Considering North Korea's threat to use nuclear weapons, you would think that markets would be exhibiting much more volatility.

But the relatively sanguine mood just goes to show how serious the markets are taking North Korea and its leader Kim Jong-un.

SBS/CNBC reporter Chery Kang, who is based in Seoul, attributed today's early sell-off to a combination of disappointing U.S. economic data, uncertainty regarding the Bank of Japan's interest rate meeting, and the threats out of North Korea.

Earlier, Stifel Nicolaus' Dave Lutz argued that the sell-off in the U.S. markets wasn't just about the North Korea. He said that if it was, we would see South Korea's stock markets tank and credit default swaps surge, which didn't happen.

Crude oil inventories in the United States rose 4.7 million barrels last week according to the ADP report on Tuesday, much higher than the expected increase of 2.2 million, suggesting that demand on oil continues to be weak.

Later today the EIA report may show that U.S. crude stockpiles probably climbed to 388 million barrels last week, the highest level in more than 22 years, which may add to the downside pressures on oil prices amid demand worries.

Meanwhile, Exxon Mobile’s Pegasus pipeline, used to supply U.S. Gulf Coast refineries, continues to be closed until regulators are satisfied with repairs, which is leading to a buildup in stockpiles near the delivery point. A leak was discovered in Arkansas last week.

- Crude oil is trading around the $96.57 a barrel level compared with the opening at $96.89, while the highest is at $96.91 and the lowest is at $96.49

- Brent is trading around $110.25 a barrel after falling 0.10% or $0.44

A number of weak economic data shows that oil prices may face further headwinds this week although the Dow and S& P 500 both closed at record highs on Tuesday after the U.S. factory orders rose 3.0% in February.

After China’s downbeat PMI manufacturing and the disappointing U.S. ISM manufacturing, Britain`s manufacturing activity shrank for a second straight month. Meanwhile, eurozone’s unemployment hits a record 12%, while Italy`s political impasse continues.

Yet the international lenders gave Cyprus until 2018 to meet new budget targets providing some relief, however markets are now eyeing the U.S. APD employment change and Friday’s key jobs data from the U.S. and the central banks meeting in Japan, UK and the eurozone.

- Natural gas is trading at $3.981 per cubic feet after rising 0.30%

- Heating oil is trading at $3.0844 a gallon after falling 0.10%

- Gasoline is trading at $3.0448 a gallon after rising 0.13%

Gold (GLD) went up on Wednesday.

It did not go up by a lot. But it meant something. The drip-drip-drip erosion in gold prices since the New Year had been the equivalent of Chinese Water Torture for gold bulls. The collective relief was palpable. Too bad the miners (GDX) still fell, but that's another story for another day.

Let us examine, dear reader, what changed such that gold, while still down year over year, has finally broken even in the New Year. It was because the Fed said it will keep pumping money in the form of QEternity. Reported Forbes:

The Bernanke Fed made it clear that it plans to continue its latest round of quantitative easing, in which it's buying $85 billion in Treasuries and residential mortgage-backed securities a month, and that interest rates will remain at record lows until unemployment drops.

This is mildly interesting. The Fed has not been shy lately talking about perpetual QEternity, so this should not have been a surprise to anyone. So why was this a shot in the arm for gold? Investor's Business Daily checked with the experts and came up with this gem:

Don Vandenbord, a portfolio manager at Fleming Island, Fla.-based Camarda Wealth Advisory Group, said in an email, " This will cheapen the U.S. dollar, which is bullish for precious metals."

Curious and curiouser. Or, perhaps, I should say, simple, and simplistic.

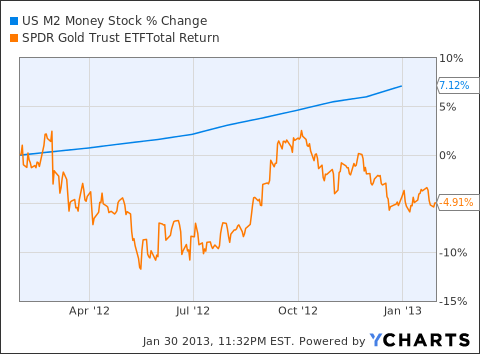

The Fed has been increasing money supply for a while, while gold prices have been flatlining. Witness the 7% growth in money supply (M2) and the 5% decline in gold prices over the past year, for example.

Let's first explain why increase in money supply didn't lead to rise in gold prices. Gold, being a commodity, can have a price rise from two different stimuli. One, there could be inflation, when gold prices would rise with all other commodities. Two, there could be increased demand for gold over and above supply increases.

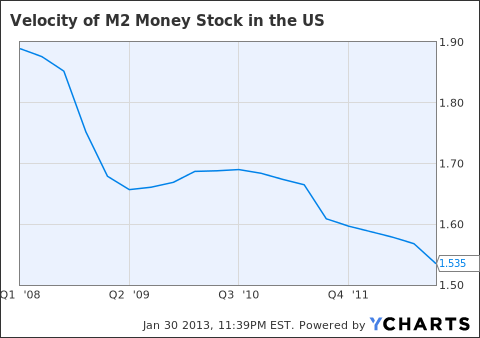

Increased money supply in the USA has not led to higher inflation. This is because the velocity of money has been, well, pathetic.

