Tks ! I think all yr counters are pretty safe . Can consider ..

rutheone1905 ( Date: 05-Oct-2012 17:12) Posted:

|

recent long position:

sph (dividend play)

smrt (cos it dives)

singtel (cos it dives n dividend)

yoma (cos myanmar play)

singpost (holding almost forever liao)

+ some reits

New123 ( Date: 05-Oct-2012 16:44) Posted:

|

What counters r u buying? It will be gd to share... I long on Wilmar & Psl waiting for it to move up...

rutheone1905 ( Date: 05-Oct-2012 16:05) Posted:

|

when i ran the sw on this counter it gave me funny read out.

then i look at the chart .......aiyo seems waiting for some happening.. moving horizontally within narrow bands...my take is i leave this alone.

nobody will be able to guess wat the direction after enough accumulation or distribution. but tat direction will be forceful, so i wont enter this.

But from past examples of placement by stocks that are less than $2 fro the past few years till now, I had noticed prior to their placement announcement dates, BBs ALWAYS push the share prices to rally very high, they always purposely push the share price to much higher than the placement price, so why do u think for BIOSENSERS the exact opposite will happen instead(since u said BBs want to keep the price very near to placement price)

infancybird ( Date: 04-Oct-2012 07:34) Posted:

|

Yes, i am betting on that... after the issue of shares the stock will move up. Hence no need to sell any of your holding as $ 120 is a very very strong support. Currently just monitor this stock knowing any move up by a few cents is just very temporary as the BB will press it down again and again. We will be lock at this price range till the news emerges , barring world stock disaster.

whencanchange ( Date: 04-Oct-2012 00:12) Posted:

|

infancybird, why no reply on this?

whencanchange ( Date: 02-Oct-2012 21:06) Posted:

|

if this stock can break 1.26 it will rally or else stay sideline from 1.2 to 1.26...

just have hope in this counter very strong fundamental and profits

Tomique ( Date: 02-Oct-2012 22:41) Posted:

|

Might be a gone case. Don't know if it has any chance to move back above $1.30.

u are meaning sell BIG??

infancybird ( Date: 02-Oct-2012 20:25) Posted:

|

are u saying it's extremely extremely likely that BIG will do a placement at $1.225 or lower in the short-term?

infancybird ( Date: 02-Oct-2012 16:48) Posted:

|

Analyst: Gary Ng

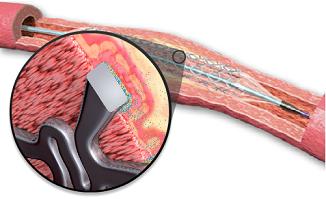

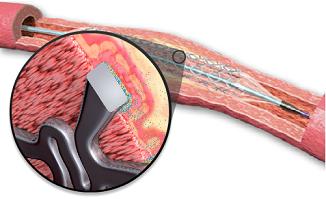

(Note: Biosensors International is the world’s fourth-largest manufacturer of drug-eluting stents. Such a stent consists of a Bare Metal Stent coated with a polymer that gradually releases a drug over three to six months to inhibit the cell proliferation that causes a recurrence of narrowing of a blood vessel.)

Even with ASP cuts in China, we believe mid-term earnings will remain solid. We believe the single biggest catalyst for BIG will be SFDA approval for the launch of BioMatrix.

On top of that, there is the potential for collaboration/JVs with international players. We keep our estimates, SOP target price ($1.82) and Outperform rating.

Potential licensing uplift. BIG’s global non-exclusive agreement with Terumo will expire at end-2012.

Royalty income from Terumo is between US$4m and US$5m a quarter, ever since 2008.

With BIG now operating more successfully in all its key markets worldwide, it will be in Terumo’s interest to renegotiate a newer and much more lucrative deal for BIG, to ensure the continuity of this arrangement.

While that does not move the dial much in BIG’s revenue, its effects on margins could be more prominent as this is a 100% GP-margin contributor.

