Blastoff ( Date: 02-Apr-2012 16:28) Posted:

|

Low share-price counters (these not necessarily low capitalization) are not being played by institutions, bank nominees, fund mgr or deep pockets investors.

Really blame sgx for its system. Where in the world do they come up with decimal cents after shares were listed for years? This is to benefit the large corporate shortists. Half a cent (previous bottom) I cannot catch you, now I make it decimal cents see whether I make or not and catch you!~!!! Sickening Bstds.

Blastoff ( Date: 14-Mar-2012 13:29) Posted:

|

About 1.2 billion shares exchanged hands.

Gainers beat losers 275 to 88.

Singapore shares up 0.07% at midday on Monday

Singapore shares was 0.07 per cent higher at 12.40pm on Monday, with the benchmark Straits Times Index at 2965.76, or 2.61 points.

About 663.2 million shares exchanged hands.

Losers beat gainers 158 to 129.

Singapore shares opened higher on Monday, with the benchmark Straits Times Index at 2968.60, up 0.18 per cent, or 5.45 points.

Singapore shares was 0.07 per cent higher at 12.40pm on Monday, with the benchmark Straits Times Index at 2965.76, or 2.61 points.

About 663.2 million shares exchanged hands.

Losers beat gainers 158 to 129.

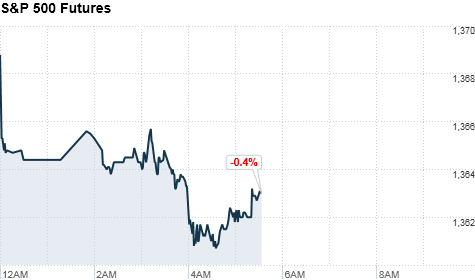

Stocks set to open lower

By CNNMoney staff @CNNMoneyMarkets March 5, 2012: 6:14 AM ETNEW YORK (CNNMoney) -- U.S. stocks were set to open lower Monday, following world markets after China lowered its annual growth target. Investors anticipate a busy week full of news on Greece's rescue package and the domestic labor market.

The Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were all about 0.4% lower ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

World markets were in the red Monday, after Chinese Premier Wen Jiabao set a lower target for China's economic growth, underscoring the need to make the country's breakneck development more sustainable.

The government is aiming for economic growth of 7.5% in 2012, Wen said -- lower than the goal for last year of about 8%. The Chinese economy often exceeds the official objective: last year it grew 9.2%.

On the domestic front, investors will head into the week looking for more evidence of a U.S. recovery under way, while keeping an tabs on developments on Europe's debt crisis.

European leaders inked a pact on Friday aimed at ensuring fiscal discipline across the continent. However, they have yet to make a decision on the size of the " financial firewall" that many believe is necessary if countries like France and Spain face further distress.

Stocks closed modestly lower Friday, with the Dow snapping a three-week winning streak.

World markets: European stocks retreated in morning trading. Britain's FTSE 100 (UKX) lost 0.5%, the DAX (DAX) in Germany dropped 1.1% and France's CAC 40 (CAC40) shed 0.8%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) closed down 0.6%, while the Hang Seng (HSI) in Hong Kong lost 1.4% and Japan's Nikkei (N225) dropped 0.8%.

Economy: Reports are due Monday morning on the services sector and factory orders.

Last week, the ISM Manufacturing Index for February slipped to 52.4, from 54.1 in January. The February edition of the ISM Services Index is expected to come in at 56.0, down from 56.8 in the month prior.

January factory orders are expected to have decreased by 1.9%, according to a survey of analysts by Briefing.com, after ticking up by 1.1% in December.

Coming later in the week are data on consumer credit and the all-important monthly jobs report.

Companies: Online reviews site Yelp (YELP) will look to continue its momentum Monday, after shares spiked 64% to top $24 a share in their debut on the New York Stock Exchange Friday.

Currencies and commodities: The dollar strengthened against British pound, but fell versus the euro and the Japanese yen.

Oil for April delivery slipped 86 cents to $105.84 a barrel.

Gold futures for April delivery fell $11.20 to $1,698.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.98% from 1.99% late Friday.

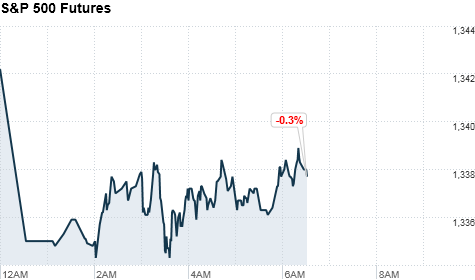

Stocks to decline on Europe worries

By CNNMoney staff @CNNMoneyMarkets February 16, 2012: 7:01 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were poised to open lower Thursday, as nervous investors continue to question whether Greece will secure a second bailout.

Investor sentiment was further dampened after Moody's put 17 global banks and 114 European financial institutions on review for possible downgrades.

The Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures fell between 0.1% and 0.3% ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

Among the global banks possibly affected by Moody's review -- nine are headquartered in Europe, the agency said. Moody's added that Swiss banks Credit Suisse (CS) and UBS (UBS), as well as New York-based Morgan Stanley (MS, Fortune 500), could see their long-term ratings slashed by up to 3 notches.

Meanwhile, uncertainty remains over Greece and its efforts to secure much-needed additional bailout funds. European finance ministersdelayed a decision on the bailout Wednesday, as they continue to evaluate a proposed austerity program from Athens.

Is Japan the next Greece?

The Eurogroup meets again on Monday and indicated it would likely give its approval for the latest economic reform proposal, which Greece needs in order to secure bailout funds and avoid defaulting on a €14.5 billion bond redemption in March.

U.S. stocks closed lower Wednesday, as the euro hit a 1-week low on uncertainty over Greece's debt crisis.

World markets: European stocks were in the red in morning trading. Britain's FTSE 100 (UKX) fell 0.7%, the DAX (DAX) in Germany dropped 1% and France's CAC 40 (CAC40) shed 0.4%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) and the Hang Seng (HSI) in Hong Kong slipped 0.4%, while Japan's Nikkei (N225) edged lower 0.2%.

Economy: Reports due Thursday morning include initial unemployment claims, producer prices and data from the housing market. Investors will look to see whether the economic data offers further signs that the U.S. is on the path to economic recovery, after a number of strong macroeconomic reports in recent weeks.

Initial unemployment claims for the week ended February 11 are expected to total 365,000, according to a survey of analysts by Briefing.com -- up from 358,000 in the week prior.

Housing starts for January are expected to total 671,000, while the Producer Price Index for January is expected to have increased by 0.3%.

Companies: Corporate earnings are on tap from firms including General Motors (GM, Fortune 500), DirecTV (DTV, Fortune 500) and J.M. Smucker (SJM, Fortune 500).

General Motors is expected to post quarterly earnings of 41 cents a share on $38.2 billion in revenue, according to a survey of analysts by Thomson Reuters.

Wanted: Americans for factory jobs

DirecTV is expected to report earnings of 92 cents a share on $7.4 billion in revenue, while J.M. Smucker is projected to post earnings of $1.41 per share on $1.5 billion in revenue.

Currencies and commodities: The dollar was higher against the euro, the British pound and the Japanese yen.

Oil for March delivery slipped 47 cents to $101.33 a barrel.

Gold futures for April delivery fell $8.40 to $1,719.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.92% from 1.93% late Wednesday. ![]()

It all depends loh. If big or very big problem, maybe and if small problem we are ok if our econ has been doing well.

Market is always hidden behind a thick bunch of cloud and you can only see what is behind the cloud after you passed it. Lol

niuyear ( Date: 16-Feb-2012 14:52) Posted:

|

analyst is saying sigapore is not faced with recession. dow future down, got effect bo?

Blastoff ( Date: 16-Feb-2012 14:47) Posted:

|

Singapore trade expands 8% in 2011

Posted: 16 February 2012 0836 hrs

Singapore: Singapore's total external trade rose by 8.0 per cent in 2011, a contrast to the 21 per cent rise seen in the previous year.

The trade growth is within the previously projected range of between 8.0 and 9.0 per cent, said IE SIngapore in its news release Thursday.

Total trade reached S$974 billion in 2011, higher than the previous year's

achievement of S$902 billion.

On a year-on-year basis, Singapore's total trade rose by 7.7 per cent in 4Q

2011, following the previous quarter's increase of 5.4 per cent due to increases in both oil and non-oil trade.

Non-oil domestic exports (NODX) rose by 2.2 per cent in 2011, following the preceding year's increase of 23 per cent, with exports of non-electronic NODX outweighing the decline in electronic NODX.

IE Singapore said the 2.2 per cent NODX figures for 2011 remain within projections of 2.0 to 3.0 per cent growth.

Looking ahead, it said projected total trade and NODX growth in 2012 are both maintained at between 3 and 5 per cent.

For 2011, electronic NODX declined by 13 per cent after an increase of 26 per cent in the previous year, while non-electronic NODX rose by 11 per cent in 2011, slower than the previous year's increase of 21 per cent.

On a year-on-year basis, NODX contracted by 2.7 per cent in 4Q 2011, following thedecline by 1.2 per cent in the previous quarter, on lower shipments of electronic NODX.

S'pore economy grows by 4.9% in 2011

Posted: 16 February 2012 0818 hrs

SINGAPORE: The Ministry of Trade and Industry (MTI) announced on Thursday that the Singapore economy had grown by 4.9 per cent in 2011, after a 14.8 per cent expansion in 2010.

MTI also maintained the growth forecast for 2012 at 1.0 to 3.0 per cent.

The GDP numbers released Thursday have experts and officials agreeing that a recession for Singapore appears less than likely.

" Trade numbers give some hope that we will not slip into recession" said MTI director Thia Jang Ping.

Singapore's real GDP grew by 3.6 per cent on a year-on-year basis in Q4 2011, compared to the 6.0 per cent in Q3.

