S& P 500 Extends Record Amid Stimulus Bets as Google Jumps

By Nick Taborek - Oct 19, 2013 4:49 AM GMT+0800

S& P 500 Extends Record Amid Stimulus Bets as Google Jumps

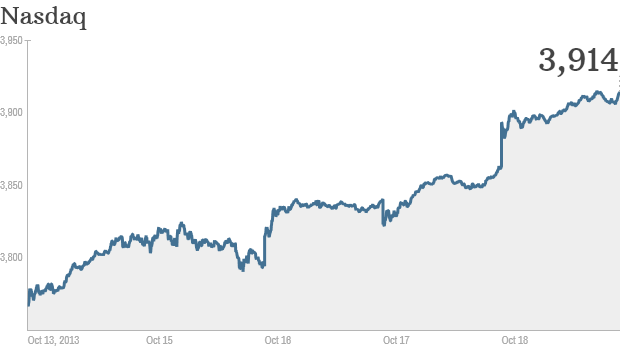

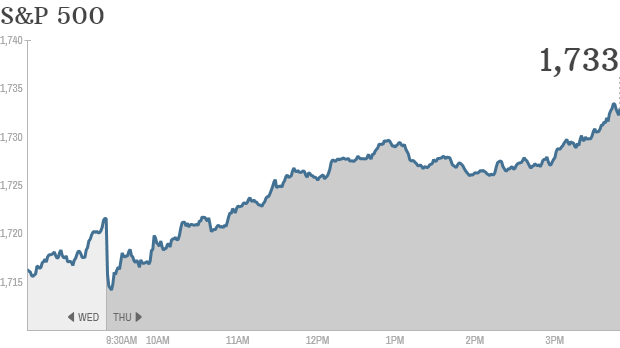

Click chart for more markets data.

U.S. stocks rose, giving the Standard & Poor?s 500 Index its best weekly gain since July, as results from Google Inc. topped estimates and speculation grew that the Federal Reserve will delay cutting monetary stimulus.

The S& P 500 added 0.7 percent to 1,744.50 at 4 p.m. in New York, extending an all-time high. The gauge has rallied 2.4 in the past five days, for its biggest weekly advance since July 12. The Dow Jones Industrial Average added 28 points, or 0.2 percent, to 15,399.65. About 6.6 billion shares changed hands on U.S. exchanges, 12 percent higher the three-month average.

?People are looking at earnings but they?re also looking at what they think is going to happen next,? Sarah Hunt, an associate fund manager and analyst who helps oversee $4.5 billion at Purchase, New York-based Alpine Woods Capital Investors LLC,said in a phone interview. ?After this political problem no one is expecting this to happen again in January. People are just looking for a little bit of a better economic backdrop to continue what?s been a pretty decent environment for stocks.?

Taper Estimates

The S& P 500 closed yesterday at a record of 1,733.15 after Congress ended the standoff over the federal budget and borrowing authority. The 16-day government shutdown government reduced growth by 0.3 percentage point this quarter, economists said in a Bloomberg News survey.

The slower growth and delayed reporting of economic data will prevent Fed policy makers from paring the monthly pace of asset buying until their March 18-19 meeting, according to the median of 40 responses by economists in the survey conducted yesterday and today. Economists had expected the central bank to reduce purchases to $80 billion last month, according to a Bloomberg survey before the September meeting.

The Fed stimulus has helped propel the S& P 500 (SPX) up by more than 150 percent from its March 2009 low. The gauge has surged 22 percent this year and jumped to its previous intraday record of 1,729.86 on Sept. 19, a day after the central bank unexpectedly delayed tapering.

Data Delay

Investors will have to wait until Oct. 21 to get the next snapshot of economic activity, when data on sales of existing homes is released. The September U.S. jobs report, originally scheduled to be released on Oct. 4, will be issued on Oct. 22. The report was delayed by the partial shutdown. October employment data will come out on Nov. 8, rather than Nov. 1.

A report today from China showed the world?s second-largest economy grew by 7.8 percent in the July-September period, accelerating for the first time in three quarters, as Premier Li Keqiang spurred factory output and investment. Industrial production (CHVAIOY) advanced in September by 10.2 percent as predicted by economists.

