GP Hotels

Global Premium Hotels - GPH - (SGX Code: P9J)

Post Reply

81-100 of 155

Post Reply

81-100 of 155

Global Premium Hotels

UOBKayhian on 25 Jan 2013

Valuation

· We initiate coverage on Global Premium Hotels (GPH) with a BUY recommendation and a target price of S$0.34, pegged to our dividend discounted cashflow model (DDM). Currently, the stock is trading at 14.2x 2012F consensus earnings with a dividend yield of 5.5%.

Investment Highlights

· Buoyant tourism to drive hotels demandSingapore experienced

a strong growth in tourist arrivals and tourism receipts between 2004

and 2011, registering a CAGR of 6.8% and 12.4% respectively. This was

driven by new attractions such as the Integrated Resorts (IR), F1 Grand

Prix and major MICE events. We have assumed tourist arrivals CAGR at 6%

in 2013-15. For the longer term, the Singapore Tourism Board (STB) has

set a tourist visitor arrival goal of 17m and tourism receipts of S$30b

by 2015. This is likely to drive demand for hotel rooms.

· LCC carrier to bring in a new segment of tourists Low-cost carriers (LCC) have gained much popularity in Singapore and

we expect these airlines to bring in a new group of budget travellers,

in particular from neighbouring countries such asMalaysia and Indonesia.

We think GPH’s portfolio of economic hotels will also complement the

sector and cater to budget travelers in the region.

· Resilient portfolio with strong track record.We

view that the economy-tier hotels are more resilient in any downturn.

For example, during the global financial crisis, we saw average room

rate and occupancy levels decline 22.3% and 10% respectively to S$191

per night and 77%, as travellers became more cost-conscious in terms of

accommodation. GPH’s group of hotels’ average room rates only declined

18.6% to S$87.50, outperforming the general market in 2009.

Financial Highlights

· GPH’s

net profit after tax grew at a CAGR of 11.9% over 2008-11 to S$22.6m in

2011 as the group added Fragrance Hotel-Bugis, Royal in 2010, and Parc

Sovereign and Fragrance Hotel- Riverside in 2011. We expect GPH to

report a net profit of S$19.9m in 2013, backed largely by improvement in

average room rates and occupancy rates, but eroded by higher interest

expenses.

Risks

· Largely dependent on the Singapore hospitality industry As

GPH runs a chain of hotels, financial performance will be dependent on

demand of rooms and the average occupancy rate. Some of the risks

pertaining to the hospitality sector mainly include changes in the

domestic, regional and global economies, environmental conditions and

viral epidemics threat of terrorism and natural disasters etc.

· High debt financing for its hotels The

current net debt to equity remains high at 1.42X with interest cover at

4.7X. As GPH is able to obtain bank financing secured by its

properties, interest rates remain low ranging from 2-3% p.a.. However,

any increase in the interest rate and interest payment is likely to

erode their profits. We estimate that a 0.5 ppt rise in interest rate

will reduce profit by 10%. However, we do expect any rate increase till

2015.

you see.. wahaha CANT GO UP.. FAKE signal.

5k lots Q @ 0.26 for sell, and few thousand lots Q @ 0.25. mostly Buyers and sellers were done at 0.255 since few weeks ago.

I think want to break 0.26 will be very hard the next few days. and on tuesday vol up 17,500k highest hit 0.265. Now back

to normal.

edwinjup ( Date: 23-Jan-2013 13:28) Posted:

| Bought some .gp.hotel.today..mainly due to it belong to koh family...they always know how to rewards shareholder..look.at maxi cash..fragrance group..etc...result.out end of the month..hope for one cent.dividen .at least...mid term.investment..now.belong.ipo .price |

|

Bought some .gp.hotel.today..mainly due to it belong to koh family...they always know how to rewards shareholder..look.at maxi cash..fragrance group..etc...result.out end of the month..hope for one cent.dividen .at least...mid term.investment..now.belong.ipo .price

FV is so close to closing price... r u sure this is good investment?

tonylim ( Date: 24-Nov-2012 10:54) Posted:

Personally I think hotels business will thrive in Singapore. So investing in hotel shares like Fragrance, Roxy etc should be good and safe bet

sanuks ( Date: 24-Nov-2012 10:43) Posted:

Global Premium Hotels: Maintain FV of S$0.29

By Sarah Ong

Fri, 9 Nov 2012, 10:22:33 SGT

Global Premium Hotels (GPH) registered 3Q12

results that were below our expectations. 3Q12 revenue increased by 8.1%

YoY to S$14.9m. EBITDA margin fell 6.6 ppt to 59.8% (excluding one-off

expenses of S$0.5m for 3Q12). 9M12 EPS of 1.34 S cents equaled 72% of

our prior FY12F estimate of 1.87 S cents, which we now lower to 1.75 S

cents. GPH has begun construction of its new mid-tier Parc Sovereign

Hotel located at Tyrwhitt Road in Aug 2012. An independent valuer has

estimated a gross development value S$150m, implying a potential fair

value gain of S$42m. We have incorporated the Tyrwhitt site development

into our RNAV model. We maintain our fair value of S$0.29 (using a 10%

discount to RNAV) and a BUY rating. GPH intends to distribute at least

80% of net profit after tax for FY12 we estimate an attractive FY12F

dividend yield of 5.8%. Lowering our FY12F EPS estimate

Global

Premium Hotels (GPH) registered 3Q12 results that were below our

expectations. 3Q12 revenue increased by 8.1% YoY to S$14.9m. Gross

profit margin declined 1.7 ppt versus 3Q11 to 86.6%. EBITDA margin fell

6.6 ppt to 59.8% (excluding one-off expenses of S$0.5m for 3Q12). 9M12

EPS of 1.34 S cents equaled 72% of our prior FY12F estimate of 1.87 S

cents, which we now lower to 1.75 S cents.

Admin. and finance expenses climb

Hotel

room revenue increased by S$1.4m or 10.5% YoY. There was a contribution

of S$1.7m from hotels that opened in 2011 (Parc Sovereign, Fragrance

Riverside and Fragrance Elegance) or underwent upgrades in 2011

(Fragrance Emerald). These were partially offset by lower room revenue

at Fragrance Ruby which is temporarily closed for asset enhancement.

Ruby is expected to launch on 1 Dec with first-of-a-kind facilities for

an economy-tier hotel, e.g. free Wi-Fi and Smart TV. Administrative

expenses rose by S$2.0m, or 52% YoY, chiefly due to general increase in

wages and additional staff needed for Riverside and Elegance. 3Q12

finance costs climbed S$1.6m, or 228% versus 3Q11. This was mainly due

to the drawdown of S$453.5m in term loans in 1H12 for partial payment of

the purchase consideration in connection with the 2Q12 IPO.

Started construction at Tyrwhitt

GPH

has begun construction of its new mid-tier Parc Sovereign Hotel located

at Tyrwhitt Road in Aug. The 265-room hotel situated on a freehold land

will become GPH's largest hotel, increasing the portfolio by 15% to

2,003 rooms. An independent valuer has estimated a gross development

value S$150m, implying a potential fair value gain of S$42m.

Maintain BUY

We

have incorporated the Tyrwhitt site development into our RNAV model. We

maintain our fair value of S$0.29 (using a 10% discount to RNAV) and a BUY

rating. GPH intends to distribute at least 80% of net profit after tax

for FY12 we estimate an attractive FY12F dividend yield of 5.8%.

|

|

|

|

Source: SGX

Global Premium Hotels Limited wishes to announce that the Company will release its

unaudited financial results for its full year ended 31 December 2012 on 31 January 2013 after

trading hours.

17 January 2013

Anyone invest in this counter???

