Second half need Kep Corp, SingTel, SembMar & Semb Corp push up STI.

| COMPONENTS FOR ^STI |

|

STI higher at midday

SINGAPORE shares were higher at 2,750.43 points at midday on Thursday.

The benchmark Straits Times Index (STI) was up by 16.04 points, or 0.59 per cent.

About 608 million shares were traded.

Gainers beat losers 241 to 90.

Hang Seng 20,192.23 +270.01 +1.36%

http://www.hsi.com.hk/HSI-Net/

Seoul Composite 1,590.90 +20.78 +1.32%

BSE30 16,169.35 +247.18 +1.55%

All Ordinaries 4,574.50 +41.50 +0.92%

Taiwan Weighted 7,441.84 +80.80 +1.10%

Nikkei225 9,963.99 +31.09 +0.31%

Stocks dip on Bernanke plan, Europe worries

By Alexandra Twin, senior writerFebruary 10, 2010: 4:22 PM ETNEW YORK (CNNMoney.com) -- Stocks struggled Wednesday as investors weighed the Greek debt situation, a stronger dollar and Fed chairman Ben Bernanke's outline for eventually taking away some of the trillions of dollars used to bolster the nation's financial system.

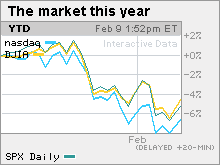

The Dow Jones industrial average (INDU) lost 20 points, or 0.2%, according to early tallies. The S&P 500 index (SPX) lost 2 points, or 0.2%, and the Nasdaq composite (COMP) lost 3 points, or 0.1%.

Stocks also remain vulnerable to a retreat in the aftermath of 2009's big rally, in which the S&P 500 gained 23%. In the last nine months of 2009, it gained 65%, bouncing off 12-year lows hit in March.

"Greece's issues will get addressed, but I wouldn't be surprised to see a bigger market pullback in the weeks ahead anyway," said Tim McCandless, senior equity analyst at Bel Air Investment Advisors.

However, he said that a larger retreat would probably be met with buyers stepping in at lower levels. Since hitting a rally high on Jan. 19, the S&P 500 is down almost 7%, as of Wednesday's close.

Bernanke's comments on the Fed's plans to wind down its extraordinary measures to bolster lending and the strengthening of the dollar versus the euro were also in play Wednesday.

Bank shares bounced up after several down sessions, countering some of the broader weakness in the market. The KBW Bank (BKX) index gained 1%.

Bernanke: The Federal Reserve Chairman said that while the U.S. economy continues to require the support of emergency programs the Fed enacted at the height of the financial crisis, "at some point the Federal Reserve will need to tighten financial conditions."

He said that the Fed will pull cash from the system before it lifts interest rates, and that its decision to boost the emergency "discount" rate is not the same as a shift in policy. The prepared testimony was meant to be delivered at a House Financial Services Committee hearing that was postponed due to snow.

Debt crisis: Reports late Wednesday said France and Germany may present a rescue plan for Greece at Thursday's meeting of euro zone countries. Meanwhile, Greece has vowed to press forward with cutbacks, despite an ongoing worker strike.

Although Greece's impact is small, the threat of a default there has intensified worries about other debt-challenged European countries, including Spain, Portugal, Ireland and Italy. A crisis overseas would set back the still-fragile global economic recovery and hurt U.S. financial institutions. Investors are also keeping an eye on the growing U.S. budget deficit.

"Even if the EU comes in and stabilizes the debt issue in Greece, my concern is that we still have so much debt around the globe that hasn't been addressed," said Dean Barber, president at Barber Financial Group.

The debt crisis has sparked something of a flight from risk over the last few weeks, with investors choosing government bonds and the dollar over stocks. Investors have fled the euro in favor of the greenback and have sold dollar-traded commodities, commodity stocks and a broad swath of securities in other sectors.

The Dow, S&P 500 and Nasdaq have all declined the past four weeks, despite improved quarterly earnings and revenues, and some positive signs in the economic reports.

