Stocks get pumped up for earnings

By Julianne Pepitone, staff reporterOctober 18, 2010: 4:51 PM ET

By Julianne Pepitone, staff reporterOctober 18, 2010: 4:51 PM ET

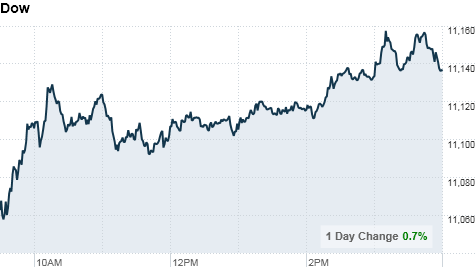

NEW YORK (CNNMoney.com) -- Stocks gained steam to close the session sharply higher Monday, extending last week's rally, on upbeat earnings from Citigroup and improvement in the housing sector.

The Dow Jones industrial average (INDU) added 81 points, or 0.7%, to end at 11,143.69. The S&P 500 (SPX) rose up 9 points, or 0.7%, to settle at 1,184.71, and the Nasdaq composite index (COMP) gained 12 points, or 0.5%, to close at 2,480.66.

The blue-chip Dow index ended strong, with 24 of its 30 components closing higher. Financial stocks helped the advance following Citi's strong earnings, with JPMorgan (JPM, Fortune 500) ending 2.8% higher. The energy sector lagged, with Halliburton and Fluor Energy losing about 5%.

It was a strong start to a week that will bring an avalanche of corporate results. Seven of the 30 companies that make up the Dow will release their third-quarter results, in addition to several big banks and tech companies.

So far, third-quarter results have generally come in above expectations. Of the S&P 500 companies that have posted results, 83% have topped analyst estimates, according to Thomson Reuters. But it's still early in the reporting period.

Spotlight on Q3 earnings: Jeff Saut, chief investment strategist with Raymond James, noted that "last year's third quarter was pretty lousy, so comparisons on a year-over-year basis are going to look pretty good."

But many companies are improving their bottom line through cost-cutting rather than material increases in performance, said Allan Boomer, investment manager at Fiduciary Management Group.

"I'm really not expecting a lot of top-line growth, but investors are positive on stocks anyway," Boomer said. "Bond yields are so low right now, and stocks are the next place investors look."

Stocks have been rising recently on speculation that the Federal Reserve will announce plans to resume large-scale purchases of U.S. Treasurys, a policy called quantitative easing, when it meets next month.

Companies: Citigroup (C, Fortune 500) posted a third-quarter profit of $2.2 billion, beating analyst forecasts as the bank reduced its credit losses to their lowest level since 2007. Shares of Citigroup ended 5.6% higher.

Goldman Sachs, Morgan Stanley and Wells Fargo will also report earnings this week. The financial sector led the market lower late last week as investors worried about the fallout from investigations into the foreclosure practices of many banks and mortgage servicers.

After the closing bell, IBM (IBM, Fortune 500) posted earnings that beat analyst estimates -- but shares still fell 3% in after-hours trading after closing Monday at a new all-time high.

Net income for the quarter was $3.6 billion, up 12% from last year. The tech giant said earnings per share rose 18% from last year to $2.82 per share. Analysts polled by Thomson Reuters expected earnings to be $2.75 per share.

Apple (AAPL, Fortune 500) also reported its fiscal fourth-quarter earnings after the bell, easily beating Wall Street estimates. The company said it earned $4.64 per share on $20.3 billion in revenue.

In other company news, BP (BP) said it is selling its businesses in Venezuela and Vietnam to Russian oil producer TNK-BP for $1.8 billion. The stock closed up 2.1%.

New England utility companies Northeast Utilities (NU, Fortune 500) and NStar (NST) announced that they have agreed to merge, creating one of the nation's largest utility companies. The company will continue to be called Northeast Utilities after Northeast buys NStar for $4.3 billion in stock.

Shares of Northeast Utilities fell 0.9%, and shares of NStar fell 0.6%.

Medical device company St. Jude Medical (STJ, Fortune 500) agreed to buy AGA Medical Holdings (AGAM) for $20.80 per share in a cash-and-stock transaction valued at a total of $1.3 billion.

Shares of St. Jude Medical ended 1.8% higher, while shares of AGA Medical Holdings skyrocketed 40.7%.

Economy: Just before the bell, the government released a report on production and activity in the nation's factories. Industrial production fell 0.2% in September, countering consensus estimates from Briefing.com that predicted a 0.2% jump. Capacity utilization stayed almost flat over the month, at 74.7%.

Later in the morning, the National Association of Home Builders released a report that showed builder confidence has increased in October. That report marked the index's first improvement in five months.

World markets: European stocks ended slightly higher. Britain's FTSE 100 added 0.7%, Germany's DAX gained 0.5% and the CAC 40 in France increased 0.2%.

Asian markets finished in negative territory. The Hang Seng in Hong Kong tumbled 1.2%. The Shanghai Composite fell 0.5%, and the Nikkei in Japan ended a shade lower.

Commodities and currencies: The dollar was flat against the British pound and euro, but it fell versus the Japanese yen.

Gold futures for December delivery gained 10 cents to settle at $1,372.10 an ounce.

Crude oil for November delivery added $1.59 to settle at $82.84 a barrel, after slipping below $81 a barrel earlier.

Bonds: The price rose on the benchmark 10-year U.S. Treasury, pushing the yield down to 2.49%.

Non-oil domestic exports see double digit growth in Sep

By Mustafa Shafawi | Posted: 18 October 2010 1330 hrs ![]()

|

||||||

A shop selling consumer electronic products |

||||||

SINGAPORE: Singapore's non-oil domestic exports (NODX) continued to enjoy double digit growth, due to an expansion of both electronic and non-electronic products.

Trade promotion agency IE Singapore said they rose by 23 per cent in September, compared to a year ago, following the 31 per cent rise in the previous month

It added electronic NODX increased by 21 per cent, after the 35 per cent rise in August.

IE Singapore said the expansion in electronic domestic exports was largely due to higher domestic exports of integrated circuits (ICs), parts of ICs and diodes & transistors.

Non-electronic products rose 24 per cent in September, after the 28 per cent rise in the previous month.

The increase in non-electronic NODX was led by higher domestic exports of specialised machinery, ships & boats and pharmaceuticals.

IE Singapore said exports to all of the top 10 NODX markets increased.

The largest contributors to the increase were the EU 27, the US and Hong Kong.

Domestic exports to emerging markets increased by 36 per cent in September compared to the 23 per cent decline in the previous month.

IE Singapore said the rise in NODX to the emerging markets was because of higher shipments to the Middle East and South Asia.

