US stocks climbed back to record highs as Macy?s better-than-expected earnings fuelled optimism about the holiday shopping season and investors speculated that Fed chair designate Janet Yellen would continue the central bank?s easy monetary policy. After the bell, Yellen said that the US economy and labour markets are performing short of their potential ad must improve before the central bank can begin to taper its stilumus in a testimony prepared for her Senate nomination hearing on Thu.

GorgeousOng ( Date: 14-Nov-2013 09:04) Posted:

|

Yeah yeah!! Hooray...Yellen!!!

Ah doi! I keep preparing this tapering sampai saya sudah bosan.. Tak nak dengar lagi!!! I just hapi hapi trade lah!!!🙊 🙉 🙈 🙈 🙉 🙊

Cheers!!!

Octavia ( Date: 14-Nov-2013 08:43) Posted:

|

Prepare for US Fed stimulus taper: Tharman

Countries should put in place domestic reforms, raise productivity

Weighing in on the issue of market jitters and speculation about tapering, Mr Tharman said: " At some point, the Fed will have to start tapering. Whether it tapers in December or sometime next year will eventually be (only) a footnote in history.

" At some point, it's going to have to taper - and it's important for all of us to start preparing for this eventuality."

万 事 通 ,

I am happy like fish hor!!!

iPunter ...🙊 🙉 🙈 🙈 🙉 🙊

Cheers!!!

WanSiTong ( Date: 14-Nov-2013 08:03) Posted:

|

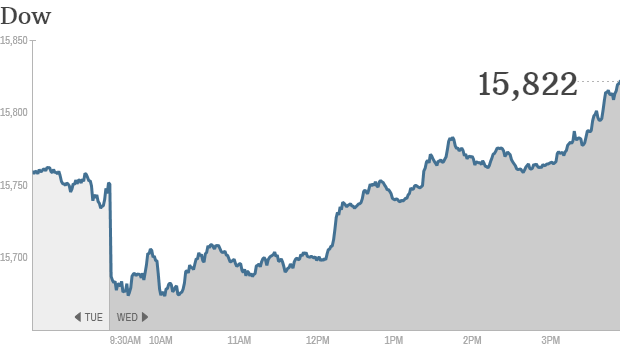

The bull is back! Dow and S& P hit records

Click for more market data.

The Dow and S& P 500 both rose to another record Wednesday, resuming their march higher after taking a breather Tuesday. Investors remain focused on the economy as they attempt to gauge when the Federal Reserve will scale back its monetary stimulus.

The Dow Jones industrial average rose 0.4% and the S& P 500 rose 0.8%. The Nasdaq rose 1% and is inching closer to the psychologically key level of 4,000, a milestone it hasn't topped since the tech bubble burst in 2000.

The gains came amid uncertainty about when the Federal Reserve will finally begin reducing, or tapering, its bond-buying program.

" Commentary by Fed officials continues to confound, with some for more stimulus and some for less, some talking of a December taper and some of later," said Mike van Dulken, head of research at Accendo Markets.

Related: Companies pledge millions to Philippines

Fed vice chair Janet Yellen may shed light on the topic when she appears before the Senate Banking Committee on Thursday for her confirmation hearing. Yellen is President Obama's nominee to replace Ben Bernanke as chairman of the Fed.

The Fed's stimulus policies have been a major driver of the bull market in stocks over the past few years. But recent reports on economic growth and hiring have some experts betting that the central bank will begin its exit strategy sooner rather than later.

Investors were also digesting a Chinese Communist Party communique on economic reform that was heavy on jargon but light on specifics.

That put pressure on Asian markets Wednesday, with the main stock indexes in Hong Kong and Shanghai declining by nearly 2%. European markets also fell. Shares in London sank amid concerns the Bank of England could hike interest rates after the bank raised its inflation expectations and lowered its outlook for unemployment.

Related: Fear & Greed Index remains in greed

What's moving: Macy's (M, Fortune 500) shares rose on better-than-expected quarterly earnings and strong same-store sales.

The retailer's results suggest American consumers could spend big this holiday season, according to some StockTwits traders.