M2 velocity, as the chart above shows, has steadily dropped over the past 5 years. Hence, the increased money supply has largely not been chasing goods and services in the economy (which is what creates inflation) but is rather sitting in risk-off assets like bonds. Given the steepness of the drop, it will be a while till the M2 velocity normalizes, which is when we will start to see inflation again.

Hence QEternity is unlikely to cause inflation anytime soon, and indeed inflation has been less than 2% over the past year, completely failing to provide any support for gold prices. In the mean time, demand for gold has dropped in India, which is why gold prices have stagnated in the past year.

We know that gold demand in India is expected to be even lower in 2013 because of hike in gold import duty by the Government of India, so that is not going to lend any support. Is there any chance the velocity of money may unexpectedly pick up causing inflation? I doubt it, because the US economy took a kick in the gut on Wednesday. Reports Forbes:

The U.S. economy greatly slowed in the fourth quarter, driven lower by reduced government spending and lower inventories.

U.S. gross domestic product fell for the first time in three and a half years in the fourth quarter, declining by an annualized 0.1%.

This, hopefully, is a glitch, and the US recovery is hopefully still intact. But if not, then unemployment will be high for longer than anticipated. Of course, this extends the duration for QEternity. But this also means the inexorable drop in the M2 velocity is likely to continue. That means even lower inflation, which is not good for gold especially when demand is dropping, too.

This made the case for shorting gold in 2013 just that much stronger. This was clear from Wednesday's market move, as, after the initial jump, gold prices slowly kept falling throughout the day, and the gold miners, strongly up at one point, ended the day with a loss.

What does this mean for your investment thesis for the rest of 2013, dear reader? Well, my projection for gold prices in 2013 remains unchanged, that shorting gold -- especially via the miners (GDX and NUGT) -- remains the play for 2013. For more details, please check out my other article titled " How Best To Short Gold - Miners Or Metal?"

In the mean time, I initiated a position in DUST on Thursday at the market open. I think the miners are really setting up to be perma shorts with falling gold prices and rising mining costs.

Disclaimer: This is not meant as investment advice. I do not have a crystal ball. I only have opinions, free at that. Before investing in any of the above-mentioned securities, investors should do their own research, consult their financial advisors, and make their own choices.

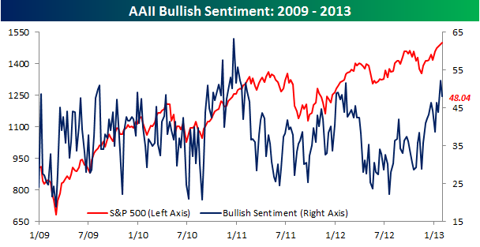

Well that didn't last long. After topping 50% for the first time since February, bullish sentiment dropped back below 50% last week.

According to the weekly survey from the American Association of Individual Investors (AAII), bullish sentiment dropped from 52.34% down to 48.04%. In spite of the drop, though, bullish sentiment is still high enough to rank as the third highest weekly reading in the last year.

(click to enlarge)

CLICK NoW !!

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 1

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 2

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 3

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 4

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 5

WWE Royal Rumble 2013 - 1/27/2013 - 27th January 2013 - HDTV - Watch Online Part 6

* All eyes on when quantitative easing program will end

NEW YORK, Jan 17 (Reuters) - The Federal Reserve will very likely need to continue its large-scale asset purchases into the second half of this year, since a big improvement in the U.S. labor market is unlikely to have happened by then, a top central bank official said on Thursday.

" My own sense of this is that it is probably going to be a struggle to see by mid-year a clear indication that the outlook for the labor markets are in a new phase, and it's quite optimistic," Atlanta Fed President Dennis Lockhart said at a conference hosted by Bloomberg.

" So I would tend to believe that this bond purchasing will need to continue longer into the year," he added. " Whether it goes beyond that, I think, is a question that the committee will take up in trying to weigh efficacy, costs and improvement."

To speed up the tepid U.S. economic recovery, the Fed is currently buying $45 billion worth of U.S. Treasury bonds and an additional $40 billion of mortgage-backed securities per month under its quantitative easing program, dubbed QE3.

Lockhart, a centrist monetary policymaker who does not vote on policy this year, later told reporters the Fed could taper its bond buying, and could also selectively reduce purchases of either Treasuries or MBS, when the time finally comes.

* Platinum at 3-month top above $1,701/oz

* Palladium hits 16-month high above $702/oz

* Gold hovers around $1,691, back above 200-day MA (Recasts and updates prices and market comments to U.S. session, changes byline and dateline, pvs LONDON)

By Barani Krishnan

NEW YORK, Jan 17 (Reuters) - Platinum jumped to a three-month high on Thursday, passing the price of gold for the second session in a row after upbeat U.S. economic data boosted optimism about demand for industrial commodities such as platinum, a vital material for automakers.

Palladium also rallied, hitting 16-month highs, as investors in platinum group metals (PGMs) remained wary about supply shortages after miner Amplats announced this week an overhaul that could cut 400,000 ounces of platinum production in a year.