Despite Tuesday's rally, the market is likely to stay a "choppy mess" for a while, Barber said.

Economy: The December trade gap widened to $40.2 billion in December from a revised $36.4 billion in November, the government reported Wednesday morning. Economists surveyed by Briefing.com thought it would narrow to $35.8 billion. The widening reflected a pick-up in imports amid the recovering economy.

Walt Disney: The media behemoth reported higher-than-expected quarterly earnings and revenue in a report released after the close of trading Tuesday. Disney (DIS, Fortune 500) shares fell 1%.

World markets: European markets mostly ended higher, while Asian markets ended with strong gains.

The dollar and commodities: The U.S. dollar rallied versus the euro and the Japanese yen.

U.S. light crude oil for March delivery rose 77 cents to settle at $74.52 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell 90 cents to settle at $1,076.30.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.64% from 3.63% late Tuesday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers beat winners by eight to seven on volume of 780 million shares. On the Nasdaq, decliners beat advancers seven to six on volume of 1.73 billion shares.

Last night was another Dow Jones 1st Bull in the Bear Market.

This is not a confirm Bull run yet.

We have to wait for 3 days to make sure people are holding to their stocks and not contra play.

Remember last week's rally? That was the 1st Bull too, but was quickly taken over by the Bear.

Lets hope the 2nd Bull appears rather than the Bear. Else more down slide.

US: Wall St gains on reports of help for Greece!

DOW JONES INDUS. AVG 10,058.64 +150.25

S&P 500 INDEX 1,070.52 +13.78

NASDAQ COMPOSITE INDEX 2,150.87 +24.82

S&P/TSX COMPOSITE INDEX 11,274.24 +158.94

MEXICO BOLSA INDEX 30,818.48 +169.04

BRAZIL BOVESPA STOCK IDX 64,718.17 +1,565.08

DJ EURO STOXX 50 € Pr 2,668.43 +4.14

FTSE 100 INDEX 5,111.84 +19.51

CAC 40 INDEX 3,612.76 +5.49

DAX INDEX 5,498.26 +13.41

IBEX 35 INDEX 10,275.40 +69.1

Stocks rally on Greek bailout hopes

By Alexandra Twin, senior writerFebruary 9, 2010: 4:22 PM ETNEW YORK (CNNMoney.com) -- Stocks rallied Tuesday as growing bets that European officials will rescue Greece from its debt problems reassured investors after a four-week selloff.

After the close, Dow component Walt Disney (DIS, Fortune 500) reported higher-than-expected quarterly earnings and revenue. Shares rose 2% in extended-hours trading.

According to early tallies, the Dow Jones industrial average (INDU) added 150 points, or 1.5%, after having risen as much as 230 points earlier in the session. It was the Dow's biggest one-day point advance since Jan. 4, when it gained 155.91.

The S&P 500 index (SPX) rose 14 points, or 1.3% and the Nasdaq composite (COMP) gained 25 points, or 1.2%.

"The prospect of the EU helping out Greece is a sigh of relief, but I really think today is mostly a bounce after the selloff," said Scott Armiger, portfolio manager at Christiana Bank & Trust.

He pointed out that last week, stocks rallied the first two sessions of the week before sliding later in the week. "Today is a good day, but it's only Tuesday," he said. "We need to see how the week plays out."

The threat of a default in Greece has sparked fears of a broader crisis that could impact Portugal, Spain, Ireland, Italy and other debt-challenged European nations. U.S. investors have been trying to gauge what kind of impact such a crisis would have on financial institutions as well as the still-fragile global economic recovery.

News that European Union leaders will meet Thursday to discuss how to manage a growing debt crisis reassured investors. Additionally, Greece said it's raising the retirement age and asking civil servants to accept bonus cuts.

European Central Bank president Jean-Claude Trichet is reportedly leaving a conference in Australia early to join the Thursday meeting. And the Wall Street Journal reported Germany is considering a plan to work with other EU members to offer loan guarantees to Greece and other troubled euro zone countries.

