Using Market Proxy to Determine Valuation of Singapore Market

There is no free and readily available information on the valuation of the Singapore stock market. Therefore, an investor needs to create his own " market proxy" price, earnings and PE chart using large Singapore stocks. The chart below is an example of a Singapore market proxy valuation chart. The data of large Singapore companies are used as a proxy to the entire Singapore market. The Straits Times Index is also plotted in the same graph to show that the two move rather closely together. From this chart it appears that the Singapore market seems to be trading at the high end of its historical range. The only thing that can take it up would be the earnings growth as forecasted by analysts.

Chart can be viewed at http://www.investingtalk.net/singapore-market-valuation.html

Dow hit 15,797 last night and reacted down....3 points shy of 15,800 i mentioned in my blogs. If the MACD cross down...time to short...wait for the signal...who knows it might do a " Double top" first before going down.

cheers,

Jason at http://myfcoach.com/ and http://millionaire-investors.blogspot.sg/

myfcoach ( Date: 17-Oct-2013 10:24) Posted:

|

Super Typhoon Haiyan

Hackers are really smart but brave people. Even dared to play at the lion's den.

Blanchard ( Date: 08-Nov-2013 08:43) Posted:

|

Market Recap

US equities fell sharply on profit taking after the indices hovered near record highs.

All but two Dow components fell with Walt Disney (-2.7%) and Goldman Sachs (-2.4%) the biggest decliners. The S& P 500 had its largest point drop since 27 Aug, and the consumer discretionary, staples and energy sectors were among the losing sectors. Despite a 73% gain by Twitter on its first trading day, the NASDAQ Composite also fell. ...

WTI Crude for Dec lost 60 cents, or 0.6%, to end at US$94.20 on while Dec Brent declined by US$1.78, or 1.7 %, to settle at US$103.46/barrel.

Dollar strength after the ECB cut rates dragged the precious metals lower. Gold for Dec delivery lost US$9.30, or 0.7%, to end at US$1,308.50/ounce while Dec Silver fell by 11 cents, or 0.5%, to end at US$21.66/ounce.

US equities fell sharply on profit taking after the indices hovered near record highs.

All but two Dow components fell with Walt Disney (-2.7%) and Goldman Sachs (-2.4%) the biggest decliners. The S& P 500 had its largest point drop since 27 Aug, and the consumer discretionary, staples and energy sectors were among the losing sectors. Despite a 73% gain by Twitter on its first trading day, the NASDAQ Composite also fell. ...

WTI Crude for Dec lost 60 cents, or 0.6%, to end at US$94.20 on while Dec Brent declined by US$1.78, or 1.7 %, to settle at US$103.46/barrel.

Dollar strength after the ECB cut rates dragged the precious metals lower. Gold for Dec delivery lost US$9.30, or 0.7%, to end at US$1,308.50/ounce while Dec Silver fell by 11 cents, or 0.5%, to end at US$21.66/ounce.

Implications for Singapore

The more than 1% plunge by the US indices overnight could spook the local bourse to a poor start this morning.

After another muted session yesterday (ended 0.1% lower), the STI continues to hover just above the 3200 psychological support....

But with today's tone likely to turn bearish, we could see the index gapping below this immediate base at the open, before sliding further towards the 3155 subsequent support (minor trough).

On the upside, the immediate obstacle is still pegged at the 3230 minor peaks, followed by the next hurdle at the 3260 key peaks.

The more than 1% plunge by the US indices overnight could spook the local bourse to a poor start this morning.

After another muted session yesterday (ended 0.1% lower), the STI continues to hover just above the 3200 psychological support....

But with today's tone likely to turn bearish, we could see the index gapping below this immediate base at the open, before sliding further towards the 3155 subsequent support (minor trough).

On the upside, the immediate obstacle is still pegged at the 3230 minor peaks, followed by the next hurdle at the 3260 key peaks.

