This article proved things I forecasted months ago. Nevertheless I still do not agree with some claims made by it. LInk: http://sg.finance.yahoo.com/news/why-fare-adjustment-remains-threat-074200118.html

Highlight:

- Green==> Forecast

- Red=> > Disagreement

Isn't there any end to it yet?

According to CIMB, revenue rose 5.3% yoy, thanks to the strong ridership in Singapore. However, with relentlessly higher operating costs, 2QFY3/14 profit was dragged lower by 57% yoy.

Costs escalated in several business segments. The large jump in costs was the result of a sharper rise in staff costs (+27% yoy), wage adjustment and higher headcount.

Here's more from CIMB:

We increase all the key operating expenditure assumptions, although we think that staff costs should hover around this level for the rest of the year (c.40% of revenue). SMRT has proposed to pay an interim dividend of 1 Sct/share, a significant jump in payout ratio in this case.We believe the risk of further dividend cuts is now less of a concern given the more robust cash flow structure.

Fare adjustment remains a problem and revenue growth will still lag behind cost inflation. We believe that SMRT is making inroads with regulators regarding the accounting of asset transfers under the new rail-financing framework.

Once this is resolved, the end result will be predictable cash flows and a more sustainable financing model, which will alter the fate of the company. Until then, the stock may continue to underperform.

I maintain sell!!! Government only subsidies because public unwilling to pay more. If public unwilling to pay more, it means SMRT is doing alot of non valued add activities. Time for it to cut down on that huge staffs cost.

Rosesyrup ( Date: 07-Nov-2013 17:18) Posted:

|

Free transport is a government scheme to pay a lump sum for public transport. In another words it is government subsidy! Which company would need subsidy if it can do well and survive on a stand alone basis.

By taking a lump sum subsidy, SMRT gave up the opportunity to profit from increased volume of customers=> limited growth opportunity.

I can't see any good news from this. Maybe just lenghten SMRT operational life for a few more years?

oldflyingfox ( Date: 07-Nov-2013 15:49) Posted:

|

If you read carefully, the so call " free transport" are actually from part of the increasing fare. Good news for SMRT but bad news for the consumer like us. My guess is the turning point when the actual increase of the fare, present price of $1.29 will be the bottom.

The risk of shorting is much more than the rewards now, take care!

Rosesyrup ( Date: 13-Oct-2013 17:42) Posted:

|

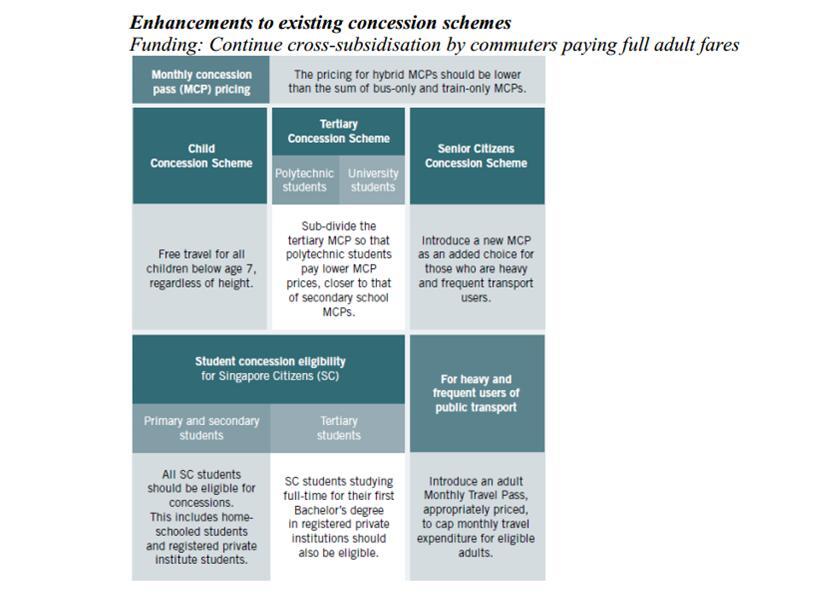

Thanking the panel for its report, Transport Minister Lui Tuck Yew said he was in favour of the Government funding proposed new concession schemes for disadvantaged groups while any enhancements to existing schemes be cross-subsidised by commuters. Noting that the last fare hike was in 2011, he said the committee?s proposal to allow for smoothening of significant fare hikes over two years using a roll-over mechanism would be helpful. ?This will avoid excessive fare hikes in any one year. My own view is that any fare increase should be below the average national-level wage increase for that year,? Mr Lui said in his Facebook page.

$_$

http://sgblogs.com/pages/2692788-former-smrt-ceo-saw-phaik-hwa-performs-super-bowl-halftime

http://izreloaded.blogspot.sg/2012/02/former-smrt-ceo-saw-phaik-hwa-performs.html

If you read Annual Report carefully, especially read Chariman's statement to get some hints on pricing power.

They came out 2 options:

1. get more consummers on aboard by observing the crowds during the peak period, it seems that SMRT has got it

2. increase fares by paying as per travelling km

However, I just can't forget the above-attached photos about ex CEO's life at SMRT ... her visibility on the cost of ...

