Post Reply

4081-4100 of 4713

Post Reply

4081-4100 of 4713

Let's see if Yangjijiang can take care of its downside!

source: www.sgdividends.blogspot.com

Let's look at Mr YangJiJiang shall we? Let's see if its at the risk of becoming like Sir Ferrochina. ( SGDividends will be using Sir Ferrochina as the benchmark.). So why are we doing this? Cos we are now looking at stocks to put on our radar screen and since we are analysing, why not share it to the world. Fact Facts Facts..thats what SGdividends hanker after...not fluff.

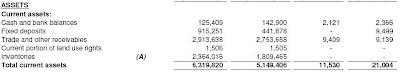

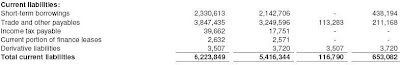

OK. Looking at the above. This company is seems pretty safe in terms of repaying its liabilities. Current Assets: RMB1612,183 VS Current Liabilities: RMB504,321. What's lovely is that it has Cash and its equivalent of RMB852,374. What this means is....it can repay debts which are due within a year easily as it has CURRENT ASSETS more than its CURRENT LIABILITIES. ( Im looking at the 2nd column of the charts above from the right , in case you are looking somewhere else.) In fact using their CASH is enough to pay their CURRENT LIABILITIES already.

Now lets Compare with

Sir Ferrochina, shall we? ( This was released when analysts were still issuing buy calls..Lelong ah..they think what..durians ah)

Current Assets : 11,530 VS Current Liabilities 116,790 ( 2nd column from right)

Current Assets : 11,530 VS Current Liabilities 116,790 ( 2nd column from right)

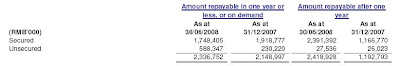

See how much they have to repay at the third chart!

Compare and contrast Mr YangJiJiang and Sir Ferrochina....Your Guess is as Good as mine !(The above are the latest financial statements available at this point of time publicly, btw.)

Investing Tip: At such times like this, look at debts of the company..seriously..share value fall never mind...but as long as they dont disappear ...games not over. Take care of the downside!

fund managers cught short sellers at last mins, those didn't cover next week can collapse ugly,make u double up !!

this trend title maybe should change to Bruising with the ship... Yangzijiang.

ha ha, lesson learnt, never buy 13 lts of stock next time.

hello, brother, it was removed from STI family, surely it is bad for them...

it is just like you are at 1st class honour, now, they removed your honour.. what does it mean? must be some glitches here and there not qualified.. i am not sure next would be Yanlord or not... looks pretty bad, going to break IPO price soon.

idesa168 ( Date: 12-Sep-2008 14:22) Posted:

| Even the big brother COSCO is up today, why not YZJ...something is not right here! NV... |

|

Even the big brother COSCO is up today, why not YZJ...something is not right here! NV...

tis baby is my last,,,,,,,,strong hold baby but heavy lost let go on monday,,,,,,,,,,,,,,,,,,,,,,,,,,,,my china hongxing dump ,,,,,,china enrgy,,,,and biosensor all one button dump at last friday,,,,,,,,,,,,,,,,,,,,,,,,now i go back and rest at bukit timah hill again,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,another tsunami look like akan datang,,,,,,,,,,,,,,,,a lot call margin investor cut lost selling,,,,,,,,,,,,,,,those still holding can see the brking hse take action force selling akan datang,,,,,,tis time very scary,,,,,,,,me also scary lay........

YZJ is lucky, every day company share buy back to support the crash... other S-shares, crash like lao sai... waiting to catch some falling knife.. because the rebound can be quite exciting....

Removed from STI.....hmmmm........

look closely tis baby and ferochina,,,,,,,,if they can fly,,,,,,,close one eye other cts sure can buy,,,,,,,,,,ferochina going to fly liao......even yangzhijiang,,,,,when they up,,,,,,,,5cts day by day,,,,,,,,,,kill short action akan datang.,,,,,,,,,,,,,,,near liao....>>>>>

i read the article at www.nextinsight.com.sg, and it says Yangzijiang has a cashhoard of $920 million.

this one rich daddy

Centaur ( Date: 01-Sep-2008 10:19) Posted:

| Anyway knows how YZJ finance its share buyback?? It got so much cash to burn or finance via borrowings?