World Markets

North and South American markets finished higher today with shares in Brazil leading the region. The Bovespa is up 0.82% while U.S.'s S& P 500 is up 0.81% and Mexico's IPC is up 0.43%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +70.96 | +0.45% | 15,821.63 | 4:33pm ET |

|

S& P 500 Index | United States | +14.31 | +0.81% | 1,782.00 | 4:33pm ET |

|

Brazil Bovespa Stock Index | Brazil | +425.96 | +0.82% | 52,230.29 | 6:01pm ET |

|

Canada S& P/TSX 60 | Canada | +3.08 | +0.40% | 771.35 | 4:19pm ET |

|

Santiago Index IPSA | Chile | -45.29 | -1.41% | 3,159.43 | 3:14pm ET |

|

IPC | Mexico | +171.28 | +0.43% | 39,765.92 | 6:06pm ET |

CEO Pan,

Last night our Green Huat Kueh factory closed....I better quickly change and go to market sapu all the Green Huat Kueh....later not enough to distribute yo!!!

Life is great all the time!!!

All the time life is great!!!!

Cheers!!!!

Peter_Pan ( Date: 14-Nov-2013 05:09) Posted:

|

Wall Street simply loves Green Huat Kueh. Chinatown Street simply loves Ang Ku Kueh. Huat lah.

Guys gear up and prepare to SHORT STI! Huat ah!! Lol

Short sell orders executed on 13 November 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131113.txt

Buying-in Executed on 13 November 2013

http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/

borrow securities 13 November 2013

https://www1.cdp.sgx.com/scdcint/sbl/viewLendingPool.do#

Asia Stocks Drop on China Plenum Disappointment, Fed Bets

By Yoshiaki Nohara - Nov 13, 2013 2:31 PM GMT+0800

Asian stocks fell after China?s leaders failed to outline steps to curb state dominance of the economy and amid bets the Federal Reserve may start reducing U.S. stimulus next month.

Banks slumped in Hong Kong after a communique at the end of China?s four-day plenum made scant mention of financial reforms. Tencent Holdings Ltd., China?s biggest Internet company, fell 2.8 percent after a news report quoted its chairman saying the company?s valuation is ?scarily? high. Noble Group Ltd. lost 4.6 percent in Singapore after Asia?s largest commodity trader by sales said profit slumped. Pioneer Corp. surged 22 percent after the Japanese maker of car stereos reported an unexpected first-half operating profit.

The MSCI Asia Pacific Index dropped 0.8 percent to 138.63 as of 3:10 p.m. in Tokyo, heading for its first decline in three days. All 10 industry groups on the measure fell.

?Quite a few people put on their positions ahead of the communique, expecting actionable moves to be made, but that?s not the case,? said Andrew Sullivan, director of sales trading at Kim Eng Securities in Hong Kong. ?The market is just disappointed.?

Hong Kong?s Hang Seng Index plunged 1.91 percent, poised for the lowest close since Sept. 4, as financial shares led declines. China?s Shanghai Composite Index lost 1.3 percent. Japan?s Topix index lost 0.1 percent after a report showed the country?s machinery orders dropped in September.

Regional Gauges

Taiwan?s Taiex Index slid 1.1 percent and Singapore?s Straits Times Index lost 0.5 percent. Australia?s S& P/ASX 200 Index dropped 1.4 percent, while New Zealand?s NZX 50 Index rose 0.1 percent. South Korea?s Kospi index fell 1.6 percent as Samsung Electronics Co., which gets 43 percent of its revenue in America and China, slid 2.5 percent to 1,419,000 won.

China stopped short of unveiling detailed policy shifts after President Xi Jinping oversaw the gathering of Communist Party leaders in Beijing. Instead, they said the role of markets would be elevated in the nation?s economic strategy.

The nation will make markets ?decisive? in allocating resources, according to yesterday?s communique from the third full meeting, or plenum, of the party?s 18th Central Committee. At the same time, the state will remain ?dominant? in the economy, indicating limits on reducing government involvement.

