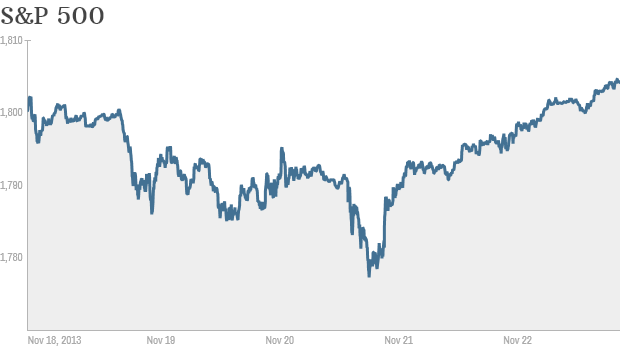

U.S. stocks rose for a seventh week, sending the Dow Jones Industrial Average (INDU) to the longest stretch of gains in almost three years, as improved data on employment and retail sales offset concern over a cut in monetary stimulus.

SThe Dow and S& P 500 both ended higher for a seventh week. The Nasdaq posted its third consecutive weekly gain. The Standard & Poor?s 500 Index (SPX) added 0.4 percent to a record 1,804.76 over the five days, extending its longest weekly advance since February. The Dow climbed 103.07 points, or 0.7 percent, to 16,064.77.

Since January, the Dow has climbed by 22%, the S& P 500 is up by 26% and the Nasdaq has soared by 31%.

The surge is thanks in large part to the massive stimulus program administered by the Fed, which has supported the economic recovery with monthly bond purchases.

Related: Fear & Greed Index remains in Greed territory

With stock prices at such lofty levels, some investors say the market is becoming too expensive and the risk of a sell-off is increasing.

" When valuations start to get stretched, that's when we get nervous," said Wasif Latif, vice president of equity investments at USAA Investments. " This thing can go on for a while, but we're becoming more cautious."

The S& P 500 is now trading at 15 times earnings estimates for the next 12 months. That's up from a level of about 12 at the beginning of the year and is just above the market's long-term average. tocks rose further into record territory Friday, as expectations that the Federal Reserve will keep buying bonds for the foreseeable future offset concerns the market is overheating.

?The big change to me looking at this week is just the change in sentiment,? Daniel Genter, who oversees about $4.3 billion as president and chief executive officer of Los Angeles-based RNC Genter Capital Management, said in a telephone interview. ?More and more people are discounting that the potential tapering is not going to totally derail this market. There is life after tapering.?

Stocks Rebound

Equities slipped during the first three days of the week as minutes from a Federal Reserve meeting indicated the central bank may reduce monetary stimulus in coming months. Stocks rebounded over the next two sessions, with the Dow closing above 16,000 for the first time, as data showed weekly jobless claims fell to the lowest level since September. Retail sales increased 0.4 percent in October, the most in three months, according to a Commerce Department report.

Four out of five investors expect the Fed to delay a decision to begin reducing its bond buying until March 2014 or later, according to the Bloomberg Global Poll of investors, traders and analysts who are subscribers. Just 5 percent are looking for a move at its Dec. 17-18 meeting, the Nov. 19 poll showed.

Three rounds of Fed bond purchases have helped push the S& P 500 up 167 percent from a bear-market low in 2009. The benchmark gauge for American equities is up 26.5 percent this year, poised for the best annual gain since 1998, and is trading for about 17 times its companies? reported earnings.

While the valuation reached the highest level since May 2010, it?s still below the multiples at the market?s two previous peaks, when the ratio reached 17.5 in October 2007 and 31 in March 2000, data compiled by Bloomberg show.

?Fairly Valued?

?The market is fairly valued,? RNC?s Genter said. ?With slow growth and minimal P/E expansion, earnings will be the focus and earnings are good and will carry us for another year.?

Profits for S& P 500 companies will grow 9.9 percent in 2014, up from a 4.8 percent increase this year, analysts? estimates compiled by Bloomberg show.

World Markets

North and South American markets finished higher today with shares in Mexico leading the region. The IPC is up 0.99% while U.S.'s S& P 500 is up 0.50% and Brazil's Bovespa is up 0.21%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

| Dow Jones Industrial Average | United States | +54.78 | +0.34% | 16,064.77 | 4:35pm ET |

| S& P 500 Index | United States | +8.91 | +0.50% | 1,804.76 | 4:35pm ET |

| Brazil Bovespa Stock Index | Brazil | +112.72 | +0.21% | 52,800.74 | 6:00pm ET |

| Canada S& P/TSX 60 | Canada | -0.02 | -0.00% | 777.49 | 4:19pm ET |

| Santiago Index IPSA | Chile | +17.30 | +0.55% | 3,168.72 | 3:11pm ET |

| IPC | Mexico | +403.46 | +0.99% | 41,199.02 | 6:06pm ET |

Short sell orders executed on 22 November 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131122.txt

Buying-in Executed on 22 November 2013

http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/

borrow securities 22 November 2013

https://www1.cdp.sgx.com/scdcint/sbl/viewLendingPool.do#