Market Snapshot - Markets on Edge as US Creeps Closer to Debt Cliff

Written By Stock Fanatic on Tuesday, October 15, 2013 | 15.10.13

Global Equities

Negotiations in Washington over the US government?s borrowing authority and how it spends its money hit a roadblock over the weekend, with neither side making concessions that would allow Washington to meet its debt commitments on time. There are only four days left before US President Barack Obama?s borrowing authority hits its USD16.7 trillion limit. By then, the White House would have to rely on cash in hand (around USD30 billion) and whatever tax revenue it receives. On Friday, with negotiations ongoing, stocks crept up in the hope of a resolution. The DJIA closed 0.7% while the S& P 500 ended the trading day 0.6% in the green. US Treasuries were slightly higher while crude oil lost ground.

But over the weekend, the blame game continued. House Republicans opposed to Mr. Obama?s healthcare laws said the president rejected the six-week proposal to raise the debt limit and discuss the budget at the same time. The White House is seeking a ?clean? debt clearance to its borrowing authority, and the ball is now in the Senate court to see if they can get the 60 votes out of 100 required to pass legislation. Mr. Obama, the House of Representatives controlled by the Republicans and the Senate need to agree to move forward. Failure to service US sovereign debt could have severe ramifications globally, with markets around the world relying on the safety of US debt. JPMorgan CEO Jamie Dimon and Deutsche Bank co-chief executive Anshu Jain both appear to signal that a no-deal scenario could be apocalyptic for financial markets. Top officials at the annual World Bank/International Monetary Fund meetings also urged US legislators to get past ideological differences and compromise.

In corporate news, earnings reports from Alcoa, JPMorgan Chase and Wells Fargo all beat analysts? expectations, according to Bloomberg News. US markets are closed today for the Columbus Day holiday.

Europe equities rallied on Friday as investors were comforted that US politicians continued to talk. The DJ Stoxx posted a 0.6% weekly gain.

Southeast Asia

Southeast Asia bourses edged up in hope of a resolution from Washington. Early Monday, Singapore?s central bank said it was maintaining its existing pace of currency appreciation. The government said separately that 3Q GDP fell 1% on-quarter compared to the revised 16.9% jump the previous quarter. This beat consensus estimates for a much larger fall, Dow Jones Newswires reported.

North Asia

Most North Asian bourses were higher, as optimism over China?s reform and trade measures helped stocks higher, while Japan got its boost from ongoing US budget and debt talks. The SHCOMP was up 1.6% to end the week 3.2% higher. But on Saturday, the government said exports fell 0.3% on-year in September, signalling how dependent it remains on global demand. Imports meanwhile, rose 7.4% for the same period. Inflation data will be released later today.

Tokyo?s Nikkei 225 leapt on optimism of a US debt deal last week. The benchmark index closed higher for a fourth straight day, and was 2.7% up the week. Japan markets are closed for a holiday today. (Read Report)

But over the weekend, the blame game continued. House Republicans opposed to Mr. Obama?s healthcare laws said the president rejected the six-week proposal to raise the debt limit and discuss the budget at the same time. The White House is seeking a ?clean? debt clearance to its borrowing authority, and the ball is now in the Senate court to see if they can get the 60 votes out of 100 required to pass legislation. Mr. Obama, the House of Representatives controlled by the Republicans and the Senate need to agree to move forward. Failure to service US sovereign debt could have severe ramifications globally, with markets around the world relying on the safety of US debt. JPMorgan CEO Jamie Dimon and Deutsche Bank co-chief executive Anshu Jain both appear to signal that a no-deal scenario could be apocalyptic for financial markets. Top officials at the annual World Bank/International Monetary Fund meetings also urged US legislators to get past ideological differences and compromise.

North Asia

Most North Asian bourses were higher, as optimism over China?s reform and trade measures helped stocks higher, while Japan got its boost from ongoing US budget and debt talks. The SHCOMP was up 1.6% to end the week 3.2% higher. But on Saturday, the government said exports fell 0.3% on-year in September, signalling how dependent it remains on global demand. Imports meanwhile, rose 7.4% for the same period. Inflation data will be released later today.

