These BBs contribute significant amount.of transaction to sgx.... without them market wont perform .... no one will participate with the market with such vol... especially with all brokerage houses still trying to recover the losses....and still curbing on the trade.on penny..... we can all say goodbye to the market.....

yummygd ( Date: 19-Nov-2013 08:17) Posted:

|

risktaker ( Date: 19-Nov-2013 07:48) Posted:

|

Icahn warns stock market could face 'big drop'

By Svea Herbst-Bayliss and Jennifer Ablan | Reuters ? 37 minutes ago

By Svea Herbst-Bayliss and Jennifer Ablan | Reuters ? 37 minutes agoBy Svea Herbst-Bayliss and Jennifer Ablan

(Reuters) - Activist investor Carl Icahn on Monday said there was a chance the stock market could suffer a big decline, saying valuations are rich and earnings at many companies are fueled more by low borrowing costs than management's efforts to boost results.

Unnerved by Icahn's prognosis, investors pushed stocks lower. The S& P 500, which was trading near unchanged before Icahn spoke, closed down 0.4 percent.

" I am very cautious on equities today. This market could easily have a big drop," Icahn said.

He said share buybacks are driving results, not profitability.

Most U.S. Stocks Decline After Dow Briefly Reaches 16,000

Most U.S. stocks fell after the Dow Jones Industrial Average rose above 16,000 for the first time, spurring concern that equities have risen too far, too fast.

Consumer companies and commodity stocks led the retreat. Microsoft Corp. (MSFT) slid 1.7 percent after Bank of America Corp. cut its rating to underperform from neutral. Tyson Foods Inc., the largest U.S. meat processor, advanced 2.3 percent after reporting revenue above analysts? estimates on a gain in prices and sales volumes for beef and chicken

The Standard & Poor?s 500 Index (SPX) slipped 0.4 percent to 1,791.53 at 4 p.m. in New York. Earlier, it topped 1,800. About three stocks fell for each that rose in the gauge. The Dow average gained 14.32 points, or 0.1 percent, to 15,976.02. About 6 billion shares changed hands on U.S. exchanges, in line with the three-month average.

?We?ve moved pretty far pretty fast,? Kevin Caron, a Florham Park, New Jersey-based market strategist at Stifel Nicolaus & Co., which oversees about $150 billion. ?Obviously there?s a potential for a little bit of a pullback.?

While four years of earnings growth and the Federal Reserve?s near-zero interest rate have led the S& P 500 on a 165 percent rally since March 2009, they have also driven valuations to a three-year high. Billionaire investor Carl Icahn, speaking at the Reuters Global Investment Outlook Summit, said he is ?very cautious? on equities.

The S& P 500 trades at 17 times reported operating profit, a 20 percent increase from the beginning of 2013, according to data compiled by Bloomberg. Last week, the benchmark?s valuation reached the highest level since May 2010.

Continued Stimulus

?As we keep going and making new highs, we get into new territory and the air keeps getting thinner and thinner up here,? Tim Hartzell, who helps manage about $425 million as chief investment officer at Sequent Asset Management, said via phone from Houston. ?Everybody is watching Yellen and feel comfortable that she?ll continue QE, maybe even put more into the system.?

U.S. stocks have risen for the past six weeks, reaching all-time highs as Janet Yellen signaled she will continue stimulus efforts as the central bank?s chairman. New York Federal Reserve Bank President William C. Dudley today said he?s ?getting more hopeful? the U.S. economy is gaining strength as the drag from fiscal policy wanes. The central bank?s monetary policy is likely to be accommodative for a long time, he said.

China Reform

The policy-setting Federal Open Market Committee is buying $85 billion of bonds every month and won?t taper its purchases until its March 18-19 meeting, according to the median estimate of 32 economists surveyed by Bloomberg News Nov. 8.

China?s leaders vowed to allow more private investment in state-controlled industries and expand farmers? land rights as part of the ruling Communist Party?s biggest package of economic reforms since the 1990s. Chinese stocks rose, with the benchmark index for mainland companies in Hong Kong surging the most since December 2011.

