loushare ( Date: 17-Feb-2011 15:27) Posted:

|

EVEN the RED one olso

EVEN the RED one olso

NEXT WEEK, ST INDEX TO RETEST 3120 POINTS

HUAT ARHHHH..

my view ^^

my view ^^

statistics study - china interest rate hike in comparsion ^^

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2011 | 5.81 | 6.06 | ||||||||||

| 2010 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.56 | 5.56 | 5.69 |

| 2009 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 | 5.31 |

| 2008 | 7.47 | 7.47 | 7.47 | 7.47 | 7.47 | 7.47 | 7.47 | 7.47 | 7.34 | 6.93 | 6.12 | 5.45 |

PPI ? CPI ?

Bank reserve requirements raised

By Wang Xiaotian (China Daily)

Updated: 2011-02-19 09:11

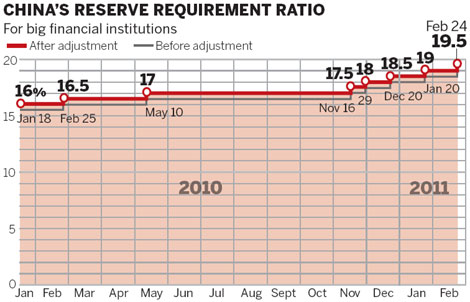

BEIJING - Banks' required reserves were raised by 50 basis points on Friday and further interest rate rises to tackle inflation were not ruled out by Zhou Xiaochuan, governor of the People's Bank of China.

The move by the central bank was the eighth hike since the beginning of 2010 to control inflation in the world's second-largest economy.

The measure will be effective from Feb 24, after which the reserve requirement ratio for big commercial banks will be 19.5 percent. The move is estimated to mop up about 350 billion yuan ($53.2 billion) from the market.

Zhou said raising the reserve requirement is just one weapon in the fight against inflation.

" We can't really say that it's the only method that we'll use to battle inflation, it's about using all means including rates and currency," he was quoted by Bloomberg as saying.

" One method doesn't exclude the other," said Zhou, who was attending a gathering of G20 finance ministers and central bankers, following the announcement.

Lu Zhengwei, chief economist at the Industrial Bank, said the move is within expectations because of the robust growth of new yuan lending in January, which was 1.04 trillion yuan compared with 480.7 billion yuan in December.

" The strong momentum of credit expansion demonstrated that economic growth remains solid. Considering rising inflation, the government has to continue the tightening to confine liquidity to a reasonable level," he said.

China's consumer inflation picked up to 4.9 percent in January from 4.6 percent in December. It hit 5.1 percent in November, a 28-month high. The recent drought in some major grain-producing areas, together with international grain price hikes, has led to increasing worries about rising inflation.

" The latest move made it clear that the central bank won't hesitate to combat inflation. As the Spring Festival holiday fades out, the market can afford to have less liquidity," said Li Mingliang, analyst at Haitong Securities.

Asset bubbles are also a major concern for policymakers. New home prices rose in January from a year earlier in 68 out of the 70 cities monitored.

To soak up excessive liquidity to help curb increasing inflation and asset bubbles, the central bank raised interest rates in February for the third time since mid-October.

Guo Tianyong, an economist at the Central University of Finance and Economics, said the reserve requirement hike is also connected with rising liquidity caused by the trade surplus.

China's trade surplus fell by 53.5 percent to $6.46 billion in January, according to the General Administration of Customs. Exports rose 37.7 percent to $150.73 billion from a year earlier while imports climbed 51 percent to $144.27 billion.

The Industrial Bank's Lu predicted another reserve requirement hike in March, with the figure for required reserves for big lenders reaching close to 23 percent sometime during this year.

Further policy tightening is on the cards, a senior economist said.

" As inflation has yet to reach its peak, policy tightening will likely remain aggressive for a while," said Chief Economist of Deutsche Bank Greater China Ma Jun, in a research note.

He predicted consumer inflation could hover at around 5 percent between February and May, and then surge in June to 5.8 percent before falling gradually toward 4 percent at the end of the year.

In global markets, prices of copper, crude and the currencies of commodity exporters such as Australia, which are sensitive to Chinese demand, all weakened. European stocks and US index futures fell.

China's stocks fell on Friday on concerns that the government may tighten monetary policy again. The benchmark Shanghai Composite Index dropped by 0.93 percent to close at 2,899.79.