?The numbers out of China are supporting markets today after recent disappointing data,? Plassard said. ?While sentiment is still positive, the rally may be short-lived as the debt-ceiling issue will come back to haunt us again soon.?

In the absence of U.S. economic reports, investors have been watching third-quarter corporate earnings. Thirteen S& P 500 companies released results for the period today. Analysts have raised their forecasts for profits and now forecast an average increase of 2.5 percent for all companies in the gauge, according to estimates compiled by Bloomberg today. That compares with an expected gain of 1.4 percent as of Oct. 11.

World Markets

North and South American markets finished higher today with shares in U.S. leading the region. The S& P 500 is up 0.65% while Mexico's IPC is up 0.53% and Brazil's Bovespa is up 0.04%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +28.00 | +0.18% | 15,399.65 | 4:36pm ET |

|

S& P 500 Index | United States | +11.35 | +0.65% | 1,744.50 | 4:36pm ET |

|

Brazil Bovespa Stock Index | Brazil | +20.33 | +0.04% | 55,378.46 | 6:02pm ET |

|

Canada S& P/TSX 60 | Canada | +6.02 | +0.80% | 754.40 | 4:20pm ET |

|

Santiago Index IPSA | Chile | -6.72 | -0.21% | 3,267.51 | 3:16pm ET |

|

IPC | Mexico | +213.22 |

Only can long pennies now.... Short properties counter.... lol

Buying Sg stocks sometimes can equate to buying to " kingdom come" . Hahaha!!

Now only buy Chinese and US stocks to huat. Forget about Sg stocks. No need that loyal, lah. Lol..

ruready ( Date: 18-Oct-2013 10:12) Posted:

|

大 統 劣 油 混 很 大 74種 油 品 全 下 架 自 由 時 報 自 由 時 報 ? 2013年 10月 18日 上 午 6:10 〔 自 由 時 報 記 者 吳 為 恭 、 張 聰 秋 、 湯 世 名 / 彰 化 報 導 〕

自 由 時 報 記 者 吳 為 恭 、 張 聰 秋 、 湯 世 名 / 彰 化 報 導 〕 大 統 特 級 橄 欖 油 爆 出 混 摻 低 價 油 及 銅 葉 綠 素 事 件 連 環 爆 , 檢 方 昨 天 發 現 , 大 統 長 基 公 司 生 產 的 葡 萄 籽 油 也 摻 雜 葵 花 油 , 更 離 譜 的 是 花 生 調 和 油 竟 然 沒 有 花 生 油 成 分 , 而 是 由 芥 花 油 、 沙 拉 油 及 花 生 油 精 調 和 而 成 , 標 榜 百 分 百 的 芝 麻 油 也 混 入 沙 拉 油 。

花 生 調 和 油 沒 花 生 油 純 芝 麻 油 混 沙 拉 油

54種 油 品 可 能 都 違 法 添 加 銅 葉 綠 素

HUAT la DOW..... futures

China GDP up good news

some members seem to open new threads for no good reason.

STI is bound to suffer reactions!

http://stockmarketmindgames.blogspot.sg/2013/10/sti-no-long_18.html

The deal will keep the government services running until Jan 15, when Republicans and Democrats will have to agree on a new tax-and-spending package. Congress will also have to vote by Feb 7 on whether to raise the debt ceiling or default on bond payments.

Today STI will swing long with Lau Ta kor kor. Good luck.

S& P 500 Surges to Record on Fed Bets After Debt Deal

By Nick Taborek - Oct 18, 2013 4:48 AM GMT+0800

U.S. stocks rose, sending the Standard & Poor?s 500 Index to a record, as speculation grew that the Federal Reserve will maintain the pace of stimulus after Congress ended the budget standoff

Click for more market data.

NEW YORK (CNNMoney)

The S& P 500 hit a new record high Thursday, one day after lawmakers voted to reopen the government and ended a fiscal showdown that put the nation at risk of default. But a batch of lackluster corporate earnings weighed on the Dow.