Wall Street stages late day comeback

By Ben Rooney, staff reporterOctober 14, 2010: 5:33 PM ET

By Ben Rooney, staff reporterOctober 14, 2010: 5:33 PM ET

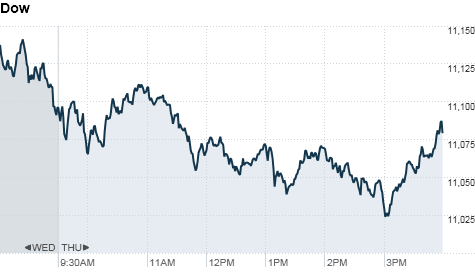

NEW YORK (CNNMoney.com) -- In an abrupt about-face, stocks closed with minor losses Thursday as investors shook off concerns about the banking sector to do some bargain hunting late in the day.

The Dow Jones industrial average (INDU) closed down 1 point, after tumbling more than 40 points earlier in the session. The S&P 500 (SPX) lost 4 points, or 0.3%. The Nasdaq (COMP) slid 6 points, or 0.2%.

Bank stocks led the market lower in the morning as concerns about investigations into foreclosure proceedings by state regulators weighed on the sector.

JPMorgan (JPM, Fortune 500) lost 2.8% one day after it reported a surge in third-quarter profit. Bank of America (BAC, Fortune 500) fell 5%, and Citigroup (C, Fortune 500) lost 4.4%.

But stocks regained most of the lost ground in the afternoon as buyers came back into the market to scoop up shares that had been beaten down earlier in the session, said Ryan Larson, a senior equity trader at RBC Global Asset Management.

"As the financials weighed on the market, things became cheap," he said.

After the closing bell, Google (GOOG, Fortune 500) reported quarterly profit and sales that rose from year-ago levels and beat Wall Street's forecasts. Shares of the web giant were up 9% after hours.

Chipmaker AMD (AMD, Fortune 500) reported a quarterly loss that narrowed from last year, although its adjusted earnings beat analysts' expectations. Shares rose 7% in extended trading.

The reports were the latest in a slew of quarterly financial statements released this week from major U.S. companies. On Friday, the deluge will continue with General Electric (GE, Fortune 500) and Mattel (MAT, Fortune 500) due to report results before the market opens.

Larson said investors are looking for solid revenue growth and will pay close attention to what executives have to say about the outlook for next year.

"It has to be about sales, not cost cutting," he said. "And the revenue picture has been mixed so far."

Meanwhile, the dollar continued to deteriorate on Thursday. That helped to drive gold prices higher as investors moved to more tangible assets. Oil prices also rose.

The greenback has been under pressure this week, as investors anticipate another round of asset purchases from the Federal Reserve. That policy -- known as quantitative easing -- could push interest rates down and keep the dollar weak.

Fed policy will probably be in focus again Friday morning when Ben Bernanke, the central bank's chairman, makes a speech in Boston.

Also on Friday, investors will take in reports on consumer prices and retail sales, as well as consumer sentiment, business inventories and regional manufacturing activity.

Stocks rallied Wednesday, amid speculation that the central bank will announce plans to do more quantitative easing at its next meeting in November.

Economy: Initial jobless claims rose to 462,000 in the latest week, from a revised 449,000 the week before, the Labor Department said.

Economists had expected initial claims to have risen to 450,000, according to consensus estimates from Briefing.com.

The government's latest reading on inflation at the manufacturing level rose 0.4% in September, matching the pace in August. Excluding volatile food and energy prices, core PPI rose 0.1%, also the same rate as the month before.

The U.S. trade balance widened to $46.3 billion in August from a revised $42.6 billion in July, the Commerce Department said.

Companies: Verizon Wireless said it will begin selling Apple's iPad at its 2,000 retail stores nationwide beginning next month.

The move ends AT&T's (T, Fortune 500) exclusive grip as the wireless carrier for Apple's wildly popular tablet, and potentially sets the stage for a broader partnership between Apple and Verizon.

Verizon (VZ, Fortune 500) shares were up 0.5%. Apple's stock, which crossed $300 for the first time Wednesday, dipped 0.4%.

Shares of Yahoo (YHOO, Fortune 500) gained 4.5%, after The Wall Street Journal reported AOL is considering teaming up with private-equity firms to make a bid for the search engine.

Apollo Group (APOL), which operates the University of Phoenix, withdrew its 2011 earnings guidance late Wednesday. Apollo said the company faces an "uncertain regulatory environment." The stock plunged 23%, dragging down other education companies such as DeVry (DV) and ITT Educational Services (ESI).

World markets: European markets ended mixed. Germany's DAX rose 0.4%, while the CAC 40 in Paris fell 0.2% and the FTSE 100 lost 0.3%.

In Asia, stocks closed in positive territory. The Hang Seng in Hong Kong rose 1.7% and the Shanghai Composite gained 0.6%. Japan's Nikkei edged higher 1.9%.

Commodities and Currencies: The dollar fell against major international currencies including the British pound, the Japanese yen and the euro.

Gold futures for December delivery rose $7.10 to close at $1,377.60 an ounce. In earlier trading, gold reached $1,388.10 an ounce -- a new intra-day trading high.

The price of oil gained 48 cents to settle at $82.53 per barrel.

Bonds: The price fell on the benchmark 10-year U.S. Treasury, pushing up the yield to 2.46% from 2.42% late Wednesday.

Singapore's GDP expands by 10.3% on-year, contracts by 19.8% on-quarter in Q3

Posted: 14 October 2010 0819 hrs ![]()

|

||||||

|

||||||

SINGAPORE: Singapore's GDP expanded by 10.3 percent on a year-on-year basis in the third quarter of 2010.

On a quarter-on-quarter basis the economy contracted by 19.8 percent, a reversal from the growth of 27.3 percent in the previous quarter.

The advance estimates released by the Ministry of Trade and Industry (MTI) on Thursday said that the Singapore economy remains on track to achieve the overall growth forecast of 13 to 15 percent for the whole of 2010.

Commenting on the sectoral decline on a quarter-on-quarter basis, MTI said the manufacturing sector contracted by 57 percent in the third quarter, after expanding by 67 percent in the preceding quarter.

It attributed the decline largely to the biomedical manufacturing cluster, where some pharmaceutical companies switched to producing a different value-mix of active pharmaceutical ingredients. MTI also cited some plant maintenance shutdowns during the quarter.

The construction sector also contracted by 12 percent, compared to an expansion of 29 percent in the preceding quarter. MTI said this was mainly due to the completion of key commercial and industrial building projects earlier in the year.

The services-producing industries registered a modest sequential growth of 1.6 percent, following a 13 percent expansion in the previous quarter.

MTI said growth for the rest of the year will be underpinned by a number of industry-specific factors.

It said continued growth in global demand for electronic products will lend some support to the electronics and precision engineering clusters.

It added that increasing visitor arrivals, drawn by the Integrated Resorts, will continue to bolster tourism in Singapore.

MTI will release the preliminary GDP estimates for the third quarter of 2010, including performance by sectors, sources of growth, inflation, employment and productivity, in November 2010.

