GorgeousOng ( Date: 17-Oct-2013 11:56) Posted:

|

DOW future is Red.. Sell on news...

us just po in a few Panado ( pain killer)...... the pain will surface after December Happy hour. ... !!!

Wah ! Vomit blood!!! 吐 血 啊 !

Peter_Pan ( Date: 17-Oct-2013 11:53) Posted:

|

The deal offers only a temporary fix and does not resolve the fundamental issues of spending and deficits that divide Republicans and Democrats. It funds the government until January 15 and raises the debt ceiling until February 7, so Americans face the possibility of another government shutdown early next year.

hi,

trading the world indices like Dow jones, Nikkei, STI, etc are pretty simple...just follow the technical indicators.

We already spotted a reversal in the Dow jones around 14,760....although the last few days were pretty volatile and uncertain, waiting for the US congress to do the right thing....the US likes to keep the world in suspense....wondering what they will do and it affects the whole world markets.....showing the world that US is STILL the big brother(or Uncle SAM)...the world largest and most powerful economy.

The next question is " how high will it go" ???

cheers,

Jason at http://myfcoach.com/ and http://millionaire-investors.blogspot.sg/

Huat lah! 😊

The Senate voted 81-18 to halt the 16-day govt shutdown and raise the U.S. debt limit, moving one step closer to ending the nation?s fiscal impasse.

The House of Representatives plans to vote later tonight and President Barack Obama supports the agreement. The Senate acted the day before U.S. borrowing authority was scheduled to lapse as Congress engaged in its fourth round of fiscal brinkmanship in less than three years.

Never ever scold the USA because they are a blessed country. Look they are the most powerful of nations in terms of military, economy and individual wealth of the top earners and also the average Joe. They don't have to slog that hard like most people outside the USA. Their marines go anywhere and everywhere, brave men are born in a brave country. Their government cares so much for its citizens and their politicians biker to provide better lives to all Americans even debating in the wee hours of the morning or in twilight. Their treasury always ensure that things in the market is going on well and if not, then they will do something for it. If there is a need to help the economy, they will think of a way to help with whatever means they could think of, for example QEs, printing more money to circulate if ever real money is intended for circulation. They will bailout big giant corporation that failed or on the verge of failing, so that the working people continue to be able to work in these corporations. They care so much for their stock markets, and are constantly ensuring that it is moving in the right direction. They make sure the world don't do wrong things, or else they will make a row about them and seek ways to ensure wrongs were righted. And there are so many good things about American that can offset the bad things that one might like to give examples of, such as guns and immorality. The USA is a very unique country. Show me one that is the same. So don't say you want to downgrade the USA. For what?

Lol, whatever truth or falsehood you find in my posting, kindly be informed that I am writing with tongue in cheek. Hahaha..

handongni ( Date: 17-Oct-2013 07:21) Posted:

|

U.S. Stocks Rally as Senate Nears Deal on Debt Ceiling

U.S. stocks rallied, sending the Standard & Poor?s 500 Index (SPX) toward a record, as the Senate crafted a deal to end the government shutdown and raise the debt ceiling before tomorrow?s deadline.

The S& P 500 rose 1.4 percent to 1,721.47 at 4 p.m. in New York. The benchmark gauge slid 0.7 percent yesterday after climbing 3.3 percent over the previous four days.

?Investors are relieved that it looks like we?re not going to go over the cliff,? Ben Hart, a research analyst at Radnor, Pennsylvania-based Haverford Trust Co., which oversees about $6 billion, said by phone. ?It takes the worst case scenario off the table.?

The S& P 500 dropped 4.1 percent from its all-time high of 1,725.52 reached Sept. 18 as Congress struggled to reach agreement on a federal budget, forcing the first partial government shutdown in 17 years. The gauge has recovered 4 percent of the decline as optimism grew that a deal would be reached, and is within about four points of its record. The S& P 500 is up 21 percent for the year.

The bipartisan leaders of the Senate reached an agreement to end the fiscal impasse and to increase U.S. borrowing authority. The Senate and House plan to vote on it later today, and the White House press secretary said President Barack Obama supports the deal.

The framework negotiated by Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell would fund the government through Jan. 15, 2014, and suspend the debt limit until Feb. 7, setting up another round of confrontations.