The spot price of platinum hit a three-month high of $1,701.50 and was up nearly 0.2 percent at $1,687.74 an ounce at 1830 GMT. Palladium was also up 0.2 percent at $722.81, having matched a Sept. 2011 high of $727.

Bullion's spot price hovered at just above $1,689, up 0.6 percent. At their session lows, bullion and platinum were almost at parity at around $1,666 an ounce, while at their peak, the difference was $5 in platinum's favor.

" There is a significant chance of platinum moving back to a normal type of premium of at least $100 (against gold)," INTL Commodities CEO Jeff Rhodes said.

" Potential for further supply shocks in the PGMs does have all the ingredients for an interesting few weeks in terms of prices," Rhodes added.

The rally came as upbeat U.S. housing and jobs data sparked a rise in U.S. stocks to five-year highs and cut early losses in the dollar, boosting appetite for risk assets, particularly industrial commodities such as PGMs. The Thomson Reuters-Jefferies CRB index, which tracks 19 commodities, hit a 2-week high.

EXPLOSIVE DEMAND FOR PGMs

Platinum and palladium are integral for reducing toxic emissions from cars.

Analysts say explosive growth in China's automobile industry, and a November report from PGM specialist and refiner Johnson Matthey forecasting the biggest palladium deficit in 12 years, had combined to create the unusual price action.

Some caution that the rally, driven largely by buying from hedge funds and money managers, might have gone too far.

Thursday's run-up came in spite of news that miners at Amplats, or Anglo American Platinum, had returned to work after an illegal walkout to protest against the world's top platinum producer's plan to cut 14,000 jobs, close two mines and sell another.

Since the year began, platinum, which is also popular in jewelry making, has already risen about 10 percent in price and palladium about 8 percent. Thomson Reuters data shows the Relative Strength Index for both metals at above 60, technically putting them in overbought territory.

The U.S. EFTS Platinum Trust has also posted an increase in its platinum holdings so far in January.

Many still think prices will push higher.

" The two markets are up nicely, but it's not like the move has been parabolic. We do think PGMs have more to go," said Mark Luschini, chief investment strategist of Janney Montgomery Scott, a broker-dealer which manages $54 billion in assets.

GOLD ABOVE 200-DAY MOVING AVERAGE

Gold moved back above its 200-day moving average this week, a key chart level, after falling below that level in early January when minutes of a Federal Reserve policy meeting showed concern about the scope of U.S. monetary easing.

" We are still in a period of trial, trying to rebuild the confidence into the gold market," Saxo Bank vice president Ole Hansen said. " We have not breached any critical levels yet to the upside, which could signal that further strength could be coming."

" While we still stay above the 200-day moving average around $1,662, there is a lot of nervousness in the market," Hansen said. " We've seen big swings at the start of January, we spent the last week trying to recover from that."

Spot gold was up 0.7 percent at $1,691.14 an ounce, while U.S. gold futures were up 0.5 percent at $1,692.30. Spot silver rose 1.2 percent to $31.80.

Dealers said physical buying interest for gold has ebbed, after a robust start to the year.

" What we did see in the gold dips was strong physical demand across the Asian world, including Thailand and India, but since (then), the physical market has definitely slowed," INTL's Rhodes said. (Additional reporting by Clara Denina in London Editing by Grant McCool and David Gregorio)

* EBay gains after results beat expectations

* Bank of America, Citigroup results weigh on financials

* Indexes up: S& P 0.61 pct, Dow 0.56 pct, Nasdaq 0.55 pct

By Chuck Mikolajczak

NEW YORK, Jan 17 (Reuters) - Wall Street rose on Thursday, with the S& P 500 climbing to a five-year intraday high, on improved housing and jobs data along with better-than-expected results from online marketplace eBay.

The data showed the number of Americans filing new claims for unemployment benefits fell to a five-year low last week, while groundbreaking for homes rose to the fastest pace in four years last month.

Strength in the housing and labor markets is key to sustained growth and higher corporate profits. Job market improvement helps stimulate consumer spending while a recovery in housing means more purchases of appliances, furniture and other household goods as well as a source of employment.

" The real estate numbers all look good, sales looked good, prices looked good, housing starts looked good," said Stephen Massocca, managing director at Wedbush Morgan in San Francisco.

" The only thing that still doesn't look really good in my mind are the employment numbers but even the claims were pretty good and inflation seems to be nonexistent so what's to stop the party from going?"

The Dow Jones industrial average gained 82.97 points, or 0.61 percent, to 13,594.20. The Standard & Poor's 500 Index advanced 8.31 points, or 0.56 percent, to 1,480.94. The Nasdaq Composite Index rose 17.12 points, or 0.55 percent, to 3,134.66.

PulteGroup Inc shares gained 4.9 percent to $20.29 and Toll Brothers Inc advanced 2.2 percent to $35.68. The PHLX housing sector index climbed 2.1 percent.

EBay's shares rose 3 percent to $54.47 a day after it reported holiday quarter results that just beat Wall Street expectations. It gave a 2013 forecast that was within analysts' estimates.

The S& P is on track for its third consecutive advance, which pushed the index above an intraday peak set in September to its highest since December 2007.