Tokyo?s Nikkei 225 leapt on optimism of a US debt deal last week. The benchmark index closed higher for a fourth straight day, and was 2.7% up the week. Japan markets are closed for a holiday today. (Read Report)

Magnitude: 7.2

Location: 5km E of Balilihan, Philippines

Time:Tue, 15 Oct 2013 00:12:37 GMT

Location: 5km E of Balilihan, Philippines

Time:Tue, 15 Oct 2013 00:12:37 GMT

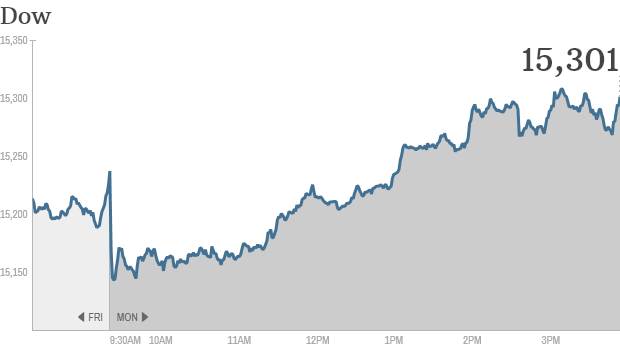

Stocks move higher on new debt talk hopes

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The weekend came and went and lawmakers still haven't resolved the debt issue or the federal government shutdown. Investors weren't too pleased at first, but there are growing hopes that some progress will soon be made.

Stocks fell Monday morning but turned higher by the afternoon following the news that President Obama and Vice President Joe Biden will meet with Congressional leaders Monday afternoon. The meeting was indefinitely postponed, but stocks held on to their gains amid signs that Senate leaders are inching closer to an agreement.

The Dow Jones industrial average, S& P 500, and Nasdaq rose between 0.4% and 0.6%.

The market enjoyed a big rally last week. The Dow gained 460 points over Wednesday, Thursday and Friday on expectations that a deal would be reached to temporarily raise the debt ceiling.

Related: Click here for more on stocks, bonds, currencies and commodities

Stocks have fallen as a result of the shutdown and debt ceiling drama, but they are not down that much from record highs. However, investors could grow more rattled as the week wears on if a deal isn't struck by Thursday. That's when the Treasury Department has warned it may run out of money to pay all government bills.

" We believe this foolish game of chicken shows Washington lawmakers have a na´ve sense of the economy and global markets," said Craig Johnson, technical market strategist at Piper Jaffray.

Johnson said ongoing " saber rattling in Washington" will likely increase market volatility this week. But he continues to believe that " neither party in Washington is foolish enough to let the U.S. default on its debt."

World Markets

North and South American markets finished mixed as of the most recent closing prices. The Bovespa gained 1.92% and the S& P 500 rose 0.41%. The IPC lost 0.23%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +64.15 | +0.42% | 15,301.26 | 4:31pm ET |

|

S& P 500 Index | United States | +6.94 | +0.41% | 1,710.14 | 4:31pm ET |

|

Brazil Bovespa Stock Index | Brazil | +1,020.98 | +1.92% | 54,170.60 | 6:00pm ET |

|

Canada S& P/TSX 60 | Canada | -0.26 | -0.04% | 741.33 | Oct 11 |

|

Santiago Index IPSA | Chile | +6.51 | +0.20% | 3,264.26 | 3:16pm ET |

|

IPC | Mexico | -93.28 | -0.23% | 40,882.09 | 6:06pm ET |

3am Singapore time suppose to hv fireworks. ....now hv to postpone. .... but still looks positive. ...

Huat la Dow!

Is time for me to buy in usd sell sgd.... Lol

How to hai Lang? My long Dow got profit leh...my short on Sti counter also profited leh... Hmmm...

PauloGan ( Date: 14-Oct-2013 19:52) Posted:

|

This snake trying to hai lang again.

I eat a little but shit a lot.

I think I'll eat more then shit lesser. Lol

I eat a little but shit a lot.