Technicallly I have to agree with you Vonntan,

But lets look at why it became bullish...The wise one who sees the impact of the budget 2011 stepped in to form the Bull pattern...

The kan chiong one pulls and wait at the coffeeshop to see entirely what is going to happen... Now we need to see how many wise one are there and how may kan chiong there is...It is good to use technical anlaysis on to see the volatilyty but fundamentally we need to see the potential of the stock....In the form of situation Awareness we need to see the market sentiments...People are all so worried of China Inflation Issues and continous drop in the STI INDEX...there even rumours people are all heading to other market to play...Analytically read the amount of news from china..alot more than anything else...

Till the China Inflation issue settles, which is the major issue here would coool down everthing..India is prepared for the run are we going to seize this opportunity? Well the unstability in politics already the biggest risk for the hungry country, Japan slowly recovering erconomically shows the signs of other market regaining too (wink)...

I might be wrong but i felt like sharing what i see....Till than i would play for Cum Dividends, and some global markets :)

vonntan ( Date: 19-Feb-2011 15:09) Posted:

|

With the STI forming a bullish harami, inverted hammer and with the Budget goodies announced on friday, STI could be poised for a short term price upward movement. However, based on the monthly charts and overview, any price upward movement is not expected to last. there is a good chance for the index to move upwards next week.

However, a bearish pennant formation is potentially taking shape on the technical charts for the STI. Best to trade small for now. Next week will be important.

http://sgsharemarket.com/home/2011/02/sti-potential-bullish-reversal-with-bearish-pennant/

Obama talks jobs with Jobs, other tech leaders

By DARLENE SUPERVILLE

Associated Press

(AP:WOODSIDE, Calif.) President Barack Obama assembled some of the biggest names in Silicon Valley to confer on jobs and innovation, trying to get leaders from companies like Google and Apple behind his push to keep spending on high-tech initiatives even as Republicans are out to slash the budget.

Wunderkind Facebook creator Mark Zuckerberg, Google chief executive Eric Schmidt, and Steve Jobs, the Apple founder and CEO who announced last month that he was taking his third medical leave, were among a dozen business leaders who met with Obama in California Thursday evening. Also attending were the heads of Twitter, Yahoo!, NetFlix and Oracle, and the president of Stanford University.

The dinner at the home of John and Ann Doerr in the San Francisco Bay area was closed to the media. Doerr, a partner at the venture capital firm of Kleiner Perkins Caufield & Byers, attended the meeting.

Obama wants to spend billions on clean energy, education, high-speed Internet and other programs even as his new budget proposal calls for a five-year freeze on domestic spending in certain other areas. The approach is getting a frosty reception from newly empowered Republicans on Capitol Hill, who are pushing steep cuts to a wide range of programs and balking at new spending.

The president argues that targeted spending, including education initiatives aimed at producing a more sophisticated workforce, is crucial for job creation and future U.S. competitiveness with other nations. A stamp of approval from the Silicon Valley's leading innovators and job creators could help.

At the same time, the president's meeting Thursday extends outreach to the business community that he's embarked upon since Democrats suffered steep losses in the November midterm elections. With unemployment stuck at 9 percent, Obama has been pleading with corporate America to hire.

White House press secretary Jay Carney said Thursday that the high-tech sector has been " a model, really, for that kind of economic activity that we want to see in other cutting-edge industries in the U.S. where jobs can be created in America and kept in America, and that's what he wants to talk about."

After his stop in California, Obama was planning to tour Intel Corp.'s semiconductor manufacturing facility in Hillsboro, Ore., on Friday with CEO Paul Otellini. Otellini, who was among a group of CEOs who met privately with Obama in December, has criticized Obama's policies as creating uncertainty for business.

Obama has left Washington weekly since his Jan. 25 State of the Union to highlight his plans to boost education, innovation and infrastructure. Education is this week's theme.

Obama last visited California and Oregon, both states he won easily in 2008, during a four-state swing in October.

AP White House Correspondent Ben Feller and Associated Press writers Julie Pace and Erica Werner contributed to this report.

krisluke ( Date: 17-Feb-2011 12:51) Posted:

|

des_khor ( Date: 17-Feb-2011 15:28) Posted:

|

loushare ( Date: 17-Feb-2011 15:27) Posted:

|

loushare ( Date: 17-Feb-2011 15:27) Posted:

|

Why STI is so useless ?

