Others

Market News that affect STI

Post Reply

201-220 of 1458

Post Reply

201-220 of 1458

Stocks: $102 oil has investors on edge

By Hibah Yousuf, staff reporterMarch 2, 2011: 4:32 PM ET

By Hibah Yousuf, staff reporterMarch 2, 2011: 4:32 PM ET

NEW YORK (CNNMoney) -- U.S. stocks ended slightly higher Wednesday, as nervous investors focus on oil prices, which rose above $102 a barrel on renewed concerns about oil and the Libyan conflict.

The Dow Jones industrial average (INDU) rose 9 points, or 0.1%, with Caterpillar (CAT, Fortune 500) and 3M (MMM, Fortune 500) posting the biggest gains.

The S& P 500 (SPX) added 2 points, or 0.2%, and the Nasdaq (COMP) gained 11 points, or 0.4%.

Yahoo (YHOO, Fortune 500) was a big winner on both of those indexes, with the stock popping 3.3% amid reports that the online portal company is in talks to sell its 30% stake in its Yahoo Japan venture.

U.S. stocks sank Tuesday, with all three major indexes falling more than 1%, as oil prices spiked almost 3%.

" We're seeing a bit of a recovery in the market from yesterday, but we're still in a tug of war period," said Karl Mills, president and chief investment officer at Jurika Mills & Keifer. " The swing factor is what's happening with the price of oil."

Oil prices continued to advance Wednesday, rising $2.60, or 2.6%, to settle at $102.23 a barrel, the highest since September 2008.

" The key is to watch how far and how quickly oil prices rise," Mills said. " The economy can handle where oil is now, but nobody sees the geopolitical uncertainties going away, and higher oil prices could curb economic growth here and in Europe."

Gold futures for April delivery also rose, as investors made a play for safety. The yellow metal touched an intraday all-time high of $1,441 an ounce, before easing slightly to settle at a fresh record of $1,437.70 an ounce.

World markets: World markets slumped Wednesday, a day after the big U.S. sell-off, as forces loyal to leader Moammar Gadhafi attacked rebels in eastern Libya.

European stocks posted losses. Britain's FTSE 100 slipped 0.4%, the DAX in Germany lost 0.6% and France's CAC 40 fell 0.8%.

Asian markets ended sharply lower. The Shanghai Composite slid 0.2%, while the Hang Seng in Hong Kong tumbled 1.5% and Japan's Nikkei sank 2.4%.

Economy: ADP released its latest private-sector jobs report, showing a gain of 217,000 jobs for February. Economists had forecast the ADP report to show that private businesses hired 165,000 new workers last month.

Employers announced plans to cut 50,702 jobs in February, a 32% increase over last month, according to Challenger, Gray & Christmas.

In the Federal Reserve's Beige Book report, a reading of the economic situation from the regional Fed banks, the central bank said manufacturers and retailers across all 12 of the Fed's districts are passing on rising commodity prices to consumers, but the economy continues to grow at a moderate pace.

Companies: Shares of Apple (AAPL, Fortune 500) rose 0.8% after the company's CEO Steve Jobs made a surprise appearance on stage in San Francisco to debut the iPad 2, which received a new, thinner design and an updated " A5" dual-core microprocessor.

Currencies and bonds The dollar fell against the euro and the British pound but rose versus the Japanese yen.

The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.46% from 3.40% late Tuesday.

IF China unrest much worse than oil spikes, STI 1000.

Organizers of an online anti-government campaign called Monday for new rallies in China on March 6 despite a smothering security response at the weekend that saw foreign journalists roughed up.

The anonymous campaigners behind the so-called " Jasmine rallies" -a reference to the " Jasmine revolution" in Tunisia that sparked unrest across the Arab world -said their movement had support in dozens of cities.

The new statement was posted on Facebook, Twitter and other overseas social networking sites officially blocked in China, and came one day after security personnel turned out in force to thwart gatherings in Beijing and Shanghai.

" According to the feedback we received, on Feb. 27, 2011, this movement spread to over 100 cities, largely exceeding our initial expectations of 27 cities," it said, calling for people to " walk" for change again next Sunday.

" We send our salutations to all Chinese citizens supporting and participating in this noble movement!" Both the U.S. ambassador to China and the European Union delegation in the country condemned the rough police handling of some foreign journalists who tried to report Sunday at the Beijing rally site.

Hundreds of uniformed and plainclothes police had blanketed the city's Wangfujing shopping street for the second week running, aggressively pushing away foreign reporters with cameras and briefly detaining several. Bloomberg News said one of its correspondents was kicked and punched by at least five men in plainclothes -apparently security personnel. He required medical treatment.

" This type of harassment and intimidation is unacceptable and deeply disturbing," U.S. Ambassador Jon Huntsman said in a statement.

A similarly tight security presence was seen at the Shanghai protest site near the city's People's Square. No protests were witnessed in Beijing, but several unidentified Chinese were seen taken away in police vans in Shanghai. Citizens have been urged to gather for subtle " strolling" demonstrations -but take no overt protest action -each Sunday afternoon at designated locations in cities across China to highlight public anger with the government.

