For newbies who want to learn more:

If somebody posts that markets will open with many sellers and bearish, it is because the futures market had already opened way before Asian markets even opened, and the futures were already red, so it is a common sense that index markets and stocks markets will open " bearishly" , gap-down and be " bearish" . It is also easy for me to say that markets will open with many sellers because the futures already flashed red before markets opened, and I will be spot on in this based on futures. However, you have to look more in depth. Is it really bearish? Is the selling real? Will US Fiasco end up getting solved? Are the big rebound targets all hit? Will bearishness all be suddenly flipped to high bullishness before you can even react? My cards are still laid out nakedly before things happen: Buy on Dip. Not Bearish. I am Bullish. Rebound waves still have got high upsides until all my upside targets are met.

Dow futures +71

Sinarmas

Ocean sky coming

Thanks jj

I jeep at 0.68

Huat ah!

I jeep at 0.68

Huat ah!

justjoin ( Date: 01-Oct-2013 10:02) Posted:

|

Rh Petrogas 72 now

justjoin ( Date: 01-Oct-2013 09:21) Posted:

|

Rex

CCFH

Singhaiyi

Think ocean sky move quiet a lot already...

justjoin ( Date: 01-Oct-2013 09:21) Posted:

|

RH Petrolgas, Ocean sky

Yes

magikonglye ( Date: 01-Oct-2013 09:05) Posted:

|

Yes

sjZheng ( Date: 01-Oct-2013 09:03) Posted:

|

rowsley can buy now?

YHM still can jeep a not?

Those whom played rowsley. Gdluck.

Y halt? anyone?

Intercept ( Date: 30-Sep-2013 12:26) Posted:

|

At closing, some of them are really sweet. My lorry still empty leh.

No hurry, take your time to pick. Tml expect to see more bigger red strawberries. Dow minus 150. Good luck.

halleluyah ( Date: 30-Sep-2013 10:31) Posted:

|

Totally agreed. This is a good way to check gap up or down before market open.

| justjoin ( Date: 30-Sep-2013 13:58) Posted: |

Broad Markets / Big Markets / Big Wind Directions

European markets are in the first 1 hour 08 minutes of trading, while US markets (Dow, S& P500 and NASDAQ) are 5 hours 22 minutes away from opening.

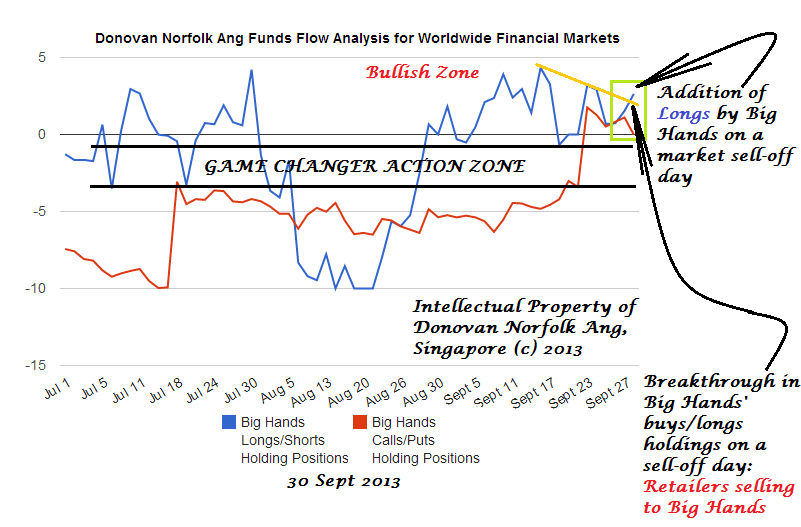

Based on current latest computational results, Holdings Index Strength of Big Hands changed from +1.533 to +2.639 in strength on the Donovan Norfolk Funds Flow Index Oscillator. Big Hands unloaded all Calls Holdings on hand, changing from +1.105 to -0.019 in strength on the Donovan Norfolk Funds Flow Index Oscillator.

Broad/Big Market (Big Wind Direction) Immediate-Term/Short-Term Posture by Big Hands:

+ Most market participants are bearish of the financial markets per said last week.

+ Today is a day of retailer longs trampling on retailer longs cheaply (i.e. small fishes selling wrongly and trying to get out on panic), while the Big Hands shake these weak holders successfully to buy strongly from them.

+ Big Hands unloading Calls but adding Longs/Buys today despite financial markets' weakness note this is an addition of strong Longs in Holdings by Big Hands on a market sell-off day.

+ Big Hands are holding on to their previous longs.

+ Smoke screen had been created the past few days to lure shortists to short the markets, and to throw confusion to buyers and market participants who are longs or who are investors.

+ Per analysed 2 weeks ago, Big Hands' consolidations were expected to end last week.

+ Immediate term selling is ending and worldwide market rallies are still expected to continue for mid term.

+ Per warned 2 weeks ago, this next wave of rally is to resume after current immediate term consolidations in financial markets worldwide.

+ Previously the worldwide rallies were expected to be merely for short-term and for shorting purposes based on DNA-FFA interpretation however, the worldwide rallies have, since last week, changed in nature to one which is of healthy large-wave bounce for mid term, essentially one which has some more upside and for fierce pump-up.

+ A persistent immediate term consolidation of the past few days (which is happening currently) will make this larger up-wave dead cat bounce a longer lasting and larger magnitude one.

+ Worldwide International Financial Markets are still inherently Bullish-Biased (Especially Europe).

+ Buy on dip for this rally and today offers a golden opportunity to buy on fear/dip.

Bro JJ....Noted wz thks..

justjoin ( Date: 30-Sep-2013 15:59) Posted:

|