?To the extent that these reforms might lead to some higher estimates of growth in the coming years, that would be welcomed by investors,? John Carey, a portfolio manager at Pioneer Investment Management, which oversees $20 billion.

The Chicago Board Options Exchange Volatility Index (VIX), the gauge of S& P 500 options known as the VIX, rose 7.5 percent to 13.10. It has fallen 27 percent this year.

Investors this week will scrutinize minutes of the Federal Open Market Committee from its Oct. 29-20 meeting and public remarks by Fed officials. The minutes are set to be released on Nov. 20. Fed Chairman Ben Bernanke is due to speak tomorrow, while Fed Bank of St. Louis President James Bullard will deliver a speech on Nov. 20.

?This week is crucial, there is a lot of Fed speak,? Quincy Krosby, a market strategist for Newark, New Jersey-based Prudential Financial Inc., which oversees more than $1 trillion, said by telephone. ?Investors want to get a little bit more color and atmospherics from the minutes.?

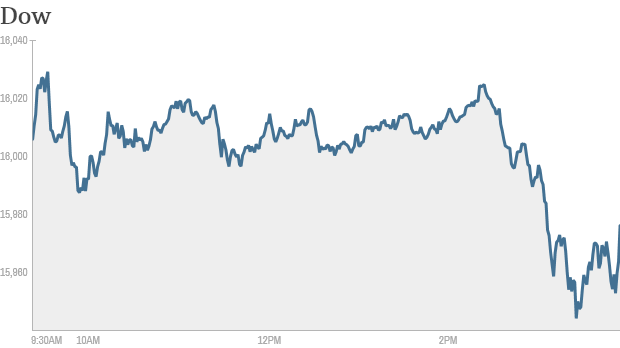

Dow can't hold on to 16,000

Click the chart for more stock market data.

The Dow Jones industrial average topped 16,000 for the first time ever Monday, while the S& P 500 briefly surpassed 1,800. But neither indexes closed above those milestones.

The Dow rose to an all-time high of 16,040.20 but pulled back as the day wore on. The S& P 500 rose to a record of 1,802.37 but finished the day lower.

The Nasdaq fell 1% Monday, but it too is on the verge of a milestone. The tech-heavy index is nearing 4,000, a level it hasn't hit since September 2000 -- just months after the tech market collapsed.

Stocks lost momentum in afternoon trading after Carl Icahn said he is " very cautious" on the stock market going forward. Speaking at the Reuters Global Investment Outlook summit, the billionaire activist investor said he could see a " big drop" in stocks. Icahn blamed earnings for his downbeat outlook, nothing that companies are boosting profits thanks to low borrowing costs instead of strong management.

Still, the Dow and S& P 500 are up more than 20% so far in 2013.

Experts say that this year's roaring bull market is due largely to stimulative monetary policies from the Federal Reserve as well as decent corporate earnings.

Investors will be keeping a close eye on the Fed in particular during the coming months. Current Fed chairman Ben Bernanke, the architect of the central bank's bond purchase program, will leave that role when his term expires at the end of January. Bernanke is likely to be replaced by Fed vice chair Janet Yellen, who just needs to be confirmed by the Senate.

The market has been encouraged by comments from Yellen during her Senate confirmation hearing last week about how the Fed's policies, particularly the $85-billion-per-month bond-buying program, can continue to help the market and economy.

But ultimately, Yellen is expected to scale back, or taper, the bond buying program at some point next year, raising questions about how much longer the nearly 5-year old bull market can last. In fact, there are some traders who think it's possible the Fed could announce it will begin tapering following its next policy meeting in December.

StockTwits user Learnstocks101 quipped, " $SPY What happens if Ben yells 'taper' in a crowded bull market?"

When Bernanke first hinted at tapering in May, the S& P 500 tumbled 6% over the subsequent four weeks. But stocks have since rallied back.

" $SPY, The only fear in this market is the fear to actually sell a stock and miss out on the greed," noted Hoyasparanoia. " Dangerous!"

Related: What will keep the rally going?