I think I'll eat more then shit lesser. Lol

Isolator ( Date: 14-Oct-2013 14:27) Posted:

|

Short sell orders executed on 14 October 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131014.txt

Singapore shares fall, snapping 4 days of gains: Reuters

Singapore shares fell on Monday, snapping four consecutive sessions of gain, as a possible U.S. default loomed closer and Chinese data showed export growth fizzled in September to post a

surprise fall.

...

The benchmark Straits Times Index dropped 0.7 percent to 3,158.15 points, the biggest decline in almost two weeks. MSCI's broadest index of Asia-Pacific shares outside Japan was 0.2 percent lower.

Some of the biggest decliners on the Singapore index include

casino operator Genting Singapore Plc and commodities trader Noble Group Ltd, which fell more than 2 percent each.

Shares of Singapore Press Holdings (SPH) outperformed the market, rising 0.5 percent.

UOB Kay Hian raised its target price on SPH to S$4.22 from S$4.07 and maintained its " hold" rating on the stock to take into account the media and property company's final dividend of 15 Singapore cents per share for 2013 fiscal year.

SPH reported after market hours on Friday a 25 percent fall in full-year net profit to S$431 million ($345.6 million), hit by lower fair-value gains from investment properties and a smaller contribution from its newspaper and magazine business.

Shares of Del Monte Pacific Ltd extended their gains, rising as much as 2.8 percent to S$0.93, the highest since late July. About 1.8 million shares were traded, 4.4 times the average full-day volume over the past 30 days.

The food and beverage company said on Friday it will buy the

canned food business of private equity-backed Del Monte Foods

Consumer Products Inc for $1.7 billion.

Maybank Kim Eng said it sees a good fit between the two entities as they operate in different geographies. " Synergies would likely come in the form of brand ownership and cost savings in certain productions."

The broker raised its target price on Del Monte to S$1.30 from S$1.05 and kept its " buy" rating.

Singapore shares fell on Monday, snapping four consecutive sessions of gain, as a possible U.S. default loomed closer and Chinese data showed export growth fizzled in September to post a

surprise fall.

...

The benchmark Straits Times Index dropped 0.7 percent to 3,158.15 points, the biggest decline in almost two weeks. MSCI's broadest index of Asia-Pacific shares outside Japan was 0.2 percent lower.

Some of the biggest decliners on the Singapore index include

casino operator Genting Singapore Plc and commodities trader Noble Group Ltd, which fell more than 2 percent each.

Shares of Singapore Press Holdings (SPH) outperformed the market, rising 0.5 percent.

UOB Kay Hian raised its target price on SPH to S$4.22 from S$4.07 and maintained its " hold" rating on the stock to take into account the media and property company's final dividend of 15 Singapore cents per share for 2013 fiscal year.

SPH reported after market hours on Friday a 25 percent fall in full-year net profit to S$431 million ($345.6 million), hit by lower fair-value gains from investment properties and a smaller contribution from its newspaper and magazine business.

Shares of Del Monte Pacific Ltd extended their gains, rising as much as 2.8 percent to S$0.93, the highest since late July. About 1.8 million shares were traded, 4.4 times the average full-day volume over the past 30 days.

The food and beverage company said on Friday it will buy the

canned food business of private equity-backed Del Monte Foods

Consumer Products Inc for $1.7 billion.

Maybank Kim Eng said it sees a good fit between the two entities as they operate in different geographies. " Synergies would likely come in the form of brand ownership and cost savings in certain productions."

The broker raised its target price on Del Monte to S$1.30 from S$1.05 and kept its " buy" rating.

Oct. 14 (Bloomberg) -- Today: China CPI and PPI, India

wholesale prices, Singapore GDP, Australia home loans earnings

from Reliance Industries, China Molybdenum, Asia Cement, Keppel

REIT Japan, Hong Kong, Indonesia, Bangladesh markets closed for

holidays. U.S. equities markets are open, while Treasury market

is closed for Columbus Day holiday.