A high-level panel tasked with studying public transport fares has recommended an improved public transport concessions framework....

http://www.channelnewsasia.com/news/singapore/up-to-1-million-commuters/874792.html

full earnings from woodland exchange and sportshub the coming yr.

the plans for the current rail infra is expanding fast.

what is worse can only get better, good times ahead!

SINGAPORE ? After hitting a speed bump, the Government?s push to get more people onto buses and trains is back on course. Public transport?s share of the total number of trips made during the peak period rose to 63 per cent last year, reversing a downward trend that first began when the Household Interview Travel Survey was first conducted in 1997.

The growth was fuelled largely by the expansion of the rail network over the last four years, with the number of train trips rising by 35 per cent to 2.3 million daily trips last year.

Citing these findings yesterday, Transport Minister Lui Tuck Yew said the Government?s ?major policy decision? five years ago to make public transport a choice mode has ?made good progress?.

Singapore, like all other growing cities in the world, will have to do more to curb the reliance on private cars, he added. ?But doing more of the same is not enough. We have to decisively push for a strategic mode shift from private to public transport,? Mr Lui said, as he launched a refreshed Land Transport Master Plan at the inaugural Singapore International Transport Congress and Exhibition.

The master plan was first launched in 2008 and came at a time when public transport use declined over the decade. Travel on public transport was 67 per cent of the total number of trips made in 1997. In 2004, it fell to 63 per cent and in 2008, it shrank to 59 per cent.

The new master plan laid out four priorities: More connections, better service, a liveable and inclusive society, and reducing reliance on private transport.

By 2030, Singapore?s rail network will be 360km ? double what it is currently and higher than in Tokyo or Hong Kong ? and its rail density will be comparable to London.

Recognising ?a multiplier effect? in having a denser and more connected rail network, which makes taking trains more attractive for motorists to switch to public transport, Mr Lui yesterday announced that the first six stations of the Downtown Line will open on Dec 22.

The stations ?Bugis, Promenade, Bayfront, Downtown, Telok Ayer and Chinatown ? will connect to existing rail lines to enhance connectivity in the city. To achieve better service, the Land Transport Authority (LTA) will, among other moves, set new requirements for trains to arrive at shorter frequencies during the 30-minute time slots before and after the morning and evening peak periods. It is also studying if information on bus crowding could be provided to commuters so that they can make more informed choices for their journeys.

While all train stations and bus interchanges have been made accessible to the less mobile, the LTA will do even more, such as implementing audio-tactile systems at more traffic junctions to aid the visually-impaired.

Speaking to reporters on the sidelines of the conference, Mr Lui said he was confident of increasing public transport modal share to 70 per cent by the end of this decade, as the rail network is expanding ?significantly?. Under the master plan, eight in 10 households will live within a 10-minute walk from a train station.

Transport analysts agreed this would be an achievable target. Associate Professor Lee Der Horng, a transport researcher at the National University of Singapore, felt that the new train lines and the high cost of car ownership could push more towards public transport.

?Despite the comfort a car brings, even non-drivers and non-car owners are thinking twice and saying it?s too expensive,? he said.

According to the survey, individuals with monthly incomes higher than S$8,000 who took public transport rose to 28 per cent last year, up from 23 per cent in 2008.

Asked about the impact of surging Certificate of Entitlement premiums on shifting motorists towards public transport, Mr Lui noted that close to one in two households own a car ? a situation unsustainable in the future. Roads comprised 12 per cent of total land area here, compared to 14 per cent for housing.

?Going forward, we must make sure that the possibility of people switching away from cars to public transport is there, and the way to do it is to make sure that the connectivity, the connections, the quality of service is much better than it is today,? Mr Lui said.

re-Rose

me, also wait patiently & see how they resolve Foundemental issues such as princing power & infrastucture

http://sias.org.sg/index9.php?handler=ir& action=ir_content& ir_content_title_id=2067

Annual report & coming AGM

Recap 4 key points to look for:

- operating expenditure

- capital expenditure

- cutting dividend

- infrastructure? how to

Capitalism needs a brain and a soul : a bigger goals, new incentives and a reconception of what business really is, not a sole goal just to maximise profit (it is on a collision course with time).

No matter how much ah kong like to show hand, he only has 2 hands.

You keep posting here, I thought got big news or something lol.

ascend88 ( Date: 05-Nov-2013 14:31) Posted:

|

Ah Kong Show hand !!!

| 13:33:36 | 1.300 | 2,000,000 | M |

its more than 52wks low....its at 2007 price

thank u ah kong....

yourdadisme ( Date: 05-Nov-2013 13:12) Posted:

|

already left.....toot toot toot.....1.30 already lor....

:)

lui lui lui....rolling in...

yourdadisme ( Date: 05-Nov-2013 13:12) Posted:

|

52 weeks low, and still timing for entry price?

boat is leaving soon!

Fare review report to be made public today

SINGAPORE ? A high-level panel studying public transport fares will make public its recommendations today, with commuter groups like average-income earners, the disabled and...

NVM, I can see the fundamental is eroding and I can wait patiently.

ascend88 ( Date: 05-Nov-2013 11:07) Posted:

|

The imminent fare-hike certainly helps.

shiok ah.....ah lui has spoken......let the wayang show begins....

have not board the thomas train yet...?

:)