The latest call urged " all social groups, intellectuals, unemployed college graduates, retired soldiers, Christians, Falun Gong practitioners, laidoff workers, victims of forced land seizures and building demolitions, and all people suffering from governmental injustice" to take part.

It said some of the organizers were present at rally sites and that those behind the effort would reveal themselves " at a proper time" .

Chinese authorities have reacted by rounding up more than 100 known dissidents and rights advocates, activists said, and blocking references to the rallies on websites and search engines. " We believe these deeds cannot stop the development of the Chinese Jasmine Revolution," the organizers said.

On Sunday Premier Wen Jiabao promised action on top public concerns including soaring inflation, runaway economic growth and official corruption in an online chat with Internet users.

China's leaders have watched developments in the Arab world nervously, as similar issues were among the root causes of the upheaval there.

Actually he is staunch...

but that can also result the worst...

LOL! OMG!! She really siao liao!!!Hulumas ( Date: 02-Mar-2011 08:00) Posted:

| Good news for Asian region market then! Huge funds fly back and heavily invest in Asian and other emerging market! SSE. SZSE, HKSE, STI . . . ETC. all will be on the immediate upt trend movement! |

|

Yea... Japanese market Nikkei fell very '

pengsan'...

and this is during extreme bullishly bullish sentiment everywhere earlier on...

zhixuen ( Date: 02-Mar-2011 08:21) Posted:

yameh? i saw a sharp dropped of Nikkei this morning?

Hulumas ( Date: 02-Mar-2011 08:00) Posted:

| Good news for Asian region market then! Huge funds fly back and heavily invest in Asian and other emerging market! SSE. SZSE, HKSE, STI . . . ETC. all will be on the immediate upt trend movement! |

|

|

|

yameh? i saw a sharp dropped of Nikkei this morning?

Hulumas ( Date: 02-Mar-2011 08:00) Posted:

| Good news for Asian region market then! Huge funds fly back and heavily invest in Asian and other emerging market! SSE. SZSE, HKSE, STI . . . ETC. all will be on the immediate upt trend movement! |

|

You mean the Asian markets and STI will "

Cheong Aaaarrrrhhh!!!" ?....

Good thinking!...

Good news for Asian region market then! Huge funds fly back and heavily invest in Asian and other emerging market! SSE. SZSE, HKSE, STI . . . ETC. all will be on the immediate upt trend movement!

Stocks drop more than 1% as oil spikes near $100

By Hibah Yousuf, staff reporterMarch 1, 2011: 5:02 PM ET

By Hibah Yousuf, staff reporterMarch 1, 2011: 5:02 PM ET

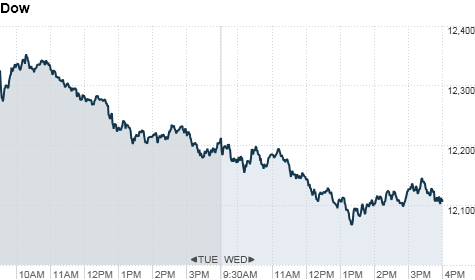

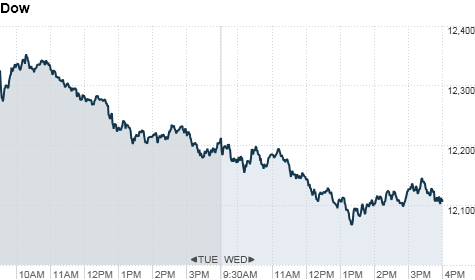

NEW YORK (CNNMoney) -- U.S. stocks tumbled Tuesday, with all three major indexes down more than 1%, as oil prices spiked to nearly $100 a barrel.

The Dow Jones industrial average (INDU) sank 168 points, or 1.4%, with Alcoa (AA, Fortune 500) and Caterpillar (CAT, Fortune 500) leading the decline. The S& P 500 (SPX) fell 21 points, or 1.6%, and the Nasdaq (COMP) lost 45 points, or 1.6%.

The sell-off came as oil prices for April delivery continued to head higher, climbing $2.66 to settle at $99.63 a barrel amid ongoing uprisings in Libya and the Middle East. In electronic trading, crude prices topped $100 a barrel Tuesday afternoon, after crossing that mark last week for the first time since 2008.

As crude climbed, gas prices rose for a seventh straight day. Meanwhile, gold prices surged $21.30, or 1.5%, to settle at a record high of $1,431.20 an ounce.

Tensions in the Middle East and North Africa will continue to cast a shadow on the market, said Matt King, chief investment officer at Bell Investment Advisors.

Investors also tuned into Federal Reserve Chairman Ben Bernanke's testimony on Capitol Hill. Bernanke warned that a sustained rise in oil prices could pose a danger to economic growth.

" Bernanke's comments reconfirm what the market's fear has been since the Libyan situation started," King said. " Bernanke hasn't been too concerned about inflation, especially in relation to high commodity prices, so this is the first time he's outlining a potential scenario with inflation."