Personally I think hotels business will thrive in Singapore. So investing in hotel shares like Fragrance, Roxy etc should be good and safe bet

sanuks ( Date: 24-Nov-2012 10:43) Posted:

Global Premium Hotels: Maintain FV of S$0.29

By Sarah Ong

Fri, 9 Nov 2012, 10:22:33 SGT

Global Premium Hotels (GPH) registered 3Q12

results that were below our expectations. 3Q12 revenue increased by 8.1%

YoY to S$14.9m. EBITDA margin fell 6.6 ppt to 59.8% (excluding one-off

expenses of S$0.5m for 3Q12). 9M12 EPS of 1.34 S cents equaled 72% of

our prior FY12F estimate of 1.87 S cents, which we now lower to 1.75 S

cents. GPH has begun construction of its new mid-tier Parc Sovereign

Hotel located at Tyrwhitt Road in Aug 2012. An independent valuer has

estimated a gross development value S$150m, implying a potential fair

value gain of S$42m. We have incorporated the Tyrwhitt site development

into our RNAV model. We maintain our fair value of S$0.29 (using a 10%

discount to RNAV) and a BUY rating. GPH intends to distribute at least

80% of net profit after tax for FY12 we estimate an attractive FY12F

dividend yield of 5.8%. Lowering our FY12F EPS estimate

Global

Premium Hotels (GPH) registered 3Q12 results that were below our

expectations. 3Q12 revenue increased by 8.1% YoY to S$14.9m. Gross

profit margin declined 1.7 ppt versus 3Q11 to 86.6%. EBITDA margin fell

6.6 ppt to 59.8% (excluding one-off expenses of S$0.5m for 3Q12). 9M12

EPS of 1.34 S cents equaled 72% of our prior FY12F estimate of 1.87 S

cents, which we now lower to 1.75 S cents.

Admin. and finance expenses climb

Hotel

room revenue increased by S$1.4m or 10.5% YoY. There was a contribution

of S$1.7m from hotels that opened in 2011 (Parc Sovereign, Fragrance

Riverside and Fragrance Elegance) or underwent upgrades in 2011

(Fragrance Emerald). These were partially offset by lower room revenue

at Fragrance Ruby which is temporarily closed for asset enhancement.

Ruby is expected to launch on 1 Dec with first-of-a-kind facilities for

an economy-tier hotel, e.g. free Wi-Fi and Smart TV. Administrative

expenses rose by S$2.0m, or 52% YoY, chiefly due to general increase in

wages and additional staff needed for Riverside and Elegance. 3Q12

finance costs climbed S$1.6m, or 228% versus 3Q11. This was mainly due

to the drawdown of S$453.5m in term loans in 1H12 for partial payment of

the purchase consideration in connection with the 2Q12 IPO.

Started construction at Tyrwhitt

GPH

has begun construction of its new mid-tier Parc Sovereign Hotel located

at Tyrwhitt Road in Aug. The 265-room hotel situated on a freehold land

will become GPH's largest hotel, increasing the portfolio by 15% to

2,003 rooms. An independent valuer has estimated a gross development

value S$150m, implying a potential fair value gain of S$42m.

Maintain BUY

We

have incorporated the Tyrwhitt site development into our RNAV model. We

maintain our fair value of S$0.29 (using a 10% discount to RNAV) and a BUY

rating. GPH intends to distribute at least 80% of net profit after tax

for FY12 we estimate an attractive FY12F dividend yield of 5.8%.

|

|

Global Premium Hotels: Maintain FV of S$0.29

By Sarah Ong

By Sarah Ong

Fri, 9 Nov 2012, 10:22:33 SGT

Global Premium Hotels (GPH) registered 3Q12

results that were below our expectations. 3Q12 revenue increased by 8.1%

YoY to S$14.9m. EBITDA margin fell 6.6 ppt to 59.8% (excluding one-off

expenses of S$0.5m for 3Q12). 9M12 EPS of 1.34 S cents equaled 72% of

our prior FY12F estimate of 1.87 S cents, which we now lower to 1.75 S

cents. GPH has begun construction of its new mid-tier Parc Sovereign

Hotel located at Tyrwhitt Road in Aug 2012. An independent valuer has

estimated a gross development value S$150m, implying a potential fair

value gain of S$42m. We have incorporated the Tyrwhitt site development

into our RNAV model. We maintain our fair value of S$0.29 (using a 10%

discount to RNAV) and a BUY rating. GPH intends to distribute at least

80% of net profit after tax for FY12 we estimate an attractive FY12F

dividend yield of 5.8%.

