Post Reply

3021-3040 of 69565

Post Reply

3021-3040 of 69565

Thank you for sharing this secret... appreciate it

risktaker ( Date: 18-Jun-2013 09:38) Posted:

I want to share a secret with u guys..... about my personal view on ramba....

Facts:

1) It really has discover quite alot of oil....

2) natural resources are limited....once u used it its gone....

3) a potential buyer is willing to buy ramba at 60-70 cents....

4) oil prices are likely to strengthen than weaken in the future....

So anyone thats smart will know that ramba is a liquid black gold.....if a potential buyer is willing to buy at 0.60-0.70 ramba true value should be at least $1.00 and above.... in business sense... you wont pay over the real value of the business ...whenever u do u always start with a lower bid... like when microsoft brought over hotmail from the india guy... in the first meeting bill gates offer him like somewhere around 100mill and the lawyer advice the indian not to accept the offer and walk away.... uncle bill came back with 300 million.... and remember .... once the well started pumping oil..... its like a printing machine.....

You guys are fools not to realised its potential.... ramba is gonna be easily $1.00 stock..... soon....

Good luck..... |

|

I want to share a secret with u guys..... about my personal view on ramba....

Facts:

1) It really has discover quite alot of oil....

2) natural resources are limited....once u used it its gone....

3) a potential buyer is willing to buy ramba at 60-70 cents....

4) oil prices are likely to strengthen than weaken in the future....

So anyone thats smart will know that ramba is a liquid black gold.....if a potential buyer is willing to buy at 0.60-0.70 ramba true value should be at least $1.00 and above.... in business sense... you wont pay over the real value of the business ...whenever u do u always start with a lower bid... like when microsoft brought over hotmail from the india guy... in the first meeting bill gates offer him like somewhere around 100mill and the lawyer advice the indian not to accept the offer and walk away.... uncle bill came back with 300 million.... and remember .... once the well started pumping oil..... its like a printing machine.....

You guys are fools not to realised its potential.... ramba is gonna be easily $1.00 stock..... soon....

Good luck.....

Risktaker is like a chart to me, up down up down, bull bear bull bear, in tandem with the market. Can feel the pulse if you follow him. Wahahaha!!

stevenlim109 ( Date: 18-Jun-2013 09:13) Posted:

really puzzle me why sifu seems to know everything ?

risktaker ( Date: 14-Jun-2013 06:50) Posted:

| Looks like our STI market going for technical rebound.... may test 3200 next week shall be little bullish.... |

|

|

|

STI

One scenario: as long as

3192 is a resistance, we are bearish with a target at 3048.

Alternative scenario: a break above 3192 would invalidate our bearish scenario. The index could then rise to 3231.

DOW JONES (60 MIN)

DOW JONES (60 MIN)

One scenario: as long as 15015 is a support, we are bullish with a target at 15540.

Alternative scenario: a break below 15015 would invalidate our bullish scenario. The index could then decline to 14845.

HANG SENG (60 MIN)

HANG SENG (60 MIN)

One scenario: as long as 21425 is a resistance, a decline towards 20650 and even 20485 seems likely.

Alternative scenario: a break above 21425 would open the way to 21820.

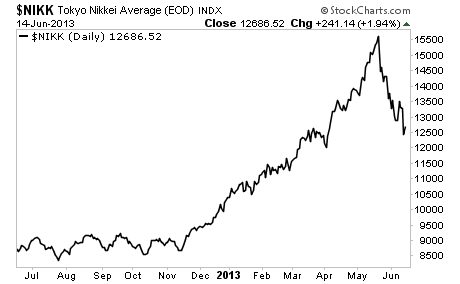

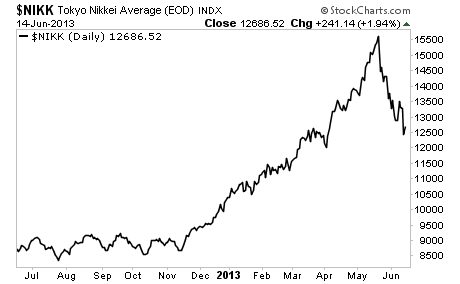

NIKKEI 225 (60 MIN)

NIKKEI 225 (60 MIN)

One scenario: as long as 13055 is a resistance, a decline towards 12415 and even 12220 seems likely.

Alternative scenario: a break above 13055 would open the way to 13585.

really puzzle me why sifu seems to know everything ?

risktaker ( Date: 14-Jun-2013 06:50) Posted:

| Looks like our STI market going for technical rebound.... may test 3200 next week shall be little bullish.... |

|

No one is good at the market, actually, from what I hear and see.