Investors Disappointed

?It underwhelmed, replete with visions but short on details,? Hao Hong, a Hong Kong-based strategist at Bocom International Holdings Co., said in an e-mail. ?Judging from investors? response, they are disappointed.?

Industrial & Commercial Bank of China Ltd. sank 3 percent to HK$5.19. China Construction Bank Corp., the second-biggest mainland lender, declined 2.4 percent to HK$5.83.

Tencent lost 2.8 percent to HK$397.60 after Chairman Pony Ma told Ming Pao Daily News its valuation will fall if the company doesn?t keep up with trends in technology and Internet businesses.

Noble Group declined 4.6 percent to S$1.03 after third-quarter profit dropped 70 percent as the company booked a non-cash loss related to its stake in coal miner Yancoal Australia Ltd.

Futures on the S& P 500 lost 0.4 percent today. The measure fell 0.2 percent yesterday as corporate earnings and an improving economy fueled speculation about the Fed?s timetable for reducing stimulus.

Fed Bank of Atlanta President Dennis Lockhart said yesterday a reduction in U.S. bond purchases ?could very well take place? next month.

Fed?s Outlook

?Tapering is obviously back on the agenda as data in the U.S. continues to be strong,? said Donald Williams, Sydney-based chief investment officer at Platypus Asset Management Ltd., which oversees about A$1.6 billion ($1.5 billion). ?Maybe that?s enough for a small correction, but I think with rates at very low levels and likely to remain low, it?s still a good environment for equity markets.?

Investors will scrutinize U.S. economic reports this week on jobless-benefit claims and manufacturing in the New York area. Economists forecast the central bank will delay tapering asset purchases until its March meeting. Policy makers will probably pare the monthly pace of bond buying to $70 billion from $85 billion at that time, according to the median of 32 estimates in a Bloomberg survey on Nov. 8. The Fed next meets Dec. 17-18.

Among stocks that rose, Pioneer surged 22 percent to 202 yen after posting an operating profit of 569 million yen ($5.7 million) for the six months ended September, beating its forecast that it would break even. The shares advanced the most since May 14.

The Asia-Pacific gauge traded at 13.6 times estimated earnings as of yesterday compared with multiples of 16 for the Standard & Poor?s 500 Index and 15 for the Stoxx Europe 600 Index, according to data compiled by Bloomberg.

Of the companies on the MSCI Asia Pacific Index that have reported quarterly earnings this season and for which Bloomberg compiles estimates, more than 50 percent exceeded analysts? profit expectations.

so pratty..must show everyone mah..lol..!!!

pepperginger ( Date: 13-Nov-2013 16:16) Posted:

|

Bro Peter, you bad!!!

Post my photo here ~~~ angry!

Post my photo here ~~~ angry!

Peter_Pan ( Date: 13-Nov-2013 15:40) Posted:

|

Nowonder STI is going lower & lore each day :(

Cash is King.Count money is better than counting paper script.

bishan22 ( Date: 13-Nov-2013 11:18) Posted:

|

SE Asian Stocks to Watch: ARA, Ausgroup, Banyan Tree, Biosensors, City Dev, Comfort Delgro, Courts Asia, EnGro, F& N, Lion Gold, Noble, Petra Foods, REX, See Hup Seng, SIA, SGX, UE, Universal Resource

Singapore

* ARA Asset Management (ARA SP): YTD net S$52.1m

* Ausgroup (AUSG SP): 1Q loss A$15.1m vs A$6.3m profit yr ago...

* Banyan Tree (BTH SP): FY2013 profit seen higher than FY2012

* Biosensors (BIG SP): 2Q net income $11.3m vs $28.2m yr ago

* City Developments (CIT SP): 3Q net -10% y/y to S$121m

* ComfortDelGro (CD SP): To report 3Q earnings

* Courts Asia (COURTS SP): 2Q gross profit S$63.5m vs S$73.3m

* EnGro (EGCL SP): 3Q net income S$3.8m vs S$1.8m yr earlier

* F& N (FNN SP): FY rev. up 22% to S$4.34b

* Golden Agri-Resources (GGR SP): 3Q net $30m vs $86m yr earlier

* LionGold (LIGO SP): 2Q loss S$47.8m vs S$1.2m loss yr earlier

* Noble (NOBL SP): 3Q net -70% y/y to $22.9m

* Petra Foods (PETRA SP): 9-mo. branded consumer net $44m vs $40m y/y

* Rex (REXI SP): 3 mo. pre-tax loss $1.58m

* See Hup Seng (SHS SP): 3Q net income +44% y/y to S$2.5m

* Singapore Airlines (SIA SP): 2Q net +78% y/y to S$161m cut to neutral from outperform at Credit Suisse