But gains were tempered by weakness in the financial sector, with Bank of America down 4.3 percent to $11.27 and Citigroup off 3 percent to $41.22 after they posted their results.

Bank of America's fourth-quarter profit fell as it took more charges to clean up mortgage-related problems. Citigroup posted $2.32 billion of charges for layoffs and lawsuits, while its new chief executive cautioned the bank needed more time to deal with its problems.

The S& P financial sector index slipped 0.14 percent as the only one of the 10 major S& P sectors to decline.

S& P 500 corporate earnings for the fourth quarter are expected to rise 2.3 percent, Thomson Reuters data showed. Expectations for the quarter have fallen considerably since October when a 9.9 percent gain was estimated.

With investors anticipating the current earnings season to be lackluster, their focus will be on the corporate earnings outlook for the months ahead, analysts said.

Shares of Boeing extended recent declines after the United States and other countries grounded the company's new 787 Dreamliner after a second incident involving battery failure. Boeing shed 0.4 percent to $74.05 and is down 1.5 percent for the week so far.

Market breadth was solid, with advancers outpacing decliners on the New York Stock Exchange 2,234 to 650, while on the Nasdaq the ratio was 1,602 to 762 in favor of advancing stocks.

First the scoreboard:

Dow: 13,390, -22.4, -0.1 percent

S& P 500: 1,458, -4.2, -0.3 percent

NASDAQ: 3,099, -13.7, -0.4 percent

And now the top stories:

It's jobs week in America. According to ADP, the private sector added 215k jobs in December. This was much higher than the 140k expected by economists. This is a good sign because many consider this to be the preview for the official employment situation report, which will be published by the Bureau of Labor Statistics tomorrow morning at 8:30 AM ET.

According to Challenger Gray And Christmas, announced layoffs plunged in December from November and December from the year prior. However, this number tends be noisy. In November, the number spiked due to the Hostess bankruptcy.

Initial claims, however, were disappointing. Claims for the week ending December 29 jumped to 372k, which was higher than the 360k expected by economists. Also, the prior week's number was revised up to 362k from a preliminary reading of 350k.

The big story of the day was certainly the minutes from the December Federal Open Market Committee meeting. This was the same meeting when the Fed announced it would employ unemployment rate and inflation rate targets to guide monetary policy. Many saw this as an extremely dovish move. However, according to the minutes today, we learned that several members of the FOMC actually wanted to halt or cut quantitative easing programs before the end of 2013, which is much sooner than most would've expected.

Stocks and gold instantly tanked on the news.

" This should significantly amplify the financial market's sensitivity to upcoming economic data, particularly if we witness a spell of robust economic reports which could bring into question the perception of the Fed's exit strategy," wrote Deutsche Bank economist Joe LaVorgna.

Five Big Post-Fiscal Cliff Questions Investors Should Ask

Now that Washington has talked American investors down from the fiscal cliff, what will be the market's next obsession?

And how might people invest for a new normal where tax rates have been decided, but everything from worldwide growth to the fate of Europe's economy remains in flux?

Stocks surged on the first day of the year in a global sigh of relief that the U.S. economy will not go over the precipice after Congress compromised on curtailing recession-threatening spending cuts (for now) and tax increases.

Now that we're over the cliff, what are the biggest worries for investors looking to make more than zero on their money? Here are five key questions and answers, from fund managers and analysts, that will matter in 2013.

1. Will the tech sector recover its sizzle?

Put another way, will Apple, the Company Formerly Known as the World's Most Valuable, find its way back to favor with investors?

Its products are still cherished by consumers, and it sits on the topmost shelf of global brand names.

But it became a dark star for tech stocks last September as its falling price dragged the entire sector lower.

A related question: Will investors ever embrace Facebook after its IPO flop?

[Read: Post-Cliff Financial Plans for 2013.]

Why it could be a problem:

Apple (symbol: AAPL) and Facebook (FB) are important because even after their declines, they make up a large portion of the tech sector. Beyond that, Apple matters for the excitement it creates among consumers.

Facebook is significant because it is seen as an indicator of whether social media can produce earnings growth to match the hype (and lofty stock prices). Clearly it is a time of transition in which both companies face challenges.

Investing solution:

There is no doubt that mobile computing and social media are booming.

But investors may need to take a broader view of tech stocks and invest in diversified tech funds, says Todd Rosenbluth, an ETF analyst at S& P Capital IQ.

Two funds he cited were Technology Select Sector SPDR (XLK) and Vanguard Information Technology ETF (VGT).

" What it does is give investors a chance to get exposure to all of those players instead of just making a bet on one," he adds. He thinks Apple (it's the largest holding in both funds) could be bargain-priced now after its 25 percent fall from a September peak above $700.

Buying broader funds also gives investors a piece of solid tech stock like IBM (IBM), Microsoft (MSFT), QUALCOMM (QCOM), and Cisco (CSCO), " just a few of our favorites in a sector that could be set for a rebound," he says.

2. Is there a bond-market bubble?

The fiscal cliff threatened to trim $500 billion to $1 trillion from U.S. growth.

The next threat on that scale comes from the bond market.

Investors have been avid buyers of U.S. debt and now hold $16 trillion worth.