Expert traders are the people who really lose alot of money. Less confident traders usually make small amounts consistently that

add up to much after a longer period.

Anyone disagrees with this " theory" or should I say " paradox" (meaning unbelievable but true story)?

Talk so much... I hope u manage to sell at low

kelvinLim123 ( Date: 18-Jun-2013 02:59) Posted:

I post just awhile ago, now it is just a mere 45 pts, from a high of 195 pts. u see as there are those on the side buying the dip, there are just as many selling to strength.

Then how do explain the drop of 195 to 50 pts.???

And if those who bought got panic and turn seller, we have cheap sale again.

Who want to buy fundamental stock? are you ready to buy on the way down.

Don't be a hero, u dies like a cowboy, I do not means to be rude,

but to those who said no cirses right now, is totally lost.

kelvinLim123 ( Date: 18-Jun-2013 02:26) Posted:

And just because dow is up 150 pts , do not be carry away, we as of now do not pace dow, nikkei future is down. today nikkei is up on tech rebounce only.

it has more to go down. STI today may be down, even if it is up, I will still be selling to strength.

I still hope it is up so i can sell, This round i hestitate to sell , thus my profit is less. regret that i hestitated.

dont catch a falling knife, think that it is good to buy.

My friend bought dukang, and told me happily that he make some money, so hold, now he is speechless.

bought 59, then it go to 6X, now it is i think 56., take care,

just observe stop loss strictly .

|

|

|

|

Dow ended up 100 points!

|

June 17, 2013 Can Bernanke Keep the Rally Going? The markets are rallying today because Bernanke and the Fed meet on Wednesday and will announce their new policies (if any). Someone might want to explain to them that the Nikkei just collapsed in spite of Central Bank policy. The bank of Japan announced it would buy $1.4 trillion worth of assets (roughly 25% of Japanís GDP) in early April. The Nikkei has already wiped out almostall of the gains since that time.

Still, US bulls continue to hope that Bernanke will engage in even more QE, despite the fact the Fed has an $85 billion per month QE policy in place already, which comes to over $1 trillion in QE per year. Given that the Fedís balance sheet is already over $3 trillion and will be over $4 trillion within 12 months, one has to wonder just what Bernanke can do. His best bet is to retire in January and let someone else try and manage the mess he created. So letís see what happens on Wednesday. The markets will likely rally until then on hopes of more juice from Bernanke. But if he should disappoint at all (read: not announce something more or at leaststrongly hint at doing so) then buckle up..............Gains, Pain and Capital

what invester want to hear is affirmative , not half sure type, and most likely i think he will procastinate type of speech will send mkt down big time.

|

I post just awhile ago, now it is just a mere 45 pts, from a high of 195 pts. u see as there are those on the side buying the dip, there are just as many selling to strength.

Then how do explain the drop of 195 to 50 pts.???

And if those who bought got panic and turn seller, we have cheap sale again.

Who want to buy fundamental stock? are you ready to buy on the way down.

Don't be a hero, u dies like a cowboy, I do not means to be rude,

but to those who said no cirses right now, is totally lost.

kelvinLim123 ( Date: 18-Jun-2013 02:26) Posted:

And just because dow is up 150 pts , do not be carry away, we as of now do not pace dow, nikkei future is down. today nikkei is up on tech rebounce only.

it has more to go down. STI today may be down, even if it is up, I will still be selling to strength.

I still hope it is up so i can sell, This round i hestitate to sell , thus my profit is less. regret that i hestitated.

dont catch a falling knife, think that it is good to buy.

My friend bought dukang, and told me happily that he make some money, so hold, now he is speechless.

bought 59, then it go to 6X, now it is i think 56., take care,

just observe stop loss strictly .

teeth53 ( Date: 18-Jun-2013 00:02) Posted:

| Dow was up +180 points...STI up...? |

|

|

|

And just because dow is up 150 pts , do not be carry away, we as of now do not pace dow, nikkei future is down. today nikkei is up on tech rebounce only.

it has more to go down. STI today may be down, even if it is up, I will still be selling to strength.

I still hope it is up so i can sell, This round i hestitate to sell , thus my profit is less. regret that i hestitated.

dont catch a falling knife, think that it is good to buy.

My friend bought dukang, and told me happily that he make some money, so hold, now he is speechless.

bought 59, then it go to 6X, now it is i think 56., take care,

just observe stop loss strictly .

teeth53 ( Date: 18-Jun-2013 00:02) Posted:

Dow was up +180 points...STI up...?.

