Stocks headed higher at the open

NEW YORK (CNNMoney) -- U.S. stocks were set to open slightly higher Wednesday, after Japanese stocks rebounded from a two-day skid in the aftermath of last week's earthquake.

Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Tokyo's Nikkei index rose 5.7% Wednesday, a bounceback from two days of losses that had drained more than 16% from the index. The partial recovery came despite more gloomy news from the crippled Fukushima Daiichi nuclear power plant, where workers trying to end the crisis were evacuated for a time because of elevated radiation levels. (CNN.com's coverage)

After three explosions and a fire in four days, a handful of workers have been struggling to contain a dangerous radiation threat at the stricken nuclear facility located about 138 miles north of Tokyo.

The increasingly desperate situation followed the 9.0-earthquake that rocked Japan on March 11 and caused a massive tsunami that has ravaged the world's third-largest economy. The death toll now stands at 3,771 people.

Other Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. Stocks in London, Frankfurt and Paris were higher in early trading.(World markets)

U.S. stocks fell sharply Tuesday as investors looked past a somewhat positive statement from the Federal Reserve to focus on the deteriorating situation at Japan's Fukushima Daiichi nuclear power plant.

Investors, stunned by the devastation in Japan, had been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. But the Wednesday rebound in Japanese stocks sent Treasuries lower.

Economy: In the United States, investors will take in reports on the nation's housing market and inflation at the wholesale level.

Before the market opens, the government will release a report on new home construction and applications for building permits in February.

Economists expect the number of housing starts rose to an annual rate of 575,000 units in the month, down from 596,000 in January. But building permits, considered a leading indicator of activity in the housing sector, are expected to have increased slightly to 563,000, according to consensus estimates from economists surveyed by Briefing.com.

Separately, the government's Producer Price Index is forecast to show prices at the wholesale level increased 0.6% in February, following a 0.8% rise in January.

Core PPI, which excludes food and energy costs, is expected to show an increase of 0.2% in the month, down from 0.5% the month before.

A report on the U.S. current account balance in the fourth quarter and the government's weekly energy inventory report are also on tap.

Currencies and commodities: The dollar gained against the euro and the Japanese yen, but eased against the British pound.

Oil prices, which fell nearly 4% on Tuesday, were higher early Wednesday as concerns the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained $1.31 to $98.49 a barrel.

Gold futures for April delivery climbed $5.40 to $1,398 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.33% from 3.3% late Tuesday.

Mar 16, 2011

Asian markets ease as Nikkei bounces back

A woman looks at a stock price board in a street in Tokyo. The Nikkei surged over 6% on Wednesday morning after a two-day sell-off. -- PHOTO: AP

TOKYO

TOKYO shares closed up 5.68 per cent on Wednesday on bargain hunting following a huge two-day selloff, as Japan scrambled to avoid a nuclear catastrophe.

The Nikkei index added 488.57 points to 9,093.72. The Topix index of all first section shares added 6.64 per cent, or 50.90 points, to 817.63.

However, shares in TEPCO, operator of the stricken Fukushima nuclear power plant at the centre of Japan's escalating atomic crisis, continued to be hammered, diving 24.57 per cent after similar losses on Monday and Tuesday.

HONG KONG

Hong Kong and Chinese shares bounced back on Wednesday as bargain-hunters moved in following heavy losses in the previous session and following a strong gain in Tokyo.

Hong Kong's benchmark Hang Seng Index rose 0.10 per cent, or 22.63 points, to end at 22,700.88 on turnover of HK$84.18 billion (S$13.8 billion).

SHANGHAI

Shanghai rose 1.19 per cent, with the Shanghai Composite Index, which covers both A and B shares, up 34.54 points at 2,930.80 on turnover of 165.8 billion yuan (S$32.2 billion).

KUALA LUMPUR

At 12.30pm on Wednesday, there were 307 gainers, 247 losers and 264 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,486.16 up 2.02 points, the FBMACE was at 3,955.48 down 4.72 points, and the FBMEmas was at 10,157.13 up 13.33 points.

Yes sir,

Did the yen surge as well?

Mar 16, 2011

Asian markets ease as Nikkei bounces back

A woman looks at a stock price board in a street in Tokyo. The Nikkei surged over 6% on Wednesday morning after a two-day sell-off. -- PHOTO: AP

TOKYO

TOKYO shares closed the morning session up 4.37 per cent Wednesday as bargain hunters moved in following the Nikkei's biggest two-day sell-off for 24 years, amid fears of a nuclear catastrophe.