Lowering our FY12F EPS estimate

Global

Premium Hotels (GPH) registered 3Q12 results that were below our

expectations. 3Q12 revenue increased by 8.1% YoY to S$14.9m. Gross

profit margin declined 1.7 ppt versus 3Q11 to 86.6%. EBITDA margin fell

6.6 ppt to 59.8% (excluding one-off expenses of S$0.5m for 3Q12). 9M12

EPS of 1.34 S cents equaled 72% of our prior FY12F estimate of 1.87 S

cents, which we now lower to 1.75 S cents.

Admin. and finance expenses climb

Hotel

room revenue increased by S$1.4m or 10.5% YoY. There was a contribution

of S$1.7m from hotels that opened in 2011 (Parc Sovereign, Fragrance

Riverside and Fragrance Elegance) or underwent upgrades in 2011

(Fragrance Emerald). These were partially offset by lower room revenue

at Fragrance Ruby which is temporarily closed for asset enhancement.

Ruby is expected to launch on 1 Dec with first-of-a-kind facilities for

an economy-tier hotel, e.g. free Wi-Fi and Smart TV. Administrative

expenses rose by S$2.0m, or 52% YoY, chiefly due to general increase in

wages and additional staff needed for Riverside and Elegance. 3Q12

finance costs climbed S$1.6m, or 228% versus 3Q11. This was mainly due

to the drawdown of S$453.5m in term loans in 1H12 for partial payment of

the purchase consideration in connection with the 2Q12 IPO.

Started construction at Tyrwhitt

GPH

has begun construction of its new mid-tier Parc Sovereign Hotel located

at Tyrwhitt Road in Aug. The 265-room hotel situated on a freehold land

will become GPH's largest hotel, increasing the portfolio by 15% to

2,003 rooms. An independent valuer has estimated a gross development

value S$150m, implying a potential fair value gain of S$42m.

Maintain BUY

We

have incorporated the Tyrwhitt site development into our RNAV model. We

maintain our fair value of S$0.29 (using a 10% discount to RNAV) and a BUY

rating. GPH intends to distribute at least 80% of net profit after tax

for FY12 we estimate an attractive FY12F dividend yield of 5.8%.

Global Premium Hotels Q3 profit down 37%

Updated 09:38 PM Nov 08, 2012

SINGAPORE - Global Premium Hotels (GPH), the

owner and operator of Singapore's second largest budget hotel chain, on

Thursday reported net profit fell 36.9 per cent in the third quarter

from the corresponding period a year earlier to S$4.2 million despite

revenue rising 8.1 per cent to S$14.9 million.

Administrative expenses for 3Q 2012 increased by S$2 million, or 51.9

per cent, mainly due to the increase in staff costs arising from higher

wages as well as additional employees required for Fragrance

Hotel-Riverside and Fragrance Hotel-Elegance, it said. Finance costs

surged by 228.2 per cent to $1.6 million, due to the drawdown of term

loans of S$453.5 million by GPH subsidiaries, it added.

The

occupancy in the Singapore hotel market has remained resilient thus

far, GPH said, but it warned that " the on-going euro crisis and global

economic uncertainty might weigh down on accommodation demand over the

next 12 months."

" Business and leisure travellers might cut

back on travelling, in turn affecting visitor arrivals and the overall

hospitality sector," it said.

Global Premium Hotels Limited wishes to announce that the Company will release its

unaudited financial results for its third quarter ended 30 September 2012

on 8 November 2012 after trading hours.

Ya! understand your concern. Sometimes, its value trap. Well! never trust analyst reports.

They actually meant it is undervalued at its current price. Anyway, just bought some just in case.

phil1314 ( Date: 04-Oct-2012 22:38) Posted:

I am always weary when analyst highlight shares trading below its fair value when there is no liquidity in the counter. Roxy Pacific, GuocoLeisures plus many others are all in the same category and prices hardly move above the fair value for many years

sanuks ( Date: 17-Sep-2012 09:35) Posted:

