Almost half day gone, total volume traded 485.4m shares trade with value $296.1m.

SGX gone case liao, what will happen to next qtr result....can't imagine.

new6ie ( Date: 26-Nov-2013 10:43) Posted:

Time to buy stocks in sg markets.

Reasons: After the legal suit against GS was announced, it has the effect

of caution for big shorties from rampaging the stock markets with their

shorting activities. There may still be shorting activities but it would

not come from biggies, because they will want to hear more news of the

suit.

If my analysis is correct, then Singapore stocks will make its run today

or tomorrow onwards.

So cheers and happy trading.

|

|

Time to buy stocks in sg markets.

Reasons: After the legal suit against GS was announced, it has the effect

of caution for big shorties from rampaging the stock markets with their

shorting activities. There may still be shorting activities but it would

not come from biggies, because they will want to hear more news of the

suit.

If my analysis is correct, then Singapore stocks will make its run today

or tomorrow onwards.

So cheers and happy trading.

In China 1.2 Million Candidates Apply For 19,000 Government Jobs

The difficulty of US workers to obtain " desirable" jobs has been noted here previously.

Recall in 2012 when Delta received 22,000 applications for about 300 flight attendant jobs in the first week after posting the positions outside the company (which was an improvement from 2010, when the Atlanta-based carrier received 100,000 applications for 1,000 jobs when it last hired flight attendants in October 2010). Or when in 2011 McDonalds

hired 62,000 minimum wage applicants out of one million total applicants. However, that is nothing compared to the job seeking frenzy in China, where as AFP reports, more than one million people took China's national civil service exam at the weekend in a modern version of an age-old rite, but faced huge odds against clinching one of the few government jobs available.

A total of 1.12 million took the National Public Servant Exam, according to figures from the State Administration of Civil Service figures. How many total job openings were there?

A tiny 19,000 according to China's Global Times, meaning less than 1 on 50 would be successful.

But that's just the tip of the scramble.

According to AFP, the most competitive role was with the National Ethnic Affairs Commission,

where 14,384 candidates were vying for just two jobs. Why the surge in applicants? " Domestic reports said it was so popular because the application process appeared to be less arduous than for other positions." Somehow math suggest that over 7,000 applicants for one job means a somewhat more " arduous" application process, not less.

As for the allure of government jobs, the story here is well-known: job safety coupled with an easy living in which one isn't expected to do much of anything:

Government jobs are especially appealing to Chinese because they are seen as stable employment and bring with them a range of privileges, as well as the status of being an official. The benefits can include living allowances, pensions, health insurance and even property -- a valuable commodity in China's prolonged housing boom.

The current civil service test is a legacy of the ancient imperial examination known as the keju, introduced during the Sui Dynasty, which ruled from 580-618 AD, and often regarded as a key meritocratic element of the governing system.

Early forms of the examinations were largely based on Confucian texts. They were open only to boys who were able to complete their education, either because of family wealth or sponsorship by benefactors.

In the US the pinnacle of professional development may mean ending up as a hedge fund billionaire on Twitter and moving stocks with nothing but a buy or sell recommendation in under 140 characters, but in China it is all about the government jobs:

The tests were only held every three years, and local officials would often present those who passed with a special banner to be hung at the entrance to their home, to ensure the success was remembered for generations.

The amusing nature of this process was not lost on the locals:

Many posters on Sina Weibo, a Chinese version of Twitter, ridiculed the candidates. " This really is China's peculiar landscape" , said one poster with the username " Law and its value" .

" Do they really want to pass the test to 'serve the people'? No. They desperately hope to go and enjoy a privileged system of wages."

Another said: " Every time (they take the test), they are in fact just competing to be able to take bribes and bend the law."

Other netizens asked whether more civil servants were needed in China, following government pledges to cut down on bureaucracy.

" Who wouldn't want to have a job that is guaranteed for life?" said one netizen.

" But the real question should be: 'Is it really necessary to recruit tens of thousands of civil servants every year?'"

The answer: of course it is. How else can the world's second most centrally-planned economy and market (after the US of course) preserve the illusion of 7%+ growth unless it created as many government jobs as needed to fill the daily growing slack. But if you think 7000 applicants for 1 " desired" job is bad, wait until the full impact of China's easing of its 1 child policy is felt...

The Dow logged another record high close, after edging up 0.05% to 16,073, but the fade in the rally toward the final hour of trading may be a signal that investors are becoming more realistic as the markets become pricier. Meanwhile, overnight US data on Nov manufacturing outlook and Oct pending home sales disappointed

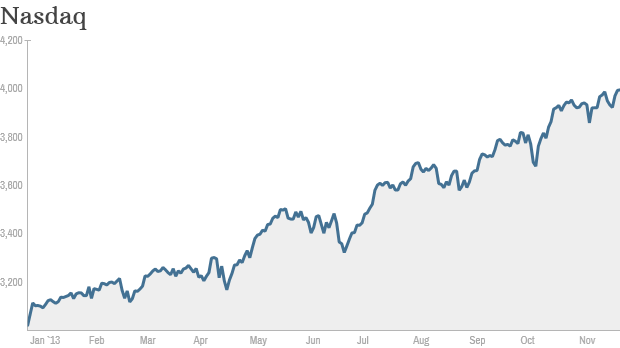

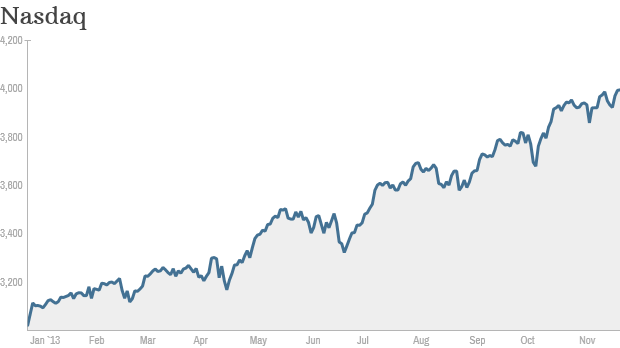

Nasdaq topped 4,000. Dow hits record again

Click the chart for more stock market data.