The Nikkei index ended the morning session up 375.99 points to 8,981.14.

SHANGHAI

The Shanghai Composite Index was up 0.4 per cent to 2,907.59 at midday, following rising Asian stocks and powered by gains in energy counters and materials.

HONG KONG

Hong Kong shares fell 0.44 per cent by the break on Wednesday as dealers cashed in early gains and amid lingering concerns over the nuclear crisis in Japan.

KUALA LUMPUR

At 12.30pm on Wednesday, there were 307 gainers, 247 losers and 264 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,486.16 up 2.02 points, the FBMACE was at 3,955.48 down 4.72 points, and the FBMEmas was at 10,157.13 up 13.33 points.

Mar 16, 2011

Japan's central bank injects new cash into markets

TOKYO - JAPAN'S central bank has injected billions of dollars into financial markets for a third day to ease the impact of last week's quake.

The Bank of Japan injected 3.5 trillion yen (S$55.5 billion) into markets on Wednesday. That came after injections totalling 23 trillion yen over the past two days.

The action is aimed at supporting financial markets that plunged after Friday's magnitude-9.0 earthquake and tsunami that caused crippling problems at nuclear power plants.

Mar 16, 2011

STI opens higher

SINGAPORE shares opened higher on Wednesday, with the benchmark Straits Times Index at 2,973.77 in early trade, up 0.96 per cent, or 27.91 points.

Around 111.3 million shares exchanged hands.

Gainers beat losers 178 to 45.

Blastoff ( Date: 16-Mar-2011 10:02) Posted:

|

Mar 16, 2011

Tokyo stocks surge more than 6%

A woman looks at a stock price board in a street in Tokyo. The Nikkei surged over 6% on Wednesday morning after a two-day sell-off. -- PHOTO: AP

TOKYO - TOKYO shares were 6.05 per cent higher on Wednesday, following the biggest two-day sell-off on the Nikkei index for 24 years on fears of the threat of a nuclear meltdown after a huge earthquake.

The Nikkei added 521.04 points to 9,126.19.

Stocks claw back from steep sell-off

By Annalyn Censky, staff reporterMarch 15, 2011: 5:27 PM ET

By Annalyn Censky, staff reporterMarch 15, 2011: 5:27 PM ET

NEW YORK (CNNMoney) -- Stocks regained some lost ground in the last hour of trading Tuesday, but Japan's devastating earthquake and nuclear crisis still have investors on edge.

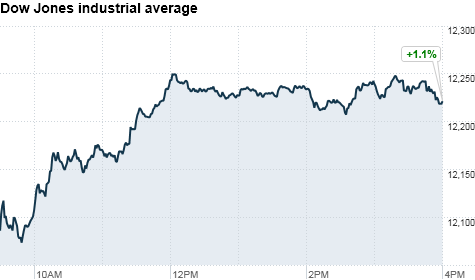

All three of the major U.S. stock indexes closed down about 1.2%, after plunging much deeper earlier in the day.

The Dow Jones industrial average (INDU) posted a 138-point loss, after falling 297 points earlier. All but one of the 30 Dow components were in the red. The S& P 500 (SPX) fell 15 points and the Nasdaq (COMP) dropped 34 points.

A somewhat positive statement from the Federal Reserve, which would typically garner attention, failed to sway investors significantly in the afternoon.

" Everybody's looking at Japan over the Fed," said Phil Streible, a senior market strategist with Lind-Waldock. " People are scrambling and trying to figure out the specific impact of Japan's problems."

The Fed made no mention of the events in Japan. Markets are reeling from the staggering human and economic toll from Japan's 9.0-measure earthquake and subsequent tsunami last Friday, which killed at least 3,373 people.

The earthquake also damaged Japan's Fukushima Daiichi nuclear power plant, and subsequent explosions and fires there have only escalated fears about a nuclear crisis in Japan.

Japan's Nikkei index (NKY) dropped 10.6% on Tuesday alone, and over the last two days, it shed 16.1% -- its worst two-day loss since 1987.

Other Asian markets also finished lower Tuesday, with the Shanghai composite losing 1.4%, and Hong Kong's Hang Seng index falling 2.9%.

European markets also closed sharply lower. Germany's DAX dropped 3.4%, while France's CAC-40 lost 2.3% and Britain's FT-100 retreated 1.3%.

The Japanese nuclear plant that exploded Saturday is equipped with reactors designed by Dow component General Electric (GE, Fortune 500). GE shares fell 1.6% Tuesday.

