Post Reply

441-460 of 499

Post Reply

441-460 of 499

activity detected 2mil done..

vested 20c contra

OCBC says VIKINGíS fair value is 32 cents

Analyst: Low Pei Han

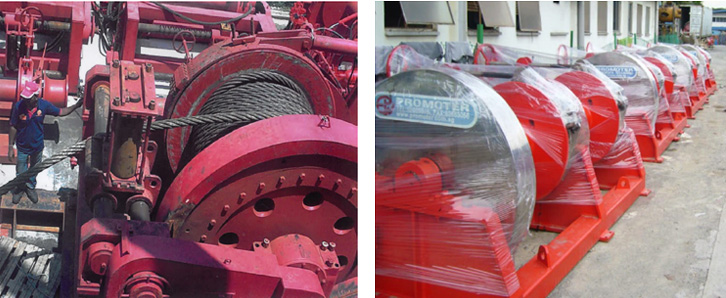

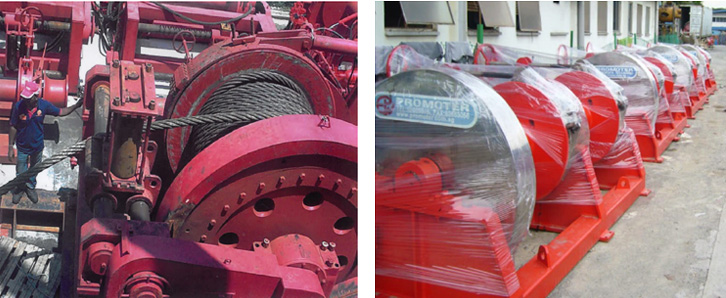

Promoter Hydraulics, a subsidiary of Viking, is the largest supplier of hydraulic winches and power packs in South East Asia. Photo: Viking website

.

Net profit was 0.2% shy of our full year estimate, and exceeded managementís guidance of S$10.5-12m.

We estimate core net profit was about S$4.9m vs. approximately S$1.1m loss in FY09.

With the recovery in rig orders, we understand that Viking has already secured work from recent rig contracts won by Keppel Corporation. The group also signed S$24.8m worth of contracts with overseas customers in 2010.

The swift pick-up in new rig orders has meant that a challenge for the group and its competitors may be an impending labour shortage rather than a lack of jobs.

Going forward, we will focus on Vikingís integration process, its ability to execute projects well and control costs. A first and final dividend of 0.3 S cents has been proposed, representing about 13% of FY10ís net profit.

Maintain

BUY with SOTP-based fair value estimate of S$0.32.

1000 lots in 1 trade..looking gd..

patience is the key to great profits

gd luck~~!

Well.............Nice Stage, beautiful decorations...............SIGN, No shows, no audiences at all.

Wonder what should investors do?

Company Results

S/NCompany NameQ/HY/FYCurrency, UnitsRevenueNet Profit

PreviousCurrentChange (%)PreviousCurrentChange (%)

1 VIKING OFFSHORE AND MARINE LTDFYRMB'00037,569 79,677 112.1%1,00012,688 1168.8%

net profit change 1168%!!!power!

Ditto..nice results..gonna be better in 2011..ozone2002 ( Date: 10-Feb-2011 09:15) Posted:

low 20s.. just buy

gd luck~! |

|

| Viking Offshore and Marine posts full-year net profit of $12.7m |

//

| WRITTEN BY THE EDGE |

| TUESDAY, 15 FEBRUARY 2011 19:07 |

SGX Catalist-listed Viking Offshore and Marine announced today net profit after tax of $12.7 million for the twelve months ended 31 December 2010 (FY2010) on first-time contributions from offshore & marine (O& M) business units acquired recently. In FY2009, Viking, formerly known as Novena Holdings, reported net profit of $1.0 million. Viking says the sterling performance was achieved on the back of a 112% increase in revenue to $79.7 million from $37.6 million in FY2009, largely on full-year contributions from wholly owned Viking Airtech Pte Ltd (Viking Airtech), a Heating, Ventilation, Air-Conditioning & Refrigeration systems (HVAC& R) specialist, which was acquired in January 2010. Gross profit margin rose to 32% in FY2010 from 19% in FY2009.

The board of directors has proposed a first and final dividend of 0.3 cents per ordinary share, representing 13% of FY2010 net profits. The proposed dividend, subject to shareholder approval, will be paid out on 12 May 2011.

|

Note: Viking NAV has increase from $0.11 (base on only 423.2million shares in issue) to a Whopping $0.17 (base on increase shares in issue of 551.2 million)

With a bigger/increase shares in issue of 128 million shares, its NAV still can grow so much, I think it is fantastic and impressive. (My personal views only)YSL888 ( Date: 15-Feb-2011 20:00) Posted:

Viking has reported a soaring net profit from 1 million for fy2009 to 12.7 million for fy2010. Its Nav also increase from 0.11 to 0.17 now.

This has achieve their proposal earlier profit of 10.5--12 million and revenue has reach 80 million also.

Hope this kind of result will have an impact on their share price, atlhough in this gloomy market condition! |

|

Viking has reported a soaring net profit from 1 million for fy2009 to 12.7 million for fy2010. Its Nav also increase from 0.11 to 0.17 now.

This has achieve their proposal earlier profit of 10.5--12 million and revenue has reach 80 million also.

Hope this kind of result will have an impact on their share price, atlhough in this gloomy market condition!

low 20s.. just buy

gd luck~!