Also, look at the last purchase of 14.5 mil shares at one go compare to previous purchase, is mgmt so confident that the counter has already bottomed? |

|

super! today 1,500,000 shares bought back by Yangzijiang.

don worry lah,,,,,,,tis one shortist heavy short but burst by last week heavy share buy back,,,,,,,,,,,,,,,,,,their back yard on fire,,,,,,im going to see shortist can tahan how long..,,,,,,,wat i noe that a lot cfd acct heavy acc long position,,,,,from local to foreign cts,,,,,,,im also heavy lost but still wait for rebound,,,,,,,im not going to buy more,,,,,,,im hold tight tis one super kill short time coming,,,,,,,,,,you will see 5cts up day by daywhen kill short coming and who heavy short 75cts....755cts ,,,,,,going to ,,,,,,,,keep it up share buy back

I'm more interested on what the mgmt gonna do with the buy-backs? Will it be cancel in normal practice or keep as treasury for staff 's bonus/performance reward or for sales in the future should price do appreciate so as to make $$ for the company? Anybody here to share info?

Anyway knows how YZJ finance its share buyback?? It got so much cash to burn or finance via borrowings?

Also, look at the last purchase of 14.5 mil shares at one go compare to previous purchase, is mgmt so confident that the counter has already bottomed?

the company has been aggressively buying back shares, from what i read at

www.nextinsight.com.sg, which produced this table.

| Date of share repurchase |

No. of shares purchased |

Price/share

(S$) |

Total value (S$) |

| 21-08-2008 |

14,500,000 |

0.595-0.60 |

~8.6 m |

| 18-08-2008 |

1,690,000 |

61-62 |

~1.04 m |

| 15-08-2008 |

1,000,000 |

0.63 |

630,000 |

| 22-07-2008 |

3,000,000 |

0.77 |

770,000 |

| 18-07-2008 |

700,000 |

0.78 |

546,000 |

| 17-07-2008 |

3,279,000 |

0.79-0.795 |

~2.6 m |

| 16-07-2008 |

2,438,000 |

0.795 |

1.938 m |

| 15-07-2008 |

3,000,000 |

0.795 |

2.385 m |

| 14-07-2008 |

357,000 |

0.815 |

290,955 |

| 08-07-2008 |

997,000 |

0.795 |

792,615 |

| 02-07-2008 |

1,000,000 |

0.79 |

790,000 |

| 01-07-2008 |

3,000,000 |

0.82 |

2.46 m |

it's about time to bottom fishing...

YZJ started share buy-back in early May. Prices range from $1.07 to $0.575.

http://www.nextinsight.com.sg/content/view/558/60/

CWQuah, in this climate, chart will fail you. Look hard at the sentiment...China had been down lately and it's still not finished with its down business yet. Better stay side on China counters .... and dun get choked by the dumplings, looks cheap now, might have bones init...hehehe! Cheers!

CWQuah ( Date: 12-Aug-2008 17:48) Posted:

|

Idesa U referring to THAT 'dumpling' stock ah?

Hehe this dumpling might be worth playing.... heheheehhe. Interesting charts and NAV.

idesa168 ( Date: 12-Aug-2008 17:40) Posted:

| I flushed my YZJ into my toilet bowl many months ago!...it went off with the dumpling too...hehehe!!! |

|

|

|

STI yardstick are DJ and HSI, it will follow suit if both peers don't perform. Of course, we don't rule out regional financial crisis may cripple Spore market as well, ie a near miss fr Vietnam financial crisis, lately. 1997 financial disaster was headed by Thailand. Spore market then toppled more than 58% within a yr, not counted losses fr closure of Glob Int over the courseway.

Spore's relative resilence comes fr low oil intensity, large fiscal and current account surpluses and a lack of fuel subsidies. Looking at our neighbours' bourses, we ought to console ourselves of being living in this pcs of small harmony island liao. Cheers Spore 43.