Stocks rally, but close off session highs

By Ben Rooney, staff reporterOctober 13, 2010: 4:48 PM ET

By Ben Rooney, staff reporterOctober 13, 2010: 4:48 PM ET

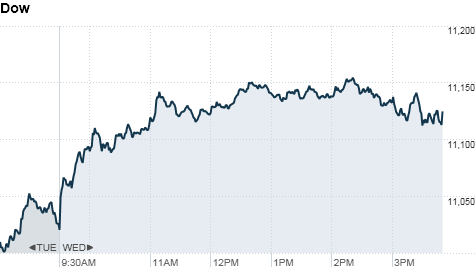

NEW YORK (CNNMoney.com) -- Stocks rallied Wednesday as investors bet that the Federal Reserve is moving toward a more accommodative policy.

The Dow Jones industrial average (INDU) closed up 76 points, or 0.7%, after climbing 130 points earlier in the session. The S&P 500 (SPX) gained 8 points, or 0.7%, and the Nasdaq (COMP) rose 23 points, or 0.9%.

The advance began after blue chips JPMorgan Chase and Intel reported quarterly earnings that beat Wall Street estimates. But traders said the rally was driven by speculation the Fed will announce plans next month to resume large-scale purchases of Treasurys, a strategy called quantitative easing.

"Earnings so far have been strong, and that's definitely a positive," said Abigail Doolittle, a portfolio manager at Johnson Illington Advisors. "But everything is taking a backseat to this incredible focus on QE2," she added, using Wall Street shorthand for the Fed policy.

Minutes from the Fed's September policy meeting showed Tuesday that the central bank is willing to make good on its pledge to support the economy if conditions continue to deteriorate. Investors took that as a sign the Fed will announce plans to buy more Treasurys at its next policy meeting in November.

The dollar, which would suffer if more Treasurys were purchased, continued to weaken Wednesday. Treasury prices fell, pushing yields higher, as investors transferred money into stocks.

The anemic dollar boosted commodities that are priced in the U.S. currency, such as gold and oil. Gold rose to another record high, and oil prices surged 1.6%.

Strength in commodities helped support shares of companies in the industrial and materials sector. Caterpillar (CAT, Fortune 500) and Boeing (BA, Fortune 500) both rose more than 1%.

The weak dollar also lifted shares of companies that do business overseas, since a softer greenback boosts profits for U.S. multinationals. IBM (IBM, Fortune 500), 3M (MMM, Fortune 500) and United Technology (UTX, Fortune 500) all gained significant ground.

"It's a risk on trade," said David Levy, portfolio manager at Kenjol Capital Management. "Investors are putting money into assets that will benefit from a weaker dollar."

Stocks recovered from early loses on Tuesday to close higher after the Fed minutes were released.

On Thursday, the nation's troubled job market could come to the fore when the Labor Department's weekly report on initial claims for unemployment benefits comes out. A report on inflation at the wholesale level is also due before the market opens.

After the closing bell Thursday, search giant Google (GOOG, Fortune 500) is expected to report another jump in quarterly profit.

Companies: Apple's (AAPL, Fortune 500) stock rose to $300.11 per share, climbing above $300 for the first time ever. That's an increase of about 40% year-to-date, driven by the success of its iPad and iPhone.

JPMorgan Chase (JPM, Fortune 500) reported earnings of $4.4 billion as its loan losses continued to decline.

After rising about 2% earlier in the session, shares of JPMorgan fell 1.4% on concerns about the legal implications of potentially inaccurate foreclosure filings.

The bank acknowledged that it has found cases in which the signers of foreclosure affidavits didn't personally review underlying loan files, as they are required to. It also said affidavits weren't properly notarized in some cases.

But the strong report could bode well for Citigroup (C, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500), Morgan Stanley (MS, Fortune 500) and Goldman Sachs (GS, Fortune 500). All are slated to report their results next week.

On Tuesday, Intel (INTC, Fortune 500), reported a rise in quarterly sales and profit. Despite the upbeat results, shares of the chipmaker fell 2.7% Wednesday.

Shares of CSX (CSX, Fortune 500) rose 4.2% after the railroad operator posted results that beat expectations after the closing bell Tuesday. Other railroad companies also gained, including Union Pacific (UNP, Fortune 500) and Norfolk Southern (NSC, Fortune 500).

Shares of MGM Resorts International (MGM, Fortune 500) fell over 11% after the casino operator warned Tuesday that it expects to suffer a loss of 70 cents per share in the third-quarter.

Chevron (CVX, Fortune 500) said Tuesday that it expects to report a drop in earnings when it releases its third-quarter results later this month. Shares of the oil giant dipped 0.2%.

Economy: The Bureau of Labor Statistics reported that U.S. import prices fell 0.3% in September, following an increase of 0.6% the prior month. The price of fuel imports led the decline, falling 3.1%.

Export prices rose in September by 0.6%, following a rise of 0.8% the prior month. This was driven by agricultural import prices, which rose 2.4%.

World markets: European markets ended sharply higher. The FTSE 100 in London, CAC 40 in Paris and Germany's DAX all gained more than 2%.

In Asia, stocks closed in positive territory. The Hang Seng in Hong Kong shot up 1.5% and the Shanghai Composite gained 0.7%. Japan's Nikkei edged higher 0.2%.

China posted a trade surplus of $16.9 billion for September, as exports climbed 25% and imports rose 24%. That's down from a $20 billion surplus in August.

But the drop was not enough to ease tensions between the China and the United States, which has been pressuring China to allow its currency to appreciate against the dollar because an undervalued yuan hurts U.S. manufacturers by undercutting their export prices.

"China's overall trade surplus may have declined slightly last month, but tensions are unlikely to do the same," said Mark Williams, senior China economist at Capital Economic.

Commodities and Currencies: The dollar slipped against the major international currencies, including the British pound, the Japanese yen and the euro.

Gold futures for December delivery surged $23.80 to settle at another record high of $1,370.50 an ounce.

The price of oil rose $1.29 to close at $82.96 per barrel.

Treasurys: The price fell on the benchmark 10-year U.S. Treasury, pushing up the yield to 2.43% from 2.42% late Tuesday.

Stocks end higher as Fed signals more aid

By Ben Rooney, staff reporterOctober 12, 2010: 4:53 PM ET

By Ben Rooney, staff reporterOctober 12, 2010: 4:53 PM ET

NEW YORK (CNNMoney.com) -- Stocks recovered from earlier losses to close higher Tuesday after meeting minutes suggested the Federal Reserve will act soon to provide additional support for the economy.

The Dow Jones industrial average (INDU) rose 10 points, or 0.1%, after falling more than 70 points earlier in the session. The S&P 500 (SPX) gained 4 points, or 0.4%. The Nasdaq (COMP) added 15 points, or 0.6%.

Fed policymakers continue to believe that the pace of the economic recovery is slowing, according to minutes from the central bank's September meeting.