The S& P 500 rose 0.7% to just above 1,733, surpassing the previous all-time high from last month. The Nasdaq also gained ground, but remains far from its record highs from 2000. The Dow Jones industrial average ended the day flat as weakness in IBM (IBM, Fortune 500), Goldman Sachs (GS, Fortune 500) and UnitedHealth (UNH, Fortune 500) was balanced by strength in American Express (AXP, Fortune 500) and Verizon (VZ, Fortune 500).

IBM and Goldman are the second and third highest weighted components in the Dow, which is weighted by stock price as opposed to market value like the S& P 500. This means moves in these higher-priced stocks have an outsized impact on the Dow.

" IBM takes a huge bite since it's the highest priced Dow stock," said Hank Smith, chief investment officer at Haverford Trust.

Stocks surged more than 1% Wednesday following news that Congress had reached a deal to reopen the federal government and avert a potentially catastrophic default. But investors are still wondering what happens when the government bumps up against the debt ceiling again in February.

" While there's great relief that a deal was inked before the so-called deadline, the reality is that these new deadlines aren't too far away in terms of passing a budget and the next debt ceiling issue in early February," said Smith.

He added that investors should brace for more volatility as lawmakers continue to butt heads over spending. But he said there could be " more upside" for stocks if Congress can pass a budget before the end of the year.

The dollar was weaker against other major world currencies, sinking as much as 1% against the euro and the pound. European stocks were lower while Asian markets finished mixed.

World Markets

North and South American markets finished mixed as of the most recent closing prices. The S& P 500 gained 0.67%, while the Bovespa led the IPC lower. They fell 1.10% and 0.39% respectively.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -2.18 | -0.01% | 15,371.65 | 4:35pm ET |

|

S& P 500 Index | United States | +11.61 | +0.67% | 1,733.15 | 4:35pm ET |

|

Brazil Bovespa Stock Index | Brazil | -614.90 | -1.10% | 55,358.13 | 6:01pm ET |

|

Canada S& P/TSX 60 | Canada | +3.56 | +0.48% | 748.38 | 4:20pm ET |

|

Santiago Index IPSA | Chile | -28.29 | -0.86% | 3,245.94 | 3:15pm ET |

|

IPC | Mexico | -155.80 | -0.39% | 40,199.47 | 5:51pm ET |

Dow will be green green tonight !

With A Final 285-144 Vote, Mission " Raise The Debt Ceiling" Is Accomplished: See You All Again In February

The BLS random number generator starts cranking again and informing everyone in just how sorry a state the economy finds itself, which of course is bullish for stocks because it means that the taper is indefinitely delayed, potentially until June 2014

the interim status quo is as follows:

- The government will be reopened through January 16

- The debt ceiling has been lifted through February 7, while the Treasury is allowed to use its assortment of emergency measures to delay running out of funds, which means the next true X-Date will hit sometime in April

- The House and Senate budget conference must reach a deal by December 13, but it may very well not achieve anything.

- Government workers get back pay for 16 days, and tomorrow return from a 2 + week vacation.

- The only thing that was actually " achieved" as a result of the government shutdown is to have income verification for Obamacare beneficiaries: something which should have been embedded in the ACA from the beginning.

USA company result very robust better than market expected,,,,,Dow jones show be green green until market closed,,,,,,huat Liao

Short sell orders executed on 17 October 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131017.txt

http://www.theaustralian.com.au/news/nation/bushfire-menaces-homes-near-lithgow-in-nsw/story-e6frg6nf-1226741566330

'Miracle' if lives not lost in NSW fires: premier

- From: AAP

- October 17, 2013 9:07PM

- See more at: http://www.theaustralian.com.au/news/nation/bushfire-menaces-homes-near-lithgow-in-nsw/story-e6frg6nf-1226741566330#sthash.2wpDH89a.dpuf

looks like some profit takings after the good news is confirmed. let's see where it will be supported. btw the 50 dMA of Dow Jones is sloping down which is abit worrying.

however, some fundamentally strong stocks can be found in SGX.

cheers,

Jason at http://myfcoach.com/ and http://millionaire-investors.blogspot.sg/