Singapore

* Abterra (ABT SP): Sees 3Q loss pared vs yr ago

* Eunetworks (EUN SP): 3Q adj. Ebitda EU6.3m

* FJ Benjamin (FJB SP): 1Q oper. profit S$2.5m vs S$3.4m y/y

* Nera Telecom (NERT SP): 3Q rev. S$50.1m

* OUE (OUE SP): 3Q profit after tax S$14.9m vs S$23.8m yr ago

* Raffles Education (RLS SP): 1Q loss S$3.9m vs S$11m loss y/y

* StarHub (STH SP): 3Q profit falls 1% y/y to S$95.3m

* SIA Engineering (SIE SP): 2Q profit increases 5.8% to S$71m

* ST Engineering (STE SP): 3Q net S$131m vs S$146m yr earlier

* Wilmar (WIL SP): 3Q net income +2.5% y/y to $416m

* Abterra (ABT SP): Sees 3Q loss pared vs yr ago

* Eunetworks (EUN SP): 3Q adj. Ebitda EU6.3m

* FJ Benjamin (FJB SP): 1Q oper. profit S$2.5m vs S$3.4m y/y

* Nera Telecom (NERT SP): 3Q rev. S$50.1m

* OUE (OUE SP): 3Q profit after tax S$14.9m vs S$23.8m yr ago

* Raffles Education (RLS SP): 1Q loss S$3.9m vs S$11m loss y/y

* StarHub (STH SP): 3Q profit falls 1% y/y to S$95.3m

* SIA Engineering (SIE SP): 2Q profit increases 5.8% to S$71m

* ST Engineering (STE SP): 3Q net S$131m vs S$146m yr earlier

* Wilmar (WIL SP): 3Q net income +2.5% y/y to $416m

Since cyber infrastructure is not entirely impenetrable, defence alone will not work well, so Singapore must counter attack by hacking into hackers' backers.

Blanchard ( Date: 08-Nov-2013 08:43) Posted:

|

PM Lee's website hacked .....

http://www.channelnewsasia.com/news/singapore/pm-lee-s-website-hacked/878906.html

risktaker ( Date: 07-Nov-2013 11:32) Posted:

|

maybe see how china hk react later bah. tonite non-farm hope jialat jialat. lol

Now the market very strange. Good economic news will also result in stocks dropping because people are afraid of the FED easing.

aiyo wall street taking ang ku kueh aka taking profits. chinatown street to copycat also bah..

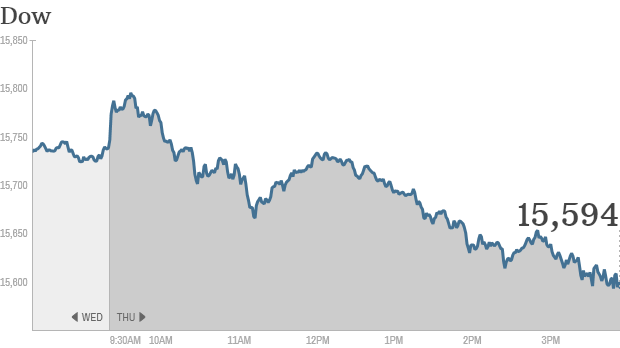

Stocks take a big dive, but Twitter surges

Click the chart for more stock market data.

Most stocks finished in the red Thursday, but the one that everyone had their eye on closed firmly in green. Shares of Twitter (TWTR) surged in their debut on the New York Stock Exchange.

But it was a pretty rough day for stocks not named Twitter. The Dow Jones industrial average fell more than 150 points, or 1%, while the S& P 500 dropped 1.3%. The Nasdaq was the biggest laggard of the day, down nearly 2%.

Stocks have been trading near all-time highs recently. In fact, the Dow hit a new record early Thursday morning before pulling back. So Thursday's slump might be a sign that investors are growing more worried about how hot the market has been this year. Some analysts feel stocks are getting close to being overvalued.

Earnings continue to roll in: The broader market was dragged down by companies with lackluster earnings.

Whole Foods (WFM, Fortune 500)was one of the biggest losers in the S& P 500 and Nasdaq as shares sank more than 11%. The sharp drop came after organic grocer cut its earnings and sales forecasts.

Related: Fear & Greed Index continues to show greed

Upbeat economic data: Investors were initially encouraged by a report that showed the U.S. economy perked up slightly this summer, driven largely by businesses re-stocking their shelves, a rise in consumer spending, and the ongoing housing recovery.

Gross domestic product -- the broadest measure of economic activity -- rose at a 2.8% annual rate in the third quarter, according to the Bureau of Economic Analysis. That marked the fastest growth in a year and was stronger than economists had anticipated. A separate report showed initial jobless claims declined for the fourth straight week.