Pop after the fizzle: Stocks have fallen for four weeks straight on worries about China curbing bank lending, Washington cracking down on bank trading practices, and more recently, Europe's debt woes.

Since peaking at a rally high on Jan. 19, the Dow has lost 7.6%, the S&P 500 has lost 7.3% and the Nasdaq has lost 8.4%.

"I don't see this as much more than a reflex rally after the downtrend," said Mike Stanfield, chief investment officer at VSR Financial Services.

"There's still a lot of uncertainty about the economic and political environment going forward," he said. "It wouldn't be surprising to see the first half of the year be something of a consolidation period."

On the move: Financial shares bounced Tuesday, with the KBW Bank (BKX) index rising 1.5%. The index has slipped nearly 5% since the stock market peaked on Jan. 19.

Big energy stocks including Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500) rallied as the dollar slipped versus the euro. Barrick Gold (ABX), Goldcorp (GG) and Alcoa (AA, Fortune 500) were among the other big commodity shares rising.

Caterpillar (CAT, Fortune 500) gained after it was reportedly upgraded to "overweight" from "underweight" by Morgan Stanley.

Economy: Wholesale inventories fell by 0.8% in December after rising 1.6% in November, according to a government report released in the morning. Economists surveyed by Briefing.com thought inventories would rise 0.5%, on average.

Toyota: Following its recalls totaling 8.1 million vehicles for accelerator problems, troubled automaker Toyota Motor (TM) announced another global recall involving 437,000 hybrids, including the 2010 Prius, for problems in their anti-lock braking systems software.

Earnings: Coca-Cola (KO, Fortune 500) reported fourth-quarter earnings of $1.54 billion or 66 cents per share, up 55% from a year earlier and in line with analysts' estimates. The Dow component reported revenue of $7.51 billion, up five percent from a year ago and better than expected.

Shares of Coca-Cola rose 2.6%.

Commodities: U.S. light crude oil for March delivery rose $2.56 to settle at $73.75 on the New York Mercantile Exchange.

COMEX gold for April delivery rose $11 to settle at $1,077.20.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.61% from 3.56% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners topped losers three to one on volume of 1.24 billion shares. On the Nasdaq, advancers beat decliners by over two to one on volume of 2.20 billion shares.

Wall Street rebounds as debt woes ease

By CNNMoney.com staffFebruary 9, 2010: 9:36 AM ETNEW YORK (CNNMoney.com) -- Stocks climbed Tuesday, rebounding from the previous session's selloff, as lingering concerns about mounting debt in Greece eased on speculation that a recovery package may be near.

The Dow Jones industrial average (INDU) added 107 points, or 1.1%, in early trading. The S&P 500 index (SPX) rose 28 points, or 1.3%, and the Nasdaq composite (COMP) gained 2 points.

Worries about European debt and the outlook for the U.S. economic recovery caused investors to flee stocks Monday. The Dow fell 1% and finished below 10,000 for the first time since November.

Economy: Investors will look to a report on wholesale inventories, which comes out later Tuesday. The government is expected to report a 0.5% increase in inventories for the month of December, according to a consensus of economist forecasts from Briefing.com. That would compare to an increase of 1.5% the prior month.

Companies: Toyota Motor (TM) announced a global recall of more than 400,000 hybrids, including the 2010 Prius, over brake problems.

World markets: European shares gained in morning trading. In Asia, the Nikkei finished the session in negative territory but Hong Kong's Hang Seng added 1.2%.

Commodities and the dollar: U.S. light crude oil for March delivery rose 40 cents per barrel to $72.29 on the New York Mercantile Exchange, extending modest gains from the previous session.

COMEX gold for April delivery rose $1.80 per ounce to $1,067.50.

Commodity prices were boosted by a softer dollar, which slipped 0.7% against the euro and 0.2% versus the pound. The greenback rose 0.5% against the yen.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.61%from 3.56% late Monday. Treasury prices and yields move in opposite directions.

williamyeo ( Date: 09-Feb-2010 22:35) Posted:

|