Post Reply

421-440 of 1050

Post Reply

421-440 of 1050

don't be like that la.. 0.035 yesterday, now 0.045.. pretty good money dude..

novena_33 ( Date: 21-Oct-2008 05:38) Posted:

| ok JJ...i wait for 0.01.... |

|

ok JJ...i wait for 0.01....

Look at this!

17/10/2008 -

Shah Capital Management increases from 9.62% to 11.6%

14/10/2008 - UBS AG

increases from 10.77% to 11.43%

10/10/2008 - Shah Capital Management

increases from 8.69% to 9.62%

10/10/2008 - UBS AG increases from 8.86% to 10.06%

06/10/2008 - Shah Capital Management increases from 6.98% to 8.25%

30/09/2008 - Shah Capital Management increases from 6.66% to 6.98%

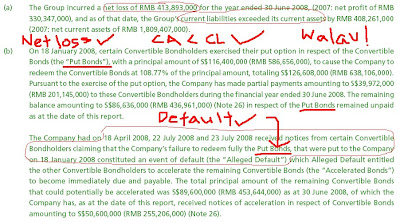

And now look at this! See below for the revised Auditor notes after they released the latest Financial Statements!

See definition of a Put Option: A put option gives the bond holder the ability to receive the principal of the bond whenever they want before maturity for whatever reason. If the bond holder feels that the prospects of the company are weakening, which could lower its ability to pay off its debts, they can simply force the issuerer to repurchase their bond through the put provision. It also could be a situation in which interest rates have risen since the bond was intially purchased, and the bond holder feels that they can get a better return now in other investments.

So has the interest rate risen or the company is weakening? ( Our pet monkey with a peabrain chooses the former.)

It's pretty strange that Shah Capital Management and UBS are increasing their share of this company. Take note that Shah Capital Management's philosophy is: "The two pillars of money management at SCM are investing for the intermediate to long term and a fundamental analysis towards security selection." Great, now where are the fundamentals, where is it???.....something we don't know perhaps?

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

0.035 ? oh no... become like digiland liao.... kau.. maybe can get it at 0.01 soon.....

| 16:41:39 |

0.035 |

1,000 |

Sell Down |

| 16:41:28 |

0.035 |

2,000 |

Sell Down |

| 16:41:18 |

0.035 |

7,000 |

Sell Down |

| 16:41:15 |

0.035 |

20,000 |

Sell Down |

| 16:38:27 |

0.035 |

2,000 |

Sell Down |

| 16:38:16 |

0.035 |

6,000 |

Sell Down |

| 16:38:05 |

0.035 |

17,000 |

Sell Down |

| 16:37:52 |

0.035 |

51,000 |

Sell Down |

| 16:37:40 |

0.035 |

154,000 |

Sell Down |

| 16:37:30 |

0.035 |

369,000 |

Sell Down |

| 16:37:29 |

0.035 |

99,000 |

Sell Down |

| 16:37:22 |

0.035 |

300,000 |

Sell Down |

| 16:36:40 |

0.035 |

1,000 |

Sell Down |

| 16:36:27 |

0.035 |

3,000 |

Sell Down |

| 16:36:17 |

0.035 |

9,000 |

Sell Down |

| 16:36:03 |

0.035 |

26,000 |

Sell Down |

| 16:35:52 |

0.035 |

79,000 |

Sell Down |

| 16:35:40 |

0.035 |

239,000 |

Sell Down |

| 16:35:29 |

0.035 |

726,000 |

Sell Down |

| 16:35:15 |

0.035 |

1,000 |

Sell Down |

|

|

|

|

| 16:17:54 |

0.04 |

2,428,000 |

Sell Down |

| 16:17:52 |

0.04 |

2,000 |

Sell Down |

| 16:17:40 |

0.04 |

5,000 |

Sell Down |

| 16:17:29 |

0.04 |

16,000 |

Sell Down |

| 16:17:15 |

0.04 |

50,000 |

Sell Down |

| 16:17:04 |

0.04 |

150,000 |

Sell Down |

| 16:16:52 |

0.04 |

153,000 |

Sell Down |

| 16:16:40 |

0.04 |

462,000 |

Sell Down |

| 16:16:32 |

0.04 |

200,000 |

Sell Down |

| 16:09:49 |

0.045 |

1,000 |

Buy Up |

| 16:09:49 |

0.04 |

1,000,000 |

Sell Down |

piss...i may change my TP....

jackjames ( Date: 01-Sep-2008 13:18) Posted:

novena, dropping to your 0.15 target soon.... 0.18 now....

wa pian. this counter... |

|

novena, dropping to your 0.15 target soon.... 0.18 now....

wa pian. this counter...

If shorting is done after a stock has fallen much, there's really not much juice left.

(I fondly remember a certain presenter who used this analogy of 'juicing sugar cane' during his workshop

seminar presentation at a local hotel )...

GOOD TO SHORT?

That's why it is very important to watch the chart like a hawk.

Then one can take swift action to quickly dump it and get out once the slightest ominous sign is detected.

Rather than clinging stubbornly to a stock as an investment. If one does this, one can get burnt real bad...

This is what trading is about... much better to buy back in when the price is even lower.

Bio-T Net Profit fell 62% to 125M RMB. No Div declared - Due to the current cash flow problem ?

I think the bet is off. A long list of issues and trouble.