GorgeousOng ( Date: 17-Jun-2013 18:50) Posted:

Dow future + 132

All mice... How is your heart beat now? |

|

|

|

And to said there are no crises right now is also not correct. First, China is definitely not OK, Japan Bond is a big problem. And Europe is still not solve,

you read this.......everyone is blowing bubbles.

http://www.businesstimes.com.sg/premium/editorial-opinion/opinion/bubble-thats-primed-explode-not-just-pop-20130613

this is not my opinion, just to share

to said no crise is total ignorant.

SFGuyRuleZ ( Date: 17-Jun-2013 22:12) Posted:

I feel I have a responsibility to share this. The whole objective of

QE, whether from Japan or US, is to promote lending and encourage

spending, so as to spur up their economies. However, whether if all

these money goes to the consumers or not, it is really very hard to

determine. If most money is kept in those banks or used to buy stocks,

there will be an asset bubble as most of these money from QE don't go to

where they should go to. Ultimately, this bubble may burst, driving

stock prices down. I have no intention to scare people, just feel that

when we invest or trade, we should have awareness and plan for rainy

days.

I am not trying to influence people's style or strategy of

investing, but just feel i can share some food for thought. 1) Never

invest more than you are willing to lose. 2) Invest in fundamentally sound stocks so that even when a market crashes,

their fall is more " cushioned" and there's always chance of rebounding

back to it's fundamental level. Having said this, it is also important

to have a 3) stop loss. 4) Lastly, is good to have a long time horizon

and be able to hold. As Warren Buffet once mentioned - as long as you

take care of the downside, the upside will take care of itself. To me,

this means holding for as long as you can until it reaches your target

price, and only to consider selling when the fundamentals of the stock

has changed, or when a strong support level has been broken and you can

sell to lock profits first.

I never feel that investing in stock

market is to follow what BBs buy and you buy accordingly. As i also

mentioned before, there are good and bad BBs, depending on his

philosophy, of stocks and life. I believe most BBs also invest in

fundamental stocks, and that's how they can grow their money to become

so rich. Of course, they have large capital to start with, I won't deny

that. Not to forget institutional investors like banks and fund managers also,

I believe they do also invest in fundamentals. I am not saying

investing in fundamentals is a guaranteed way to make money, as market

nowadays are getting more and more irrational. However, investing in

fundamentals offers a large margin of safety, so that when crisis

strikes, we are still more or less " shielded" .Ultimately, your

money your call. No one can control what you want to do with your money.

And in case i am being accused of a doomsayer feeling that the market

will crash, I definitely don't feel there is any impending crisis now, I

hope. Lastly, even though it may sound silly, but from the profits you

earn in the stock market, spend at least some of them so as to spur the

economy also, be it buying things you really want/need, or even a simple

yet occasional expensive dinner with your loved ones.. May all huat!!

=)

|

|

That is not correct. Follow BB means follow the trend, the trend is your friend. If you do not follow BB, then u are standing in front of a moving train.

U are right to said to have a stop loss for all vestment, irrespective of whether short , long or whatever term.

To stubbornly hold to so call fundamental stock in a down market is self defecting. In a down market even the deepest of the blue chip will not be spare.

They will still be sell down, so why foolishly follow it down, and up and gain nothing, u shd cut and buy at the low, even if it is not the lowest, at least, your chance of profit is greater.

And most BB dont invest in fundamental stock, only institutional does, BB are out to suck retail blood. that is how they become rich, and BB got deep pocket which most of you here don't.

Your no 2 only sound reasonable, if you are a value invester, not trader, u shd always buy blue chip , not penny, penny, mid and small cap are for trading .

Your points are nothing new but what we have always heard,

Just thanks for the reminder,

SFGuyRuleZ ( Date: 17-Jun-2013 22:12) Posted:

I feel I have a responsibility to share this. The whole objective of

QE, whether from Japan or US, is to promote lending and encourage

spending, so as to spur up their economies. However, whether if all

these money goes to the consumers or not, it is really very hard to

determine. If most money is kept in those banks or used to buy stocks,

there will be an asset bubble as most of these money from QE don't go to

where they should go to. Ultimately, this bubble may burst, driving

stock prices down. I have no intention to scare people, just feel that

when we invest or trade, we should have awareness and plan for rainy

days.

I am not trying to influence people's style or strategy of

investing, but just feel i can share some food for thought. 1) Never

invest more than you are willing to lose. 2) Invest in fundamentally sound stocks so that even when a market crashes,

their fall is more " cushioned" and there's always chance of rebounding

back to it's fundamental level. Having said this, it is also important

to have a 3) stop loss. 4) Lastly, is good to have a long time horizon

and be able to hold. As Warren Buffet once mentioned - as long as you

take care of the downside, the upside will take care of itself. To me,

this means holding for as long as you can until it reaches your target

price, and only to consider selling when the fundamentals of the stock

has changed, or when a strong support level has been broken and you can

sell to lock profits first.

