OSK DMG also recommend to Buy, with TP $0.35

Today reached a high of 0.29, hope it can hit the 0.30 soon. Holding significant lots of it.

DBS super promoting this stock.. time to sell into strength..so many analysts upgrading TP

Nam Cheong announced another round of vessel sales worth

US$70.5m for 2 PSVs and 1 accommodation work barge

(AWB) to be delivered between 1Q14-4Q14. The AWB was

sold to a subsidiary of Malaysian contractor Perdana

Petroleum, a repeat customer who had earlier bought 2

similar vessels in April 2013. 1 of the PSVs were sold to an

existing Asian customer, who had earlier bought 4 PSVs in

May 2013, and the other PSV was bought by new customer

EDT Offshore, a specialist OSV operator based in Cyprus. Nam

Cheong is well on track to achieve its sales target of 19

vessels in FY13 and 25 in FY14. Orderbook now stands at

about RM1.5bn. This underpins robust net profit CAGR of

20% for the Group in FY13/14. Maintain BUY with TP of

S$0.36. Expect further near term catalysts from a strong

showing in 2Q13.

analysts reports are out..time to sell into strength..

Nam Cheong Limited (NCL SP) BUY

Price/Tgt: S$0.275/S$0.34 Mkt Cap: US$458.1m 3-mth daily volume: US$1.9m 1-Yr Hi/Lo: S$0.295/0.176

Scores with US$70m Sale of 3 Vessels

Analysts: Tan Jun Da / Nancy Wei Tel: (65) 6590 6616/6628

What’s New?

· Sold 2 PSVs and 1 accommodation work barge. Nam Cheong has sold 2 platform supply vessels (PSVs) and 1 accommodation barge worth a total of US$70.5m. One of the PSVs was sold to an existing customer who bought four PSVs from Nam Cheong in May 13, while the other PSV was sold to a subsidiary of EDT Offshore, a new customer in Cyprus. The accommodation work barge was sold to a subsidiary of Perdana Petroleum.

· Strong orderbook underpins earnings visibility. With these contract wins, Nam Cheong’s orderbook stands at RM1.5b, providing strong earnings visibility for the next three years.

· Surpassed record vessel sales in 2012. Ytd, Nam Cheong has sold 16 build-to-stock vessels worth US$311.6m, exceeding the US$293.2m worth of vessel sales in 2012 (excluding 4 build-to-order multi-purpose PSVs worth US$130m, to be recognized from 2013-15).

Our Take

· Brisk PSV sales mitigate oversupply concerns. Ytd, Nam Cheong has already sold 11 of its 18 PSVs under its 2013 and 2014 shipbuilding programme, easing concerns that its build-to-stock PSVs may be hit by a potential oversupply. Recently, there have been concerns that vessel class may have been over-built. Management is cognizant of potential PSV oversupply concerns but pointed out that the supply glut will mainly affect the large 5,000dwt and multi-purpose PSVs, which Nam Cheong has limited exposure to.

· Beneficiary of Petronas’ aggressive capex scheme. We continue to like Nam Cheong for its leadership in a high barrier-to-entry Malaysian market (50-75% market share), which will experience a structural ramp-up in E& P spending on the back of Petronas’ aggressive capex plan. Under this scheme, the national oil company will invest RM50b-55b annually over the next five years, 35-50% higher than the 5-year average for 2007-11.

Valuation/ Recommendation

· Maintain BUY. Our target price of S$0.34 is based on 9.7x FY14F PE (2014F EPS: 8.8 sen or 3.5 S cents). Our target PE is 1.3SD above peers’ long-term PE mean of 7.0x, which we think is justified given Nam Cheong’s dominant 50-75% market share in a high barrier-to-entry market.

ozone2002 ( Date: 24-Jul-2013 09:12) Posted:

|

high vol today on the gd news.. good chance to sell on news..gd luck dyodd

Last:0.285 Vol:9257k

+0.01

+0.01

diam diam cheong! :)

one risk that nam cheong has is they pre build before orders come in..

so they may get stuck with lot of inventories if orders do no come flowing in..

but for now seems like orders are streaming in..

gd luck dyodd

jiejie ( Date: 23-Jul-2013 19:16) Posted:

|

Guess the company will reach sale number of about 28 vessels this year.

Will the stock go up tmr?

Second PSV sold to a new customer in Cyprus,EDT Offshore, a well establishedoffshore marine services company

DBS advocating this stock which in my opinion is an undervalued gem based on the fundamentals

DBS TP is $0.36

Last:0.28 Vol:1186k -

gd luck dyodd

CHIONG AH 28c!!!! :) up 5 % today..

let's go..nam cheong cheong cheong

gd luck dyodd

Shipyard in insurer’s clothing

Using Chinese yards to support its build-to-stock business model, Nam Cheong is like an insurer, underwriting customers’ construction and market risks. For the risks it takes on, Nam Cheong enjoys high vessel sales as well as superior profitability and returns vs. Singapore peers.