WHAT TO WATCH:

* Yen strengthens as U.S. lawmakers struggle to resolve fiscal

impasse world says it?s keeping faith in Treasuries

* China?s Sept. exports unexpectedly fall 0.3% Y/y, trailing

all 46 ests. in Bloomberg survey

* World should consider new reserve currency, Xinhua News

Agency says in commentary

* China plans to require banks to have minimum liquidity

coverage ratio of 100% by 2018

* Death toll from cyclone in India rises to 17 tons of rice

production to be lost

* India?s unexpectedly slow production growth adds pressure

for more measures to revive economy

* Peugeot prepares 3b euro shr sale, with Dongfeng Motor and

French govt buying matching stakes, Reuters reports

* Japan plans to let private financial institutions manage

part of its $1.27t in foreign exchange reserves

* Malaysian PM Najib Razak says govt can avoid rating cut

central bank governor predicts expansion

* China names 72 cos. violating environment rules incl.

PetroChina?s Hohot Petrochemical, Datong Coal Mine Group:

Xinhua

* Lew, Chidambaram discuss improving investment climate

* China to set up cross-strait equity exchange: National Radio

* Sun Hung Kai lifts luxury flat prices on demand: SMP

ECONOMY (Hong Kong time):

* 5:30am: New Zealand Sept Performance Services Index no est.

(prior 53.2)

* 8am: Singapore 3Q A GDP SAAR Q/q est. -4.0% (prior 15.5%)

* 8am: Singapore 3Q A GDP Y/y est. 3.8% (prior 3.8%)

* 8:30am: Australia Aug Credit Card Balances no est. (prior

$A49.2b)

* 8:30am: Australia Aug Credit Card Purchases no est. (prior

$A23.0b)

* 8:30am: Australia Aug Home Loans M/m est. -2.5% (prior

2.4%)

* 8:30am: Australia Aug Investment Lending no est. (prior

2.9%)

* 8:30am: Australia Aug Owner-Occupier Loan Value M/m no est.

(prior 0.0%)

* 9:30am: China Sept CPI Y/y est. 2.8% (prior 2.6%)

* 9:30am: China Sept PPI Y/y est. -1.4% (prior -1.6%)

* 1pm: Singapore Aug Retail Sales Ex Auto Y/y no est. (prior

2.5%)

* 1pm: Singapore Aug Retail Sales Y/y est. -5.2% (prior

-7.8%)

* 1pm: Singapore Aug Retail Sales SA M/m est. 4.6% (prior

-5.3%)

* 2:30pm: India Sept Wholesale Prices Y/y est. 6.00% (prior

6.10%)

* 8pm: India Sept CPI Y/y est. 9.50% (prior 9.52%)

CENTRAL BANKS (Hong Kong time):

* 8am: Monetary Authority of Singapore twice-yearly monetary

policy statement

GOVERNMENT (Hong Kong time):

* Nothing major scheduled

EARNINGS (Hong Kong time, estimates where available):

* Asia Cement (1102 TT) 3Q NT$1.8b (10 analysts)

* China Molybdenum (603993 CH) 3Q

* IndusInd Bank (IIB IN) 2Q net income adj. median 3.12b

rupees (27 analysts)

* Reliance Industries (RIL IN) 2Q net income adj. median 54.2b

rupees (20 analysts)

IPO WATCH:

* Ta Liang Technology to price 7.63m shrs at NT$28-NT$32

CORPORATE EVENTS/CONFERENCES (Hong Kong time):

* Mitsubishi Heavy Industries (7011 JP) at 8th Annual LNG Tech

Global Summit, Barcelona

STOCKS TO WATCH

* Greater China Highlights

* Banks: CBRC plans bank liquidity-coverage ratio

requirement

* ZTE (000063 CH): Expects to be in world?s top three

handset companies in three years, Executive VP says

* India Highlights

* Bajaj Hindusthan (BJH IN), Balrampur Chini Mills (BRCM

IN): Sugar mills face wider losses as election

approaches

* Japan Highlights

* Japanese markets closed for holiday

* South East Asia Highlights

* Singapore Press (SPH SP): FY net S$431m beats est.