With prices at an all-time high and yields at an all-time low (prices are inverse to yield), some fear it is a massive bubble.

When it could be a problem:

There will be a series of critical checkpoints for the bond market. One of the biggest tests could come as early as next month when Congress must decide whether to raise the debt ceiling to fund government operations.

There are also eight Federal Reserve Open Market meetings this year and each will include a full review of the Fed strategy of keeping rates low, although recent decisions to keep rates very low until the jobless rate falls to 6.5 percent make sudden moves unlikely.

Still, even tiny increases in interest rates could mean big risks for bond investors.

" Rates are so low they are eventually going to have to go up and when they do, people are going to lose money in bond-market positions," says Hugh Johnson, chairman of Hugh Johnson Advisors.

" It's very deep worry and it's got a bubble feeling."

Rates should be stable and unthreatening this year, he says, but 2014 could be a year of reckoning.

[Read: Use MLPs to Tap a Booming Energy Sector.]

Investing solution:

It's a good time to look at your portfolio and make sure it is not overloaded with long-dated U.S. debt, especially in bond funds.

If you own long-term government debt securities yielding 3 percent to 4 percent, you might consider selling them over the next year—or prepare to hold them to maturity as prices fall.

Bond funds could be even riskier since the yield they pay fluctuates with the market—so there is not a true hold-to-the-bitter-end fixed payout option.

Their value also falls as rates rise.

3. What happens in the rest of the world?

Everyone has been focusing on Washington's budget crisis for much of the past year and a half.

Attention is now likely to turn back to trouble spots in the world at large.

European stocks rallied last year, but Europe is far from solving its towering debt issues.

China, though, is back on a growth track after more than a year of pulling back on economic stimulus to slow inflation.

The export problem:

U.S. export sales dipped during the recession and have remained under pressure.

Rising commodity costs have curbed the appetite for American farm produce, usually one of the steadiest exports.

Higher-end products from computers to jets have lagged as world economic growth stagnated.

Investing solution:

Global stocks are not cheap after a solid year.

But since half the profit of major U.S. companies is derived from abroad, investing in U.S. equity provides plenty of foreign exposure.

" International stocks have been doing better for a while," says Johnson. But as investors become willing to take on more risk, that global rally could fan out to include " small and midsized companies" that have been left out.

4. How solid is the housing recovery?

Look for housing sales and prices, especially the S& P Schiller index, to become a bigger focus again as investors try to gauge the staying power of a recovery that gained momentum last year.

Housing always has a large direct impact on the economy—more so since the housing collapse of five years ago destroyed consumer confidence and reversed the feel-good " wealth effect" of home equity.

One problem:

The big recovery seen in the past year could dissipate if job growth remains tepid.

" The housing and jobs markets are improving in the U.S., but only modestly," says David Edwards, president of Heron Capital Management, Inc.

[See: 10 Golden Parachutes to Make Your Head Spin.]

Investing solution:

In the wake of big gains in real estate investment trusts (REITs) and other direct housing investments over the past three years, investors might be better off looking at the consumer and housing-related sectors that have not recovered as fully.

5. Why are industrials attractive now?

Nothing is ever fail-safe when it comes to investing.

And industrials are notoriously volatile.

But there is wide consensus that this sector is more promising than most others in a strengthening global economy.

A weaker dollar makes U.S. industrial goods more competitive and translates directly to higher earnings from other, stronger currencies.

Even so, businesses are still reluctant to invest in capital goods until they see clearer end-user demand from consumers.

Investing solution:

A pure equity play focused on larger industrials is the safest, partly because the cash-rich companies can pay dividends and support shares through stock buybacks and get a lift from foreign earnings and a weak dollar.

Says S& P's Rosenbluth: " We see economic growth improving now that the first level of the cliff is resolved and more cyclicals like industrials and consumer discretionary stocks will do well in this kind of environment."

The defensive stocks—utilities, consumer staples—will lag, he adds.

" People pulled back on the risk at the end of 2012," says Rosenbluth. Now it's back on—until the next cliff approaches.

This story was originally published by U.S. News & World Report.

It's That Time Of Year When Traders Talk About The S& P 5-Day Rule

Take for instance the S& P 5-day rule, which comes from the Stock Market Almanac. According to the rule, the S& P 500 ends the year positive if it ends the first five trading days of the year positive.

It has worked between 80 to 90 percent of the time.

And it worked last year.

And according to Art Cashin, UBS Financial Services Director of Floor Operations, traders are chatting about it again.

From this morning's Cashin's Comments:

What Does Wednesday's Rally Indicate? – Lots of folks tried to extrapolate Wednesday's rally to indicator status. As Steven Russolillo of the WSJ notes, the predictability provided by the action of the first trading day of the year is about the same as a coin flip – it's right 50% of the time.

The first five days of trading, however, have a more discernible record. According to the very helpful Traders Almanac, the last 39 times the market rose in the first five days, it closed up on the year 33 times (84.69%). So stay tuned.

* Potential duty hike set to hurt Indian gold demand

* Turkish gold imports rose 57 pct in 2012

By David Brough

LONDON, Jan 3 (Reuters) - Gold fell from the prior session's two-week peak on Thursday as the dollar strengthened and a stock market rally stalled, with investors focusing on coming U.S. budget talks as euphoria over a vote to avert a fiscal crisis faded.