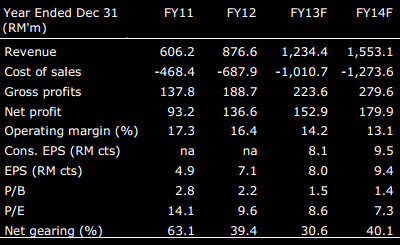

Given Malaysian E& P spend and a raising OSV market, we project a 3-year EPS CAGR of 15%. The group has bolstered its balance sheet and its newbuild programme is backed by long-term debt. Hence, liquidity risks are mitigated if the OSV market plunges. We initiate Nam Cheong with an Outperform and target P/E of 8x CY14 (15% premium to peers’ average). Potential catalysts are stronger-than-expected vessel sales and earnings beat.

Malaysia’s largest OSV builder

By turnover, Nam Cheong is Malaysia’s largest offshore support vessel (OSV) builder. The group has over 20 years of track record in building OSVs and has delivered over 80 vessels since 2007. Using Chinese yards to support its build-to-stock business model, Nam Cheong has achieved a 3-year average gross margin of 19% vs. Singapore peers’ 9%. In terms of ROE, it achieved a 3-year average of 30% vs. Singapore peers’ 7%. Although build-to-stock is not unique to Nam Cheong in Malaysia, the company stands out with its close relationships with Malaysian OSV owners.

Rosy outlook

Malaysia’s Petronas has budgeted RM300bn (US$100bn) in E& P spend over 2012-17, up 70% from the previous five years, to arrest a production decline and boost reserves. Initiatives such as marginal and deepwater field developments as well as enhanced oil recovery mean more work for the Malaysian OSV sector. Given the improving OSV market, Nam Cheong has launched its most ambitious newbuild programme to date, which should propel earnings growth.

Still cheap vs. peers

Although its share price surged 96% in 2012, Nam Cheong trades at 6x CY14 P/E on a 3-year EPS CAGR of 15%. Singapore OSV builders are trading at 7x on flat earnings. Also, our cross-sectional P/BV to ROE regression analysis shows that the stock is relatively undervalued.

Nam Cheong

COMPANY NOTE

NCL SP / NMCG.SI

Current

S$0.27

SHORT TERM (3 MTH)

LONG TERM

Market Cap

Avg Daily Turnover

Free Float

Target

S$0.35

US$446.4m

US$1.98m

49.7%

Prev. Target

N/A

S$567.8m

S$2.48m

2,103 m shares

Up/Downside

28.2%

Conviction|

|

truly a gd analyst..buying into nam cheong.. gd luck dyodd

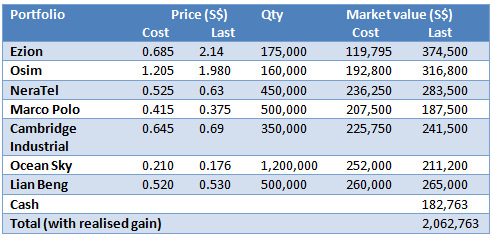

| Terence Wong: " Am selling OCEAN SKY, MARCO POLO buying NAM CHEONG" |

|

Excerpts from report today byTerence Wong, co-head of research at OSK-DMG

Terence Wong, CFA. MY MODEL portfolio came off by 0.9% WoW (week-on-week), which was slightly better than STI’s 1.2% decline. Terence Wong, CFA. MY MODEL portfolio came off by 0.9% WoW (week-on-week), which was slightly better than STI’s 1.2% decline.The poor showing was due largely to the possibility of a premature tapering of the QE by the Fed. I will be making a few changes to my portfolio: > Ocean Sky (Sell 1.2m shares at SGD0.176). The dividends that I have been waiting for has finally been dished out – SGD0.024 in all.

When I bought into the stock, I thought that the mouth-watering yields of over 10% would have been a big draw. But investors thought otherwise. After taking into account the dividend collected, I will have made no gains with this investment. > Switching out from Marco Polo Marine (Sell 500k shares at SGD0.375) into Nam Cheong (Buy 750k shares at SGD0.265).

Marco Polo was another disappointment. Given the improvement in charter rates and the implementation of the Indonesian cabotage law, I would have expected more from the shipcharterer/builder. Fundamentals still remain sound, but I believe Malaysia-based ship-builder Nam Cheong will likely outperform on the back of strong orders from national oil company Petronas.  |

check out DBS target price for this stock.. gd luck dyodd

Stock Picks – Small /Mid Cap

Rec’n Price ($)

14 Jun

Target Price

($)

Nam Cheong Buy 0.275 0.36

ozone2002 ( Date: 18-May-2013 10:33) Posted:

|

aputako ( Date: 04-Jun-2013 13:47) Posted:

|

OCBC Investment Research raises fair value of Nam Cheong to 35 cents.

Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period.

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period. We believe this will likely result in increased investments across the Malaysian offshore oil & gas industry.

Already, Nam Cheong is seeing a healthy pick-up in order wins (FY11: 13 vessels FY12: 21 vessels) and it has recently expanded its shipbuilding programme to 28 vessels for FY14F (FY13: 19 vessels).

Its large order-book of RM1.3b, for 26 vessels delivered over FY13-15F, helps to mitigate its risk by providing a base level of earnings.

Given the strong growth profile, we find current valuation (FY13F PER of 8.6x) attractive.

We now raise our FV to S$0.35 (previously S$0.30) on a higher PER of 11x. Maintain BUY.