S$382m

* Felda Global (FGV MK): Offers 2.2b ringgit to Koperasi

Permodalan Felda Malaysia for 51% of Felda Holdings

MARKETS:

* S& P 500 up 0.6% to 1,703.20

* Stoxx Europe 600 up 0.4% to 311.61

* U.S. 10-year yield up 0.6bps to 2.687%

* Brent futures down 0.5% to $111.28/bbl

* Gold futures down 2.2% to $1,268.20/oz

wholesale prices, Singapore GDP, Australia home loans earnings

from Reliance Industries, China Molybdenum, Asia Cement, Keppel

REIT Japan, Hong Kong, Indonesia, Bangladesh markets closed for

holidays. U.S. equities markets are open, while Treasury market

is closed for Columbus Day holiday.

WHAT TO WATCH:

* Yen strengthens as U.S. lawmakers struggle to resolve fiscal

impasse world says it?s keeping faith in Treasuries

* China?s Sept. exports unexpectedly fall 0.3% Y/y, trailing

all 46 ests. in Bloomberg survey

* World should consider new reserve currency, Xinhua News

Agency says in commentary

* China plans to require banks to have minimum liquidity

coverage ratio of 100% by 2018

* Death toll from cyclone in India rises to 17 tons of rice

production to be lost

* India?s unexpectedly slow production growth adds pressure

for more measures to revive economy

* Peugeot prepares 3b euro shr sale, with Dongfeng Motor and

French govt buying matching stakes, Reuters reports

* Japan plans to let private financial institutions manage

part of its $1.27t in foreign exchange reserves

* Malaysian PM Najib Razak says govt can avoid rating cut

central bank governor predicts expansion

* China names 72 cos. violating environment rules incl.

PetroChina?s Hohot Petrochemical, Datong Coal Mine Group:

Xinhua

* Lew, Chidambaram discuss improving investment climate

* China to set up cross-strait equity exchange: National Radio

* Sun Hung Kai lifts luxury flat prices on demand: SMP

ECONOMY (Hong Kong time):

* 5:30am: New Zealand Sept Performance Services Index no est.

(prior 53.2)

* 8am: Singapore 3Q A GDP SAAR Q/q est. -4.0% (prior 15.5%)

* 8am: Singapore 3Q A GDP Y/y est. 3.8% (prior 3.8%)

* 8:30am: Australia Aug Credit Card Balances no est. (prior

$A49.2b)

* 8:30am: Australia Aug Credit Card Purchases no est. (prior

$A23.0b)

* 8:30am: Australia Aug Home Loans M/m est. -2.5% (prior

2.4%)

* 8:30am: Australia Aug Investment Lending no est. (prior

2.9%)

* 8:30am: Australia Aug Owner-Occupier Loan Value M/m no est.

(prior 0.0%)

* 9:30am: China Sept CPI Y/y est. 2.8% (prior 2.6%)

* 9:30am: China Sept PPI Y/y est. -1.4% (prior -1.6%)

* 1pm: Singapore Aug Retail Sales Ex Auto Y/y no est. (prior

2.5%)

* 1pm: Singapore Aug Retail Sales Y/y est. -5.2% (prior

-7.8%)

* 1pm: Singapore Aug Retail Sales SA M/m est. 4.6% (prior

-5.3%)

* 2:30pm: India Sept Wholesale Prices Y/y est. 6.00% (prior

6.10%)

* 8pm: India Sept CPI Y/y est. 9.50% (prior 9.52%)

CENTRAL BANKS (Hong Kong time):

* 8am: Monetary Authority of Singapore twice-yearly monetary

policy statement

GOVERNMENT (Hong Kong time):

* Nothing major scheduled

EARNINGS (Hong Kong time, estimates where available):

* Asia Cement (1102 TT) 3Q NT$1.8b (10 analysts)

* China Molybdenum (603993 CH) 3Q

* IndusInd Bank (IIB IN) 2Q net income adj. median 3.12b

rupees (27 analysts)

* Reliance Industries (RIL IN) 2Q net income adj. median 54.2b

rupees (20 analysts)

IPO WATCH:

* Ta Liang Technology to price 7.63m shrs at NT$28-NT$32

CORPORATE EVENTS/CONFERENCES (Hong Kong time):

* Mitsubishi Heavy Industries (7011 JP) at 8th Annual LNG Tech

Global Summit, Barcelona

STOCKS TO WATCH

* Greater China Highlights

* Banks: CBRC plans bank liquidity-coverage ratio

requirement

* ZTE (000063 CH): Expects to be in world?s top three

handset companies in three years, Executive VP says

* India Highlights

* Bajaj Hindusthan (BJH IN), Balrampur Chini Mills (BRCM

IN): Sugar mills face wider losses as election

approaches

* Japan Highlights

* Japanese markets closed for holiday

* South East Asia Highlights

* Singapore Press (SPH SP): FY net S$431m beats est.

S$382m

* Felda Global (FGV MK): Offers 2.2b ringgit to Koperasi

Permodalan Felda Malaysia for 51% of Felda Holdings

MARKETS:

* S& P 500 up 0.6% to 1,703.20

* Stoxx Europe 600 up 0.4% to 311.61

* U.S. 10-year yield up 0.6bps to 2.687%

* Brent futures down 0.5% to $111.28/bbl

* Gold futures down 2.2% to $1,268.20/oz

US equities ended Friday higher to post weekly gains for the first time in three weeks.

Johnson & Johnson (+1.9%) led gains for the Dow, which saw 24 advancers out of 30. The index ended the week up 1.1%. The S& P 500 also gained 0.8% for the week. Rounding off the major indices, the NASDAQ Composite fell 0.4% for the week for its first loss in six weeks. NYSE composite volume was light at 2.9b (3.4b previously)....

WTI Crude for Nov lost 99 cents, or 1%, to end at US$102.02/barrel while Nov Brent shed 52 cents, or 0.5%, to settle at US$111.28/barrel. For the week, WTI lost 1.8% but Brent gained 1.7%.

Gold for Dec delivery fell by US$28.70, or 2.2%, to end at US$1,268.20/ounce. Dec Silver declined by 64 cents, or 2.9%, to end at US$21.26/ounce. For the week, gold and silver lost 3.2% and 2.3% respectively.

Implications for Singapore

Despite the continued gains on Wall Street Friday, the STI could be facing a fair bit of a resistance today, as caution could set in ahead of 17 Oct?s deadline to raise the US debt ceiling.

Moreover, the index did not manage to convincingly clear the key resistance at 3179 (centre of Bollinger Band) intraday high of 3197 was also short of the next hurdle at 3200 (formed a bearish candlestick instead).

Overall trading was relatively light on Friday, and could remain so ahead of the public holiday tomorrow.

Above 3200, we peg the next key resistance at 3260, clearing which could trigger a bullish reverse head and shoulders formation (potential target of 3530).

On the downside, we see 3125 (minor uptrend line since 28 Aug) as the initial support, ahead of the 3051-3071 gap.

Johnson & Johnson (+1.9%) led gains for the Dow, which saw 24 advancers out of 30. The index ended the week up 1.1%. The S& P 500 also gained 0.8% for the week. Rounding off the major indices, the NASDAQ Composite fell 0.4% for the week for its first loss in six weeks. NYSE composite volume was light at 2.9b (3.4b previously)....

WTI Crude for Nov lost 99 cents, or 1%, to end at US$102.02/barrel while Nov Brent shed 52 cents, or 0.5%, to settle at US$111.28/barrel. For the week, WTI lost 1.8% but Brent gained 1.7%.

Gold for Dec delivery fell by US$28.70, or 2.2%, to end at US$1,268.20/ounce. Dec Silver declined by 64 cents, or 2.9%, to end at US$21.26/ounce. For the week, gold and silver lost 3.2% and 2.3% respectively.

Implications for Singapore

Despite the continued gains on Wall Street Friday, the STI could be facing a fair bit of a resistance today, as caution could set in ahead of 17 Oct?s deadline to raise the US debt ceiling.