Four-Week Standoff

The agreement concludes a four-week standoff that began with Republicans demanding defunding of Obama?s 2010 health-care law, and objecting to raising the debt limit and funding the government without policy concessions. House Speaker John Boehner said in a statement that Republicans won?t block the Senate compromise.

With no deal, the U.S. would exhaust its borrowing authority tomorrow and the government may start missing payments at some point between Oct. 22 and Oct. 31, according to the Congressional Budget Office. Fitch Ratings put the world?s biggest economy on watch for a possible credit downgrade yesterday, citing lawmakers? inability to agree.

The S& P 500?s advance over the past week has squeezed managers who borrowed and sold shares to bet on declines lawmakers would struggle to reach a deal. U.S. companies with the most short sales have climbed 4.7 percent since Oct. 9, compared with a 3.9 percent advance for the benchmark gauge, data compiled by Bloomberg and Goldman Sachs Group Inc. show.

Hedge funds, whose bearish bets on stocks have held their returns to half the Standard & Poor?s 500 Index in 2013, helped send a gauge of manager bullishness compiled by ISI Group LLC within 0.2 point of its lowest reading in 2013 last week.

Fed Stimulus

Equities have surged in 2013 as the Federal Reserve maintained efforts to stimulate the economy by holding interest rates near zero percent and purchasing $85 billion of bonds each month under a program known as quantitative easing.

The rally in 2013 has been the broadest in at least 23 years, with S& P 500 companies extending the streak of quarters in which they have avoided an earnings contraction to 15 and valuations holding below historic averages. Of S& P 500 members, 443 are up so far in 2013, data compiled by Bloomberg show. The next-closest year was 1997, when 436 companies had advanced and the index was quadrupling.

Profits for companies in the index probably increased 1.4 percent during the third quarter while sales rose 2 percent, according to analysts? estimates compiled by Bloomberg. Some 22 companies in the S& P 500 are due to post results today.

U.S. economic growth remained ?modest to moderate? as consumer spending maintained gains and business investment grew, the Fed said today in its latest Beige Book business survey. Four of the 12 Fed districts reported slower economic growth while eight others said the expansion held steady amid ?uncertainty? stemming from the U.S. fiscal deadlock.

The report provides policy makers anecdotal accounts from the Fed districts two weeks before they meet to set monetary policy.

To contact the reporter on this story: Nick Taborek in New York at ntaborek@bloomberg.net

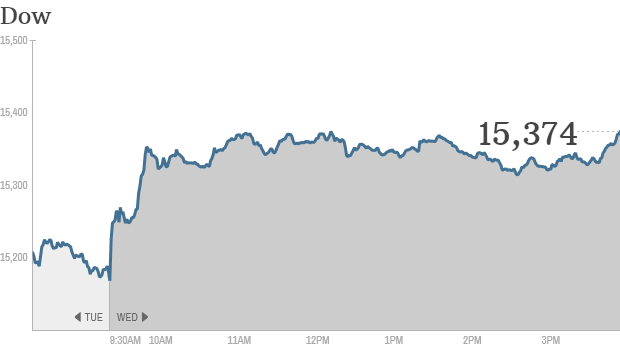

Dow gains 200 points as debt deal emerges

By Ben Rooney @CNNMoneyInvest October 16, 2013: 4:32 PM ET

Click for more market data.

Stocks surged Wednesday as investors cheered news that Senate lawmakers have reached a deal to reopen the government and avoid a possible United States debt default.

The Dow Jones industrial average jumped more than 200 points, or 1.3%. The S& P 500 and Nasdaq both gained more than 1%.

Senate officials announced an agreement Wednesday that would end a 16-day government shutdown and raise the debt ceiling ahead of a midnight deadline. Lawmakers in the House and Senate could vote on the bill as soon as tonight, Congressional aides told CNN.

The Treasury Department has warned that it will no longer be able to borrow the money it needs to pay all the nation's bills and will start burning through its cash reserves starting Thursday. This has raised concerns around the world that America could default on its debts.

If passed, the bill would forestall what most economists say would have been a shock to the global financial system. But some investors say Congress is merely kicking the can down the road. The deal funds the government through January 15 and raises the debt ceiling until February 7.