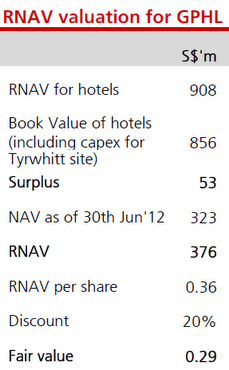

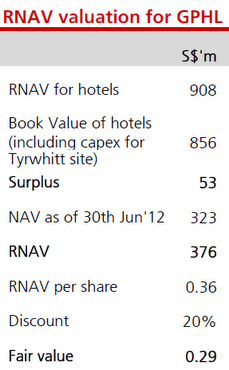

DBS Vickers, first to cover GLOBAL PREMIUM HOTELS, says its fair value is 29 cents

Source: DBS Vickers

Analyst: Derek TAN CPA

• Household name in the Economy hotel space

• Resilient operating model with portfolio expansion from the development of a new 265-room hotel

• Fair value of S$0.29 based on 20% discount to RNAV

Fair

value of S$0.29. Given GPHL’s leading position in the economy tier

segment of the Singapore hotel sector, we derive a fair value of S$0.29,

based on a 20% discount to its RNAV of S$0.36.

This implies FY14F EV/EBITDA of 17x, in line with hospitality peers.

Earnings

upgrade will be a price catalyst. Better than expected performance from

its hotel segment in the coming quarters or acquisitions not factored

in our forecasts are likely to drive profitability and stock price.

Balance

sheet is relatively highly geared. GPHL’s net debt to equity ratio is

relatively high at 1.4x, due to acquisition of its initial portfolio

upon listing.

We noted that other metrics, such as interest cover, is comfortable at c.4-5x.

|

|

|

|

I am always weary when analyst highlight shares trading below its fair value when there is no liquidity in the counter. Roxy Pacific, GuocoLeisures plus many others are all in the same category and prices hardly move above the fair value for many years

sanuks ( Date: 17-Sep-2012 09:35) Posted:

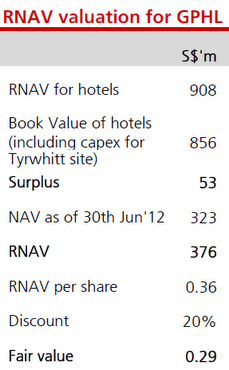

DBS Vickers, first to cover GLOBAL PREMIUM HOTELS, says its fair value is 29 cents

Source: DBS Vickers

Analyst: Derek TAN CPA

• Household name in the Economy hotel space

• Resilient operating model with portfolio expansion from the development of a new 265-room hotel

• Fair value of S$0.29 based on 20% discount to RNAV

Fair

value of S$0.29. Given GPHL’s leading position in the economy tier

segment of the Singapore hotel sector, we derive a fair value of S$0.29,

based on a 20% discount to its RNAV of S$0.36.

This implies FY14F EV/EBITDA of 17x, in line with hospitality peers.

Earnings

upgrade will be a price catalyst. Better than expected performance from

its hotel segment in the coming quarters or acquisitions not factored

in our forecasts are likely to drive profitability and stock price.

Balance

sheet is relatively highly geared. GPHL’s net debt to equity ratio is

relatively high at 1.4x, due to acquisition of its initial portfolio

upon listing.

We noted that other metrics, such as interest cover, is comfortable at c.4-5x.

|

|

| 2012-10-03 |

| GLOBAL PREMIUM HOTELS LIMITED | Lim Chee Chong |

| Buy | Open Market Purchase | 80000 | 0.250 |

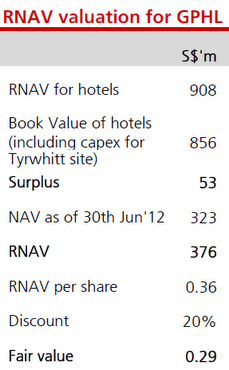

DBS Vickers, first to cover GLOBAL PREMIUM HOTELS, says its fair value is 29 cents

Source: DBS Vickers

: Derek TAN CPA

• Household name in the Economy hotel space

• Resilient operating model with portfolio expansion from the development of a new 265-room hotel

• Fair value of S$0.29 based on 20% discount to RNAV

Fair

value of S$0.29. Given GPHL’s leading position in the economy tier

segment of the Singapore hotel sector, we derive a fair value of S$0.29,

based on a 20% discount to its RNAV of S$0.36.

This implies FY14F EV/EBITDA of 17x, in line with hospitality peers.

