Post Reply

401-420 of 1192

Post Reply

401-420 of 1192

correct me if im wrong, im seeing a wave "C" currently.

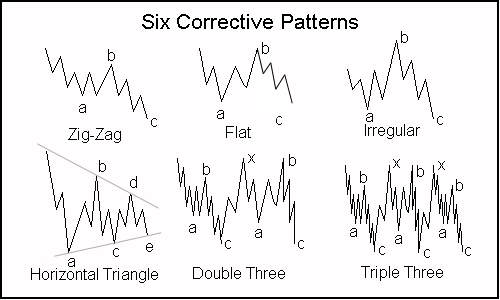

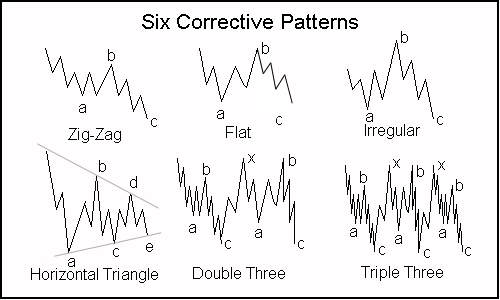

or.... ... could it be horizontal triangle ? ?? I'm kanna confused on the elliott wave mann. any experts here can share this view.

Still waiting for 3.15 to enter... MACD is going into bearish.

resistance at 3.38 , not 3.88 . typo error

13th Jann 2011 The downside prevails as long as 3.88 is the resistance

Our pivot point stands at 3.38.

Our preference: the downside prevails as long as 3.38 is resistance.

Alternative scenario: above 3.38, look for 3.46 and 3.51.

Comment: the RSI is below its neutrality area at 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is trading under both its 20 and 50 day MA (standing respectively at 3.35 and 3.34).

Supports and resistances: 3.46 *3.38 **3.34 3.29 last 3.18 3.13 **3.08 *

// TRADING CENTRAL is a commentary service specialising in technical analysis. //

" breakout on the chart ? ?? "

" breakout on the chart ? ?? "

ST Engg could be poised for short term technical rebound. Bullish reversal pattern spotted.

http://sgsharemarket.com/home/2011/01/st-engineering-bullish-reversal-pattern/ go go go!!!

Submitted with respect to: SINGAPORE TECH ENGINEERING LTD

Announcement Title: MISCELLANEOUS :: ST ENGINEERING'S US SUBSIDIARY AWARDED PROXY AGREEMENT AND ANNOUNCES NEW BOARD MEMBERS

Broadcast Date: 12-Jan-2011 Broadcast Time: 12:34:15 Stock Code: S63 Reference No.: 00015

// brewing some news //

Can figure out the elliott wave sequence. the tall black candle till date looks like corrective waves . could be irregular ... ...

for example.

" waiting for areospace business to take off, or bombardment is in the process ? ?? "

" waiting for areospace business to take off, or bombardment is in the process ? ?? "

(,") comments ... ...

Waiting for 3.15 to enter back.

lousy stock !! lousy dividends also !! excellent for bad times whenever risk profile reduce significantly : )

Ready to go in at 3.25. Range trading.

got out at 3.34 . good luck!

Weak buying power. Time to get out?

krisluke ( Date: 05-Jan-2011 12:21) Posted:

|

Our pivot point is at 3.42.Our preference: short term technical rebound towards 3.42 before a new drop.

Alternative scenario: above 3.42, look for 3.5 and 3.55.Comment: the RSI is above its neutrality area at 50. The MACD is above itssignal line and positive. The configuration is positive. Moreover, the stockis trading under both its 20 and 50 day MA (standing respectively at 3.34 and3.34).

Singapore Technologies Eng is currently trading near its 52 week highreached at 3.5 on 10/11/10.

Supports and resistances: 3.5 *3.42 **3.383.34 last3.243.19 **3.14

// TRADING CENTRAL is a commentary service specialising in technical analysis //

(,") |

|

ST Engineering’s electronics arm acquires remaining 30% equity stake in PM-B

|

| WRITTEN BY THE EDGE |

| WEDNESDAY, 05 JANUARY 2011 19:39 |

ST Engineering says ST Electronics (Info-Software Systems) (STEE-InfoSoft) has acquired the remaining 30% equity stake in PM-B from the other existing shareholder, Nicky Ting, for a total cash consideration of $2 million.

With the acquisition, PM-B becomes a wholly-owned subsidiary of STEE-InfoSoft, which in turn is a wholly-owned subsidiary of ST Electronics, the electronics arm of ST Engineering. PM-B, which was established in 1991, specialises in the design and implementation of mission critical, customised data centres, and disaster recovery facilities and has successfully started data centre co-location service.

As a wholly owned subsidiary, PM-B will help grow ST Electronics’ data centre and cloud computing business. |

///

Our pivot point is at 3.42.Our preference: short term technical rebound towards 3.42 before a new drop.

Alternative scenario: above 3.42, look for 3.5 and 3.55.Comment: the RSI is above its neutrality area at 50. The MACD is above itssignal line and positive. The configuration is positive. Moreover, the stockis trading under both its 20 and 50 day MA (standing respectively at 3.34 and3.34).

Singapore Technologies Eng is currently trading near its 52 week highreached at 3.5 on 10/11/10.

Supports and resistances: 3.5 *3.42 **3.383.34 last3.243.19 **3.14

// TRADING CENTRAL is a commentary service specialising in technical analysis //

(,")

for example.

for example.