... given the article on Big Discounts To Asset Values, today chart result in black candle...

... besides a harami pattern is form... imply the prior rally likely to end ...

... may go into sideways movement and up again ..?.. to monitor next week ...

Excerpts from analysts' reports RHB-OSK is first to issue rated report on GuocoLeisure with $1.25 target Analysts: Goh Han Peng & Edison Chen |

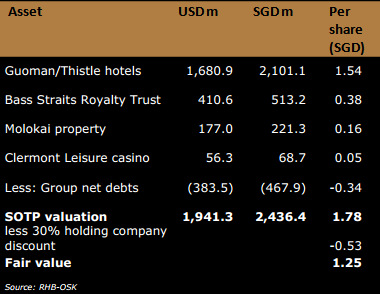

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments.

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments. We value its Guoman/Thistle hotel portfolio at EUR250,000 per key for its London hotels, a 21% discount to the average transaction of EUR316,000 per key in 2012.

We use net present value to value the cash flow stream from Bass Straits Royalty Trust, without factoring in upside from future reserve growth.

Our valuation yields a SOTP of SGD1.78. We apply a 30% holding company discount to derive a TP of SGD1.25.

In our view, GLL offers a compelling asset play with imminent catalysts from restructuring

within the group and greater transparency on its hotel assets. Reiterate BUY.

http://www.nextinsight.net/index.php/story-archive-mainmenu-60/919-2013/6623-guocoleisure-ying-li-what-analysts-now-say

Company Update - GuocoLeisure

Due for a Re-rating

http://research.osk188.com/attachments/95/osk-report-sg-guocoleisure_coporate-update_20130326-IWNu90985803151517679b0e6c.pdf

| GuocoLeisure: IFA report on parent may shed light on asset value |

| WRITTEN BY ADELE TEO |

| MONDAY, 25 MARCH 2013 22:13 |

An independent valuation report due out soon on Hong Kong-listed Guoco Group, because of a privatisation offer, might shed some light on the value of the assets held by its 66.5%-owned subsidiary GuocoLeisure.

Singapore-listed GuocoLeisure owns a formidable collection of real estate interests, including hotel and casino properties. The company owns the Guoman hotel chain, which owns and manages 37 five-star hotels across the UK. It also owns the Thistle brand of hotels, with properties located mainly in the UK as well as Malaysia. Then there is Clermont Leisure, an exclusive members-only casino in the posh suburb of Mayfair, London. Clermont Leisure has five gaming licences throughout the UK.

The company’ s other interests include property development in Fiji and Hawaii, as well as The Bass Strait Oil Royalty, an investment holding firm that collects royalties from BHP Billiton and Esso for oil production in Australia.

GuocoLeisure carries its hotel assets on its balance sheet at cost less depreciation. As at end-December 2012, the company had a book net asset value of 87.8 US cents a share. Shares in the company, which are up nearly 21% in the last 12 months, are trading at a 48% discount to this NAV. On Dec 12, 2012, Guoco Group received a delisting offer from GuoLine Overseas Ltd. Standard Chartered Bank has been engaged as the independent financial adviser (IFA) and is due to publish a report on Guoco’ s asset valuation next month.

To be sure, GuocoLeisure is unlikely to offload its main hotel assets. So, whatever value is placed on its property assets by the IFA report, shares in GuocoLeisure might not necessarily react strongly. Still, GuocoLeisure seems attractive on valuation yardsticks other than price-to- NAV. Notably, the company’ s market capitalisation of $1.03 billion is only 10.4 times its earnings for the financial year to June 2012.

GROWING HOTEL BUSINESS

GuocoLeisure’ s core hotel business has established itself as a market leader in the UK. Thistle is one of the largest hotel chains there, with more than 8,000 rooms, of which 5,000 are in London. While Thistle caters to the business traveller, Guoman targets the upmarket segment.

Now, GuocoLeisure is expanding its hotel business in Asia-Pacific. Over the next four to five years, it aims to have 45 to 50 hotels in the region. It plans to own a few flagship hotel properties, and operate the others via management contracts or leases. It already operates two Guoman hotels in Malaysia under the Thistle brand, in Port Dickson and Johor Baru. In its FY2010 annual report, it noted the soft launch of its premier Guoman Hotel Shanghai.

In Singapore, its sister company GuocoLand is developing an integrated project located above Tanjong Pagar MRT station. The 1.7 million sq ft development will feature premier Grade-A office and retail space, an international hotel and exclusive residential apartments. The hotel portion could involve GuocoLeisure.

On Aug 1, 2012, GuocoLeisure appointed Michael Bernard DeNoma as the new CEO of Guoman Hotels Ltd. DeNoma was once head of global consumer bank at Standard Chartered, and later chairman and CEO of Chinatrust Commercial Bank.

POSSIBLE ASSET DIVESTMENT

While GuocoLeisure is intent on expanding its hotels business, it might divest some of its non-hotel assets. In particular, its property development units Molokai Properties Ltd and Tabua Investments Ltd could be put on the block.

Molokai Properties owns a 54,677-acre property on the island of Molokai in Hawaii. The company had made several attempts to undertake property development but encountered resistance from the natives, who wanted to preserve the natural state of the environment there. According to DMG research analyst Goh Han Peng, several parcels of land have been transacted at prices above book value.

Tabua Investments is GuocoLeisure’ s property investment arm in Denarau, Fiji. The company has been actively looking for buyers for its Fiji assets. As at end-December 2012, the book value of the land stood at US$177 million ($221.2 million).

Meanwhile, GuocoLeisure is receiving a steady stream of cash from an oil-and-gas investment. Essentially, it earns royalties from BHP and Esso based on the gross value of all hydrocarbons produced and recovered in designated areas within the Bass Straits of Australia. Based on estimates by Esso, the Bass Straits has reserves to last another 30 years. For the last five FYs, GuocoLeisure has been receiving a steady cashflow stream of US$40 million to US$50 million.

According to UOB KayHian analyst Loke Chunying, the net present value of the royalty income stream is about US$357 million, three times higher than the asset’ s historical cost of US$122.4 million as at end-FY2012 on the balance sheet.

SOLID BALANCE SHEET

GuocoLeisure had cash and cash equivalents of US$28.6 million as at end-2012, and a gearing ratio of 0.3 times. The company is generating positive cash flows. For the half-year to December, net cash generated increased 26.5% to US$8.6 million.

For the six-month period, the company reported a 7.5% increase in revenue to US$203.9 million on the back of higher hotel occupancy rates during the 2012 London Summer Olympics, slightly pared by the volatility in its gaming segment. Earnings fell 4.1% to US$35.5 million as expenses rose on the increased cost of hotel operations, the recruitment of additional hotel staff as well as the general labour cost inflation in the UK.

For FY ended June 30, 2012, the company paid out dividends of two cents a share, or a yield of 2.7% based on its current share price.

While the valuation report for Guoco Group might not necessarily spark a re-rating of shares in GuocoLeisure, it is worth noting that the former offered to take the latter private back in 2005 at $1.25 a share.

for more details , see my guocoleisure chart ( click here) .tq

hello123 ( Date: 15-Mar-2013 13:13) Posted:

|

hello123 ( Date: 15-Mar-2013 13:13) Posted:

|

Guoco leisure moving up 3c to 79c now - looks like taking one day longer than predicted ..sorry

for more details see my guocoleisure chart ( click here) tq

hello123 ( Date: 14-Mar-2013 05:43) Posted:

|

What happened?No action leh?

Like a jelly now.

Guocoleisure now 76c, may hit 80-82c this morning

for more details , see my guocoleisure chart ( click here) .tq