anyone just bought this, if so who is sell party?

0.465 if good shld be able to hold right unless BBs slowly distribute out?

Any thots?

| SINO GRANDNESS, PALM OIL stocks : What analysts now say... |

|

Excerpts from latest analyst reports..... UOB Kay Hian pegs 64-cent target for SINO GRANDNESS

Sino Grandness has completed a Rmb270m issue of convertible bonds to Goldman Sachs and its co-investor. This is to fund its beverage business for eventual spin-off and listing. Analyst: Brandon Ng, CFA We re-iterate our BUY recommendation on Sino Grandness Food (SGF) with a target price of S$0.64. This translates into 3.0x 2013F PE, pegged to Singapore-listed peers’ average. Expect strong revenue and net profit in 2013. We forecast SGF to report revenue of Rmb1911.2m (+24.4% yoy growth) and net profit of Rmb285.3m (+35.9% yoy growth) in 2013. SGF will be able to enjoy the full economic benefits of the increased production capacity for the beverage business and the expansion of canned food business within the domestic market. Share Price Catalyst. • We note the potential upside of S$1.12/share if Garden Fresh obtains approval from an exchange to list assuming a holding company discount of 20% to SGF’s Garden stake and a 3.0x 2014F PE valuation to its remaining business. • SGF is also able to enjoy a re-rating once the company announces the engagement of any financial advisors for this listing. Last week, we saw an infrastructure-related stock jump more than 20% the day the company announced the intention to demerge and list its assets in an overseas exchange.

Source: UOBKH, Bloomberg, Sino Grandness

|

your reason being?

francisd ( Date: 04-Oct-2012 16:25) Posted:

|

time to get low price before it cheong high, don't wait for the counter cheong, then chase.

There are many other counters on SGX to put your money.

I want to avoid this stock. Cheers.

yabbest ( Date: 04-Oct-2012 09:53) Posted:

|

refer to below nav endjune2012

Net asset value (NAV) Group Company

(RMB cents) 263.4 52.6

high is 50c..

break that .. this baby will fly..

gd luck dyodd..

do not just take my view blindly..

| sgnewbie ( Date: 03-Oct-2012 11:21) Posted: |

this is a super value play..

PE 4x, revenue increase almost 50% every year.

wow!..

this is a gem..

vested 48.. gd luck dyodd

Sino Grandness Food (SFGI SP)

Additional Rmb270m To Fund Beverage Expansion

BUY

Price/ Target

Mkt. Cap/ F. Float

+34.7%

S$0.475/S$0.64

S$126.0m/56%

Fundamental View Technical View

Source: Nextview

The stock is likely to trend higher after forming an interim

base with immediate support at S$0.455. Resistance could

be found at S$0.525 with S$0.60 as the next potential

resistance level.

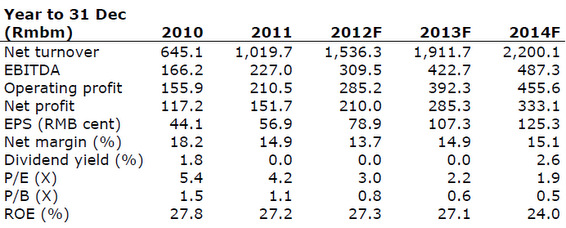

Financials

Year to 31 Dec

(Rmbm) 2010 2011 2012F 2013F 2014F

Net turnover 645.1 1,019.7 1,536.3 1,911.7 2,200.1

EBITDA 166.2 227.0 309.5 422.7 487.3

Operating profit 155.9 210.5 285.2 392.3 455.6

Net profit 117.2 151.7 210.0 285.3 333.1

EPS (RMB cent) 44.1 56.9 78.9 107.3 125.3

Net margin (%) 18.2 14.9 13.7 14.9 15.1

Dividend yield (%) 1.8 0.0 0.0 0.0 2.6

P/E (X) 5.4 4.2 3.0 2.2 1.9

P/B (X) 1.5 1.1 0.8 0.6 0.5

ROE (%) 27.8 27.2 27.3 27.1 24.0

Source: Sino Grandness, Bloomberg, UOB Kay Hian.