Markets also came under pressure after the Securities and Exchange Commission filed a lawsuit against former Goldman Sachs (GS, Fortune 500) director Rajat Gupta for insider trading.

" It's just another hit to investor confidence, and it's scary to think about potential repercussions," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. " All this insider trading at hedge funds can make individual investors hesitant to come back to the market."

Investors are also looking ahead to the government's monthly payroll report on Friday, which will reveal how many jobs were created in February.

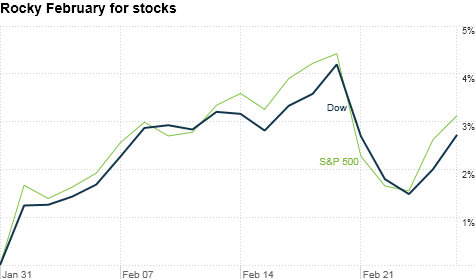

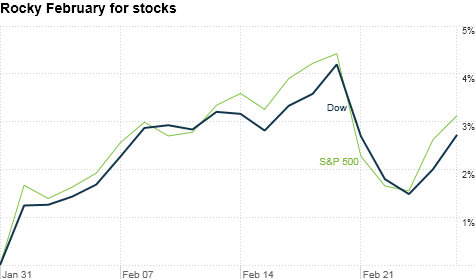

Despite a slight step back last week, stocks closed out February on an upbeat note -- posting their third-straight month of gains. Overall, all three major indexes were up nearly 3% during the month, and have risen more than 5% since the beginning of the year.

Economy: The Institute for Supply Management's manufacturing index rose for a 19th consecutive month, reaching 61.4% -- a level last seen in May 2004. The level signals continuing expansion in the sector.

Companies: General Motors (GM) said total U.S. sales rose 46% last month on an annual basis, while Ford's sales rose 14%. Shares of both U.S. automakers fell about 2%.

Shares of Japanese automaker Toyota (TM) slipped 0.5% after the company said sales rose 42% last month from a year earlier, when monthly sales fell 8.7% on recall problems.

Shares of Las Vegas Sands (LVS, Fortune 500) dropped 6.3% after the casino operator said that it has received a subpoena from the SEC requesting documents related to the Foreign Corrupt Practices Act. The company said it is also being investigated by the Department of Justice.

Shares of J. Crew Group (JCG) rose 1% after stockholders agreed to adopt the previously announced merger agreement with Chinos, an affiliate of private equity firms TPG Capital and Leonard Green & Partners.

World markets: European stocks closed lower. Britain's FTSE 100 lost 0.8%, the DAX in Germany fell 0.5% and France's CAC 40 declined by 0.7%.

Asian markets ended higher. The Shanghai Composite rose 0.5%, the Hang Seng in Hong Kong added 0.2% and Japan's Nikkei jumped 1.2%.

Currencies and commodities: The dollar rose against the euro, was weaker versus the British pound and firmer versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.41% from 3.43% late Monday.

Stocks end 'tough month' in the black

By Annalyn Censky, staff reporterFebruary 28, 2011: 4:29 PM ET

By Annalyn Censky, staff reporterFebruary 28, 2011: 4:29 PM ET

NEW YORK (CNNMoney) -- Despite a slight step back last week, stocks closed out February on an upbeat note, posting their third straight month of gains.

The Dow Jones industrial average (INDU) rose 96 points, or 0.8%, on Monday the S& P 500 (SPX) rose 3 points, or 0.2% the Nasdaq (COMP) was flat for the day.

Overall, all three major indexes were up nearly 3% during the month and have risen more than 5% since the beginning of the year.

" All being said, the market did very well in February," said Rich Ilczyszyn, market strategist with futures broker Lind-Waldock.

But that doesn't mean the ride wasn't a bumpy one. While stocks started February off strong thanks to solid earnings reports, uprisings in the Middle East sent oil prices skyrocketing and stocks falling last week.

" It's really been kind of a tough month," said Jack Ablin, chief investment officer of Harris Private Bank in Chicago. " I'm hopeful that as long as consumers believe higher energy prices are temporary, I think we can work our way through this."

Investors are looking ahead to the government's monthly payroll report on Friday, which will reveal how many jobs were created in February.

Economy: A report showing that personal incomes climbed 1% in January got investors in an upbeat mood early in the day, even though most of that increase was due to a 2% payroll tax holiday passed by legislators in late 2010.

" We saw a knee-jerk reaction to that headline," Ablin said. " I'm surprised that number wasn't already baked into the market."

Later, investors also welcomed a report on Chicago-area manufacturing showing that sector accelerated at a faster-than-expected pace in February. The Chicago PMI rose to 71.2 from 68.8 in January, although economists had expected a slight decline.

A report on the housing market came in slightly better than expected, showing pending home sales fell 2.8% instead of the deeper 3.2% fall economists had been forecasting.

Investors remain generally unfazed by a potential shutdown of the federal government, which could occur if Congress fails to approve a spending bill before midnight Friday.