The minutes also suggest that the Fed is ready to make good on its previous pledge to provide additional "unconventional measures" to boost the economy.

While there is still debate over how to proceed, the minutes revealed that talks in September centered around more large-scale purchases of assets such as U.S. Treasurys, a policy known as quantitative easing.

The minutes did not specify how big the program could be, when it could start or how long it could last. But investors took the notes as further evidence that the Fed will announce plans to buy more assets when it meets next month.

"This communiqué leaves the door open for actions in November," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors.

The dollar fell versus the euro, reversing an earlier advance. Prices for Treasurys remained under pressure, pushing the yield on the 10-year note up to 2.42%.

Meanwhile, investors are also focused on the outlook for the third-quarter corporate reporting period, which gets into full swing this week.

After the market closed Tuesday, Intel Corp (INTC, Fortune 500). reported quarterly profit and sales figures that rose sharply from a year ago and beat Wall Street's forecasts.

Intel is one of several major U.S. companies due to report results this week. JPMorgan Chase (JPM, Fortune 500) reports before the opening bell Wednesday, while General Electric (GE, Fortune 500) and Google (GOOG, Fortune 500) are slated to post results this week.

Corporate earnings have largely exceeded expectations in recent quarters, but investors are eager to hear what companies are doing to boost profits beyond cutting costs.

"Forward-looking comments will be far more important than in past quarters," said Creatura.

Stocks ended with single-digit gains Monday, with the Dow closing above the key 11,000 level for a second straight session.

Companies: Drugmaker Pfizer (PFE, Fortune 500) announced it is buying King Pharmaceuticals (KG) for $3.6 billion, or $14.25 per share. King Pharmaceutical's stock spiked 39.3%.

Shares of Avon (AVP, Fortune 500) gained more than 8% on speculation that France's L'Oreal was considering a takeover bid for the cosmetics and beauty products manufacturer. The rally cooled off as the session wore on with Avon's stock gaining 4% near midday.

Google said it has agreed to invest in a proposed$5 billion transmission system that will connect offshore wind farms built along a 350-mile stretch between New Jersey and Virginia.

Gap (GPS, Fortune 500) said it is reverting to its classic logo, after a new logo it debuted on its website ignited a customer backlash.

Wal-Mart (WMT, Fortune 500) finance chief Charles Holley will speak at a two-day investor conference Tuesday evening. The company just unveiled plans to start selling the iPad come February. The retailer's performance is considered a key measure of consumer spending and the overall health of the economy.

Shares of Transocean (RIG) rose nearly 5% after the Obama administration said it would allow deepwater drilling to resume in the Gulf of Mexico for companies that meet all U.S. safety requirements. The ban on deepwater drilling was put in place earlier this year in response to the BP oil spill.

Diamond Offshore Drilling (DOS), Seahawk Drilling (HAWK) and Noble Corp (NE) were also higher.

Starbucks (SBUX, Fortune 500) and Green Mountain (GMCR) both rallied as investors warmed to the coffee companies. Starbucks got a lift from an analyst upgrade, while Green Mountain was boosted by takeover talk.

World markets: European stocks closed lower. Britain's FTSE 100 lost 0.2%, and France's CAC 40 tumbled 0.5%. The DAX in Germany fell less than 0.1%.

Asian markets ended the session mixed. The Shanghai Composite rose about 1.2%, while the Hang Seng in Hong Kong slipped 0.4%. Japan's Nikkei sank 2.1%.

Large Chinese banks dropped in Shanghai and Hong Kong after Reuters reported that China has temporarily raised reserve requirements on six banks as it tries to temper inflation and sustain the recovery.

Currencies and commodities: The dollar fell against the euro, but remained weak versus the British pound and the Japanese yen.

Oil for November delivery slipped 47 cents to $81.74 a barrel.

Gold futures for December delivery dropped $3.40 to $1,351.20 an ounce.

Bonds: Treasury yields rose as prices fell. Yields on 10-year notes rose to 2.42% on Tuesday, down from a close of 2.39% on Friday. The bond market was closed Monday for Columbus Day.

Dow holds above 11,000

By Ben Rooney, staff reporterOctober 11, 2010: 5:13 PM ET

By Ben Rooney, staff reporterOctober 11, 2010: 5:13 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended with slight gains Monday as investors shifted their focus towards corporate financial results.

The Dow Jones industrial average (INDU) gained nearly 3 points, or less than 0.1%, to close at 11,010 points. The S&P 500 (SPX) edged up 2 points, while the Nasdaq (COMP) gained about half a point.

The U.S. government and Treasury market were closed for Columbus Day, but all other financial markets were open. Trading volumes were light because of the holiday, and stocks traded in a narrow range for most of the session.

Stocks were supported earlier by ongoing speculation that the Federal Reserve will take additional steps to boost the economy.

But the market reversed course late Monday afternoon, as investors look ahead to quarterly financial statements due later this week from several major U.S. companies, including Intel, (INTC, Fortune 500) which reports after the closing bell Tuesday.

JPMorgan (JPM, Fortune 500) and General Electric (GE, Fortune 500) are also scheduled to release third-quarter results this week, as well as Google (GOOG, Fortune 500) and Mattel (MAT, Fortune 500).

"There's a lot ahead of us this week and not much news today to set the tone," said Nick Kalivas, vice president of financial research at MF Global. "I think people are waiting for direction."

A disappointing jobs report on Friday raised bets the Fed will announce plans to resume large-scale purchases of U.S. Treasurys when the central bank meets early next month, sending the Dow above 11,000 for the first time since May.

Economy: No major economic reports were on the agenda Monday, but a survey of leading economists showed that the outlook for growth remains dim.

Gross domestic product, the broadest measure of the economy, is expected to grow at a pace of 2.6% in both 2010 and 2011, according to a survey of 46 economists by the National Association for Business Economics. That's down from the group's previous prediction of 3.2%.

Given the lackluster prospects for growth, many investors expect the Fed to expand its policy of buying U.S. Treasurys. The goal is to pressure long-term interest rates and support the faltering economic recovery, a strategy known as quantitative easing, or QE for short.

The central bank bought billions of U.S. bonds and notes two years ago, but there has been some debate among Fed policymakers over whether to resume large-scale purchases. In August, the Fed said it would reinvest certain proceeds into the Treasury market.

On Tuesday, the Fed will release minutes from its September meeting, but investors don't expect any announcement about additional stimulus measures until the policy makers meet November 3.

Art Hogan, chief market analyst at Jefferies & Co., said 70% of market participants are expecting the Fed to announce another round of asset purchases next month. But in the meantime, the day-to-day focus will be on corporate earnings.

Earnings: A total of 15 S&P 500 companies will open up their books this week. According to Thomson Reuters, third-quarter results are expected to be up almost 24% from the same period a year ago, while revenues are forecast to gain 7%.