Are stocks overvalued? The big gains in stocks have also raised concerns about whether stocks may be in a bubble.

According to FactSet, the S& P 500 is trading at 15 times earnings expectations for the next 12 months. That puts the valuation of the stock market slightly above its 5-year and 10-year average.

A slightly different measurement also shows that stocks aren't overvalued. The S& P 500 is trading at 17 times earnings from last year, just slightly above the historical average of 16, according to Bank of America Merrill Lynch. In the bubble days of 2000, the index was trading at nearly 30 times trailing earnings.

Related: Fear & Greed Index: Flirting with Extreme Greed!

Whether or not stocks are in a bubble, experts aren't expecting the robust gains from this year to keep coming.

Historically, when the market has advanced more than 25% in a year, that gain has been followed by a rise of no more than 10% the year after, said William Riegel, head of equity investments at TIAA-CREF.

World Markets

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | +14.32 | +0.09% | 15,976.02 | 4:33pm ET |

|

S& P 500 Index | United States | -6.65 | -0.37% | 1,791.53 | 4:33pm ET |

|

Brazil Bovespa Stock Index | Brazil | +855.44 | +1.60% | 54,307.04 | 6:01pm ET |

|

Canada S& P/TSX 60 | Canada | -1.24 | -0.16% | 776.05 | 4:20pm ET |

|

Santiago Index IPSA | Chile | +37.12 | +1.15% | 3,260.56 | 2:58pm ET |

|

IPC | Mexico | +727.41 | +1.80% | 41,034.11 | Nov 15 |

nqing87 ( Date: 18-Nov-2013 23:49) Posted:

|

|

S& P 500 Exceeds 1,800 for First Time Amid Global Rally

U.S. stocks rose, sending the Standard & Poor?s 500 Index above 1,800 for the first time, as global equities rallied after China pledged to expand economic freedoms.

The S& P 500 climbed 0.2 percent to 1,801.09 at 9:32 a.m. in New York. Stocks rose for the sixth week to a record after Janet Yellen signaled she will continue Federal Reserve stimulus efforts as the central bank?s chairman. The Dow Jones Industrial Average added 54 points, or 0.3 percent, to 16,015.96.

?There is room here to take profits from this bullish trend,? Arnaud Scarpaci, who helps oversee about $270 million at Montaigne Capital in Paris, said by phone today. ?As we head towards the end of the year and next year?s debt-ceiling debate, I expect volatility to start rising. I am very cautious about the beginning of next year.?

China?s leaders vowed to allow more private investment in state-controlled industries and expand farmers? land rights as part of the ruling Communist Party?s biggest package of economic reforms since the 1990s. New York Federal Reserve Bank President William C. Dudley and Philadelphia Fed Bank President Charles Plosser are scheduled to speak today. The Fed?s decision to maintain the pace of stimulus has helped the S& P 500 jump 26 percent this year.

China?s stocks rose today, with the benchmark index for mainland companies in Hong Kong surging the most since December 2011. The Stoxx Europe 600 Index rose 0.5 percent.

?We believe China is on the cusp of a massive multiyear bull run,? Christie Ju, managing director at Jefferies Group LLC in Hong Kong, wrote in a note to clients.

While four years of earnings growth and the Federal Reserve?s near-zero interest rate have led the S& P 500 on a 166 percent rally since March 2009, they have also driven up valuations just as the bull market approaches the end of its fifth year.

Cheap is converging with expensive in the American equity market, narrowing options for investors looking for bargains after the broadest rally on record lifted almost 90 percent of the S& P 500 this year. A measure of the dispersion of price-earnings ratios in the S& P 500 compiled by Goldman Sachs Group Inc. narrowed to 41 percent in June, the lowest on record, and held around that level since.

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131118.txt

Buying-in Executed on 18 November 2013

http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/

borrow securities 18 November 2013

https://www1.cdp.sgx.com/scdcint/sbl/viewLendingPool.do#

My pratty pratty girlfriends all from the ShakeLegs Department, no can do..! Must kah gee lai..! Yea baby yea yea yea!!!