Moreover, the index did not manage to convincingly clear the key resistance at 3179 (centre of Bollinger Band) intraday high of 3197 was also short of the next hurdle at 3200 (formed a bearish candlestick instead).

Overall trading was relatively light on Friday, and could remain so ahead of the public holiday tomorrow.

Above 3200, we peg the next key resistance at 3260, clearing which could trigger a bullish reverse head and shoulders formation (potential target of 3530).

On the downside, we see 3125 (minor uptrend line since 28 Aug) as the initial support, ahead of the 3051-3071 gap.

Still have long on dow.... lesser position.... I only entered short on STI counter.... But also reduce position....

New123 ( Date: 14-Oct-2013 11:53) Posted:

|

Thot -áToday, Monday. Oct 14 for chinese mean Oct 14 is.... 10月 10日 . Then again date line for U.S debt fall on Thursday Oct 17, to our trading system, it start on Friday Oct 18 which is in Chinese calender fell on 10月 14日 ....oso very Jialat loh...Thurs red red n Friday green green.

are u still longing dow? i thought u hv entered yr short position

Isolator ( Date: 14-Oct-2013 10:11) Posted:

|

lunch eat longtong or eat shortong??

Reduce my shorts on STI..... take some profit.....

Still long dow.....

Global Markets: UOB

? Note that the US and Japan will be closed today for their respective holidays.

? The US will be celebrating the Columbus Day Holiday on Monday (14 Oct) but there may not be in any holiday mood in Washington, as the US government partial shutdown enters its third week and the most clear and present danger to the US and global financial markets will be the US debt ceiling ultimatum. Frankly nothing else matters this week except the 17 October 2013 US debt ceiling limit deadline set by the US Treasury. ...

Over the weekend (12-13 Oct), there was disappointment as there was still no breakthrough on either raising the US debt ceiling or re-starting the US government after US President Obama rejected US House Republicans? proposal on Sat (12 Oct). And on Sunday (13 Oct), Obama spoke with House minority Democrat leader Nancy Pelosi, reiterating the need to reopen the Government and raise the debt ceiling for a year with a ?clean? legislation, free from other policy conditions.

Presently, the negotiations have shifted to US Senate leaders who are struggling to resolve the fiscal impasse as the threat of a US default looms ever closer. To emphasize the urgency of the situation, both the Senate and House are scheduled to be in session today despite the US federal holiday.

Note also that the US stock markets will be opened today (14 Oct) on the federal Columbus Day holiday but the US bonds markets will be closed. We expect a bloodbath in global and US equity markets today.

In addition, China reported disappointing export numbers over the weekend (-0.3%y/y in Sep from +7.2% in Aug), and that should add to the downside sentiment in equity markets.

? Note that the US and Japan will be closed today for their respective holidays.

? The US will be celebrating the Columbus Day Holiday on Monday (14 Oct) but there may not be in any holiday mood in Washington, as the US government partial shutdown enters its third week and the most clear and present danger to the US and global financial markets will be the US debt ceiling ultimatum. Frankly nothing else matters this week except the 17 October 2013 US debt ceiling limit deadline set by the US Treasury. ...

Over the weekend (12-13 Oct), there was disappointment as there was still no breakthrough on either raising the US debt ceiling or re-starting the US government after US President Obama rejected US House Republicans? proposal on Sat (12 Oct). And on Sunday (13 Oct), Obama spoke with House minority Democrat leader Nancy Pelosi, reiterating the need to reopen the Government and raise the debt ceiling for a year with a ?clean? legislation, free from other policy conditions.

Presently, the negotiations have shifted to US Senate leaders who are struggling to resolve the fiscal impasse as the threat of a US default looms ever closer. To emphasize the urgency of the situation, both the Senate and House are scheduled to be in session today despite the US federal holiday.

Note also that the US stock markets will be opened today (14 Oct) on the federal Columbus Day holiday but the US bonds markets will be closed. We expect a bloodbath in global and US equity markets today.

In addition, China reported disappointing export numbers over the weekend (-0.3%y/y in Sep from +7.2% in Aug), and that should add to the downside sentiment in equity markets.