华 丽 姐 ,

早 起 的 鸟 兒 有 虫 吃 ! !

GorgeousOng ( Date: 11-Oct-2013 06:12) Posted:

|

万 事 通 ,

大 发 咯 ! ! !

WanSiTong ( Date: 11-Oct-2013 06:06) Posted:

|

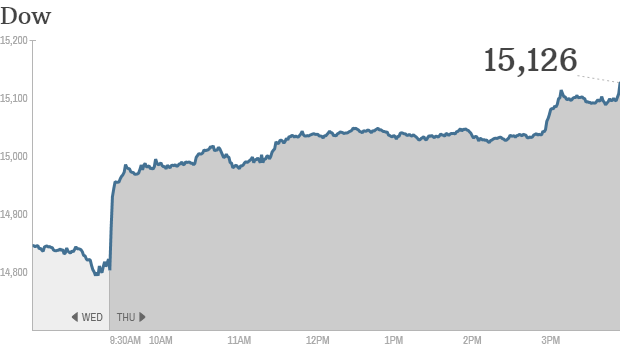

Best day of 2013 for Dow on possible debt deal

By Maureen Farrell @CNNMoneyInvest October 10, 2013: 4:36 PM ET

Click chart for more markets data.

NEW YORK (CNNMoney)

Washington didn't even need to finalize a debt ceiling deal to convince investors to buy stocks again.

The Dow posted its best gains of the year, adding more than 300 points, or 2.2%. Both the S& P 500 and the Nasdaq also advanced more than 2%.

The reason for the euphoria? House Republicans offered a proposal to raise the debt ceiling temporarily, while the government would remain partially shut down.

Relief rippled throughout the financial markets.

One key proxy for investor fear, the CBOE's Volatility Index (VIX) or the VIX, dropped 16%. It had spiked in recent days. CNNMoney's own Fear and Greed Index, which tracks the VIX and six other gauges of sentiment, moved higher. The index still shows Fear, but it had been flashing signs of Extreme Fear for the past few days.

Related: Investors a little less afraid

Rates on short-term Treasuries, known as T-bills, also dipped slightly Thursday, another indication that investors now believe a U.S. default is less likely.

The optimism about a possible deal also spread to European markets, which closed up between 1.5% and 2.2%. Asian markets ended mixed.

Investors have been growing increasingly concerned as October 17th, a key deadline to increase the debt ceiling, comes closer. Should politicians fail to raise the debt ceiling, the U.S. is likely to default on some of its debt or could be forced to choose between interest payments on the debt and paying for key government services.

Related: Click here for more on stocks, bonds, currencies, and commodities

Unemployment edging up? Although the government has still not reported on the latest monthly employment figures due to the shutdown, there was another weekly report out Thursday that could have made investors uneasy about the jobs market. The Labor Department's report on initial jobless claims showed a sharp jump in claims over the previous week.

Huat arh.............

World Markets

North and South American markets finished broadly higher today with shares in U.S. leading the region. The S& P 500 is up 2.18% while Mexico's IPC is up 1.56% and Brazil's Bovespa is up 0.85%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +323.09 | +2.18% | 15,126.07 | 4:31pm ET |

|

S& P 500 Index | United States | +36.16 | +2.18% | 1,692.56 | 4:31pm ET |

|

Brazil Bovespa Stock Index | Brazil | +448.93 | +0.85% | 52,996.64 | 4:17pm ET |

|

Canada S& P/TSX 60 | Canada | +10.39 | +1.42% | 741.59 | 4:19pm ET |

|

Santiago Index IPSA | Chile | +36.36 | +1.13% | 3,243.02 | 3:17pm ET |

|

IPC | Mexico | +623.78 | +1.56% | 40,489.95 | 4:06pm ET |

Ma Hou Pao, whenever you post, I tua huat..... My Dow HUAT la.... LOL

medivh ( Date: 10-Oct-2013 21:50) Posted:

|

All eyes on the betas guess who are the leading stars this time . Big B ,Big A ,and Big L. The director is none other than our famous Dai_ and his son. Happy times. We need someone to ccreate the firework right. The Great Gatsby.

Tomorro tua huat...arhh. Debt deal hopes boost stocks

11:29 am: Stocks rise on hopes of a temporary resolution to the U.S. debt ceiling crisis. More (DOW cross - 15,037.33 points liao or +1.6%)

Peter_Pan ( Date: 10-Oct-2013 23:40) Posted:

|

US default is off the table for now

Debt deal hopes push stocks higher, Dow up more than 180 point. Stocks rallied Thursday morning on reports that lawmakers could be close to striking a short-term deal that would keep the United States from defaulting on its debt.

