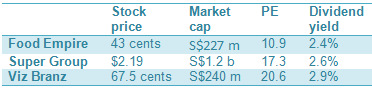

Super 's PE has to come down sharply, or Food Empire's stock price has to go up sharply to close the valuation gap.

nice rally yesterday

FOOD EMPIRE: Stock price up on F& B sector re-rating

Photos by Sim Kih

FOOD EMPIRE shares gained 9.9% yesterday to close at 50 cents after the company did a corporate presentation to over 100 remisiers and dealers at Phillip Securities' office in Raffles City on Monday evening.

The stock was also buoyed by an upturn in investor sentiment towards the F& B sector, with several F& B stocks such as Yeo Hiap Seng and Petra Foods rising yesterday.

Food Empire's executive chairman, Tan Wang Cheow, was asked about the falling cost of raw materials that Food Empire uses to produce its key products, especially 3-in-1 coffee.

In particular, there has been a lot of news recently about crude palm oil prices having corrected sharply throughout this year, leading to a selldown in the shares of palm oil companies such as Wilmar and Golden Agri Resources.

Palm oil is used in the making of non-diary creamer for 3-in-1 coffee. Would it follow that creamer costs have come down for Food Empire?

Mr Tan began by saying that in the last 1-2 years, prices of raw materials hit high levels but have come down since.

L-R: Food Empire executive chairman Tan Wang Cheow Brand Manager Bruce Chin.

Sugar at its peak in 2008/2009 was trading at almost US$900 per tonne. Today, Food Empire is buying it at roughly US$630 per tonne, said Mr Tan.

As for creamer, Food Empire bought at the US$1.80 per kg level in the past two years. Now, it's US$1.50-1.60.

As for coffee beans, prices too have come down.

However, for freeze dried coffee, which is premium instant coffee, the price has not come down as significantly.

" At the high, we paid close to US$10 per kg. Today we are buying at slightly over US$9."

Mr Tan added: " All the savings will add to our profit margins -- as long as we can maintain the selling price of our products."

He cautioned that coffee, sugar and creamer are only one factor in the cost of production. There are also packing materials whose cost is linked to crude oil prices.

And there are other factors (which affect the suppliers of sugar, creamer and coffee) such as labour cost and energy cost, and these are all going up, said Mr Tan.

And with QE3 coming on stream, " we are not sure how it will affect commodity prices."

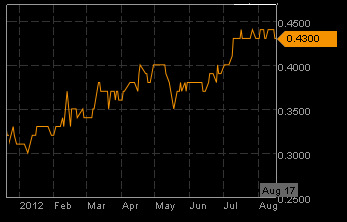

Food Empire stock (50 cents) has gained 58.7% in the year to date. Chart: FT.com

In that case, does Food Empire do hedging?

Mr Tan replied that hedging is a double-edged sword, citing the example of a company that suffered massively after its hedging on the price of oil went awry.

" We make judgemental calls on the market. We watch how prices are moving -- when they come down within a trading range, we will buy and stock up.

" When prices go up, we hold back and use up our stock."

If prices continue to go up, as happened in 2007, for example, Food Empire would have to pass part of the increase to the consumer. " It's unfortunate but the whole market will also have to do it," said Mr Tan.

Question: What is Food Empire's gross margin?

Answer: It depends on the market where the products are sold but it ranges between 35-50%.

Source: Bloomberg

Food Empire has had a good year so far. In 1H2012, its net profit rose 25.8% to US$8.8 million.

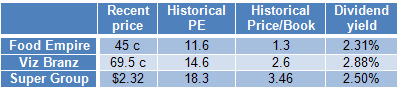

Its stock price has gone up 58.7% but is still cheaper than its peers Super Coffeemix and Viz Branz in terms of price/earnings (see table)

I am looking closely at ETIKA, a multiple foods processing company. Its foundamental was better than all of THREE companies. Current price of 20c is a good buy to me.

ozone2002:

Isn't Super better than Food Empire?