Companies: Humana (HUM, Fortune 500) shares rose 3.9% after the company announced the Department of Defense awarded the health insurer a major contract, covering military personnel and their families in the South.

UnitedHealth Group (UNH, Fortune 500) had previously held the contract, and its shares were flat Monday.

Kenneth Cole Productions (KCP) shares tumbled 7% Monday, after the high-end clothing company announced its CEO Jill Granoff is stepping down, effective immediately. The company posted a loss of $2.7 million in the fourth quarter, an improvement over a $52 million loss in the year-ago quarter.

The fashion house's namesake had recently come under fire in the social media sphere, for tweeting a promotion that joked about protests in Egypt.

Shares of Overstock.com (OSTK) soared 9%, after the online retailer announced earnings that beat Wall Street estimates.

3M (MMM, Fortune 500) gained 2.2%, after a Barrons article reported the company will launch a " blizzard" of new products and soon see rising sales in international markets. Over the weekend, 3M CEO George Buckley slammed President Obama as " anti-business," calling his policies " Robin Hood-esque."

Amazon (AMZN, Fortune 500) shares fell more than 2.2%, after UBS downgraded its stock to " neutral."

World markets: European stocks ended the day mixed. Britain's FTSE 100 fell 0.1%, the DAX in Germany ticked up 1.2% and France's CAC 40 edged up 1.3%.

Asian markets ended the session higher. The Shanghai Composite added 0.9%, the Hang Seng in Hong Kong gained 1.4% and Japan's Nikkei rose 0.9%.

Currencies and commodities: The greenback fell against the euro, the British pound and the Japanese yen.

Oil for April delivery slipped 91 cents to settle at $96.97 a barrel.

Gold futures for April delivery rose 60 cents to settle at $1,409.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.43% from 3.59% late Friday.

Feb 28, 2011

Asian stocks mixed at midday

TOKYO

JAPANESE shares fell 0.62 per cent on Monday morning on concerns over the yen's continued strength and jitters over turmoil in the Middle East that has raised oil prices.

The benchmark Nikkei index of the Tokyo Stock Exchange fell 65.65 points to 10,461.11 by the break.

SHANGHAI

In China, the Shanghai Composite Index was up 0.2 per cent at 2883.4, still below the 2,900-level breached last week as markets were shaken by surging crude oil prices and political turmoil in the Middle East.

HONG KONG

Hong Kong shares rose 0.79 per cent on Monday morning as dealers picked up bargains from earlier losses despite concerns over China's decision to lower its growth target for the next five years.

The benchmark Hang Seng Index rose 180.92 points to 23,193.29.

KUALA LUMPUR

At 12.30pm on Monday, there were 162 gainers, 565 losers and 209 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,487.82 down 1.45 points, the FBMACE was at 4,125.12 down 79.70 points, and the FBMEmas was at 10,192.16 down 34.00 points.

Now also dont know when qadafi will step down, i think with US interference sooner or later sure end. So, stay out of the market now. Wait until a while more, when things start to settle down, then take risk and go in again before it rebounds will be better. Now just let all the impatient and fearful investors throw away their precious chips.

warrenbegger ( Date: 24-Feb-2011 19:19) Posted:

| WORLD PEACE PLEASE!!! Everday like that i dont dare to touch any counter, only dare to play below ball ball. |

|

WORLD PEACE PLEASE!!! Everday like that i dont dare to touch any counter, only dare to play below ball ball.

City Developments, Singapore’s second-largest property developer, said home prices will fall this year from 2010’s record because of government policies to cool the market and tackle speculation.

Home prices may decline 3% to 5% in 2011, Executive Chairman Kwek Leng Beng told reporters in Singapore. The company expects sales volume to drop in the short-term after rising 13% to $2.1 billion in 2010, when it sold 1,560 homes, it said in an exchange statement today.

Singapore last month applied new curbs including limits on loans and higher sales taxes after private home prices climbed to a record in the fourth quarter. Housing values increased as the economy expanded a record 14.5% in 2010, which probably made the city of 5 million people the fastest growing in the world after Qatar, according to International Monetary Fund estimates.

“Residential volumes have started to go down somewhat, but prices are still not down yet,” Kwek said. “Usually it’s the volume that is the precursor to prices going up or down. Unless you have a lot of people coming from overseas to buy, I believe the prices will go down 3 to 5%.”

Singapore’s January private residential sales fell 11% to 1,189 from 1,332 in December, its lowest level in three months, following the new policies.

MORE CURBS

The government may impose more curbs if the market “improves a lot” and prices don’t drop, Kwek said. The developer plans to market 580 homes in the first half.

The decline in home prices may be limited as “continued GDP growth and job creation, coupled with rising inflation exacerbating the negative real interest rate situation, means property remains a compelling investment choice,” Adrian Chua, an analyst at UBS AG, wrote in a report today.

He predicts so-called mass-market home prices to slip 5% to 10% this year. Future measures will focus on the initial purchase stage by “raising the level of equity required upfront,” Chua said.