But the positive economic data also reignited speculation that the Federal Reserve may begin tapering its bond buying program, said analysts at Wells Fargo Advisors. The Fed's stimulus measures have been a major driver of the bull market over the past several years.

Investors will continue to keep close tabs on economic data, particularly readings on the job market. The October jobs report is due early Friday. Economists surveyed by CNNMoney expect 120,000 jobs were added last month.

ECB unexpectedly cuts rates: In Europe, it's all about the European Central Bank. The ECB said it cut a key interest rate to 0.25%, a sign of how fragile the European economic recovery is. European stock markets made modest gains in afternoon trading, keeping them near five-year highs.

World Markets

North and South American markets finished broadly lower today with shares in U.S. leading the region. The S& P 500 is down 1.32% while Brazil's Bovespa is off 1.21% and Mexico's IPC is lower by 0.73%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -152.90 | -0.97% | 15,593.98 | 4:35pm ET |

|

S& P 500 Index | United States | -23.34 | -1.32% | 1,747.15 | 4:35pm ET |

|

Brazil Bovespa Stock Index | Brazil | -643.81 | -1.21% | 52,740.79 | 2:17pm ET |

|

Canada S& P/TSX 60 | Canada | -4.36 | -0.57% | 765.45 | 4:20pm ET |

|

Santiago Index IPSA | Chile | +0.18 | +0.01% | 3,314.69 | 3:18pm ET |

|

IPC | Mexico | -294.55 | -0.73% | 40,009.90 | 4:06pm ET |

STI poised for a good rally.

Pic. Tks 4 ur info. Gd luck!

bishan22 ( Date: 07-Nov-2013 11:41) Posted:

|

Short sell orders executed on 7 November 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131107.txt

Buying-in Executed on 7 November 2013

http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/

borrow securities 7 November 2013

https://www1.cdp.sgx.com/scdcint/sbl/viewLendingPool.do#

All kia si wan. Waiting for NFP and China weekend news. Good luck.

Shirleyfong88888 ( Date: 07-Nov-2013 11:12) Posted:

|

Well done...big thumb up for.... PM Lee...every singaporean play their part catch the hacker that threaten singapore....

Singapore vows to hunt down Anonymous hackersAFP News ? 9 hours ago

Singapore will "spare no effort" to hunt down hackers from activist group Anonymous who last week threatened to wage a cyber war against the government, Prime Minister Lee Hsien Loong said Wednesday.

Lee told reporters the city-state had also strengthened its defences against such attacks.

"Our IT (information technology) network, the Internet, our communications have become an essential part of our business and our lives now," the Today newspaper quoted him as saying in its online edition.

"And, therefore, when somebody threatens to do harm to it... we take that very seriously and we will spare no effort to try and track down the culprits and if we can find him, we will bring him to justice and he will be dealt with severely."

It was Lee's first comment since a person claiming to be from the international hackers' group Anonymous threatened to mount cyber attacks against the government in protest at new licensing rules for news websites.

In the video posted last Thursday on YouTube, a person speaking with a computer digitised voice and wearing a Guy Fawkes mask, the global symbol of Anonymous, said the group would "go to war" with the Singapore government.

A day later a person claiming to be affiliated with Anonymous hacked a reporter's blog on the website of the pro-government Straits Times newspaper.

The hacker also warned of further attacks on the tightly governed city-state if demands for greater Internet freedom were not met.

Lee said authorities had worked to make cyber infrastructure less vulnerable but IT systems were complicated and not entirely impenetrable.

Singapore strictly regulates the traditional media. Its new Internet rules have sparked anger in the blogging and social media community, which has raised fears they aim to muzzle free expression.

Authorities have said the new licensing rules do not impinge on Internet freedom.

Singapore vows to hunt down Anonymous hackersAFP News ? 9 hours ago

Singapore will "spare no effort" to hunt down hackers from activist group Anonymous who last week threatened to wage a cyber war against the government, Prime Minister Lee Hsien Loong said Wednesday.

Lee told reporters the city-state had also strengthened its defences against such attacks.

"Our IT (information technology) network, the Internet, our communications have become an essential part of our business and our lives now," the Today newspaper quoted him as saying in its online edition.