Hogan said investors are particularly eager to hear what companies plan to do with their cash, which has been piling up over the last several months.

"Cash levels remain historically high," he said. "If dividends and buybacks are announced, I think that will be applauded."

Companies: Shares of Gymboree (GYMB) surged 22% after buyout firm Bain Capital announced plans to acquire the children's apparel retailer for $1.8 billion.

The New York Times Company (NYT), which has been the subject of takeover rumors this year, rose 8%.

Microsoft (MSFT, Fortune 500) unveiled a new line of phones running the Windows Phone 7 operating system, as the software company looks to compete with the iPhone, Android and BlackBerry smartphones.

Microsoft CEO Steve Ballmer said that Windows Phone 7 smartphones would be available in the United States on AT&T's (T, Fortune 500) network.

Apple (APPL) rose to a record high of $297.74 a share before ending the day at $295.36. The stock has been supported by ongoing enthusiasm over products such as the iPad and iPhone, as well as strong sales of Mac computers. IBM (IBM, Fortune 500) also hit an all-time trading high.

World markets: European stocks moved higher. Britain's FTSE 100 gained 0.2%, France's CAC 40 rose 0.1% and the DAX in Germany rose 0.3%.

Asian markets ended the session with solid gains. The Shanghai Composite soared about 2.5% and the Hang Seng in Hong Kong jumped nearly 1.2%. Japanese markets were closed.

Currencies and commodities: The dollar rose against the Japanese yen, the British pound and the euro.

Oil for November delivery slid 43 cents to $82.23 a barrel.

Gold futures for December delivery gained $9.10 to settle at a fresh record high of $1,354.40 an ounce.

Corn prices surged for the third straight day on the back of an unexpectedly weak crop report.

Stocks sag ahead of monthly jobs report

By Hibah Yousuf, staff reporter October 7, 2010: 4:52 PM ET

By Hibah Yousuf, staff reporter October 7, 2010: 4:52 PM ET

NEW YORK (CNNMoney.com) -- Stocks finished mixed after a sluggish session Thursday afternoon, as cautious investors paused and geared up for the monthly jobs report due Friday.

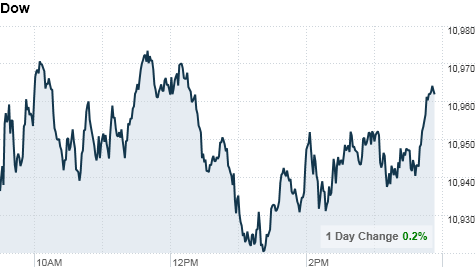

The Dow Jones industrial average (INDU) closed down 19 points, or 0.2%. The blue chip index started off the day with a pop and was less than 2 points shy of the 11,000 mark, a level it hasn't traded at since May. But the Dow drifted as the session wore on and sank almost 75 points before recovering.

The S&P 500 (SPX) lost 2 points, or 0.2%, while the tech-heavy Nasdaq (COMP) added 3 points, or 0.1%.

Stocks surged earlier this week, with all three major indexes hitting 5-month highs. But investors have had trouble keeping up that momentum, as reports showed continued weakness in the labor market.

Some of that sentiment briefly lifted Thursday morning as weekly jobless claims fell to a 3-month low, but traders remain wary ahead of the the true test -- Friday's monthly payrolls report.

"We're likely to have a muted day on Wall Street because the of September jobs report coming up tomorrow," said Timothy Ghriskey, chief investment officer at Solaris Asset Management. "We still have incredible weakness in the job market, so there is some concern leading up to the numbers."

According to a consensus of economists polled by Briefing.com, the number of jobs is expected to remain flat in the upcoming monthly report. At the same time, the unemployment rate is expected to have ticked up to 9.7% from 9.6%.

Ghriskey added that investors will also be cautious as companies begin reporting third-quarter financial results.

While PepsiCo (PEP, Fortune 500) reported results in line with forecasts before the bell Thursday, Ghriskey said the company's performance is not as reflective of broader economic conditions as a company like aluminum maker Alcoa (AA, Fortune 500). Alcoa, which delivered results after the market close Thursday, will also be in focus during Friday's trading session.

Stocks also felt some pressure Thursday afternoon as the dollar gained ground. Though it remained broadly weaker, the buck clawed back and rallied against the euro, which had climbed above $1.40 earlier Thursday. It also moved higher versus the pound.

The dollar index, which measures the greenback against a basket of rival currencies, gained almost 0.4% before easing back.

Economy: The initial jobless claims number was the lowest in nearly 3 months, providing a breath of fresh air to the market. The Labor Department on Thursday reported that jobless claims totaled 445,000 in the week ended Oct. 2 -- down 11,000 from the prior week.

Economists were expecting the government to report 455,000 Americans filed for unemployment for the first time last week, pointing to continued weakness in the job market.

Investors are also eyeing retailers' September same-store sales figures Thursday for indications about consumer spending. Thomson Reuters, which tracks same-store sales for a group of 28 national chains, said total sales for the group rose 2.8% in September -- better than its initial forecast of a 2.1% gain in the month.

Companies: Rumors that Apple (AAPL, Fortune 500) is preparing a version of its iPhone for Verizon (VZ, Fortune 500) -- the phone is currently only carried by AT&T (T, Fortune 500) -- started swirling again, after the Wall Street Journal published a report saying the phone may be on shelves early next year. Apple's stock edged higher as Verizon's slipped.

PepsiCo (PEP, Fortune 500) was the first major company to report third-quarter results Thursday. Pepsi earned $1.22 per share during the quarter, in line with analysts' forecasts and up 13% from the year-ago quarter. But the beverage giant reduced the higher end of its profit outlook for the the year. Pepsi decreased about 3%.

Alcoa (AA, Fortune 500) was the first Dow component to report results. The aluminum giant raked in $61 million, or 6 cents per share. Excluding certain items, Aloca brought in 9 cents per share, topping forecasts for earnings of 5 cents per share. Sales rose 15% to $5.3 billion, beating expectations for $4.96 billion in revenue.

Adobe (ADBE) shares jumped almost 12% late Thursday after a New York Times blog reported a Microsoft (MSFT, Fortune 500) team, including chief executive Steve Ballmer, held a secret meeting with Adobe CEO Shantanu Narayen on a number of topics including the possibility of a merger between the two tech giants.

World markets: European shares finished mixed. Britain's FTSE 100 fell 0.3%, while the DAX in Germany and France's CAC 40 closed with slight gains.

Asian markets were also flat. Japan's Nikkei index and the Hang Seng in Hong Kong both finished little changed. The Shanghai Composite is closed for a week-long holiday.

Currencies and commodities: As investors anticipate another round of asset purchases from the Federal Reserve, the dollar has continued to fall against the Japanese yen.

But the greenback climbed higher against the euro and the pound after suffering sharp declines Thursday.