World shares struggled for traction on Thursday as investors grew concerned about new political battles looming in Washington over spending cuts, following Wednesday's rally on the back of a deal to avoid the so-called " fiscal cliff" .

Spot gold was at $1,678.46 by 1446 GMT, down 0.48 percent after having touched a two-week peak above $1,694 in the previous session. U.S. gold futures for December delivery were down $9.80 an ounce at $1,679.00.

An ADP National Employment Report, which showed private sector employers added more jobs than expected in December, undermined the safe-haven appeal of U.S. government debt on Thursday and added pressure to gold, analysts said.

Gold's gains have been driven largely by successive rounds of U.S. quantitative easing, which have kept pressure on long-term interest rates and fuelled fears of inflation. Any further easing measures have been explicitly tied to jobs growth.

" You could argue that the U.S. is creating jobs - and that is another sign that the U.S. economy is in recovery mode," Daniel Briesemann, an analyst with Commerzbank in Germany.

Closely watched U.S. non-farm payrolls data due on Friday is expected to show the economy added 150,000 jobs last month, after adding 146,000 in November.

Briesemann said that after the relief over the U.S. deal to avoid a fiscal crisis, financial markets were waking up to the challenges that lie ahead in U.S. budget talks.

" The euphoria is cooling down somewhat, and market participants are taking a more realistic view of what is ahead," he said.

U.S. lawmakers left unresolved a sticky issue involving $109 billion in planned spending cuts, promising more political showdowns on the budget in coming months.

" The deal to avoid a fiscal cliff has booted some problems into the long grass by a considerable distance, but there are still issues out there such as expanding the debt ceiling, which could prove to be difficult negotiations," said David Jollie, strategic analyst at Mitsui Precious Metals.

HEADWINDS FOR GOLD

Gold ended up around 7 percent in 2012, the 12th straight year of gains, but faces headwinds this year after posting its worst quarterly performance in more than four years in the last three months of 2012.

Gold importers in India, the world's biggest buyer of the metal last year, retreated a day after rumours of an import tax hike, as a weaker rupee helped keep prices around their highest level in two weeks.

" Physical gold demand may be negatively affected in the next few months by the fact that the Indian government is considering raising duties on gold imports even further," Commerzbank said in a note.

" The aim is to tackle the country's record-high current account deficit, for which - according to India's central bank - gold imports are roughly 80 percent to blame."

The Istanbul Gold Exchange reported on Thursday that Turkey's gold imports rose by 57 percent last year to 120.78 tonnes from 79.7 tonnes in 2011.

Among other precious metals, silver was down 0.45 percent to $30.83 an ounce, while platinum firmed 0.69 percent to $1,571.25 and palladium slipped 0.91 percent to $695.97 an ounce.

How will DOW perform tonight??

How will it affect STI on last trading day of the first week, 2013??

let's see...

What he had said recently ... ...

What he had said recently ... ...

Dec 28, 2012

A Zero Sum Game In Currencies/ Trade Balances

Dec 27, 2012

The Debt Ceiling Is A Dumb Idea

Related: SPDR SP 500 ETF (NYSE:SPY)

Dec 26, 2012

" Benefit" Of Falling Off The Cliff

Dec 21, 2012

The Fiscal Cliff Looms Closer

Dec 20, 2012

The Euro Zone Periphery Shows Little Sign Of Recovery

Related: iShares MSCI Italy Index ETF (EWI), iShares MSCI Spain Index ETF (EWP), iShares

Singapore shares rose to their highest since August 2011 after encouraging economic data from China, led by CapitaLand Ltd

The Straits Times Index was up 0.3 percent at 3,212.44, in line with the rise in MSCI Asia Pacific ex-Japan index of stocks.

Shares of CapitaLand, Southeast Asia's largest property developer, rose more than 2 percent on volume of nearly 12.5 million shares, 1.4 times the average full-day volume over the past 30 days.

CapitaMalls Asia Ltd

CapitaLand said on Thursday it had overhauled its top management and organised its businesses into four main areas - CapitaLand Singapore, CapitaLand China, CapitaMalls Asia and The Ascott Ltd.

Shares of Olam International Ltd

Stocks linked to Myanmar surged on investor interest in the Southeast Asian country. Shares of AsiaMedic Ltd

Reporting by Eveline Danubrata in Singapore Editing by Anupama Dwivedi eveline.danubrata@thomsonreuters.com

***************************************************************************************************

STOCKS NEWS SINGAPORE

Olam extends rise, nears pre-Muddy Waters attack level Shares of Olam International Ltd

Shares in the commodity firm rose as much as 4.6 percent to S$1.72 and traded just below the level before Muddy Waters launched an attack on Nov. 19 on its prospects and accounting practices.

The stock had fallen as much as 22 percent since the allegations. Last week, Olam said Temasek had raised its stake in the company to 19 percent from around 16 percent before the Muddy Waters attack.

Temasek is backing Olam's $1.2 billion bonds-with-warrants issue.

" We deem the move by Temasek as a potential confidence booster in the near-term. However, we continue to believe that there are still several medium- to long-term issues that need addressing," OCBC Investment Research said in a report.