Assuming successful re-negotiations to a licensing agreement whereby royalties double, the accretion to BIG’s core PATMI could be 7%.

The M& A scene. BIG has been taking away market share from peers in the international market, with its game-changing product.

For these larger players to look at what BIG is doing and not offer to collaborate with it or even acquire it is nearly inconceivable to us, though any such deal will depend on how major shareholder, Shangdong Weigao, plays the card.

(Note: Biosensors International is the world’s fourth-largest manufacturer of drug-eluting stents. Such a stent consists of a Bare Metal Stent coated with a polymer that gradually releases a drug over three to six months to inhibit the cell proliferation that causes a recurrence of narrowing of a blood vessel.)

Recommendations on Biosensors. Compiled by NextInsight

Even with ASP cuts in China, we believe mid-term earnings will remain solid. We believe the single biggest catalyst for BIG will be SFDA approval for the launch of BioMatrix.

On top of that, there is the potential for collaboration/JVs with international players. We keep our estimates, SOP target price ($1.82) and Outperform rating.

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: company

Potential licensing uplift. BIG’s global non-exclusive agreement with Terumo will expire at end-2012.

Royalty income from Terumo is between US$4m and US$5m a quarter, ever since 2008.

With BIG now operating more successfully in all its key markets worldwide, it will be in Terumo’s interest to renegotiate a newer and much more lucrative deal for BIG, to ensure the continuity of this arrangement.

While that does not move the dial much in BIG’s revenue, its effects on margins could be more prominent as this is a 100% GP-margin contributor.

Assuming successful re-negotiations to a licensing agreement whereby royalties double, the accretion to BIG’s core PATMI could be 7%.

The M& A scene. BIG has been taking away market share from peers in the international market, with its game-changing product.

For these larger players to look at what BIG is doing and not offer to collaborate with it or even acquire it is nearly inconceivable to us, though any such deal will depend on how major shareholder, Shangdong Weigao, plays the card.

missed all the postings, vested today at 1,22 thrown by 83 citigroup at matching!!

If today your BIG is $ 1.50 and tmr mgt issues the large amt of new shares to a new large investor for $1.225........what will happen?? The stock price will correct heavily to factor in the new share issued at lower price......will you as small investors jump?? Sure you not only jump but curse nonstop at the mgt. this is why price must be kept low to accomodate such issue. The new investor will not like to see high price, lower the better for them while we small investor wanted higher price, higher the better.

neutral ( Date: 02-Oct-2012 16:42) Posted:

|

Can you explain in detail yr this part why the BBs need to keep the share price close to 1.225 and if the share price were to rally now it will incur more wrath from the small investors?

infancybird ( Date: 02-Oct-2012 10:09) Posted:

|

Currently, I still left $85,000 in my trading capital.

A bit undecided whether use the money to buy more of this Biosensers at currrent price or buy Golden Agri at today's price??

your question of when to buy is hard to answer...but you may look at the Bid /Ask quote on SGX. Today for eg, there is a constant endless supply of large blocking Ask volume at 1.225 , effectively blocking all effort to buy up....thus indicating the BBs is not letting go as yet. Once this pattern changes in future trading day will tell us its time to get in. On the other hand, you may start accumulating piecemeal within your finiacial comfort. Mid to end Oct may see shift of sentiment.

ah.wei ( Date: 02-Oct-2012 14:22) Posted:

|

seriously we gt no idea when the BBs is going to make their moves... i bgt alr and wait lor... anyway their financial report coming out in oct.. just holding on...

whencanchange ( Date: 02-Oct-2012 13:58) Posted:

|

so roughly by when u think BBs will push this BIOSENSERS to rally strongly? is it end Oct?? or should be more likely next year?

infancybird ( Date: 02-Oct-2012 10:09) Posted:

|

Quite a good analysis. Small investors should write to harrass Biosensors management and board about their bias against the interests of retail investors. When voting for re election of directors always vote against the current team. They have a world class product but not so their management/board.

infancybird ( Date: 02-Oct-2012 10:09) Posted:

|