Insurance companies in the S& P 500 also sank, led by Aflac (AFL, Fortune 500) which tumbled 5.6%. Aflac generated about 75% of its revenue in Japan last year.

Hartford Financial Services Group (HIG, Fortune 500) fell 4.6%, Prudential (PRU, Fortune 500) dropped 2% and MetLife (MET, Fortune 500) fell 3%.

Netflix (NFLX) was one of the few stocks to buck the downward trend, rising 7.9% after Goldman Sachs (GS, Fortune 500) upgraded the stock earlier in the day.

Meanwhile, oil prices fell nearly 4% as investors pulled back after its recent run, and gold prices fell 2.3%.

The dollar rose versus the euro and the British pound, but fell slightly against the yen. Like the U.S. dollar, the yen is considered a safe-haven asset in times of economic uncertainty.

The price on the benchmark 10-year U.S. Treasury rose as investors sought the safety of government debt, pushing the yield down to 3.32% from 3.35% late Monday.

The Japanese government has taken steps to shore up the nation's financial system. But investors remain nervous about the short-term outlook for the world's third-largest economy.

Ahead of the opening bell, steep losses in world markets triggered the New York Stock Exchange to invoke Rule 48 -- which gives the exchange the right to pause trading in the event of exteme volatility.

NYSE typically invokes the rule several times each year.

Wall Street's most widely cited measure of volatility, the VIX (VIX) surged 14.8%.

Stocks surge as banks lead gains, oil drops

By Ken Sweet, contributing writerMarch 8, 2011: 4:20 PM ET

By Ken Sweet, contributing writerMarch 8, 2011: 4:20 PM ET

NEW YORK (CNNMoney) -- U.S. stocks closed broadly higher Tuesday, led by a strong performance in the financial sector.

Easing oil prices lent further support. Crude prices retreated following reports that Libyan leader Moammar Gadhafi is working to step down and exit the country safely.

The Dow Jones industrial average (INDU) advanced 124 points, or 1%, to close at 12,214 the S& P 500 (SPX) added 11.7 points, or 0.9%, to 1,321.80 and the Nasdaq Composite (COMP) gained 20 points, or 0.7%, to 2,766.

Bank of America (BAC, Fortune 500) sparked a rally in financial shares after CEO Brian Moynihan issued a rosy multi-year outlook at the bank's first shareholder meeting in four years. Moynihan also said the banking giant plans to increase its buyback program and may raise its dividend.

Shares of Bank of America jumped 5% American Express (AXP, Fortune 500) rose 3.5% and JPMorgan Chase & Co. (JPM, Fortune 500) rose 2.7%. The jump in BofA shares is a change of pace for the Charlotte N.C.-based bank, which has seen its stock price fall 12% from a year ago despite the S& P 500 being up 16%.

Shares of other retail banks were also higher, with SunTrust (STI, Fortune 500), USBancorp (USB, Fortune 500) and Hutchington Bancshares (HBAN) each rising 3% or more.

" The whole financial sector was way oversold, so this move could be just a technical bounce," said David Rovelli, managing director of U.S. equity trading at Canaccord Adams. " There's still a ton of risk in the financials and BofA still has the mortgage processing problems."

Oil prices: Investors continue to monitor developments in Libya and the civil war's effect on energy prices. Oil futures lost 53 cents or 0.5%, to $104.91 a barrel Tuesday. The retreat came a day after prices spiked to almost $107.

Shares of major oil drilling and refining names also fell with Chesapeake Energy (CHK, Fortune 500) falling 2%, ConocoPhilips (COP, Fortune 500) dropping 1% andTesoro (TSO, Fortune 500) shares falling 4%.

Gold also eased from the prior session's highs, with prices closing down $7.30 to $1,427.20 an ounce. Gold settled at a record high of $1,434.50 an ounce Monday, as investors sought perceived safety in the precious metal.

Investors have been focusing on geopolitical developments and oil prices across North Africa and the Middle East. Traders are worried that spreading unrest will keep commodities at these elevated levels and will undermine the economic recovery.

" When you throw together high oil with increases in cotton, soy and food, you have a nasty combination that will impact earnings," Rovelli said. " The whole key is how long commodities stay up there. If they don't start to decline, it's going to be a burden on stocks."

Over the long term, however, analysts surveyed by CNNMoney agree that the oil and gold volatility will fade as the crisis in Libya abates.

In the meantime, Jim McDonald, chief investment strategist with Northern Trust, said investors should remain overweight the materials and energy sectors.