The final result shall be post on 15Feb 2011 Tuesday. For the time being, watch the stock price and Transactions whether is substaining @ current $0.21 -- $0.215. Watchout how the buying against the seller, atlhough maybe small but if there is always bit by bit eating up seller price, then this maybe indicating internal buying interest where someone (always) have the directions for what result is due to report.(Personal views)

Huat Ah........It's still within Chinese New Year

Bon3260 ( Date: 09-Feb-2011 17:40) Posted:

| * Asterisks denote mandatory information |

| " DISCLAIMER:- This announcement was prepared and issued by the below mentioned listed issuer to the Exchange. The Exchange assumes no responsibility for the correctness of any of the statements made, opinions expressed or reports contained in this announcement and is posting this announcement on SGXNET for the sole purpose of dissemination only. In the event of any queries or clarification required in respect of any matters arising from this announcement, such queries are to be made to the listed issuer directly and not to the Exchange. The Exchange shall not be liable for any losses or damages howsoever arising as a result of the circulation, publication and dissemination of this announcement." |

| Name of Announcer * |

VIKING OFFSHORE AND MARINE LTD |

| Company Registration No. |

199307300M |

| Announcement submitted on behalf of |

VIKING OFFSHORE AND MARINE LTD |

| Announcement is submitted with respect to * |

VIKING OFFSHORE AND MARINE LTD |

| Announcement is submitted by * |

Low Jooi Kok |

| Designation * |

Chief Financial Officer |

| Date & Time of Broadcast |

09-Feb-2011 17:23:18 |

| Announcement No. |

00059 |

| The details of the announcement start here ... |

| For the Financial Period Ended * |

31-12-2010 |

| Description |

Please refer to the attachment. |

| Attachments |

Total size = 14K

(2048K size limit recommended)

|

|

|

| * Asterisks denote mandatory information |

| " DISCLAIMER:- This announcement was prepared and issued by the below mentioned listed issuer to the Exchange. The Exchange assumes no responsibility for the correctness of any of the statements made, opinions expressed or reports contained in this announcement and is posting this announcement on SGXNET for the sole purpose of dissemination only. In the event of any queries or clarification required in respect of any matters arising from this announcement, such queries are to be made to the listed issuer directly and not to the Exchange. The Exchange shall not be liable for any losses or damages howsoever arising as a result of the circulation, publication and dissemination of this announcement." |

| Name of Announcer * |

VIKING OFFSHORE AND MARINE LTD |

| Company Registration No. |

199307300M |

| Announcement submitted on behalf of |

VIKING OFFSHORE AND MARINE LTD |

| Announcement is submitted with respect to * |

VIKING OFFSHORE AND MARINE LTD |

| Announcement is submitted by * |

Low Jooi Kok |

| Designation * |

Chief Financial Officer |

| Date & Time of Broadcast |

09-Feb-2011 17:23:18 |

| Announcement No. |

00059 |

| The details of the announcement start here ... |

| For the Financial Period Ended * |

31-12-2010 |

| Description |

Please refer to the attachment. |

| Attachments |

Total size = 14K

(2048K size limit recommended)

|

Hi all, have we all forgotten about VIKING? Understand its result will be broadcast tomorrow 09Feb 2011, wonder how it is?

From its price movement, its seems to be substaining @ $0.21cents but no breaking momentum. After so much of work n efforts building this company into its desire oil/gas market, painting beautiful impression to attract investors, it is not gettiing so much attention after all. However, recent market playing styles maybe different from past some prices shoot up only after anouncement. We need to hear what they are going to broadcast their result in conjuction with how their share move so to see next moves.

Good luck to all VIKING investors

tanstg ( Date: 17-Jan-2011 11:02) Posted:

Just share....

Here is a good opportunity to invest on Viking btw 0.21 to .22 before their announcement on their annual report. Their financial report should be optimistic base on past year report. More upside after this consolidation .... |

|

1,939 lot buy up!!!!!!!!!!!!

When is the annual report? Around end Feb or early Mar 2011

tanstg ( Date: 17-Jan-2011 11:02) Posted:

Just share....

Here is a good opportunity to invest on Viking btw 0.21 to .22 before their announcement on their annual report. Their financial report should be optimistic base on past year report. More upside after this consolidation .... |

|

Just share....

Here is a good opportunity to invest on Viking btw 0.21 to .22 before their announcement on their annual report. Their financial report should be optimistic base on past year report. More upside after this consolidation ....

that is why i m not doing anything for quite some time liao......hehehe......i m still around.....vested more......hehehe thks....

tanstg ( Date: 10-Jan-2011 00:04) Posted:

|

Follow your heart ....

do not monitor too closely into hourly trade if you are trading mid or long term - stay abit away from the wall and you will see it clearer.

lawcheemeng ( Date: 08-Dec-2010 14:15) Posted:

| do not look too well ....may drop some more....wait awhile more.

|

|

|

|

As I mentioned Viking is forming a long ascending Triangle and now confirmed to be one. On 07 Jan it breakout with huge volume (although almost half is internal trading) and now it seems to be consolidating and may have a retractment to support level of $0.215, but this should be normal for Triangle behaviour. (if there isn't any breakout; then the triangle is not valid)

Normally, when a breakout follow by a retractment, the next breakout will be between 2 weeks to a month from first breakout which is 07 Jan this case. So those who had missed the initial surge, this maybe a good entry point to enter, but you got to have holding power.

Target as per TA plotting will bring price to around 0.27cts and hopefully will move towards 0.32cts as per OCBC recommendation. Thanks

A SSH selling his stake in the company may not necessarily be a bad thing..

reason behind it could be anything from need cash,shifting to other investments etc.. u'll never know until u hear it from the horses mouth..

but one thing for sure is that the MAJOR shareholder is still in this baby..

so i'm very confident this stock will do well..

gd luck!

and the other guy who trim his holding in viking is Kwan Chee Seng from 20.14% on 23 apr 2010 to 6.14% today

http://vikingom.listedcompany.com/stock_insider.html/year/2010