Isn't Super better than Food Empire?

|

gd biz, market leader in russia, undervalued relative to peers and most important neglected by investors.. FOOD EMPIRE: Net profit up 25% to US$8.7 m in 1H2012 |

Written by Sim Kih

Thursday, 23 August 2012 07:10

Food Empire's successful marketing campaigns has made its flagship MacCoffee Russia's no.1 brand for 3-in-1 instant coffeemix.

Food Empire stock has risen steadily this year. Chart: Bloomberg SUPER GROUP has done superbly, its shares rising from $1.29 at the start of this year to $2.19 this week. Now, consider another instant coffee player listed on the Singapore Exchange -- Food Empire. Its stock started the year at 31 cents and ended last week at 43 cents. We checked out its story, and found things to like about it. Its revenue for the first half year was US$110.7 million, an increase of 3.4% year on year. Profit after tax jumped 24.6% to US$8.7 million on improved margins and a tax write back. The improved margins arose from decreases in the prices of the raw materials it used for its coffee products - coffee, sugar and creamer. Unlike Super Group which focuses on markets such as Singapore and the region, Food Empire is big on Russia, where its sales stood at US$64.9 million in 1H. Food Empire's other key markets are Eastern Europe and Central Asia (comprising Ukraine, Kazakhstan and the CIS Countries) where sales rose by 4.4% to US$33.1 million Historically, people in Russia, Middle East, China and India have not consumed vast quantities of coffee. But in the recent decade, coffee cultures have been developing in these regions at rates that beat economic growth. For example, Chinaís annual coffee consumption is growing rapidly at around 15% a year. Coffee drinking is still at an infancy stage in China, where per-capita consumption is about 3 cups a year, versus 3.5 cups a day in the US. Which is why Food Empire wants to penetrate the Chinese and India market. Last month, it incorporated subsidiaries in China and India to bring its products into China and to manufacture instant coffee in India. Right place right time

Founder Tan Wang Cheow has been featured in Forbes magazine.

Food empire founder Tan Wang Cheow did not start out in F& B, but was exporting personal computers and related peripherals to Eastern Europe and Central Asia in the late eighties. Some of these countries had freezing winters with temperates dropping below 30 degrees Celcius. People drank Vodka and bought hot coffee beverages from street side stalls to keep warm. He decided to provide a convenient solution to help people keep warm and the group started distributing third party brands of 3-in-1 instant coffee in Kazakhstan and Russia in 1993. When Soviet Union disbanded in 1991, Mr Tanís F& B products sold like hot cakes to pent-up demand for all manner of capitalist goods. About 57% of Group revenue in FY2011 was from Russia, where its flagship MacCoffee has been consistently ranked as the leading 3-in-1 coffeemix brand.

William Fong, CFO of Food Empire.

Other than Russia, MacCoffee is also the no.1 coffee brand in Ukraine and Kazakhstan. Food Empire products are exported to over 60 countries, especially Central Asia and the Middle East. It markets over 400 types of products under its proprietary brands, which also include MacChocolate, MacTea, FesAroma, MacCandy, Zinties, Melosa, Petrovskaya Sloboda, Klassno, OrienBites and Kracks. Like everyone else, Food Empire wants a piece of the China pie, but its F& B market is known to be the toughest in the whole world. Singapore F& B players have a track record of success there.