" The situation in North Africa and the Mid East is a wild card but it remains a situation that you don't want to disrupt your portfolio for," McDonald said. " Stick with companies with solid balance sheets who are positioned for strong economic growth."

Companies: Urban Outfitters (URBN) shares plunged 17% after the retailer reported a profit late Monday that widely missed forecasts, saying its margins were hit by increased markdowns.

Shares of Sprint Nextel (S, Fortune 500) jumped 5%, on reports that the company was in early negotiations with Germany's Deutsche Telekom to sell Deutsche's T-Mobile business to Sprint.

Starbucks (SBUX, Fortune 500) began rolling out its new logo Tuesday, as the coffee company celebrates its 40th anniversary this week. Shares rose 1.2%.

Morgan Stanley (MS, Fortune 500) is considering dropping the Smith Barney name from its brokerage business, according to sources cited in the Wall Street Journal. Shares gained 1.7%.

Economy: There were no major reports on Tuesday's calendar.

World markets: European stocks closed mostly flat. Britain's FTSE 100 rose less than 0.1%, and the DAX in Germany ticked up 0.1%, while France's CAC 40 added 0.6%.

Asian markets ended higher. The Shanghai Composite ticked up 0.1%, the Hang Seng in Hong Kong jumped 1.7%, and Japan's Nikkei advanced 0.2%.

Currencies: The dollar gained against the euro, the Japanese yen and the British pound.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, with the yield rising to 3.55%.

Mar 8, 2011

Asian stocks mixed at midday

TOKYO

JAPANESE shares staged a modest 0.38 per cent rebound by noon Tuesday on bargain-hunting after crude futures fell during early Asia trade, amid fears high oil prices will hit global growth.

The Nikkei index of the Tokyo Stock Exchange rose 40.42 points to 10,545.44.

SHANGHAI

The Shanghai Composite Index eased 0.4 per cent to 2,984.1, falling for the first time in three days but holding comfortably above its February peak at 2,940 that market players see as near-term support.

HONG KONG

Hong Kong stocks rose 0.23 per cent by the break on Tuesday, helped by a slight easing of oil prices in Asian trading hours.

The benchmark Hang Seng Index climbed 53.83 points to 23,367.02.

KUALA LUMPUR

At 12.30pm on Tuesday, there were 264 gainers, 286 losers and 282 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,517.16 up 1.42 points, the FBMACE was at 4,031.23 up 5.32 points, and the FBMEmas was at 10,321.42 up 10.83 points.

Stocks sink on oil fears

By Annalyn Censky, staff reporterMarch 7, 2011: 4:36 PM ET

By Annalyn Censky, staff reporterMarch 7, 2011: 4:36 PM ET

NEW YORK (CNNMoney) -- Surging oil prices continued to rain on the stock market's parade at the start of the week. Add a lagging tech sector and Greece's latest debt woes to the mix, and Monday was a downer to say the least.

The Dow Jones industrial average (INDU) sank 80 points, or 0.7% the S& P 500 (SPX) fell 11 points, or 0.8% and the tech-heavy Nasdaq (COMP) shed 40 points, or 1.4%.

" It's pretty clear that we're dealing with international and Middle East tensions here," said Jason Pride, director of investment strategy at Glenmede. " The reality is, oil is getting into the price range now where people are going to start questioning its impact on the broader economy."

Investors are keeping a close eye on commodities, after crude oil rose to more than $106 a barrel early Monday on continued tensions in Libya. Oil finished the day at about $105.44, an increase of more than a dollar.

" The stock market wants to bask in the recent slew of good economic data, but its Achilles' heel is this oil market right now," said Phil Flynn, senior market analyst with PFG Best. " This is really a situation that we're going to have to monitor every day."

Meanwhile, gold set a new intraday record in early trading, rising to $1,445 an ounce, as investors sought safety in the precious metal. It pared back those gains later in the day though, settling at $1,434.50 an ounce on the Chicago Mercantile Exchange.

U.S. stocks managed to claw out gains last week, despite a sharp sell-off on Friday.

Companies: Tech stocks dragged on the entire market after Wells Fargo downgraded the semiconductor sector Monday. Intel (INTC, Fortune 500) fell 1.6% and the Philadelphia Semiconductor Index (SOX) dropped 2.7%.

Western Digital's (WDC, Fortune 500) stock climbed 15.6%, after the company agreed to acquire Hitachi's (HIT) hard disk drive business. The stock and cash transaction is valued at $4.3 billion.

Western Digital's top rival, Seagate Technology (STX), rose 9% on the news.