As the dollar gained ground, commodity prices fell under pressure.

Gold futures for December retreated from record territory. The precious metal's price fell $12.70 to settle at $1,335.00 an ounce. It had touched a new intraday high of $1,366 an ounce earlier.

The price of crude oil for November delivery decreased $1.56 cents to settle at $81.67 per barrel.

Bonds: Despite the bid for safer investments, Treasury prices were flat. The yield for the benchmark 10-year U.S. Treasury held steady at 2.40%.

Dow hits 5-month high, Nasdaq sinks

By Hibah Yousuf, staff reporter October 6, 2010: 4:31 PM ET

By Hibah Yousuf, staff reporter October 6, 2010: 4:31 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended Wednesday's choppy session mixed, as cautious investors mulled two reports showing continued weakness in the job market. The news comes ahead of the closely-watched monthly jobs report due Friday.

The Dow Jones industrial average (INDU) added 23 points, or 0.2%, with GE (GE, Fortune 500) and Alcoa (AA, Fortune 500) leading the advance. The modest gains allowed the blue chip index to close at a fresh five-month high. The index's laggards included AT&T (T, Fortune 500) and Bank of America (BAC, Fortune 500).

The S&P 500 (SPX) seesawed between gains and losses, but ended the session flat, down less than one point from the five-month high it closed at Tuesday.

The Nasdaq (COMP) slumped throughout the day, and ended the session 19 points lower, or 0.8%. The tech-heavy index was dragged down as telecommunications company Equinix (EQIX) plunged 33% and computer software firm Citrix Systems (CTXS) sank 14.3%.

All three major indexes rallied 2% Tuesday to the highest levels since May. A report showing that service sector activity improved in September, and a surprise move by Japan's central bank to cut interest rates, sparked a broad-based rally.

But the enthusiasm evaporated Wednesday, as the dour jobs numbers weighed on investor sentiment ahead of the government's September jobs report on tap for Friday.

"The market remains focused on economic news, and most of the concerns are over the employment picture. So anything like today's payroll numbers reminds investors that the economy is still far from perfect, which leads to some weakness," said Matt King, chief investment officer at Bell Investment Advisors.

According to a consensus of economists polled by Briefing.com, the number of jobs is expected to remain flat in the upcoming monthly report. At the same time, the unemployment rate is expected to have ticked up to 9.7% from 9.6%.

But King said corporate earnings season, which unofficially kicks off after the closing bell on Thursday when Alcoa (AA, Fortune 500) reports its results, could lift the markets.

"We're expecting company results to show the same type of improvement we've seen for most of this year, and regain the market's attention," King said. "As those come in, stocks should move higher throughout the fourth quarter."

Economy: Payroll processing firm ADP reported the private sector jobs plunged in September, trouncing the forecast of an increase.

The U.S. economy lost 39,000 private sector jobs last month, said ADP on Wednesday -- which was much worse than expected. Economists were forecasting the report to show private sector employers added 18,000 jobs in September.

The number of job cuts planned by employers edged up slightly in September. However, the number remained near a rock bottom 10-year low reported in August, according to a report from outplacement firm Challenger, Gray & Christmas.

Employers said they would cut 37,151 jobs in September, up 7% from the 34,768 job cuts reported in August.

As traders look ahead to the government's jobs report due on Friday, they will use the ADP and Challenger reports as a gauge of the national unemployment picture.

Meanwhile, the International Monetary Fund said a double dip recession is unlikely, but global economic growth will slow from 4.8% this year to 4.2% in 2011.

Companies: Johnson & Johnson (JNJ, Fortune 500) announced a deal to aquire Dutch biotechnology company Crucell (CRXL) for about $2.43 billion. J&J already owns 17.9% of Crucell's outstanding shares and last year, the two companies started working together on a flu vaccine. Both companies' stocks finished higher.

Costco (COST, Fortune 500) said its fourth-quarter income rose 16% to $432 million, or 97 cents per share -- beating analysts' estimates of 95 cents per share. The wholesaler's earnings got a boost from increased membership sales and strength overseas. Shares rallied 1.2%.

In a continued effort to expand its $40 billion energy business, GE (GE, Fortune 500) said it is buying energy technology and service provider Dressing Inc. for $3 billion. GE's stock rose 2.4%.

Shares of AMR (AMR, Fortune 500), the parent company of American Airlines, rose 1.6% after the airline said it is bringing back hundreds of furloughed pilots and attendants, after forming joint businesses with several other airlines.

Verizon's (VZ, Fortune 500) stock climbed out of negative territory and spiked 0.9% after rumors that Apple (AAPL, Fortune 500) is building a "Verizon-ready" iPhone resurfaced in a story in the Wall Street Journal.

World markets: European shares closed with solid gains. Britain's FTSE 100 climbed 0.8%, while France's CAC 40 and the DAX in Germany advanced 0.9%.

Asian shares finished sharply higher. Japan's Nikkei index leapt 1.8% and the Hang Seng in Hong Kong jumped nearly 1.1%. The Shanghai Composite is closed for a week-long holiday.

Currencies and commodities: The dollar slipped against the euro, the British pound and the Japanese yen.

Gold futures for December delivery rose $7.40 to settle at an all-time high of $1,347.70 an ounce, after reaching a fresh intraday record trading high of $1,351 an ounce earlier.

The price of crude oil for November delivery added 41 cents to settle at $83.23 a barrel.

Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.40% from 2.48% late Tuesday. Bond prices and yields move in opposite directions.

Stocks surge to 5-month highs on Japan, services

By Hibah Yousuf, staff reporter October 5, 2010: 4:33 PM ET

By Hibah Yousuf, staff reporter October 5, 2010: 4:33 PM ET

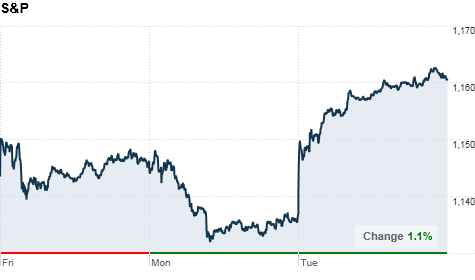

NEW YORK (CNNMoney.com) -- U.S. stocks rallied right out of the gate and continued to surge Tuesday, with all three major indexes gaining about 2% and finishing at their highest levels since May. Investors welcomed a surprise move by the Bank of Japan to cut its key lending rate, as well as improved data for the U.S. service sector.

The Dow Jones industrial average (INDU) jumped 193 points, or 1.8%, to finish at 10,945, its highest level since May 3. Gains were broad-based as 29 of 30 Dow issues closing higher, with Boeing (BA, Fortune 500), Bank of America (BAC, Fortune 500) and DuPont (DD, Fortune 500) logging the biggest increases.

The S&P 500 (SPX) added 24 points, or 2.1%, with Harley-Davidson (HOG, Fortune 500) closing up 9.1%. The tech-heavy Nasdaq (COMP) climbed 55 points, or 2.4%. Both indexes closed at their highest levels since May 12.

