CIMB take the bull by the horns. Dont play play ....

Thai Beverage - Spirits do not scare us

Publish date: Tue, 6 Aug 11:44 | |

Target S$0.74 (Long Term: Out Perform)

Recent

fears that the impact of an excise tax increase and a cut in rice

subsidies on farmers' incomes will affect Thai Bev's spirits business

are unfounded. Rice farmers constitute a small portion of the white

spirits customer base and any drop in volumes from tax hikes is

temporal. Revenues will still increase this year because higher ASPs

will compensate for any fall in volumes. We tweak our estimates slightly

for housekeeping matters, which trims our SOP-based target price.

Maintain Outperform. Catalysts could come from corporate restructuring.

Revenues

will still increase this year because higher ASPs will compensate for

any fall in volumes. We tweak our estimates slightly for housekeeping

matters, which trims our SOP-based target price. Maintain Outperform.

Catalysts could come from corporate restructuring.

Spirits revenue will hold

We are not worried that the excise tax hike and any cuts in rice subsidies will affect spirits sales. Yes, volumes may be flat or could decline slightly. As consumers adjust to a new price reality, this will be temporal and unlikely to be large enough to wipe out ASP increases (est. 8% in FY13). Comparing with the most challenging period for spirits in the past (2005-2007), a 6%-decline in volume only came through when two large excise tax hikes of more than 50% took place and there was flooding in rural provinces. Yet, revenues still rose 3%. 2012's excise tax hike of 15-25% is hardly painful. The fear that a decline in farm income will impair white spirits sales is also speculative, in our view. Unskilled labourers from other labour-intensive industries, such as manufacturing, motor vehicle repair and construction, outweigh agriculture's three to one! If any, consumption should increase because these consumers will have benefited from the rise in minimum wage put in place in 2012-13. At the end of the day, spirits revenue has never had a down year in the past decade. Thai Bev enjoys an effective monopoly and consumers eventually return because they have little other choice. History says so, not just us!

Restructuring risk low

Minorities hold the key to any proposed transaction because TCC and Thai Bev, as related parties, cannot vote. As long as F& N is listed, selling out its properties on the cheap to TCC can be ruled out.

Maintain Outperform

Current share price only accounts for the spirits business, with no value ascribed to beer and non-alcoholic beverage businesses. We acknowledge short-term earnings strains as spirits take time to digest the impact of excise duties and A& P expenditure stay elevated. But, these are needed to build the business and it will pass.

Spirits revenue will hold

We are not worried that the excise tax hike and any cuts in rice subsidies will affect spirits sales. Yes, volumes may be flat or could decline slightly. As consumers adjust to a new price reality, this will be temporal and unlikely to be large enough to wipe out ASP increases (est. 8% in FY13). Comparing with the most challenging period for spirits in the past (2005-2007), a 6%-decline in volume only came through when two large excise tax hikes of more than 50% took place and there was flooding in rural provinces. Yet, revenues still rose 3%. 2012's excise tax hike of 15-25% is hardly painful. The fear that a decline in farm income will impair white spirits sales is also speculative, in our view. Unskilled labourers from other labour-intensive industries, such as manufacturing, motor vehicle repair and construction, outweigh agriculture's three to one! If any, consumption should increase because these consumers will have benefited from the rise in minimum wage put in place in 2012-13. At the end of the day, spirits revenue has never had a down year in the past decade. Thai Bev enjoys an effective monopoly and consumers eventually return because they have little other choice. History says so, not just us!

Restructuring risk low

Minorities hold the key to any proposed transaction because TCC and Thai Bev, as related parties, cannot vote. As long as F& N is listed, selling out its properties on the cheap to TCC can be ruled out.

Maintain Outperform

Current share price only accounts for the spirits business, with no value ascribed to beer and non-alcoholic beverage businesses. We acknowledge short-term earnings strains as spirits take time to digest the impact of excise duties and A& P expenditure stay elevated. But, these are needed to build the business and it will pass.

i worried it might meet strong resistance at 0.58-60 cents as predicted by some trader over here and start tumbling down to 45cents. must trade with care haha..this counter too volatile alrd

Shh...shh...shh ... we drink gold label now!