* Singapore Exchange (SGX SP): Introduces 3 new Asian Index Futures for investors contracts to start trading from Nov. 25

* United Engineers (UEM SP): Signs S$309m secured loan facility agreement

* Universal Resource (URS SP): 3Q net S$1.7m vs S$3.6m yr ago

Singapore

* ARA Asset Management (ARA SP): YTD net S$52.1m

* Ausgroup (AUSG SP): 1Q loss A$15.1m vs A$6.3m profit yr ago...

* Banyan Tree (BTH SP): FY2013 profit seen higher than FY2012

* Biosensors (BIG SP): 2Q net income $11.3m vs $28.2m yr ago

* City Developments (CIT SP): 3Q net -10% y/y to S$121m

* ComfortDelGro (CD SP): To report 3Q earnings

* Courts Asia (COURTS SP): 2Q gross profit S$63.5m vs S$73.3m

* EnGro (EGCL SP): 3Q net income S$3.8m vs S$1.8m yr earlier

* F& N (FNN SP): FY rev. up 22% to S$4.34b

* Golden Agri-Resources (GGR SP): 3Q net $30m vs $86m yr earlier

* LionGold (LIGO SP): 2Q loss S$47.8m vs S$1.2m loss yr earlier

* Noble (NOBL SP): 3Q net -70% y/y to $22.9m

* Petra Foods (PETRA SP): 9-mo. branded consumer net $44m vs $40m y/y

* Rex (REXI SP): 3 mo. pre-tax loss $1.58m

* See Hup Seng (SHS SP): 3Q net income +44% y/y to S$2.5m

* Singapore Airlines (SIA SP): 2Q net +78% y/y to S$161m cut to neutral from outperform at Credit Suisse

* Singapore Exchange (SGX SP): Introduces 3 new Asian Index Futures for investors contracts to start trading from Nov. 25

* United Engineers (UEM SP): Signs S$309m secured loan facility agreement

* Universal Resource (URS SP): 3Q net S$1.7m vs S$3.6m yr ago

Singapore Q3 2013 Corporate Earnings: Reuters

DATE COMPANY NAME RIC PERIOD

Nov 13 HTL International Holdings Ltd Q3

Nov 13 Haw Par Corporation Ltd Q3...

Nov 13 CSE Global Ltd Q3

Nov 13 Comfortdelgro Corporation Ltd Q3

Nov 13 Yanlord Land Group Limited Q3

Nov 13 Hong Leong Finance Ltd Q3

Nov 14 Global Logistic Properties Q2

Nov 14 Olam International Ltd Q1

Nov 14 SingTel Ltd Q2

Nov 14 Midas Holdings Ltd Q3

Nov 14 Ho Bee Investment Ltd Q3

Nov 15 WBL Corporation Ltd Q4

DATE COMPANY NAME RIC PERIOD

Nov 13 HTL International Holdings Ltd Q3

Nov 13 Haw Par Corporation Ltd Q3...

Nov 13 CSE Global Ltd Q3

Nov 13 Comfortdelgro Corporation Ltd Q3

Nov 13 Yanlord Land Group Limited Q3

Nov 13 Hong Leong Finance Ltd Q3

Nov 14 Global Logistic Properties Q2

Nov 14 Olam International Ltd Q1

Nov 14 SingTel Ltd Q2

Nov 14 Midas Holdings Ltd Q3

Nov 14 Ho Bee Investment Ltd Q3

Nov 15 WBL Corporation Ltd Q4

China news are dragging many counters to be buried under pillows.... sleep well and dont think about them.