On a quarter-on-quarter seasonally-adjusted annualised basis, the economy contracted by 2.5 per cent, reversing the 2.0 per cent growth in the previous quarter.

On a year-on-year basis, the manufacturing sector grew by 9.2 per cent, slower than the 13.7 per cent growth in Q3.

On a sequential basis, the manufacturing sector contracted by 11.1 per cent, compared to a 11.0 per cent increase in the previous quarter. This was due to a decline across most manufacturing clusters.

The construction sector grew by 2.9 per cent on a year-on-year basis, a slight improvement from the 2.4 per cent growth in the preceding quarter. On a sequential basis, the sector contracted by 2.2 per cent (annualised) largely due to a decline in private residential and commercial building activities.

The wholesale & retail trade and transportation & storage sectors registered relatively weak growth of 0.9 and 2.4 per cent respectively on a year-on-year basis.

On a sequential basis, the wholesale & retail trade sector expanded by an annualised pace of 10.2 per cent, reflecting a pick-up in re-export activities. By contrast, the transportation & storage sector contracted by 2.9 per cent.

Growth in the finance & insurance and business services sectors were modest, at 3.5 and 1.9 per cent respectively on a year-on-year basis.

On a sequential basis, the finance & insurance sector declined by 4.4 per cent (annualised), dragged down by poor performance in the sentiment-sensitive segments such as fund management and stock broking.

Growth momentum in the business services sector picked up slightly to 2.4 per cent.

| STI up 1.2%, or 35.52 points at 2,953.47 by midday |

| Written by The Edge | |

| Monday, 06 February 2012 13:24 | |

|

Singapore shares rose by by midday on Monday, helped by better-than-expected jobs data from the United States that pushed most Asian bourses higher.

Commodities firm Noble Group outperformed the broader market, lifted by hopes of an earnings rebound and buzz generated by a planned merger involving industry giants Glencore International and Xstrata Plc. By 1:00 p.m., the Straits Times Index was up 1.2%, or 35.52 points, at 2,953.47. Some 1.77 billion shares worth $1.1 billion were traded, compared with 1.96 billion shares worth $883.6 million at the same time on Friday.

|

Stocks look to start 2012 higher

By CNNMoney staff @CNNMoneyMarkets January 3, 2012: 7:51 AM ETNEW YORK (CNNMoney) -- U.S. stocks were headed for a rally on the first day of 2012, as investors welcome stronger manufacturing reports out of emerging economies.

In early trading, Dow Jones industrial average (INDU) futures were up 1.7%, S& P 500 (SPX) futures gained 1.8% and Nasdaq (COMP) futures rose 2%. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

U.S. markets were closed for the New Year holiday on Monday.

" There's an element of catch-up for the U.S.," said David Jones, chief market strategist at IG Index. " Probably more importantly, we've had some strong manufacturing data out for China and India that was better than expected."

Over the weekend, the Chinese government released its official reading onmanufacturing activity, showing the sector expanded slightly in December, after contracting the month before. And on Monday, a report compiled by HSBC and Markit showed India's manufacturing activity picked up significantly during the month.

Investors worldwide are tuning in closely to economic numbers out of China in particular, because its rapid growth has led the global recovery -- but recent figures have shown some signs of weakness.

Stocks in 2012: Choppy but higher

U.S. stocks finished little changed Friday, bringing to an end a year in which the S& P dropped just 0.04 points -- the smallest annual change in history.

The Dow rose 5.5% for the year, while the Nasdaq lost 1.8%.

Trading was slow all last week, with many investment professionals on break for the holidays.

In addition, few major economic and earnings reports were released, leaving investors mulling the same macro problems that moved markets through much of the year. As trading begins in 2012, all eyes remain on Europe and its long-running sovereign debt crisis.

Economy: The December installment of the ISM Manufacturing Index, due after the market open, is expected to rise to 53.4 from 52.7 in November, according to a consensus of economists surveyed by Briefing.com. Any reading above 50 signals expansion in the sector.

The government will release data on construction spending for the month of November . Analysts surveyed by Briefing.com expect construction spending to have risen by 0.5%, after rising 0.8% in October.

Also on Tuesday, the Federal Reserve will release minutes from its Dec. 13 meeting.

Companies: Chesapeake Energy (CHK, Fortune 500) shares rose 3.2% in premarket trading, after the Oklahoma City-based energy company announced it completed a venture with an affiliate of French oil company Total (TTFNF) that gives the French firm a 25% stake in more than 600,000 acres in eastern Ohio, an area rich in shale oil.

World markets: European stocks were mixed in midday trading. Britain's FTSE 100 (UKX) rose 1.2%, the DAX (DAX) in Germany added 1% and France's CAC 40 (CAC40) lost 0.5%.

The Hang Seng (HSI) in Hong Kong added 2.4% Markets in Shanghai (SHCOMP) and Tokyo (N225) were both closed for an extended New Year holiday.

Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen.

Oil for February delivery added $2.59 to $101.42 a barrel.

Gold futures for February delivery rose $27.30 to $1,594.1 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.95% from 1.87% late Friday. ![]()