"And, therefore, when somebody threatens to do harm to it... we take that very seriously and we will spare no effort to try and track down the culprits and if we can find him, we will bring him to justice and he will be dealt with severely."

It was Lee's first comment since a person claiming to be from the international hackers' group Anonymous threatened to mount cyber attacks against the government in protest at new licensing rules for news websites.

In the video posted last Thursday on YouTube, a person speaking with a computer digitised voice and wearing a Guy Fawkes mask, the global symbol of Anonymous, said the group would "go to war" with the Singapore government.

A day later a person claiming to be affiliated with Anonymous hacked a reporter's blog on the website of the pro-government Straits Times newspaper.

The hacker also warned of further attacks on the tightly governed city-state if demands for greater Internet freedom were not met.

Lee said authorities had worked to make cyber infrastructure less vulnerable but IT systems were complicated and not entirely impenetrable.

Singapore strictly regulates the traditional media. Its new Internet rules have sparked anger in the blogging and social media community, which has raised fears they aim to muzzle free expression.

Authorities have said the new licensing rules do not impinge on Internet freedom.

But it didn't lift up STI a lot leh....

Still ranging 3200+......

My counter still no up:(

Still ranging 3200+......

My counter still no up:(

bishan22 ( Date: 07-Nov-2013 05:19) Posted:

|

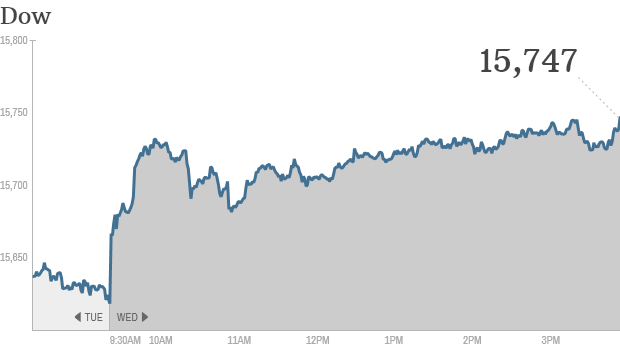

Dow hits another record high

Click for more market data.

NEW YORK (CNNMoney)

The Dow rose to an all-time high Wednesday as investors focused on mostly solid corporate earnings.

The Dow gained 126 points to surpass its record high from last week. Microsoft (MSFT, Fortune 500) and Chevron (CVX, Fortune 500) were the best performing blue-chips in the Dow 30. Nike (NKE, Fortune 500) and Home Depot (HD, Fortune 500)were among the few Dow components that were lower.

The S& P 500 ended just below its record high, but the Nasdaq dipped. Stocks ended mostly flat Tuesday.

Looking ahead to the rest of the week, investors are awaiting the U.S. October jobs report from the Bureau of Labor Statistics. The report, due out Friday morning, has a strong influence on market sentiment.

Investors are zeroing in on the economy as they attempt to gauge when the Federal Reserve will begin to slow, or taper, the pace of its $85 billion per month stimulus program.

The Fed is expected to stay on hold until sometime next year, but any sign of improvement in growth, particularly in the job market, could stoke concerns about an early exit.

" We all know the taper is coming, we just don't know when," said Stone.

Related: Fear & Greed Index nearing extreme greed

On Thursday both the European Central Bank and the Bank of England will announce interest rate decisions. The ECB is under pressure to cut rates to a new low.

European markets and Asia's stock markets ended mixed.

World Markets

North and South American markets finished mixed as of the most recent closing prices. The S& P 500 gained 0.43%, while the Bovespa led the IPC lower. They fell 0.83% and 0.06% respectively.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +128.66 | +0.82% | 15,746.88 | 4:37pm ET |

|

S& P 500 Index | United States | +7.52 | +0.43% | 1,770.49 | 4:37pm ET |

|

Brazil Bovespa Stock Index | Brazil | -447.25 | -0.83% | 53,384.60 | 2:15pm ET |

|

Canada S& P/TSX 60 | Canada | +1.16 | +0.15% | 769.81 | 4:19pm ET |

|

Santiago Index IPSA | Chile | -16.33 | -0.49% | 3,314.51 | 3:14pm ET |

|

IPC | Mexico | -24.36 | -0.06% | 40,280.09 | 6:06pm ET |