In a statement on Wednesday, Olam said its net debt to equity before fair value adjustment stood at 1.81 times as of June 30, the lowest level since its listing in 2005.

It said its board is " comfortable" with its current equity levels and gearing.

OCBC expects markets to watch Olam's acquisitions with greater scrutiny, especially those into non-related industries, as well as the execution of past acquisitions.

It maintained its 'hold' rating and S$1.44 target price on Olam stock.

Reporting by Eveline Danubrata in Singapore Editing by Sunil Nair eveline.danubrata@thomsonreuters.com

I also hope to hear news of property prices going down. The best if there is a:

lol

January effect may act on stock market

It happens when fund manager sell in dec to make their portfolio capital looks good and re invest in january before on holiday.

And CNY is on february... ...

Stocks soar on budget deal, but problems lurk

NEW YORK — The " fiscal cliff" compromise, even with all its chaos, controversy and unresolved questions, was enough to ignite the stock market on Wednesday, the first trading day of the new year.

The Dow Jones industrial average careened more than 300 points higher, its biggest gain since December 2011. It's now just 5 percent below its record high close reached in October 2007. The Russell 2000, an index that tracks smaller companies, shot up to the highest close in its history.

The reverie multiplied across the globe, with stock indexes throughout Europe and Asia leaping higher. A leading British index, the FTSE 100, closed above 6,000 for the first time since July 2011.

In the U.S., the rally was extraordinarily broad. For every stock that fell on the New York Stock Exchange, roughly 10 rose. Technology stocks rose the most. U.S. government bond prices fell sharply as investors pulled money out of safe-harbor investments. And the VIX, an index that measures investors' expectations of future market volatility, plunged more than 18 percent to 14.68, the lowest close since October.

The very last week of each year and the first two days of the new year usually average out to a gain for U.S. stocks. But this year stood out. From 2008 to 2012, the Dow rose an average of 93 points on the first trading day of the year, less than a third of Wednesday's gain of 308.41. During that period the Dow fell on the first trading day of the year only once, in 2008.

Despite the euphoria, many investors remained cautious. The deal that politicians hammered out merely postpones the country's budget reckoning, they said, rather than averting it.

" Washington negotiations remind me of the Beach Boys song, 'We'll have fun, fun, fun 'til her daddy takes the T-Bird away," Jack Ablin, chief investment officer of BMO Private Bank in Chicago, wrote in a note to clients.

" Nothing got solved," added T. Doug Dale, chief investment officer for Security Ballew Wealth Management in Jackson, Miss.

According to these and other market watchers, investors were celebrating Wednesday not because they love the budget deal that was cobbled together, but because they were grateful there was any deal at all.

" Most people think that no deal would have been worse than a bad deal," said Mark Lehmann, president of JMP Securities in San Francisco.

The House passed the budget bill late Tuesday night, a contentious exercise because many Republicans had wanted a deal that did more to cut government spending. The Senate had already approved the bill.

The late-night haggling was a product of lawmakers wanting to avert a sweeping set of government spending cuts and tax increases that kicked in Tuesday, the start of the new year, because there was no budget deal ready. The scenario came to be known as the fiscal cliff, because of the threat it posed to the fragile U.S. economic recovery.

The bill passed Tuesday night ended the stalemate for now, but it leaves many questions unanswered.

The deal doesn't include any significant deficit-cutting agreement, meaning the country still doesn't have a long-term plan or even an agreement in principle on how to rein in spending. Big cuts to defense and domestic programs, which were slated to kick in with the new year, weren't worked out but instead were just delayed for two months. And the U.S. is still bumping up against its borrowing limit, or " debt ceiling."

" There's definitely another drama coming down the road," said Lehmann. " That's the March cliff."

The political bickering that's almost certain to persist could have another unwelcome effect: influencing ratings agencies to cut the U.S. government's credit score. That happened before, when Standard & Poor's cut its rating on U.S. government debt in August 2011, and the stock market plunged.

Even so, Wednesday's performance gave no hint of the dark clouds on the horizon.

The Dow enjoyed big gains throughout the day, up by more than 200 points within minutes of the opening bell. It swelled even bigger in the final half hour of trading, and closed up 2.4 percent to 13,412.55.

The Standard & Poor's 500 jumped 36.23, or 2.5 percent, to 1,462.42. The Nasdaq rose 92.75, or 3.1 percent, to 3,112.26.

The yield on the 10-year Treasury note rose sharply, to 1.84 percent from 1.75 percent. Prices for oil and key metals were up. The price of copper, which can be a gauge of how investors feel about manufacturing, rose 2.3 percent.

The gains persisted despite small reminders that there are still serious problems punctuating the world economy, like middling growth in the U.S. and the still-unsolved European debt crisis. The government reported that U.S. builders spent less on construction projects in November, the first decline in eight months. And the president of debt-wracked Cyprus said he'd refuse to sell government-owned companies, a provision that the country's bailout deal says it must at least consider.

Among stocks making big moves, Zipcar shot up 48 percent, rising $3.94 to $12.18, after the company said it would sell itself to Avis. Avis rose 95 cents to $20.77, or 5 percent.