Peter_Pan ( Date: 06-Aug-2013 10:04) Posted:

|

Shortists BBs drank Orh Bak Kak Label...

Spirits do not scare us - OUTPERFORM - TP S$0.74 - CIMB

Well done Chang beer!!! Cheers!!!

More than half of the volume are shorts-sales!

Last minute buy-up! Nice closing!

Haha guess just hold it and forget it, next year then come and see, hopefully by then thaibev has benefited from acquisition of f& n

Really very orh bak kak...

Peter_Pan ( Date: 29-Jul-2013 16:33) Posted:

|

Heard market expects fund raising from Thbev and investors have been selling ahead.

Gone case liao

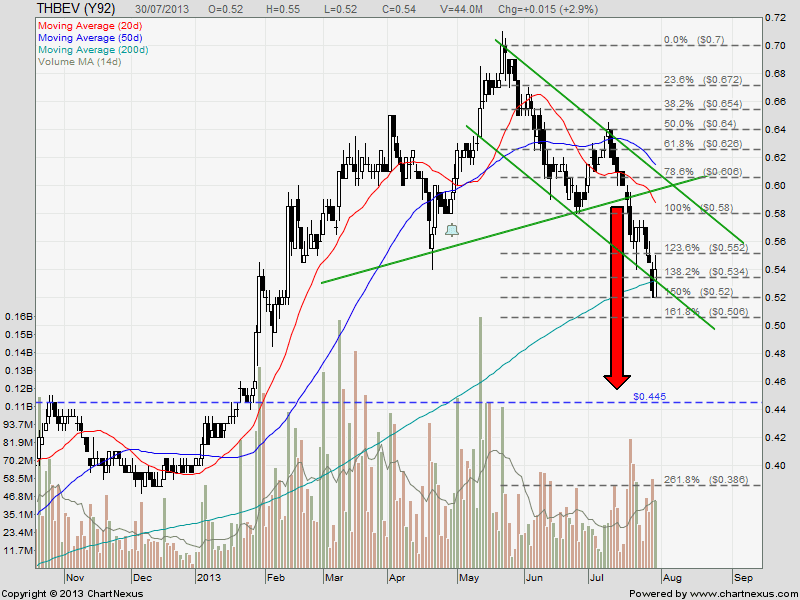

Thai Beverage (THBEV) is currently trading in a down trend channel after breaking down from a Head and Shoulders. The price target of this breakdown is about $0.45. THBEV may rebound from the 200D SMA support back to neckline support turned resistance between $0.58 to $0.60 (also the down trend channel resistance and both 20D/50D SMA), before continue the drop to price target.

Key Statistics for THBEV

| Current P/E Ratio (ttm) | 12.0905 |

|---|---|

| Estimated P/E(12/2013) | 17.1601 |

| Relative P/E vs. FSSTI | 0.9106 |

| Earnings Per Share (THB) (ttm) | 1.1000 |

| Est. EPS (THB) (12/2013) | 0.7750 |

| Est. PEG Ratio | 1.4060 |

| Market Cap (M SGD) | 13,559.41 |

| Shares Outstanding (M) | 25,110.03 |

| 30 Day Average Volume | 34,995,670 |

| Price/Book (mrq) | 3.8272 |

| Price/Sale (ttm) | 2.0914 |

| Dividend Indicated Gross Yield | 3.22% |

| Cash Dividend (THB) | 0.2520 |

| Last Dividend | 04/29/2013 |

| 5 Year Dividend Growth | 6.66% |

| Next Earnings Announcement | 08/14/2013 |

Same view here. Rebounding mode. The price will go up very fast if more short covering!

http://mystocksinvesting.com/singapore-stocks/thbev/thai-beverage-thbev-bearish-trend/

Tempest ( Date: 30-Jul-2013 12:03) Posted:

|

Emmm..Shorted 17975 lots! Did not expect the short sell is so high!!!

Bought at 0.525! Huat ah! Going 0.555 soon

this stock is really volatile.

BB is playing.

next resistance is $0.57?

support $0 .52

====================

Rebounding mode.. Don't miss the boat! Vested

Falling everyday. More negative news incoming?

So how has this news contribute to the fall in the price??