Post Reply

61-80 of 170

Post Reply

61-80 of 170

What a suay day to annouce they aquire site.

Tuesday, 17 August 2010 17:05

SIAS Research says ‘increase exposure’ to Roxy-Pacific

Roxy-Pacific Holdings Ltd (“Company”) announced its financial year 2010 second quarter results on 4th August 2010.

We maintain our Increase Exposure rating on the counter, based on an intrinsic value of S$0.450 - representing an upside of 42.9% over its last traded price of S$0.315.

Key Developments:

• The Company has outperformed our earlier expectations. Total revenue and net profit after tax for 2Q2010 were recorded at S$55.4m and S$12.9m respectively – representing impressive YoY increases of 27% (revenue) and 37% (NPAT).

On a QoQ basis, Roxy also improved on their bottom line performance by growing NPAT 43% over 1Q2010.

• Roxy’s robust quarterly performance was achieved on the back of a 25% increase in revenue from its Property Development segment as well as a substantial 145% uptick in top line from their Property Investment segment.

Roxy’s Hotel Ownership segment also reported a 27% increase in revenue for the last quarter.

• We like Roxy’s robust balance sheet position as total assets expanded 8% from S$425.5m as at end-2009 to S$461.4m at 30th June 2010. Over the same period, the Company’s total debt figure also grew from S$250.4m to S$270.1m. That said, both the Company’s valuation metrics - NAV and RNAV - picked up in the second quarter of 2010.

Outlook:

With the Singapore government expecting economic growth of 13% to 15% in 2010, we believe that Roxy will benefit from a robust Singapore property and tourism market.

In addition, the Company has a substantial holding of unrecognized pre-sale revenue to be accounted for going forward. At its current price, we believe that Roxy is still significantly undervalued.

|

|

Wah. Always hover around 0.335. Can start loading liao

Wow. 3rd consective day red.

BUY in

Can they approve 1 more cents of divident during the agm? Haha

chiong ah!!!1

Started! Chiong ah!

buy in b4 its too late....

AGM at 10am....

TP S$0.440

Last Done S$0.360

REWARD S$0.080 (20+%)

I sold all my 80 lot of HL Asia and invest in this counter which I believe will give me a better return of profit.

Kensonic77 ( Date: 30-Mar-2010 16:22) Posted:

Dun wait anymore. Me vested 100 lots. Waiting to buy another 100 lots. |

|

haha....

Dun wait anymore. Me vested 100 lots. Waiting to buy another 100 lots.

so u mean we can buy today?

Awaiting for news and more action from this stock tmr....

A FORGOTTEN GEM NOT TO BE MISSED... TP 0.44

Chill man more good news coming the way... AGM on 31st March...

Sian. Y today red

ROXY-PACIFIC is a mid-mass market property developer. Its projects are mainly small and medium size, and are concentrated in the eastern part of Singapore.

In FY09, 76% of Roxy’s total revenue was from the Property Development segment, with the balance mainly from Hotel Ownership division.

We like the stock for :-

1) Its ability to replenish landbank at reasonable price;

2) Exposure to the hospitality sector and

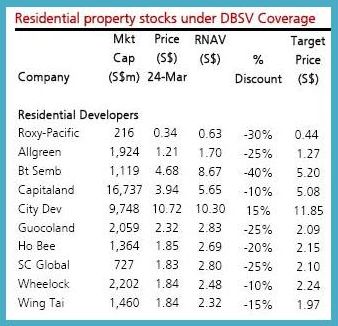

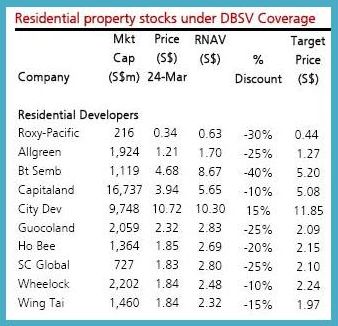

3) Trading at a steep discount to RNAV compared to peers.

Our target price for Roxy is $0.44 based on a 30% discount to RNAV of S$0.63

Landbank replenished

Source: DBS Vickers, Mar 26

The group has been replenishing its landbank since 2H09, having launched and fully sold all its residential projects. It has been on a buying spree in the past few months, acquiring 6 pieces of land, mainly in the eastern region of Singapore.

Roxy’s policy is not to hold the land for too long. It usually develops the land within six months from the completion of purchase.

Prudent management

Led by Executive Chairman and Chief Executive Officer, Teo Hong Lim, and supported by an experienced management team, construction for a typical project will only commence if the group can secure 60% to 70% sales and collects about 20% of proceeds to fund construction cost.

Upside potential to hotel

The Grand Mercure Roxy Hotel, together with the office premise was valued at about S$232.4m by

independent valuer as at 31 Dec 09, vs book value of S$64.5m. Going forward, there is potential for the hotel to be revalued up on the back of the improved outlook of the hospitality sector. Our estimated value for the hotel is about S$245.5m, based on value per room of $440,000.

Attractive compared to peers

Roxy’s RNAV works out to be about S$0.63, after taking into consideration proceeds from the nine existing projects which have been fully sold, development from the six new sites and contribution from the hotel and investment properties.

Given its relatively small market cap, we apply a 30% discount to RNAV to obtain a target price of $0.44, or 30% upside potential. Roxy is also currently trading at an attractive 0.54x P/RNAV, vs an average of 0.74x for property stocks under DBSV coverage. We recommend a Trading Buy for the stock.