World Markets

North and South American markets are broadly higher today with shares in U.S. leading the region. The S& P 500 is up 1.39% while Mexico's IPC is up 1.35% and Brazil's Bovespa is up 0.47%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +181.54 | +1.23% | 14,984.52 | 10:06am ET |

|

S& P 500 Index | United States | +22.13 | +1.34% | 1,678.53 | 10:06am ET |

|

Brazil Bovespa Stock Index | Brazil | +391.05 | +0.74% | 52,938.76 | 9:42am ET |

|

Canada S& P/TSX 60 | Canada | +7.32 | +1.00% | 738.52 | 9:51am ET |

|

Santiago Index IPSA | Chile | +28.45 | +0.89% | 3,235.11 | 9:46am ET |

|

IPC | Mexico | +521.40 | +1.31% | 40,387.57 | 9:46am ET |

haha they so clever hor..

medivh ( Date: 10-Oct-2013 21:50) Posted:

|

hehe u worried ah? maybe they tapau and kept in their freezer one la.. won't blame u hehe.

Peter_Pan ( Date: 10-Oct-2013 21:40) Posted:

|

dunno who fed one leh? ate more than they r supposed to eat! siao liao

medivh ( Date: 10-Oct-2013 21:25) Posted:

|

u fed them with huat kway is it? lol

Peter_Pan ( Date: 10-Oct-2013 18:57) Posted:

|

Short sell orders executed on 10 October 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131010.txt

the bulls are back with a vengence.. lol

Now back to Dow again.... My long Dow still red, but less red...... Good turn up.... LOL

Europe Stocks, U.S. Futures Gain With Dollar as Oil Rises

By Pratish Narayanan & Emma O?Brien - Oct 10, 2013 4:33 PM GMT+0800

European stocks rebounded from a one-month low, U.S. index futures and the dollar advanced while Treasuries fell as American lawmakers indicated they?re open to a short-term increase in the debt ceiling. Crude oil increased after Libya?s prime minister was taken by a revolutionary group.

The Stoxx Europe 600 Index climbed 1 percent to 308.09 at 9:30 a.m. in London and Standard & Poor?s 500 Index (SPX) futures rose 0.8 percent. The U.S. currency appreciated for a third day against the yen while the 10-year Treasury yield increased to a two-week high. Corporate bond risk declined for the first time in four days. Brent oil added 0.8 percent after a Libyan official said Prime Minister Ali Zaidan was taken from a Tripoli hotel this morning.

House Republican and Senate Democratic leaders in the U.S. are open to an increase in the $16.7 trillion debt ceiling, according to congressional aides. Hong Kong Exchanges & Clearing Ltd. increased the haircut on U.S. Treasury bills for maturities of less than 1 year. Treasury Secretary Jacob J. Lew is scheduled to testify before the Senate Finance Committee today.

?It?s just not very likely the political gridlock will persist because the fallout could be catastrophic to the U.S. and the world economy,? Donald Williams, the Sydney-based chief investment officer at Platypus Asset Management Ltd., which oversees about A$1.6 billion ($1.5 billion), said by phone. ?But having said that, the market is uncertain until this is resolved and so we?ve got choppy trading conditions ahead for the next week or so.?

Banks Gain

The Stoxx 600 rebounded from the lowest close since Sept. 5 as all 19 industry groups advanced. Italy?s Banco Popolare SC and Germany?s Commerzbank AG led gains in financial shares, rising more than 4 percent. CGG (CGG), the largest seismic surveyor of oilfields, rallied 4.9 percent in Paris after saying its vessel production rate climbed.

The gain in S& P 500 futures indicated the U.S. gauge will extend yesterday?s 0.1 percent advance. A report at 8:30 a.m. in Washington may show initial claims for jobless benefits increased by 3,000 to 311,000 last week, according to a Bloomberg survey of economists.

The MSCI Emerging Markets Index gained 0.2 percent Benchmark gauges in Indonesia, Turkey, Thailand and Poland advanced at least 0.7 percent. The Shanghai Composite Index lost 0.9 percent, led by financial companies on concern earnings growth will slow.

huat ah

Peter_Pan ( Date: 10-Oct-2013 12:06) Posted:

|

European markets open strongly,Dow futures +88.Huat arh!

U.S. debt-ceiling hopes boost European stocks

LONDON (MarketWatch) -- European stock markets showed broad-based gains at the open on Thursday, as U.S. lawmakers signaled they were open to a short-term increase in the debt limit, which is set to be reached on Oct. 17. Additionally, House leaders met late on Wednesday, a fresh sign Washington is trying to resolve thegovernment shutdown -- now on Day 10. The Stoxx Europe 600 index XX:SXXP +0.79%rose 0.5% to 306.49, on track to break a three-day losing streak. Drug makers and banks helped lift the pan-European benchmark, with shares of Sanofi SA FR:SAN +1.38%SNY +0.01% up 1.3% and HSBC Holdings PLC UK:HSBA +0.90% HBC -0.02% HK:5 +0.12%0.5% higher. Among country-specific indexes, the U.K.'s FTSE 100 index UK:UKX +0.56%rose 0.4% to 6,361.32 and France's CAC 40 index FR:PX1 +0.98% gained 0.7%. Germany's DAX 30 index DX:DAX +0.72% added 0.6% to 8,563.70.