I never feel that investing in stock

market is to follow what BBs buy and you buy accordingly. As i also

mentioned before, there are good and bad BBs, depending on his

philosophy, of stocks and life. I believe most BBs also invest in

fundamental stocks, and that's how they can grow their money to become

so rich. Of course, they have large capital to start with, I won't deny

that. Not to forget institutional investors like banks and fund managers also,

I believe they do also invest in fundamentals. I am not saying

investing in fundamentals is a guaranteed way to make money, as market

nowadays are getting more and more irrational. However, investing in

fundamentals offers a large margin of safety, so that when crisis

strikes, we are still more or less " shielded" .Ultimately, your

money your call. No one can control what you want to do with your money.

And in case i am being accused of a doomsayer feeling that the market

will crash, I definitely don't feel there is any impending crisis now, I

hope. Lastly, even though it may sound silly, but from the profits you

earn in the stock market, spend at least some of them so as to spur the

economy also, be it buying things you really want/need, or even a simple

yet occasional expensive dinner with your loved ones.. May all huat!!

=)

|

|

Dow was up +180 points...STI up...?.

GorgeousOng ( Date: 17-Jun-2013 18:50) Posted:

Dow future + 132

All mice... How is your heart beat now? |

|

Dow was up 180 points or 1.2%.†Regional bourses rally....STI huat huat...arhh.

GorgeousOng ( Date: 17-Jun-2013 18:50) Posted:

Dow future + 132

All mice... How is your heart beat now? |

|

1st time for a long time I see such informative contribution from forummer..

Thumbs up (" ,)

SFGuyRuleZ ( Date: 17-Jun-2013 22:12) Posted:

I feel I have a responsibility to share this. The whole objective of

QE, whether from Japan or US, is to promote lending and encourage

spending, so as to spur up their economies. However, whether if all

these money goes to the consumers or not, it is really very hard to

determine. If most money is kept in those banks or used to buy stocks,

there will be an asset bubble as most of these money from QE don't go to

where they should go to. Ultimately, this bubble may burst, driving

stock prices down. I have no intention to scare people, just feel that

when we invest or trade, we should have awareness and plan for rainy

days.

I am not trying to influence people's style or strategy of

investing, but just feel i can share some food for thought. 1) Never

invest more than you are willing to lose. 2) Invest in fundamentally sound stocks so that even when a market crashes,

their fall is more " cushioned" and there's always chance of rebounding

back to it's fundamental level. Having said this, it is also important

to have a 3) stop loss. 4) Lastly, is good to have a long time horizon

and be able to hold. As Warren Buffet once mentioned - as long as you

take care of the downside, the upside will take care of itself. To me,

this means holding for as long as you can until it reaches your target

price, and only to consider selling when the fundamentals of the stock

has changed, or when a strong support level has been broken and you can

sell to lock profits first.

I never feel that investing in stock

market is to follow what BBs buy and you buy accordingly. As i also

mentioned before, there are good and bad BBs, depending on his

philosophy, of stocks and life. I believe most BBs also invest in

fundamental stocks, and that's how they can grow their money to become

so rich. Of course, they have large capital to start with, I won't deny

that. Not to forget institutional investors like banks and fund managers also,

I believe they do also invest in fundamentals. I am not saying

investing in fundamentals is a guaranteed way to make money, as market

nowadays are getting more and more irrational. However, investing in

fundamentals offers a large margin of safety, so that when crisis

strikes, we are still more or less " shielded" .Ultimately, your

money your call. No one can control what you want to do with your money.

And in case i am being accused of a doomsayer feeling that the market

will crash, I definitely don't feel there is any impending crisis now, I

hope. Lastly, even though it may sound silly, but from the profits you

earn in the stock market, spend at least some of them so as to spur the

economy also, be it buying things you really want/need, or even a simple

yet occasional expensive dinner with your loved ones.. May all huat!!

=)

|

|

Thks for your sharing!

SFGuyRuleZ ( Date: 17-Jun-2013 22:12) Posted:

I feel I have a responsibility to share this. The whole objective of

QE, whether from Japan or US, is to promote lending and encourage

spending, so as to spur up their economies. However, whether if all

these money goes to the consumers or not, it is really very hard to

determine. If most money is kept in those banks or used to buy stocks,

there will be an asset bubble as most of these money from QE don't go to

where they should go to. Ultimately, this bubble may burst, driving

stock prices down. I have no intention to scare people, just feel that

when we invest or trade, we should have awareness and plan for rainy

days.