Last traded when it was 87cts. Wanted to buy @ 54, 48, 32, 27.... I guess I still have a bit of luck left...heee

on what basis

tajixu ( Date: 27-Aug-2008 16:51) Posted:

Is it time to fish this babe now?

|

|

|

|

| Last Done: |

0.200 |

Volume ('000): |

1,180 |

| Change: |

-0.005 |

% Change: |

-2.4 |

| Day's Range: |

0.200 - 0.210 |

52 Weeks' Range: |

0.200 - 0.980 |

Historical EPS ($) a

0.07284 |

NAV ($) b

0.4656 |

Historical PE

2.746 |

Price / NAV b

0.430 |

Dividend ($) d

0.007400 |

52 Weeks High

0.980 |

Dividend Yield (%) d

3.700 |

52 Weeks Low

0.200 |

Par Value ($)

HKD 0.400 |

Market Cap (M)

178.265 |

Issued & Paid-up Shares c

891,324,000 |

IPO Information

Listing Date

Feb 16, 2004 |

Subscription Rate

106.00 |

IPO Price

0.460 |

Current vs IPO Price (%)

-56.52 |

First Day Close

0.870 |

First Day Gain (%)

89.1 |

First Week Close

1.040 |

First Week Gain (%)

126.1 |

|

|

Is it time to fish this babe now?

|

|

|

|

| Last Done: |

0.200 |

Volume ('000): |

1,180 |

| Change: |

-0.005 |

% Change: |

-2.4 |

| Day's Range: |

0.200 - 0.210 |

52 Weeks' Range: |

0.200 - 0.980 |

Historical EPS ($) a

0.07284 |

NAV ($) b

0.4656 |

Historical PE

2.746 |

Price / NAV b

0.430 |

Dividend ($) d

0.007400 |

52 Weeks High

0.980 |

Dividend Yield (%) d

3.700 |

52 Weeks Low

0.200 |

Par Value ($)

HKD 0.400 |

Market Cap (M)

178.265 |

Issued & Paid-up Shares c

891,324,000 |

IPO Information

Listing Date

Feb 16, 2004 |

Subscription Rate

106.00 |

IPO Price

0.460 |

Current vs IPO Price (%)

-56.52 |

First Day Close

0.870 |

First Day Gain (%)

89.1 |

First Week Close

1.040 |

First Week Gain (%)

126.1 |

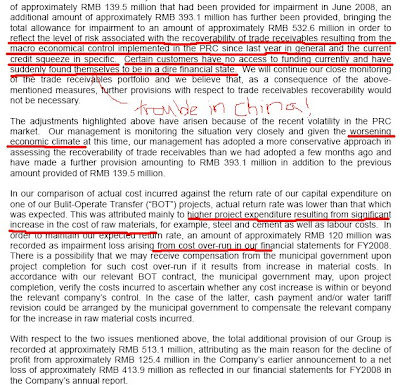

Bio-Treat Technology Mon said it has decided not to pursue a proposed rights offering that would have raised up to $156 million.

The wastewater treatment company may instead raise funds by selling its portfolio of water-related infrastructure assets or by placing them in a business trust, it said in a statement.

"The group's decision follows a series of meetings Bio-Treat had with major financial institutions, private equity funds and key players in the water-related infrastructure industry," the statement said.

Bio-Treat said in Apr it would seek approval from bondholders to execute the rights offering to fund payment on 7-year convertible bonds after Merrill Lynch filed a default notice related to bonds totaling $27.6 million.

In Apr Bio-Treat said the outstanding convertible bonds stood at $169 million, down from $206 million in original principal.

Bio-Treat Technology said the $206mn convertible bonds (CBs) programme that it entered into two years ago was a mismatch for the company and it is now determined to resolve this issue.

Chief financial officer Alan Lau shed some light on why Bio-Treat had defaulted on put options exercised by the CB holders. He noted that the terms of the CB programme did not match the group's financing needs for projects that are long-term in nature. Under the zero-coupon CB programme due to mature in 2013, the first opportunity for CB holders to exercise put options on their CBs was on Jan 18 this year, just two years after the bonds were issued. But the typical payback period for the group's wastewater treatment projects is eight to nine years.

Mr Lau said the company is in a long-term BOT (build-operate-transfer) construction activity, so it was unable to generate enough cash to pay back bondholders within two years' time. News of Bio-Treat defaulting on payment for the put options made due on the CBs had sent its stock on a dive in April. To resolve this, Bio-Treat is considering options including a DBS-arranged $80 million five-year CB issue and an asset securitisation plan. The group had in February proposed a rights issue of up to 297.11m shares at 52.5 cents but a circular has not been issued to shareholders as the plan is still pending bondholders' approval.

Algae may we11 be the 'saviour' of sorts...

Think alternative energy...

and also huge contracts for innovative emergency treatment...

Even in bad economic times...

But of course this is all only speculation...

Massive Algae-covered lakes and reservoirs come to mind readily when I see this counter...

UBS raised its stake in Bio-treat from 4.89% to 5% on 26/6.

price edging up after CEO bot much shares....water wk campaign juz over,who knw co. might get some prjects ahead,worth a bet at 28c

12 May, 10 June the vol is very much higher then 27 June and the price when up on this date.

Now what happen on the next day after the price up?

The price close lower the next day on 13May and 11Juneand never turn back to look at it. Do back testing is important and you will see how many time the price go up and up for few days. Just do a back testing for 6month to see you winning trade on this stock.