Marriott rose 4 percent, up $1.52 to $38.79, after SunTrust analysts upgraded the stock to " buy." Headphone maker Skullcandy dropped 13 percent, losing 99 cents to $6.80, after Jefferies analysts downgraded it to " underperform."

Associated Press

WASHINGTON (AP) - Onward to the next fiscal crisis. Actually, several of them, potentially. The New Year's Day deal averting the " fiscal cliff" lays the groundwork for more combustible struggles in Washington over taxes, spending and debt in the next few months.

President Barack Obama's victory on taxes this week was the second, grudging round of piecemeal successes in as many years in chipping away at the nation's mountainous deficits. Despite the length and intensity of the debate, the deal to raise the top income tax rate on families earning over $450,000 a year - about 1 percent of households - and including only $12 billion in spending cuts turned out to be a relatively easy vote for many. This was particularly so because the alternative was to raise taxes on everyone.

But in banking $620 billion in higher taxes over the coming decade from wealthier earners, Obama and his Republican rivals have barely touched deficits still expected to be in the $650 billion range by the end of his second term. And those back-of-the-envelope calculations assume policymakers can find more than $1 trillion over 10 years to replace automatic across-the-board spending cuts known as a sequester.

" They didn't do any of the tough stuff," said Erskine Bowles, chairman of Obama's 2010 deficit commission. " We've taken two steps now, but those two steps combined aren't enough to put our fiscal house in order."

In 2011, the government adopted tighter caps on day-to-day operating budgets of the Pentagon and other cabinet agencies to save $1.1 trillion over 10 years.

The measure passed Tuesday prevents middle-class taxes from going up while raising rates on higher incomes. It also blocks severe across-the-board spending cuts for two months, extends unemployment benefits for the long-term jobless for a year, stops a 27 percent cut in Medicare fees paid to doctors and prevents a possible doubling of milk prices.

The alternative was going over the cliff, an economy-punching half-trillion-dollar combination of sweeping tax increases and spending cuts. Despite the deal, the government partially went over the brink anyway with the expiration of a two-year cut in Social Security payroll taxes of two percentage points.

Action inside a dysfunctional Washington now only comes with binding deadlines. So, naturally, this week's hard-fought bargain sets up another crisis in two months, when painful across-the-board spending cuts to the Pentagon and domestic programs are set to kick in and the government runs out of the ability to juggle its $16.4 trillion debt without having to borrow more money.

Unless Congress increases or allows Obama to increase that borrowing cap, the government risks a first-ever default on U.S. obligations. Republicans will use this as an opportunity to leverage more spending cuts from Obama, just like they did in the summer of 2011.

House Speaker John Boehner, R-Ohio, vows that any increase in the debt limit - which needs to be enacted by Congress by the end of February or sometime in March - must be accompanied by an equal amount in cuts to federal spending. That puts him on yet another collision course with Obama, who has vowed anew that he won't let haggling over spending cuts complicate the debate over the debt limit.

The cliff compromise represented the first time since 1990 that Republicans condoned a tax increase. That has whipped up a fury among tea party conservatives and increased the pressure on Boehner to adopt a hard line in coming confrontations over the borrowing cap and the spending cuts that won only a two-month reprieve in this weeks' deal.

Put simply, House Republicans are demanding new spending cuts - possibly through changes in Social Security and Medicare benefit formulas - as a scalp, and they're dead set against raising more revenues through anything less than an overhaul of the tax code now that Obama has won higher taxes on the wealthy.

" Now the focus turns to spending," Boehner said after Tuesday's vote, promising that future budget battles will center on " significant spending cuts and reforms to the entitlement programs that are driving our country deeper and deeper into debt."

Obama is just as adamant on the other side, saying higher revenues have to be part of any formula for further diverting the automatic spending cuts.

While conservative activist Grover Norquist gave Republicans a pass on violating his anti-tax pledge with this week's vote, he and other forces on the right won't be so forgiving on any future effort to increase revenues.

The refusal of Republicans to consider additional new taxes is sure to stir up resistance among Democrats when they're asked to consider politically painful cuts to so-called entitlement programs like Medicare. Democratic protests led Obama and Boehner to take a proposal to increase the Medicare eligibility age off the table in the recent round of talks.

The upshot? More scorched-earth politics on the budget will probably dominate the initial few months of Obama's second term, when the president would prefer to focus on legacy accomplishments like fixing the immigration problem and implementing his overhaul of health care.

The relationship between Boehner and Obama has never been especially close and seemed to have suffered a setback last month after the speaker withdrew from negotiations on a broader deficit deal. The two get along personally, but politically, a series of collapsed negotiations has bred mistrust. The White House has the view that Boehner cannot deliver while the speaker is frustrated that matters brought up in his talks with the president are not followed through by White House staff.

And on the debt limit, Boehner and Obama at this point are simply talking past each other.

" While I will negotiate over many things, I will not have another debate with this Congress over whether or not they should pay the bills that they've already racked up through the laws that they passed," Obama said after the deal was approved.

Said Boehner spokesman Michael Steel: " The speaker's position is clear. Any increase in the debt limit must be matched by spending cuts or reforms that exceed the increase."