CapitaLand, Singapore’s biggest property developer, said this week it plans to put 1,700 homes on sale in the city- state this year. The government’s steps have “subdued the market and caused overall sentiment to dip,” it said, though it expects home sales to remain healthy.

Allgreen Properties, the developer controlled by Malaysian billionaire Robert Kuok, said today it sold a record 16,292 homes last year.

TRANSACTIONS TO DROP

“Whist the longer-term impact of the January 2011 measures remains to be seen, what is clear is that the number of transactions for the first quarter will likely drop,” Allgreen said in an exchange statement today. “Given that there is still genuine demand for housing, current prices may well hold.”

City Developments rose 2.1% to close at $10.92 in Singapore trading. The stock lost 13% this year, twice the 6.8% retreat in the Singapore benchmark Straits Times Index.

City Developments said today fourth-quarter profit climbed 41% to $249.2 million, or 26.1 cents per share, from $176.7 million, or 18.3 cents, a year earlier. Quarterly sales fell 25% to $691 million.

Full-year profit increased 26% to $749 million from $593.4 million a year earlier, beating the $686 million average estimate of 24 analysts surveyed by Bloomberg.

The company, which relied on New Zealand for 7% of its 2010 hotel revenue, said effects from halted operations in Christchurch following this week’s earthquake were “negligible.” Its unit Millennium & Copthorne Hotels New Zealand evacuated its employees and guests after the country’s deadliest quake in 80 years.

City Developments also said it’s not averse to new partners for its South Beach development, a downtown Singapore hotel, office, residential and retail project of which it hopes to own at least 50%, Chairman Kwek said. Its partners include Dubai World and El-Ad Properties.

Stocks sink for second day as oil hits $100

By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET

By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET

NEW YORK (CNNMoney) -- Stocks declined for a second straight session Wednesday as oil prices surged to briefly cross the $100 per barrel mark amid mounting turmoil in Libya.

The Dow Jones industrial average (INDU) fell 107 points, or 0.9%, a day after the blue-chip index plunged nearly 180 points. That was the first back-to-back triple-digit drop for the blue-chip index since June.

Meanwhile, the S& P 500 (SPX) slipped 8 points, or 0.6%.

Both indexes were also dragged lower by a 10% tumble in shares of Hewlett-Packard (HPQ, Fortune 500). Late Tuesday, the computer company issued a disappointing outlook and quarterly sales figures.

The Nasdaq (COMP) fell 33 points, or 1.2%, with a 7% decline in shares of Dollar Tree (DLTR, Fortune 500) leading the index lower. HP is not included in the tech-heavy index.

Oil prices continued to climb, jumping more than 4% to $100 a barrel for the first time since October 2008 amid talk of production disruptions. The North African country is the first oil exporting nation to be affected by the unrest sweeping across the Arab world.

While Libya only contributes about 2% of global output, analysts are worried about the violence and chaos spreading to bigger exporting neighbors.

" Investors are watching what's happening across the Middle East, and waiting to see if more dominoes will fall," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

Traders are keeping a particularly close eye on oil-rich Saudi Arabia, where King Abdullah announced a series of measures worth billions of dollars Wednesday in an effort to ward off the kind of revolts that have roiled the region.

World markets: European stocks closed lower. Britain's FTSE 100 fell 1%, the DAX in Germany slid 1.6% and France's CAC 40 edged lower by 0.8%.

Asian markets ended the session mixed. The Hang Seng in Hong Kong declined 0.4% and Japan's Nikkei fell 0.8%, while the Shanghai Composite ticked up 0.2%.

Companies: Shares of CBOE Holdings (CBOE), the parent company of the Chicago Board Options Exchange, jumped almost 2% after Reuters reported that the company is " open to 'strategic transactions" such as a sale or merger with another exchange operator." CBOE declined comment.

Shares of home improvement chain Lowe's (LOW, Fortune 500) declined 1% after the company reported quarterly earnings that beat analysts' expectations.

Economy: A report from the National Association of Realtors showed that existing home sales rose 2.7% to an annual rate of 5.36 million units.

Currencies and bonds: The dollar dropped versus the euro, the British pound and the Japanese yen.

The price on the benchmark 10-year U.S. Treasury fell slightly, with the yield pushing up to 3.49% from Tuesday yield of 3.46%.

Feb. 23, 2011, 11:18 a.m. EST

Oil futures extend gains amid unrest

Brent crude flirts with $110 a barrel WTI at best in 28 months

SAN FRANCISCO (MarketWatch) — Crude-oil futures pushed towards $100 a barrel Wednesday, buoyed by concerns that civil strife roiling Libya and antigovernment protests in other parts of the Mideast and North Africa could result in the disruption of oil supplies.

Light sweet crude for April delivery (CLJ11 98.11, +2.69, +2.82%), the new benchmark contract, gained $2.47, or 2.6%, to $97.90 a barrel on the New York Mercantile Exchange. A close around these levels would be oil’s highest since Oct. 1, 2008.

The contract surged more than 6% in New York on Tuesday, while the March contract, which expired Tuesday, jumped 8.6%.Brent crude, the benchmark European oil contract, also picked up steam. Brent for April delivery advanced $4.09, or 3.9%, to $109.87 a barrel on the ICE Futures exchange in London......