Starbucks (SBUX, Fortune 500) stock rose 1.5%, after Morgan Stanley analysts upgraded the company's price target and CEO Howard Schultz told the Wall Street Journal the coffee company is planning several acquisitions over the next 12 to 18 months to bolster its consumer products division.

Starbucks is kicking off a campaign celebrating its 40th anniversary this week, starting with newspaper articles Monday and rolling out with television ads and in-store promotions Tuesday.

World markets: Analysts at Moody's slashed Greece's credit rating three notches Monday to B1.

" The country's very large debt burden and the significant implementation risks in its structural reform package both skew risks to the downside," Moody's wrote in its report.

European stocks finished lower. Britain's FTSE 100 lost 0.3%, France's CAC 40 fell 0.7% and the DAX in Germany eased 0.2%.

Asian markets ended mixed. The Shanghai Composite jumped 1.8%, while the Hang Seng in Hong Kong slid 0.4% and Japan's Nikkei tumbled 1.8%.

Economy: Consumer credit increased by $5 billion in January, according to a report by the Federal Reserve released Monday afternoon. Economists surveyed by Briefing.com had expected consumer credit to have increased by $3.3 billion in January.

Currencies: The dollar gained against the euro and the British pound, but fell versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.50% from 3.55% late Friday.

niuyear ( Date: 07-Mar-2011 13:29) Posted:

|

Investors' decision: Will jobs or oil rule the market this week?

Wild swings in crude will continue amid Mideast unrest, but employment bodes well for U.S. economy

Dont travel for time being becos airfare is very high pricing in oil-hike.

sell your car

bring out your bike

go to the pool or beach to get rid of heat and yes, shower. there as well.......lol! let me know if you are doing this in open space.

err... use less aircon, i.e. shirf your TV into a room instead of living them in the sitting room where bigger space , consumption of aircon is higher.

yummygd ( Date: 07-Mar-2011 12:58) Posted:

|

wah now unrest..best time for other countries to go in n humtum n take over den they become the oil rich controller liao

niuyear ( Date: 03-Mar-2011 08:58) Posted:

|

Mar 7, 2011

Asian stocks open mixed

TOKYO

JAPANESE shares opened 0.62 per cent lower on Monday, following a fall in US stocks on soaring oil prices and the resignation of Japan?s foreign minister, brokers said.

The Nikkei index of the Tokyo Stock Exchange opened down 66.69 points at 10,626.97. It lost 1.31 percent in the first 40 minutes of trade.

SHANGHAI

Chinese shares rose 0.89 per cent in early trade on Monday on expectations of no further interest hikes in the short term after a top official reiterated inflation likely slowed in February, dealers said.

The Shanghai Composite Index, which covers both A and B shares, was up 26.31 points at 2,968.62.

HONG KONG

Hong Kong shares fell 0.09 per cent in early trade on Monday, with the Hang Seng Index shedding 21.73 points to 23,387.13.

New extended trading hours started Monday, with the market opening 30 minutes earlier at 9.30am (0130 GMT, 9.30am S'pore time).

KUALA LUMPUR

At 9.30am on Monday, there were 98 gainers, 241 losers and 133 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,515.52 down 7.09 points, the FBMACE was at 4,072.87 up 9.10 points, and the FBMEmas was at 10,320.57 down 44.17 points.

Mar 4, 2011

Asian stocks close higher

TOKYO

Tokyo shares gained 1.02 per cent on Friday, boosted by sharp overnight gains on Wall Street and a weaker yen, which helped lift stocks in the country's exporters.

The Nikkei index of the Tokyo Stock Exchange rose 107.64 points to 10,693.66. The Topix index of all first section shares increased 0.73 per cent, or 6.90 points, to 955.59.

SHANGHAI

On the mainland, the Shanghai Composite Index rose 1.35 per cent, led by steel makers and property developers as investors anticipated that supportive policies would emerge from China's annual legislative meeting, which begins Saturday, dealers said..

The Shanghai index, which covers both A and B shares, rose 39.33 points to 2,942.31.

HONG KONG

Hong Kong shares rose 1.24 per cent on Friday, lifted by a strong performance on Wall Street and slightly easing world oil prices.

The benchmark Hang Seng Index climbed 286.44 points to 23,408.86.

KUALA LUMPUR

At 5.00pm on Friday, there were 674 gainers, 148 losers and 240 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,522.61 up 15.73 points, the FBMACE was at 4,063.77 up 72.50 points, and the FBMEmas was at 10,364.74 up 113.58 points.