Earnings

upgrade will be a price catalyst. Better than expected performance from

its hotel segment in the coming quarters or acquisitions not factored

in our forecasts are likely to drive profitability and stock price.

Balance

sheet is relatively highly geared. GPHL’s net debt to equity ratio is

relatively high at 1.4x, due to acquisition of its initial portfolio

upon listing.

We noted that other metrics, such as interest cover, is comfortable at c.4-5x.

Yong, Cheong Beng - (RESIGNED - His last day of service with the Group is 15September 2012.)

Mr. Yong Cheong Beng is Vice President - Sales of Global Premium

Hotels Ltd. He joined the company on 2 June 2010 and his

responsibilities include managing the local and foreign travel agents,

marine companies customer accounts and carrying out marketing activities

at regional travel fairs. Prior to joining the company, from August

2004 to May 2010, Mr. Yong was the sales and marketing manager of

Metropolitan YMCA Singapore where he was responsible for the regional

markets and managed the local travel agents, corporate accounts,

internet portal sales and internet agents. From January 1999 to July

2004, Mr. Yong was the sales and marketing manager at Online Technology

Pte. Ltd. where he was responsible for managing the online portal. From

February 1997 to December 1998, Mr. Yong was a sales and marketing

executive at Pasta Fresca De Salvatore Pte. Ltd. where he was

responsible formanaging the banquet sales. From January 1986 to January

1997, Mr. Yong was the sales and marketing manager at Initial Services

Pte. Ltd. where he was responsible for managing a sales team and

attending to trade fair enquiries. Mr. Yong earned a Diploma in

Marketing from the Chartered Institute of Marketing in 1989. He also

holds a Diploma in Sales and Marketing since 1988 and a Certificate in

Sales and Marketing from the Marketing Institute of Singapore since

1985.

Lim Hwee Leng - (APPOINTED)

Ms.Lim Hwee Leng is our Vice President, Business Development.She joined us in February

2009 and is responsible for the marketing and sales of our hotel rooms.

From February 2002 to January 2009, Ms.Lim was the business development manager of DSL

Design & Contracts Pte. Ltd. and Shwee Realty Pte. Ltd. where she was responsible for its

business development and client servicing. From March 2001 to February 2002, Ms. Lim

worked as an air-traffic control officer for the Civil and Aviation Authority of Singapore.

From June 2000 to February 2001, Ms. Lim was the senior visual merchandiser for OG Pte. Ltd.

where she was responsible for planning and implementing effective visual merchandising

strategies for the stores that she was in charge of.From February1997 to June 2000, Ms.Lim

was the senior visual merchandiser of Lee Hwa Jewellery where she was responsible for

conceptualising and implementing visual ideas in to effective window and in-stored is plays and

decorations for all the island-wide outlets. From November 1995 to February 1997, Ms. Lim

worked as a visual merchandiser of Takashimaya Singapore Ltd. where she was responsible

for planning, developing and implementing the display and visual merchandising strategies for

Takashimaya-Ngee Ann City Shopping Centre.

Ms. Lim holds a Bachelor of Arts (Honours) in Graphic Design degree from The London

Institute—Camberwell College of Arts in 1995 and a Diploma in Graphic Design fromTemasek

Polytechnic of Singapore in 1993.

Ms. Lim is the sister-in-law of our Executive Director, Mr. Lim Chee Chong, who as set out

above, is the brother-in-law of our Non-Executive Director, Mr. Koh Wee Meng.

Announcement: GP Hotels

Source: SGX

The Board of Directors of Global Premium Hotels Limited (“the Company”) wishes to

announce the resignation of Mr Yong Cheong Beng as the Vice President, Sales of the

Group. His last day of service with the Group is 15September 2012. His duties will be

assumed by Ms Lim Hwee Leng, who is the Vice President, Business development of the

Group.

The Board of Directors would like to express its appreciation to Mr Yong for his contributions

to the Group, and wish him the best in his future endeavours.

The details of the resignation of Mr Yong are contained in separate announcement made

today.

10 September 2012

tradehuathuat ( Date: 10-Sep-2012 11:03) Posted:

| Congrats to al who buy GP HOTEL last week $0.24 |

|