Stocks: Worst drop of the year amid Libya turmoil

By Hibah Yousuf, staff reporterFebruary 22, 2011: 4:42 PM ET

By Hibah Yousuf, staff reporterFebruary 22, 2011: 4:42 PM ET

NEW YORK (CNNMoney) -- Libya's escalating political crisis sparked a sharp sell-off in U.S. stocks Tuesday, with the three major indexes posting their biggest one-day drops of the year, as oil prices continued to skyrocket.

Ongoing weakness in the housing market also added pressure after a report showed that national home prices fell 4.1% during the fourth quarter of 2010.

The Dow Jones industrial average (INDU) sank 178 points, or 1.4%. That was its worst decline since November. Wal-Mart (WMT, Fortune 500) was one of the biggest losers on the Dow, with shares down 3% after the retailer reported disappointing U.S. sales figures.

The S& P 500 (SPX) dropped 28 points, or 2.1%, and the tech-heavy Nasdaq (COMP) shed 78 points, or 2.7%. Those were the biggest drops since August for both indexes.

The CBOE volatility index (VIX), which is known as the VIX and is used to gauge fear in the market,jumped almost 30% Tuesday.

Market strategists seem to agree that the market is due for a short-term pullback given its steady rise since late August, and the spike in oil prices may be the catalyst to trigger that retreat.

Libya and oil: Oil prices spiked 6% Tuesday to settle at $95.42 a barrel as the trouble in Libya entered an eighth day. Earlier, oil prices came within $2 of $100 a barrel.

The turmoil in North Africa and the Middle East has roiled world financial markets, with stocks sinking across Asia and markets in Europe under pressure.

" We're facing a fear of the unknown," said Michael Sheldon, chief market strategist at RDM Financial Group. " Investors don't know how serious the political upheaval will become, or how high oil prices may end up going over the next several weeks."

The political strife in Libya is part of a chain of uprisings that started this year in Tunisia and spread to Egypt, where protesters deposed Hosni Mubarak earlier this month.

Until Libya, the movement in the Middle East had not impacted a major exporter of crude. Now, investors are concerned that the unrest could disrupt the flow of oil from other key producing countries.

World markets: European stocks fell on the ongoing concerns about Libya. Britain's FTSE 100 fell 0.3%, France's CAC 40 dropped 1.2% and the DAX in Germany lost 0.1%.

Asian markets ended sharply lower. The Shanghai Composite plunged 2.6%, the Hang Seng in Hong Kong tumbled 2.1% and Japan's Nikkei sank 1.8%.

Late Monday, Moody's changed its outlook on Japan's bond rating to negative. The credit ratings agency cited difficulties facing the government and dimming prospects to stem the country's rising debt burden, according to reports.

Economy: Consumer confidence, as measured by the Conference Board's monthly index, rose to a 3-year high in February.

Companies: Shares of Hewlett-Packard Co. (HPQ, Fortune 500) tumbled more than 6% in after-hours trading. The company reported a quarterly profit that rose from year-ago results and soundly beat Wall Street's forecasts. But the company's overall sales and outlook still disappointed.

Shares of Mentor Graphics (MENT) jumped 6.5% after billionaire investor Carl Icahn offered to buy the company for $17 per share, according to a letter obtained by the Wall Street Journal. The stock closed Friday at $14.52 per share.

Chesapeake Energy (CHK, Fortune 500) was up 5.2% after Australian resources company BHP Billiton (BHP) announced plans to buy Chesapeake's shale assets in Arkansas for $4.75 billion.

Shares of Barnes & Noble (BKS, Fortune 500) fell 14.4% after the bookstore suspended its quarterly dividend of 25 cents per share. Barnes & Noble also said it has decided not to issue sales or earnings guidance for the remainder of the year due to the unknown impact of Borders Group's bankruptcy filing.

Currencies and Bonds: The dollar rose against the euro and the British pound, but was weaker versus the Japanese yen.

The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.46% from 3.62% late Friday.

-- The CNN Wire contributed to this report.

Reading Between The Lines Of President Obama's Budget

In a recent column, I argued that the president’s budget, which was released on Feb. 14, doesn’t deserve the attention it gets since Congress always starts from scratch anyway and mostly ignores every president’s proposal. But this does not mean that the budget document is worthless.

On the contrary, it is an extremely valuable compendium of data and analysis on a wide range of fiscal, economic and social issues.

The physical budget is a large document that is quite expensive if one wants to buy a printed copy. Fortunately, it is available online for free. Many of the tables are even available in spreadsheet form for those who want to do their own analyses.

The budget itself is relatively short and lays out the president’s proposals in broad form. The nitty-gritty details are in the appendix, a huge document with information on every department, agency and line item that Congress must appropriate funds for.

The two budget documents I use most often are the historical tables, because many aspects of the budget cannot be comprehended without looking at trends, and the analytical perspectives volume, which contains a great deal of interesting analysis on a variety of budget-related topics.