Background

Valuation

•

Food (SGF) with a target price of S$0.64. This translates

into 3.0x 2013F PE, pegged to Singapore-listed peers’

average.

We re-iterate our BUY recommendation on Sino GrandnessInvestment Highlights

•

bonds (CB) to Goldman Sachs Investments Holdings Asia

Limited and its co-investor. This is to fund its beverage

business for the eventual spin-off and listing in an approved

exchange. With the cash in hand, we expect the group to

speed up the advertising and promotion (A& P) activities and

increase its distribution points. To recap, the beverage

segment has to achieve Rmb140m in net profit for 2012 and

Rmb250m for 2013 within the CBs’ performance target to

obtain minimal dilution. As of 1H12, we estimate the

company had recorded NPAT of Rmb70.6m in the beverage

segment on Rmb392.4m (+120.7% yoy) of sales.

SGF has completed the Rmb270m issue of convertible•

cash cow

revenue. This will be driven by new customers and new

products. Sales of canned products for the domestic market

have expanded tremendously in 1H12 to Rmb53.6m from a

mere Rmb2.8m in 1H11. To cater for more domestic

demand, SGF is looking to distribute bottled cut fruits to

supermarkets such as Walmart and Carrefour.

Canned fruits and vegetables business remains as, with a targeted 15-20% growth in annual•

forecast SGF to report revenue of Rmb1911.2m (+24.4%

yoy growth) and net profit of Rmb285.3m (+35.9% yoy

growth) in 2013. SGF will be able to enjoy the full economic

benefits of the increased production capacity for the

beverage business and the expansion of canned food

business within the domestic market.

Expect strong revenue and net profit in 2013. WeShare Price Catalyst

•

Fresh obtains approval from an exchange to list assuming a

holding company discount of 20% to SGF’s Garden stake

and a 3.0x 2014F PE valuation to its remaining business.

We note the potential upside of S$1.12/share if Garden•

announces the engagement of any financial advisors for this

listing. Last week, we saw an infrastructure-related stock

jump more than 20% the day the company announced the

intention to demerge and list its assets in an overseas

exchange.

SGF is also able to enjoy a re-rating once the companyPeer Comparison

Company Currency

Price Market

Cap

(m)

PE

FY11

(x)

PB

FY11

(x)

TINGYI HLDG CO HK$ 23.350 130587 40.10 8.02

CHINA HUIYUAN HK$ 2.350 3473 9.13 0.54

WANT WANT CHINA HK$ 9.890 130822 34.85 12.26

UNI-PRESIDENT HK$ 8.920 32107 40.90 3.59

Average 31.24 6.10

YAMADA GREEN RES S$ 0.126 51.78 1.90 0.76

CHINA MINZHONG S$ 0.795 443.16 3.36 0.64

Average

SINO GRANDNESS S$

2.63 0.700.475 125.96 4.28 1.17Source: Bloomberg, UOB Kay Hian

Sino Grandness is an integrated manufacturer and

distributor of bottled juices as well as canned fruits and

vegetables. Since its establishment in 1997, the group has

rapidly grown to become one of the leading exporters of

canned asparagus, long beans and mushrooms from China.

The group serves globally renowned customers across

Europe, North America and Asia, such as Lidl, Rewe,

Carrefour, Walmart, Huepeden, Coles and Metro.

In 2010, the group successfully launched its own-branded

bottled juices,

juice and vegetable-fruit juice to target the huge domestic

consumer base in China. As a percentage to group revenue,

sales from the Chinese market have surged from 4.8% in

to strong sales growth of the

2008 to 41.9% in 2011 due

own-branded bottled juices.

yeah. still holding from 0.445.

agreed target 0.50.

novicealex ( Date: 18-Sep-2012 09:56) Posted:

|

0.47 Cleared on high volume. Breakout play. Target 0.50

Vested at 0.465

Volume picking up today...

Chart is looking for a breakout... Resistance 0.47

Vested at 0.465. Target 0.50

$0.50 no sell