Early Tuesday, Japan's central bank announced a move to lower its key interest rate to between 0% and 0.1%. It previously stood at 0.1%. The bank also said it would purchase about $60 billion of government bonds and other assets, to boost the pace of the country's recovery.

The Bank of Japan downgraded its economic forecast, but investors took the monetary policy move as a hopeful sign for the world's third-largest economy.

Investors were also encouraged after the Institute for Supply Management's index measuring U.S. service sector activity rose more than economists had forecast.

"The markets are feeling reassured after Japan's move to ease monetary policy and the fact that the service sector, which accounts for 90% of our economic activity, is stronger than we were expecting," said Jack Ablin, chief investment officer at Harris Private Bank.

U.S. stocks are coming off of a big dip on Monday, when investors were feeling cautious ahead of corporate earnings season and key employment data due later in the week. Last week, they kicked off the start of October and the fourth quarter with modest gains.

Experts said stocks will likely continue treading water, lacking day-to-day consistency, until the upcoming reports give the market a better direction.

"The lynchpin economically is still unemployment," said Erick Maronak, senior portfolio manager at Victory Capital Management. "That's what gets people off the ledge. Some improvement there would be more than welcome by investors and non-investors alike."

Economists polled by Briefing.com expect the unemployment rate to have risen to 9.7% in September, up from 9.6% in August, when the government reports the figure Friday.

World markets: Japan's Nikkei rallied 1.5% after the Bank of Japan's decision, and the Hang Seng in Hong Kong ended the session up 0.1%. The Shanghai Composite was closed for the week-long Golden Week holiday.

European stocks also finished higher. The CAC 40 in France climbed 2.3%, while Britain's FTSE 100 rose 1.5% and Germany's DAX advanced 1.3%.

European investors welcomed better-than-expected data on the euro-zone services sector, but gains were limited by fears about Ireland's debt crisis. Moody's said Tuesday that it was considering a possible downgrade for the country.

Economy: The Institute for Supply Management's index -- measuring the nation's non-manufacturing business activity -- rose to 53.2 in September, from 51.5 the previous month. Economists were expecting the gauge to inch up to 51.8. Any number above 50 indicates growth in the sector.

Currencies and commodities: The dollar fell sharply against major currencies Tuesdays, with the dollar index touching its lowest levels since January.

The greenback sank to an 8-month low against the euro, and also slipped versus the British pound and the Japanese yen.

"There's a very bearish tone toward the U.S. dollar regardless of the broader economic conditions around the globe," said Gareth Sylvester, senior currency strategist at HIFX in San Francisco. "The market is largely fixated on the story of a weak domestic economy and therefore a weak dollar."

The dollar has been under pressure since the Federal Reserve announced it may buy long-term U.S. Treasurys to boost the economy. While the Japanese central bank announced a similar move for its economy, it didn't help curb the strength of the yen.

Rather, the dollar fell to the lowest level against the yen since the Japanese government announced intervention, a 15-month low. News of fiscal woes in Ireland have been largely ignored as well, Sylvester said.

"The currency market has a blinkered attitude at the moment" he said. "But if upcoming economic data consistently shows that the worst of the U.S. economy has been seen, investors may start to shift focus."

The buck's softness has helped boost prices of commodities priced in U.S. dollars, including gold and oil.

Gold futures for December continued to run in record territory. Prices spiked $23.50 to settle at an all-time high of $1,340.30 an ounce, after reaching a fresh intraday record trading high of $1,342.60 an ounce earlier Tuesday.

The price of crude oil for November delivery rose $1.35 to settle at $82.82 per barrel.

Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.47% from 2.48% late Monday. Bond prices and yields move in opposite directions.

Stocks finish near session lows

By Hibah Yousuf, staff reporter October 4, 2010: 4:53 PM ET

By Hibah Yousuf, staff reporter October 4, 2010: 4:53 PM ET

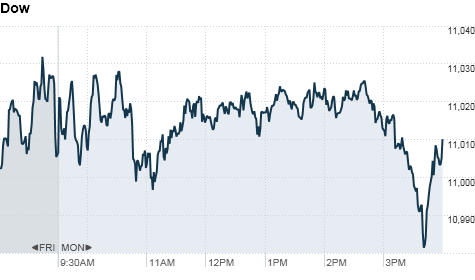

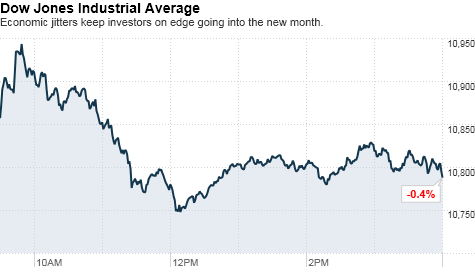

NEW YORK (CNNMoney.com) -- Stocks finished near session lows Monday following a midday sell-off, with the Dow and Nasdaq indexes posting their largest one-day losses in nearly a month, as investors remain cautious ahead of corporate earnings season and key employment data due later in the week.

The Dow Jones industrial average (INDU) tumbled 78 points, or 0.7%, with components Intel (INTC, Fortune 500), Alcoa (AA, Fortune 500), American Express (AXP, Fortune 500) and Microsoft (MSFT, Fortune 500) sinking the most.

The S&P 500 (SPX) lost 9 points, or 0.8%. The Nasdaq (COMP) dropped 26 points, or 1.1%, with a Microsoft downgrade dragging the tech-heavy index lower. Other big tech shares losing ground included Apple (AAPL, Fortune 500) and Google (GOOG, Fortune 500).

Stocks started the day near the breakeven point, but selling accelerated as the session wore on. With little on the economic docket to attract investors, the September rally has lost its momentum.

"We're just seeing a pullback from that," said Peter Cardillo, chief market economist at Avalon Partners. "We're going to get the monthly jobs report later this week, so volume will be light and the market could be volatile ahead of that release."

A report showing a continued slowdown in manufacturing, coupled with data showing some pickup in the housing market, did little to stem the jitters on Monday.

"We'll continue to see a lot of mixed signals," said Karl Mills, president and chief investment officer at Jurika Mills and Keifer. "I think it will be hard for the market to repeat as strong of a month as what we just saw, but it'll depend on the companies' earnings and their outlooks."

Alcoa kicks off the unofficial start of earnings season after the closing bell on Thursday. Investors will also be gearing up for the government's monthly jobs report, due out Friday.

Stocks had started October on a positive note -- although Friday's advance was limited. But with economic uncertainty continuing to underpin the markets, investors could be in for a rough month.

Economy: A report from the Commerce Department showed that factory orders fell 0.5% in August, heightening fears about a slowdown in U.S. manufacturing growth. Economists were expecting order to decrease by 0.4%.