One chapter I always read in the analytical perspectives volume is the one on long-term budget trends. It makes clear that Medicare, Medicaid and Social Security are the principal drivers of spending. Spending on these three programs is expected to rise by 3 percentage points of the gross domestic product (GDP) by the year 2030 and consume 60 percent of non-interest spending. The main driver is the aging of the population, as the giant baby boom generation retires. The fact that health spending has long been rising faster than the rate of growth of the economy is also important.

The long-term trends chapter also makes the point that insofar as we are concerned about the debt and deficits, the government’s revenue-raising capacity is also a critical factor. Although Republicans simply deny that tax cuts have any effect on the deficit, anyone with a modicum of common sense knows that this is ridiculous.

According to the historical tables, federal revenues will only consume 14.4 percent of GDP this year – the lowest percentage since 1950. The postwar average is about 18.5 percent and there were many very prosperous years when revenues were considerably higher. In the late 1990s, they averaged more than 20 percent of GDP, which was a key reason why we ran budget surpluses.

The budget somewhat implausibly assumes that the ineffective Bush tax cuts will finally be allowed to expire at the end of 2012, as they are scheduled to do under current law. This causes revenues to raise to 17.9 percent of GDP in 2013, 18.7 percent in 2014, 19.1 percent in 2016, and 19.3 percent in 2016. In the long run, the budget assumes that revenues will remain at about 20 percent of GDP, even though total government spending will continue to rise to more than a third of GDP by 2080.

For revenues to be allowed to rise this substantially in such a short period of time will require President Obama to renounce his pledge never to raise taxes on those with incomes below $250,000 essentially campaign on allowing the tax cuts to expire on schedule, and still get re-elected in 2012. Those are three really big “ifs.” We can assume that the Republican nominee will insist not just on permanent extension of the tax cuts, but on still more big tax cuts on top of those, while continuing to insist that tax cuts have nothing to do with the deficit, which is terrible and must be reduced.

The budget makes the important point that tax reform is necessary to ensure that the government’s revenue-raising capacity is adequate to fund the health and retirement benefits that people expect. Economists know how to design a tax code that can raise more revenue without increasing the economic burden of taxation. That is because some taxes impose a greater economic burden, which economists call the deadweight cost of taxation, than others. Thus tax reform has the potential to increase revenues while stimulating growth at the same time.

This brings me to a chapter entitled, “Interactions Between the Economy and the Budget.” It’s useful because it allows anyone to forecast budget trends based on their knowledge of things like inflation, interest rates, and real growth in the economy. Thus we see that if inflation is one percentage point higher than forecast every year for the next 10 years, it will cause federals spending to rise by a total of $1.4 trillion over that period. But revenues will rise by $2.8 trillion, thus reducing projected deficits.

Many conservative economists, like Larry Kudlow, continually claim that faster growth is all we need to get out from under our debt problem. The budget tells us that if real GDP grows 1 percentage point faster over the next 10 years then federal receipts will cumulatively be $2.9 trillion higher and spending will be $349 billion lower, for a total budget improvement of $3.2 trillion. That would obviously help a lot. But with the debt expected to rise by more than $8 trillion over the next 10 years even with a fairly sharp rise in revenues, the economy would essentially have to grow twice as fast as its historical trend to keep the debt from rising.

Furthermore, for faster growth to reduce the deficit it would have to arise immaculately, so to speak, and not through enactment of further tax cuts, because that would take away the higher revenues that are the principal reason why faster growth improves federal finances. Moreover, getting a significant, sustained rise in real GDP growth is very, very hard to do. In short, the idea that all we have to do is enact still more tax cuts and that this will automatically raise growth, which will make the deficit evaporate, is rank nonsense.

Moving on, I always like to look at the chapter on federal borrowing and debt. One of the points it makes is that the debt limit applies to what’s called the gross federal debt, which includes Treasury securities held by the Social Security trust fund and other government trust funds. These balances will continue to rise even if the federal budget were balanced, meaning that the debt limit would still have to rise from time to time. This is among the reasons why refusing to raise the debt limit, as many Republicans insist they will never do, is really dumb.

This chapter also makes the important point that the federal government does a lot of borrowing that is unrelated to the budget. Government-sponsored enterprises, such as Fannie Mae and Freddie Mac, the big housing agencies, do a lot of borrowing to maintain liquidity in the mortgage market. There are also loan guarantees for student loans and a variety of other purposes.

Finally, this chapter presents data on domestic and foreign holding of Treasury securities. It shows that 40 years ago, almost all of the national debt was owed to Americans we literally owed it to ourselves. But now, close to half the debt held by the public is owed to foreigners, primarily the Chinese, Japanese, and British. In many cases, however, these debts are not held by private individuals, but by foreign central banks, which use dollars as backing for their own currencies.

The budget also contains a chapter on federal regulation because the Office of Management and Budget, which compiles the budget, oversees federal regulatory policy. One of the things OMB strives to do is ensure that regulations meet a cost-benefit test. If at all possible, the benefits should exceed the costs.