The Nasdaq briefly topped 4,000 Monday for the first time since September 2000, but failed to close above that key level.

And while the tech-heavy Nasdaq did cross a big milestone, it is still well below its peak of above 5,000, which was set in March 2000.

The

Dow managed to log another record closing high though, while the

S& P 500 finished in the red after hitting a new all-time high earlier in the day.

Stocks ended mixed as investors took in a disappointing report on the housing market. Pending home sales dropped 0.6% in October from the prior month. That was the fifth straight decline. Economists expected a 1.3% increase. The housing recovery has been a big boon for the stock market this year, so signs of weakness are worrisome.

Meanwhile, investors seemed encouraged by a landmark deal reached between Iran and the United States, the United Kingdom, France, Russia, China and Germany over the weekend.

As part of the

agreement, world powers will relax economic sanctions against Iran in exchange for a promise that the country scales back its nuclear program.

Oil prices sank on the expectation of

more oil exports from Iran following the

nuclear deal.

World markets also climbed on the news.

European markets finished with solid gains, with Germany's benchmark

Dax index leading the way. Most

Asian markets ended higher, with Japan's

Nikkei jumping 1.5% as the yen weakened against the dollar

Related: Fear & Greed Index remains in Greed territory Besides the Iran deal and pending home sales, there wasn't much other news moving markets. Trading volume is expected to be low during this holiday-shortened week and there are few economic and earnings reports on tap. U.S. markets will be closed Thursday for Thanksgiving and will shut at 1 p.m. ET on Friday.

The

Standard & Poor?s 500 Index (SPX) fell, after seven consecutive weekly gains that lifted the gauge to a record, as energy shares retreated following

Iran?s agreement to limit its nuclear program

The S& P 500 dropped 0.1 percent to 1,802.48 at 4 p.m. in

New York, erasing earlier gains of as much as 0.2 percent. The

Dow Jones Industrial Average added 7.77 points, or 0.1 percent, to an all-time high of 16,072.54. The Nasdaq Composite Index rose 0.1 percent to 3,994.57, after briefly surpassing 4,000 for the first time since September 2000. About 5.6 billion shares

changed hands on U.S. exchanges, about 7.8 percent below the three-month average.

?The market is not necessarily over-extended, but probably moderately rich,? Cam Albright, director of

asset allocation at the investment advisory unit of Wilmington Trust, said by phone from Wilmington. The firm oversees about $79 billion. ?It?s probably difficult to envision this market getting a lot more upside unless it has this continued success on earnings and economic growth. The deal with Iran takes some of the

risk premium out of the marketplace for the moment at least.?

Iran Accord

Iran agreed yesterday to curtail nuclear activities in return for easing of some sanctions on oil, auto parts, gold and precious metals, an accord that broke a decade-long deadlock.

The S& P 500 has

rallied 26 percent this year, closing for the first time above 1,800 on Nov. 22, as the

Federal Reserve continued to buy $85 billion of bonds a month to stimulate economic growth. The gauge is challenging 2003 for the best annual gain since 1998.

The index is trading for about 17 times its companies? reported earnings. While the

valuation reached the highest level since May 2010, it?s still below the multiples at the market?s two previous peaks, when the ratio reached 17.5 in October 2007 and 31 in March 2000, data compiled by Bloomberg show.

Minutes from the latest Fed meeting indicated the central bank may reduce monetary stimulus in coming months. Four out of five investors expect the Fed to delay a decision to begin reducing the stimulus until March 2014 or later, according to the Bloomberg Global Poll of investors, traders and analysts who are subscribers. Just 5 percent are looking for a move at its Dec. 17-18 meeting, the Nov. 19 poll showed.

Most Bullish

?The most bullish thing you could have is the Fed says, ?Hey, we feel comfortable enough to step away,?? Warren Koontz, the co-manager of the Loomis Sayles Value Fund in

Boston, said in a phone interview. Loomis Sayles & Co. manages about $191 billion. ?The underpinning of the stock market is probably pretty good.?

The

S& P 500 last week capped its longest winning streak since February as reports showed retail sales beat estimates and fewer Americans than expected filed for jobless benefits.

Data today from the National Association of Realtors showed pending home sales fell 0.6 percent in October, a fifth month of declines, amid higher borrowing costs. The median projection in a Bloomberg survey of economists called for a 1 percent gain from the month before.

?The real strong rebound in housing that we saw between 2011 and the first quarter of this year has tapered off now,? Charlie Smith, chief investment officer of Pittsburgh-based Fort Pitt Capital Group Inc., said in a phone interview. His firm oversees $1.5 billion. ?The question people have is, ?Can the uptrend in housing be sustained by what classically has been growth in income and therefore the ability to get loans???