The National Association of Realtors said pending home sales rose 4.3% in August. Economists were expecting the report to show a mere 1% uptick in sales. But pending home sales only indicate contracts being signed and not actual closed purchases.

Companies: Shares of American Express tumbled 6.5%, after the Department of Justice filed an antitrust lawsuit against the company. The credit card giant said it has "no intention of settling the case."

The suit comes as rivals Visa (V, Fortune 500) and Mastercard (MA, Fortune 500) settled their antitrust case regarding their credit card policies. Neither company admitted any wrongdoing.

French pharmaceutical giant Sanofi-Aventis (SNY) launched a hostile takeover of Genzyme (GENZ, Fortune 500). Sanofi said it was taking its $18.5 billion offer for its rival directly to shareholders, after its efforts to work with the board of Genzyme were "blocked at every turn." Shares of Sanofi fell 0.8%, while Genzyme's stock rose 0.2%.

Shares of Sara Lee (SLE, Fortune 500) climbed 7.2%, after the New York Post reported that the company turned down a $12 billion buyout offer from investment firm KKR & Co.

Microsoft (MSFT, Fortune 500) fell 1.9%, after the tech giant's shares were cut by a Goldman Sachs analyst.

World markets: European stocks declined Monday. The CAC 40 in France and Germany's DAX closed down at 1.2%. Britain's FTSE 100 fell 0.7%

In Asia, the Hang Seng gained nearly 1.2%. Japan's Nikkei finished the session down 0.3%. The Bank of Japan started a two-day policy meeting. The Shanghai Composite was closed for Golden Week.

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell slightly against the British pound.

Gold futures for December delivery fell $1 to settle at $1,316.80 an ounce.

The price of crude oil for November delivery fell 11 cents to settle at $81.47 per barrel.

Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.48% from 2.51% late Friday. Bond prices and yields move in opposite directions. The 2-year yield touched a record low just below 0.40%

Oct 1, 2010

Nikkei opens higher

TOKYO

JAPANESE shares opened higher Friday, with the Tokyo Stock Exchange's Nikkei index gaining 0.76 per cent or 71.17 points to 9,440.52 in the first minutes of trading.

Stocks post best September in 71 years

By Blake Ellis, staff reporterSeptember 30, 2010: 5:16 PM ET

By Blake Ellis, staff reporterSeptember 30, 2010: 5:16 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks fizzled Thursday, but that didn't stop the market from logging its best September in decades.

Dow Jones industrial average (INDU) slipped 47 points, or 0.4%, after soaring more than 100 points at the start of trading. The S&P 500 (SPX) fell 4 points, or 0.3%, and the Nasdaq (COMP) ticked down 8 points, or 0.3%.

Economic jitters have kept stocks from breaking out of a narrow range this week. And while upbeat readings on employment and economic growth helped spark an early rally Thursday, gains subsided as worries about the euro zone bubbled up.

Despite the stomach churning month, stocks ended September on a high note. The Dow jumped 7.7%, the biggest September gain in 71 years. The S&P also posted the biggest gain since 1939, rising 8.7% in the month, while the Nasdaq climbed 12%.

All 30 Dow components were on track to end September with gains, as of Wednesday's market close. Caterpillar (CAT, Fortune 500), Alcoa (A, Fortune 500), GE (GE, Fortune 500), Home Depot (HD, Fortune 500) and 3M (MMM, Fortune 500) are among the biggest gainers.

And only 18 of the S&P 500 were down on the month. Carmax (KMX, Fortune 500), JC Penney (JCP, Fortune 500) and Office Depot (ODP, Fortune 500) are among the biggest gainers on the broader index.

"There was a lot of talk this summer about a double-dip recession, and while it's true things have slowed down, the technicals have really changed and it's a much more healthy environment now," said Kenny Landgraf, principal at Kenjol Capital Markets.

Economy: The number of Americans filing for unemployment insurance edged down to 453,000 in the week ended Sept. 25, according to the Labor Department. The figure was slightly better than the 457,000 jobless claims economists had expected.

"The big bash against this recovery has been that it's a jobless recovery ... so investors are obviously going to take that [report] well," said Landgraf.

Meanwhile, the Commerce Department released its final reading on second-quarter gross domestic product, raising it slightly to a gain of 1.7% from the previously reported 1.6%.

Economists surveyed by Briefing.com had expected the figure to remain unchanged.

World markets: Despite the wave of upbeat readings on the U.S. economy, bad news from overseas reignited fears about a slowing global recovery.

Ireland's central bank unveiled a bank bailout that could reach about $46 billion. Ireland's budget deficit is on track to hit 10 times the European Union guidelines for eurozone members. Meanwhile, Moody's downgraded Spain's credit rating.

"These are just further signs that we've covered up the European financial situation and tried to push it aside, but it's really still a big issue," said Dean Barber, president of Barber Financial group.

European stocks slumped. France's CAC 40 fell 0.6%, Britain's FTSE 100 dipped 0.4% and Germany's DAX lost 0.3%.

Asian markets shares ended mixed. The strong yen continues to plague Japanese stocks, with the Nikkei ending down 2%. The Hang Seng in Hong Kong lost 0.1%, while the Shanghai Composite rose 1.7%.

Companies: AIG (AIG, Fortune 500) took a major step toward paying back its government bailout Thursday, after announcing an agreement to pay down its debt to U.S. taxpayers. Part of this includes the insurer's plan to sell its Japan-based units for $4.8 billion. Shares of AIG gained more than 4%.

Shares of Johnson & Johnson (JNJ, Fortune 500) slipped less than a percent after CEO William Weldon took responsibility for the company's recall issues and admitted to hiding a Motrin recall effort.

Overall, Johnson & Johnson's stock has emerged unscathed from the recall issue as investors have largely shrugged off the issue since there were no reports of people getting sick.

Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen.

On Wednesday, Congress overwhelmingly passed legislation to impose tariffs on China for undervaluing its currency, the yuan, in order to keep export prices cheap.

Gold futures for December delivery slipped 70 cents to settle at $1,309.60 an ounce, after hitting another intra-day trading record of $1,316.20 an ounce earlier in the session.

Crude oil futures for November delivery gained $2.11 to settle at $79.97 a barrel.

Bonds: The price on the benchmark 10-year bond fell, pushing up the yield up to 2.52% from 2.5% late Wednesday.

Good morning Pharoah...

What a nice and interesting way to start the day...

pharoah88 ( Date: 30-Sep-2010 08:56) Posted:

|

WEALTH

cannOt bUy

HEALTH

? ? ? ?

Most probably so...

But we should not take the stock market for granted, and leave it at that..

Because at any time, the beast can behave in unexpected ways too..

Thus, to assert our own personal favourite 'scripts' of what the

market is going to do next is the height of folly.

I mean, even if one is very confident, there's still at an at least

1% chance of one being wrong, agree?

scotty ( Date: 30-Sep-2010 08:20) Posted:

|