Of course, conservatives routinely deny that there are any benefits whatsoever to federal regulation they simply impose unnecessary costs. However, it is obvious that many health and safety regulations confer enormous benefits, and we also know from experience that corporate America often cuts corners in pursuit of profits. Consequently, there are many cases where the benefits of a regulation exceed the costs.

Lastly, the budget contains a chapter on social indicators, a laundry list of various statistics that tell us how well we are going as a society in improving living conditions. Many of these indicators, such as the unemployment rate and real median family income, are fairly well known. Others are more obscure.

For example, we see that the share of total income going to the lower 60 percent of households has fallen from 32.3 percent in 1970 to 26.6 percent in 2009. At the same time, the share going to just the top one percent of taxpayers has risen from 7.8 percent in 1970 to 17.7 percent in 2008. Obviously, if the benefits of growth are not widely shared and are going disproportionately to the well-to-do, it’s something people ought to care about.

We also see that air pollution has fallen sharply over the last 30 years according to a variety of indicators in the budget, energy consumption and greenhouse gas emissions per capita are trending downward, infant mortality has fallen from 26 per 1000 live births in 1960 to 6.6 in 2008, life expectancy at birth has risen from 69.7 years in 1960 to 77.8 in 2008, the percentage of the population that smokes has fallen from 37.4 percent in 1970 to 20.6 percent in 2009, the violent crime rate has fallen from almost 5 percent to just 1.7 percent in 2009, and so on.

There are, of course, many other things in the budget document worth calling attention to. The point I would like to leave is that the budget is much more than just some proposals relating to taxes and spending it’s a resource that tells us a great deal about how the government operates and its impact on society. Sometimes that impact is for ill, but often for the good. Those looking for good ammunition to counter the relentless disparagement of government that comes from Republican politicians and right-wing think tanks can find it here.

This article originally appeared at The Fiscal Times.

Australia's Largest Ship Launched

By CHRISTOPHER P. CAVAS

Published: 18 Feb 2011 16:40

The largest ship ever to be built for the Australian Navy took to the water for the first time Feb. 17 on the north coast of Spain.

The Canberra is the first of two 25,000-ton assault ships being built for Australia in Spain. (Royal Australian Navy)

The launch of the future HMAS Canberra took place at the Navantia dockyards in Ferrol, Spain. The 25,000-ton amphibious assault ship - a Landing Helicopter Dock or LHD in Navy parlance - will be towed to Williamstown, Australia, for completion at the Tenix shipyard, and is planned to enter service in 2014.

Vice Adm. Russ Crane, the chief of Navy, was on hand for the event, along with dozens of children of Australian diplomats waving Australian flags, according to an Australian Navy news release.

" We are well progressed in our planning for the LHD arrival," Crane said. " For now, this project is on time and on budget."

A second ship, the Adelaide, is also under construction at Ferrol, and is to be commissioned in 2015. Both ships will be based at Garden Island, Sydney, and be crewed from all three services.

A similar ship, the Juan Carlos I, was commissioned in September into the Spanish Navy.

Taiwan Makes Case, Again, For U.S. Fighter Jets

AGENCE FRANCE-PRESSE

Published: 17 Feb 2011 18:06

WASHINGTON - Taiwanese President Ma Ying-jeou on Feb. 17 renewed his call for the United States to sell fighter jets to the island, arguing its survival was at stake despite his outreach to China.

Taiwan " is a sovereign state we must have our national defense," Ma, who often plays down suggestions of the island's separate identity, said in an interview with The Washington Post.

" While we negotiate with the mainland, we hope to carry out such talks with sufficient self-defense capabilities and not negotiate out of fear."

Relations between the China and Taiwan have improved markedly since Ma took office in 2008. But Taiwan fears that the military balance is shifting toward a rapidly growing China, which recently rolled out a stealth fighter jet.

" We oppose the use of military force to resolve cross-strait disputes. However, this is not to say that we cannot maintain a military capability necessary for Taiwan's security," Ma said.

The United States last year approved a $46.4 billion weapons package for Taiwan including Patriot missiles, Black Hawk helicopters, and equipment for Taiwan's F-16 fighter jets, but no submarines or new fighter jets.

China considers Taiwan, where the mainland's defeated nationalists fled in 1949, to be a province awaiting reunification, by force if necessary. Ma last year reached a sweeping trade pact with China, seen as a milestone in ties.

Ma, whose Beijing-friendly policies have sometimes been controversial at home, defended his record on human rights which he said were a " core value" for Taiwan.

Ma noted that he has marked China's 1989 crackdown on the Tiananmen Square democracy protests and urged Beijing to release Nobel Prize-winning dissident Liu Xiaobo.

" Naturally, we hope that the mainland as it interacts with us can gradually become free and democratic," Ma said, while acknowledging that " this is not an easy task."

But Ma also pointed to comments by Chinese President Hu Jintao and Premier Wen Jiabao on political reforms, saying: " They have even on many occasions talked of democracy, saying that democracy is a very good system."

" We are naturally delighted to see this," Ma said.