" You could call it a relief rally, but I don't know that anything has really been resolved," said Brent Schutte, market strategist at BMO Private Bank. " At least the market can stop worrying about it for a while."

Yields on short-term Treasury bills had been rising lately on default concerns. But demand was strong at Wednesday's sale of one-month T-bills and one-year notes.

Fed taper delayed even further? There may be one potential bright spot from the continued dysfunction in Washington. The Federal Reserve is unlikely to cut back on, or taper, its bond-buying program anytime soon.

" With more uncertainty and the potential for the government shutdown to drag on the economy, the last thing the Fed wants to do is begin to taper," said Bernard Kavanagh, vice president of portfolio management at Stifel Nicolaus. " That should give the market a bit of a tailwind."

In its latest snapshot of economic conditions, known as the Beige Book, the Fed said growth continues at a modest pace.

World Markets

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +205.82 | +1.36% | 15,373.83 | 4:40pm ET |

|

S& P 500 Index | United States | +23.48 | +1.38% | 1,721.54 | 4:40pm ET |

|

Brazil Bovespa Stock Index | Brazil | +992.39 | +1.80% | 55,973.03 | 4:15pm ET |

|

Canada S& P/TSX 60 | Canada | +1.19 | +0.16% | 744.82 | 4:19pm ET |

|

Santiago Index IPSA | Chile | +2.93 | +0.09% | 3,274.23 | 3:16pm ET |

|

IPC | Mexico | +136.95 | +0.34% | 40,355.27 | 4:06pm ET |

Society of Remisiers defends contra trading

SINGAPORE: The great penny stock crash earlier this month wiped out billions of dollars from the Singapore market, and some have blamed contra trading for causing share price bubbles.

But the Society of Remisiers has come out with a spirited defence of the practice.

The three companies at the centre of the controversy -- Blumont Group, Asiasons Capital and Liongold Corp -- lost S$8.6 billion in combined value, over just three days.

Contra trading is the buying and selling of stocks without having to pay for the cost of the stocks upfront.

In such cases, investors have up to three days or T+3 to settle their trades according to SGX rules.

Before the settlement date, the investor may be able to sell off their earlier purchases and book a contra profit or loss.

And the settlement period can be extended depending on the investor's relationship with the broker and credit history.

Some clients can get up to another three days to settle any outstanding credit on their purchases without having to put up cash or collateral.

According to the Society of Remisiers, contra trades can account for up to 80 per cent of retail trading volume on some days.

Jimmy Ho, president of the Society of Remisiers (Singapore), said: " This is one source of important liquidity. We have 40 per cent of the market volume coming from retail investors.

?These contra trades...when it comes to the contribution into our market -- it cushions the down periods. We can't imagine that the foreign funds will be in Singapore to play our stocks all the time, there are so many exchanges all over the world to get involved in."

Contra trading is currently practiced only in Singapore and Malaysia.

Although the Securities Investors Association of Singapore (SIAS) said it generally does not encourage retail investors to engage in contra trading, the advocacy group for retail investors does not believe a blanket ban on such unsecured trading will be beneficial to the market.

David Gerald, president and chief executive officer of SIAS, said: " At SIAS, we believe that the best protection for both brokers and customers is knowledge through education. Investors and traders need to be educated and understand the risks and the potential losses they can sustain.?

" In addition, I also believe that we need to offer choice. Let the consumer choose if it's a contra trade or cash trade."

Other experts go further, saying that blaming the penny stock crash on contra trading will be barking up the wrong tree.

Gabriel Yap, executive chairman of GCP Global, said: " Possible suspicion of these three stocks as well as other related stocks like IPCO, Innopac -- it's not something new. It is something that we've seen during the nineties, for Malaysian stocks.

?The modus operandi is actually similar, in the sense that you actually have a case where the share prices are being ramped up at the same time, the companies involved are making announcements, pertaining to projects that promise a great deal."

- CNA/nd

House expected to pass Senate deal first, could reach Obama's desk today

Breaking News - CNBC

Isolator ( Date: 16-Oct-2013 23:31) Posted:

|

http://www.cnbc.com/id/100968089