Food Empire looks relatively undervalued. Bloomberg data Viz Branz, which owns Gold Roast, BenCafe, Cafť 21, CappaRoma and Jaffa Juice, derives half of group revenue from China. In FY2011, its sales from China grew 10.5% year-on-year to reach S$83.4 million. Super, Southeast Asia's leading 3-in-1 coffeemix player, has also made headway in China with non-diary creamer ingredient sales. Its brands include Super, Cafť Nova, Super Power, Owl, Yť Yť, Coffee King, Gold Eagle, Negresco, Eagle King, Liang Bao and Superkids. Food Empire has been very successful employing sophisticated brand-building activities, after the style of the world's top brands. It is so good at marketing that in spite of the runaway success of its own brand, 18.6% its FY2011 revenue was from marketing and packaging services for third party brands. The company invests in creative advertisements and promotions, as well as sponsorships to ensure high brand cognition when consumers shop. The question is, will it be able to export its successful branding and marketing campaigns to new markets like China and India? |

The management should look into the raw materials and comsumable use,coz it ate up alot of profits no doubt increasing of revenue even by 31%..If local supergroup of coffeemix can do it,why i can't see Mr food empire dun't....hope u can do it.

Mainboard-listed Food Empire Holdings, the international company in the food and beverage sector, says profit after tax increased to US$13.7 million ($17.4 million) in 2010 from US$2.7 million in 2009, an increase of 413%.

Sales grew in all the groupís key regions resulting in a 30.4% increase in full-year revenue. Revenue rose to US$175.8 million in 2010 from US$134.8 million in 2009.

Russia, the groupís largest market, was the best performer with full year revenue of US$100.5 million in 2010 compared to US$68.2 million last year, an increase of 47.5%.

Sales to Eastern Europe and Central Asia rose by 12.2% in 2010 to US$55.2 million, while other markets rose by 15.0%, to US$20.1 million.

Food Empire says it was also pleased with the performance of its Petrovskaya Sloboda brand, acquired in 2007, which contributed 10.7% to the groupís revenue in 2010.

Sales grew in all the groupís key regions resulting in a 30.4% increase in full-year revenue. Revenue rose to US$175.8 million in 2010 from US$134.8 million in 2009.

Russia, the groupís largest market, was the best performer with full year revenue of US$100.5 million in 2010 compared to US$68.2 million last year, an increase of 47.5%.

Sales to Eastern Europe and Central Asia rose by 12.2% in 2010 to US$55.2 million, while other markets rose by 15.0%, to US$20.1 million.

Food Empire says it was also pleased with the performance of its Petrovskaya Sloboda brand, acquired in 2007, which contributed 10.7% to the groupís revenue in 2010.

Hot stock |

/kim eng/- i read i post

Think 1st quarter results going to be out in this week or so.Probably will move abit due to better results compare to last year.I have confidence in u baby although u have a setback last year.Cheers...Mr Food Empire.

The company has declared a special dividend of 0.0078cents on Mar 3.From my point of view the management already knew the past Jan and Feb earnings which is good or not bad compared to last year 1st quarter.Since they have the confidence to and willing pay out special dividend,i don't think there is trouble ahead for her.Infact i will wait patiencely for her to turnaround and watch her perform as the past few years since listing.

Paying S$0.335 for S$0.320

is GREAT MOTIVATION

Extremely HARD to find such MOTIVATOR

knightrider ( Date: 29-Jan-2010 14:53) Posted:

|

Don't worry everyone,food empire will not disappoint us,coz she will definitely turn around with good results in 1st quarter as about in may...Quite a hidden gems but must have patience,with patience there will be good rewards.

Too bad, I hold this stock too.

simbao66 ( Date: 23-Mar-2010 13:28) Posted:

|

After suffering from cold and cough,hope she return back to normal and may perform well in the future.She will by all means continue expand and properous as the years goes by.

sad case, on forbes list before. but making big losses being an entreprenuer overseas while local supercoffee still earning profits.

Food Empire is not some food court. It is a coffee market and European food distributor. It makes Russia's most popular coffee - Mac Coffee. Its business is primarily in Russia and Eastern Europe. It is been hard hit by the downward pressure in the Roubles.

This counter is been corner la. It must be a great joke, one shareholder exercise the share option of 100 lots at S$0.335. And the market price is just S$0.32. So how eh, trying to convince the market this is a real good counter. Then he should buy more in S$0.32 or push up trend. My own guess.

Hidden gems!!