云 妹 ....我 们 的 朋 友 又 回 来 了 ...嘻 嘻

Will there be a rebound since shares are oversold the few months?

S?pore shares are expected to take cover after Wall Street turned lower in final hour after US edged closer towards taking military action against Syria, which might draw Iran and Russia into a wider Mid-East conflict. Investors could also spooked by a WSJ report that suggested the US government would hit its debt limit by mid-Oct.

Yesterday, the STI backed away to close lower after bridging the breakdown gap at 3,108, suggesting the bearish trend is still intact. Immediate downside support is at the 3,065 with resistance at 3,108, followed by 3,180.

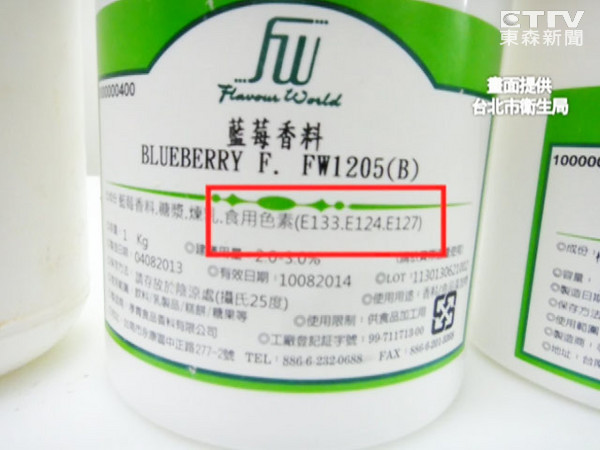

衛 生 局 突 擊 ! 胖 達 人 藏 大 量 香 料 色 素 「 天 然 謊 言 」 破 ...

http://www.ettoday.net/news/20130823/260691.htm

パ ン (胖 )達 人 手 感 烘 焙 ::TOP POT BAKERY::

http://www.tpbakery.com/

Before Ben Beneke step down , can give that man Green Huat Kueh?Give 1 big one haha

Good chance of that.

8bliz8 ( Date: 26-Aug-2013 20:41) Posted:

|

When you have done..... just give us a haul ya! Cheers!!!!

risktaker ( Date: 27-Aug-2013 07:03) Posted:

|

Short sell orders executed on 26 August 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20130826.txt

Hoho......the bear is here....short.......

then those who buy million dollar exec lugi like mad if interest raise up

Siwomp ( Date: 26-Aug-2013 15:59) Posted:

|

My opinion some time back on STI and Emerging Markets are coming true.......

I expect the local Bank interest rate to hit 3% to 4% in 1 to 1.5 yrs time. At which that will trigger selling presure on the local property markets. Residential will be first affected, followed by Industrial then Commercial.

So preprare you Cash for cheaper properties in 1 to 2 yrs time.

My opinion only (deduced from currently available information and development)

yeah...read in the news yesterday...Fed meeting around mid Sep to discuss QE

Octavia ( Date: 26-Aug-2013 15:44) Posted:

|

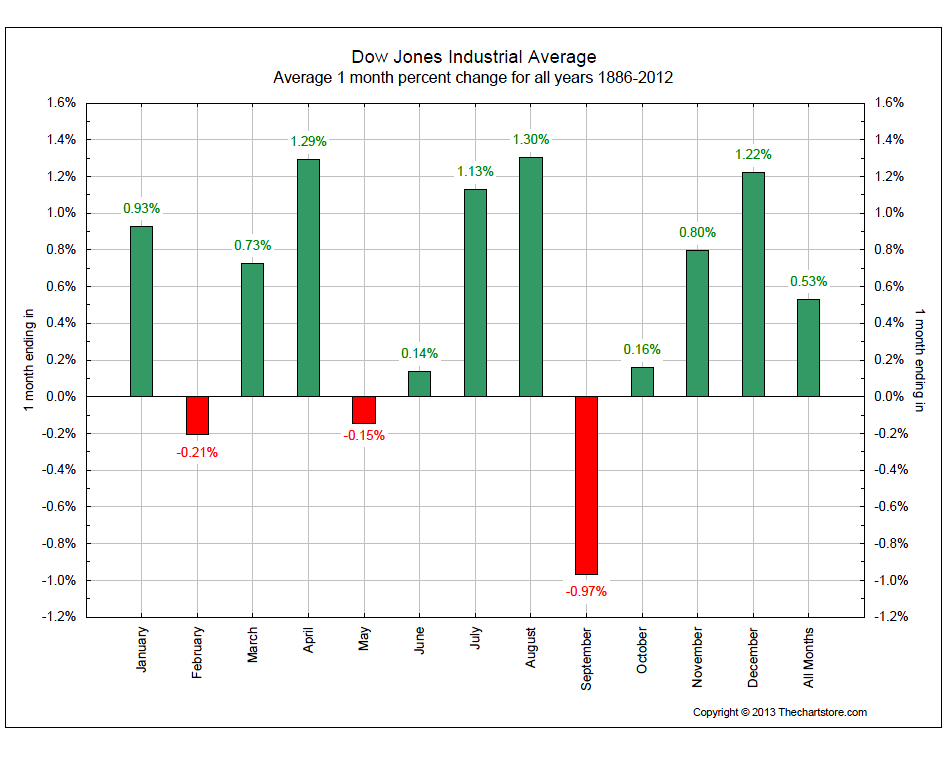

September?s Performance Stands Out

Summer is almost over boys and girls. There?s only one more week before September gets going. So as we enter the last few days of the season, I believe it?s prudent to think about what?s coming up next. How can we be best prepared for September? Well, I think now is probably as good a time as any to check the seasonality stats as we head into Labor Day.

This chart below shows the average monthly performance going back to the beginning of the Dow Jones Industrial Average in 1886. There?s one month in particular that really stands out:

On China economy- clearer signs of stabilisation and positive change, helped by some external improvement, and is on track for the 2013 growth target of 7.5%, the state statistics bureau said on Monday.

teeth53 ( Date: 22-Aug-2013 21:51) Posted:

|

China's economy is showing clearer signs of stabilisation and positive change, helped by some external improvement, and is on track for the 2013 growth target of 7.5 percent, the state statistics bureau said on Monday.

The comments by National Bureau of Statistics spokesman Sheng Laiyun were at a briefing organised by the foreign ministry that may have been aimed at allaying concern in global markets about China's slowdown.

A private factory survey reinforced signs of stabilising in the economy in the third quarter after the government took supportive measures, including scrapping taxes for small firms and accelerating investment in urban infrastructure and railways.

China's annual economic growth slowed to 7.5 per cent in the second quarter, down from 7.7 per cent in the three months ending Mar 31 - the ninth such deceleration in the past 10 quarters. - Reuters

The comments by National Bureau of Statistics spokesman Sheng Laiyun were at a briefing organised by the foreign ministry that may have been aimed at allaying concern in global markets about China's slowdown.

A private factory survey reinforced signs of stabilising in the economy in the third quarter after the government took supportive measures, including scrapping taxes for small firms and accelerating investment in urban infrastructure and railways.

China's annual economic growth slowed to 7.5 per cent in the second quarter, down from 7.7 per cent in the three months ending Mar 31 - the ninth such deceleration in the past 10 quarters. - Reuters

In Europe, Gemany reported that its economy grew 0.7% in 2Q, while Britain revised it growth rate upwards. Emerging market equities gained for the first time in seven days. The Nikkei and ASX also opened slightly in the positive territory. Near term, the STI may attempt to close the breakdown gap at 3,108 set on 22 Aug but upside will be capped given the uncertainty over interest rates, capital outflows and economic growth. The key index is also trading well below its 20, 50 and 200-day moving averages, which reaffirms the bearish sentiment. Immediate downside support is at the 3,065 level.

We do think that Singapore has reached a region of supports. 3000-3100 is always the region we hope to accumulate some singapore stocks. We mentioned it on radio recently too. Do not invest all at one go, but a portion of your funds. We expect a strong support at 3000. Anything below that is angbao to us.

However picking stocks in this seemingly lifeless environment is never an easy task. Good technical and fundamental skillsets are needed.

www.danielloh.com

http://singapore-stocks-investing.blogspot.sg/?m=1

24/8/13

Singapore Stocks STI to head south to 2,500?

When the stock markets globally went south during 2008, sparked by the Lehman Brothers saga, global stocks markets went south as a result. The US delivered a solution which equated to money printing via Quantitative Easing. After these rounds of money printing, the US stocks markets seem okay now, hence the Federal Reserves may scale back on its Quantitative Easing program and this causes investors to pull out their investments and sell their stocks, driving the stock markets regionally and globally south.

24/8/13

Singapore Stocks STI to head south to 2,500?

When the stock markets globally went south during 2008, sparked by the Lehman Brothers saga, global stocks markets went south as a result. The US delivered a solution which equated to money printing via Quantitative Easing. After these rounds of money printing, the US stocks markets seem okay now, hence the Federal Reserves may scale back on its Quantitative Easing program and this causes investors to pull out their investments and sell their stocks, driving the stock markets regionally and globally south.

Water symbolizes wealth for Chinese. A storm may be coming, but there is always sunshine (and sometimes rainbow) after that. But yeap, it is better to seek shelter from the rain first and observe, unless you are a commando or naval diver. Just my thought.. =)

halleluyah ( Date: 25-Aug-2013 22:34) Posted:

|