I am not trying to influence people's style or strategy of

investing, but just feel i can share some food for thought. 1) Never

invest more than you are willing to lose. 2) Invest in fundamentally sound stocks so that even when a market crashes,

their fall is more " cushioned" and there's always chance of rebounding

back to it's fundamental level. Having said this, it is also important

to have a 3) stop loss. 4) Lastly, is good to have a long time horizon

and be able to hold. As Warren Buffet once mentioned - as long as you

take care of the downside, the upside will take care of itself. To me,

this means holding for as long as you can until it reaches your target

price, and only to consider selling when the fundamentals of the stock

has changed, or when a strong support level has been broken and you can

sell to lock profits first.

I never feel that investing in stock

market is to follow what BBs buy and you buy accordingly. As i also

mentioned before, there are good and bad BBs, depending on his

philosophy, of stocks and life. I believe most BBs also invest in

fundamental stocks, and that's how they can grow their money to become

so rich. Of course, they have large capital to start with, I won't deny

that. Not to forget institutional investors like banks and fund managers also,

I believe they do also invest in fundamentals. I am not saying

investing in fundamentals is a guaranteed way to make money, as market

nowadays are getting more and more irrational. However, investing in

fundamentals offers a large margin of safety, so that when crisis

strikes, we are still more or less " shielded" .Ultimately, your

money your call. No one can control what you want to do with your money.

And in case i am being accused of a doomsayer feeling that the market

will crash, I definitely don't feel there is any impending crisis now, I

hope. Lastly, even though it may sound silly, but from the profits you

earn in the stock market, spend at least some of them so as to spur the

economy also, be it buying things you really want/need, or even a simple

yet occasional expensive dinner with your loved ones.. May all huat!!

=)

|

|

I feel I have a responsibility to share this. The whole objective of

QE, whether from Japan or US, is to promote lending and encourage

spending, so as to spur up their economies. However, whether if all

these money goes to the consumers or not, it is really very hard to

determine. If most money is kept in those banks or used to buy stocks,

there will be an asset bubble as most of these money from QE don't go to

where they should go to. Ultimately, this bubble may burst, driving

stock prices down. I have no intention to scare people, just feel that

when we invest or trade, we should have awareness and plan for rainy

days.

I am not trying to influence people's style or strategy of

investing, but just feel i can share some food for thought. 1) Never

invest more than you are willing to lose. 2) Invest in fundamentally sound stocks so that even when a market crashes,

their fall is more " cushioned" and there's always chance of rebounding

back to it's fundamental level. Having said this, it is also important

to have a 3) stop loss. 4) Lastly, is good to have a long time horizon

and be able to hold. As Warren Buffet once mentioned - as long as you

take care of the downside, the upside will take care of itself. To me,

this means holding for as long as you can until it reaches your target

price, and only to consider selling when the fundamentals of the stock

has changed, or when a strong support level has been broken and you can

sell to lock profits first.

I never feel that investing in stock

market is to follow what BBs buy and you buy accordingly. As i also

mentioned before, there are good and bad BBs, depending on his

philosophy, of stocks and life. I believe most BBs also invest in

fundamental stocks, and that's how they can grow their money to become

so rich. Of course, they have large capital to start with, I won't deny

that. Not to forget institutional investors like banks and fund managers also,

I believe they do also invest in fundamentals. I am not saying

investing in fundamentals is a guaranteed way to make money, as market

nowadays are getting more and more irrational. However, investing in

fundamentals offers a large margin of safety, so that when crisis

strikes, we are still more or less " shielded" .Ultimately, your

money your call. No one can control what you want to do with your money.

And in case i am being accused of a doomsayer feeling that the market

will crash, I definitely don't feel there is any impending crisis now, I

hope. Lastly, even though it may sound silly, but from the profits you

earn in the stock market, spend at least some of them so as to spur the

economy also, be it buying things you really want/need, or even a simple

yet occasional expensive dinner with your loved ones.. May all huat!!

=)

Anyone have forex trading account,I'm new and don't have trade before but wanna to learnt it before open the account ?like saxo,cmc or plus500,,,which one is the best and how to withdrawal the fund ,just now I try the plus500 the Mobil trading is very easy but just want to find out how to withdraw money back,,,anyone here got trade plus 500 before?thank you

The Secret Trading Strategy From The 1930s That Hedge Funders Don't Want You To Know About

See

Link