GorgeousOng ( Date: 18-Nov-2013 08:30) Posted:

|

oldbirdy ( Date: 18-Nov-2013 15:14) Posted:

|

STI No. 1 Rrrrrrrr !!!

Hsi and Shanghai up 2.5% or more....... STI up 0.32% neh neh !!! Solid man !!!

Asian Stocks Extends Two-Week High After China Reforms

Asian stocks rose for a third day, with the benchmark index extending a two-week high, after China vowed to carry out the broadest expansion of economic freedoms since at least the 1990s.

China Mengniu Dairy Co., a maker of milk products, jumped 4.8 percent after policy makers pledged to relax the nation?s one-child policy. China Galaxy Securities Co. jumped 7.2 percent in Hong Kong as prospects for financial reform boosted brokerages. Dwango Co. soared by the daily limit in Tokyo for a second day after saying Nintendo Co. bought a stake in the company that provides content through mobile phones.

The MSCI Asia Pacific Index added 0.8 percent to 142.64 as of 12:33 p.m. in Tokyo after closing at the highest level since Oct. 31 last week. All 10 of the measure?s industry groups gained. China pledged to allow more private investment in state-controlled industries, ease its family-planning policy and expand farmers? land rights, according to a Communist Party policy decision published by Xinhua News Agency on Nov. 15.

?The investors who were on the sidelines don?t have to hesitate anymore,? Zeng Xianzhao, an analyst at Everbright Securities Co. in Chongqing, said by phone today. ?In the next few years, we will see faster implementation of these reforms and the efficiency of the enterprises will improve as well. There were noises about possible disappointment at the plenum this got rid of all such negative rumors.?

Hong Kong?s Hang Seng Index soared 2 percent on volume 193 percent higher than the 30-day intraday average. The HSI Volatility Index, which measures the cost of options on the Hong Kong equity gauge, jumped 7.5 percent today, poised for the biggest advance since Sept. 30. The Hang Seng China Enterprises Index of mainland companies listed in the city surged 3.9 percent, heading for the highest close since May. China?s Shanghai Composite Index added 1.4 percent.

Bull Run

Chinese shares are on the cusp of a historic bull run, according to a research note from Jefferies Group LLC. Comprehensive reform decisions from the plenum impressed ?tremendously,? with a significance rivaling that of Deng Xiaoping declaring the opening of China in 1978, analysts led by Christie Ju wrote.

Japan?s Topix (TPX) index added 0.3 percent as the yen maintained its slide past 100 per dollar. The Nikkei 225 Stock Average rose 0.1 percent after jumping 7.7 percent last week, the steepest rally in almost four years. Japanese stocks are poised to surpass this year?s high set in May as a stronger U.S. economy weakens the yen and Prime Minister Shinzo Abe?s reflation policy leads to wage increases, according to BNP Paribas Investment Partners SA and SMBC Nikko Securities Inc.

Regional Gauges

South Korea?s Kospi index climbed 0.4 percent while data showed the nation?s producer prices fell 1.4 percent last month from a year ealier. Taiwan?s Taiex Index gained 0.2 percent and Singapore?s Straits Times Index advanced 0.2 percent. Australia?s S& P/ASX 200 Index dropped 0.3 percent, while New Zealand?s NZX 50 Index lost 0.3 percent.

Futures on the Standard & Poor?s 500 Index declined 0.1 percent. The measure rose 1.6 percent last week to close at an all-time high after Janet Yellen, nominated to succeed Ben S. Bernanke as the Fed chairman, said the central bank should take care not to withdraw stimulus too early from an economy that is operating well below potential.

?They are not willing to move yet on tapering,? said Evan Lucas, Melbourne-based market strategist at IG Ltd. ?That?s a positive thing for risk and that means equities are going to be in the green.?

The Asia-Pacific gauge traded at 13.8 times estimated earnings as of Nov. 15, compared with 16.2 for the S& P 500 and 15.1 for the Stoxx Europe 600 Index, according to data compiled by Bloomberg.

赛 莫 达 债 台 高 筑 威 胁 银 行 业 ?