It goes up less than others but drops more than others in terms of percentage !

Worst still is KLCI, HSI, DJIA, NASDAQ, S& P500,N225 & TOPIX all going up today, but STI down!

How can spore economic worst than these countries ?

Where are the eyes ?

Meanwhile, the co is seeking a US$3b loan, and has invited ~10 banks to participate. Proceeds to be used for working capital and to repay debt and shareholder loans.

Singapore Non Oil Domestic Exports Up 9.4% For December 2010

Posted on: 17th January 2011

On a month-on-month seasonally adjusted (m-o-m SA) basis, non-oil domestic exports (NODX) increased by 8.9 per cent in December 2010, compared to the previous monthís 13 per cent contraction.

On a year-on-year (y-o-y) basis, NODX rose by 9.4 per cent in December 2010, following the 9.9 per cent increase in the previous month, due to non-electronic NODX.

On a m-o-m SA basis, non-oil re-exports (NORX) expanded by 3.5 per cent in December 2010, in contrast to the 1.9 per cent decline in the previous month.

On a y-o-y basis, NORX expanded by 14 per cent in December 2010, after the 13 per cent increase in the previous month, due to both electronic and non-electronic NORX.Overall Trend

On a m-o-m SA basis, NODX increased by 8.9 per cent in December 2010, compared to the previous monthís 13 per cent decline, due to non-electronic NODX.

On a y-o-y basis, NODX grew by 9.4 per cent in December 2010, following the 9.9 per cent increase in the previous month.

On a 3-month moving average (3MMA) y-o-y basis, NODX expanded by 18 per cent in December 2010, following the 22 per cent increase in the previous month.

On a SA basis, non-oil retained imports of intermediate goods2 (NORI) decreased by S$1,172 million from S$5,355 million in the previous month to reach S$4,183 million in December 2010.

Performance of Key Trade Components: Total Trade

On a m-o-m SA basis, total trade expanded by 1.5 per cent in December 2010, compared to the 2.2 per cent decrease in the previous month.

Total exports rose by 4.9 per cent in December 2010, in contrast to a 4.7 per cent decline in the previous month. Total imports contracted by 2.3 per cent in December 2010, compared to a 0.8 per cent expansion in the previous month.

On a y-o-y basis, total trade rose by 9.1 per cent in December 2010, following the 13 per cent increase in the previous month.

Total exports grew by 12 per cent in December 2010, identical to the expansion in the previous month. Total imports increased by 5.5 per cent in December 2010, following the 14 per cent rise in the preceding month.

Non-oil Domestic Exports (NODX)

On a y-o-y basis, NODX rose by 9.4 per cent in December 2010, following the 9.9 per cent growth in the previous month, due to an expansion in non-electronic domestic exports.

Electronic products. On a y-o-y basis, electronic NODX contracted by 1.1 per cent in December 2010, in contrast to the 11 per cent growth in the previous month. The decrease in electronic domestic exports was largely due to disk drives, parts of PCs and parts of ICs.

Non-electronic products. On a y-o-y basis, non-electronic NODX expanded by 16 per cent in December 2010, following the 9.4 per cent increase in the previous month. The rise in non-electronic NODX was led by petrochemicals, specialised machinery and measuring instruments.

Oil Domestic Exports

On a m-o-m SA basis, oil domestic exports grew by 5.3 per cent in December 2010, following a rise of 6.5 per cent in the previous month. On a y-o-y basis, oil domestic exports expanded by 12 per cent in December 2010, after the preceding monthís 10 per cent increase.

The y-o-y growth of oil domestic exports was mainly due to sales to China (+25 per cent), the EU 27 (+27 per cent) and Liberia (+39 per cent). In volume terms, oil domestic exports declined by 0.4 per cent in December 2010, compared to the 3.6 per cent expansion in the previous month.

Non-oil Re-exports (NORX)

On a m-o-m SA basis, NORX increased by 3.5 per cent in December 2010, in contrast to the 1.9 per cent contraction in the previous month, due to a rise in electronic NORX.

On a y-o-y basis, NORX rose by 14 per cent in December 2010, after the 13 per cent expansion in the previous month, due to an increase in both electronic and non-electronic NORX.

On a 3MMA y-o-y basis, NORX expanded by 13 per cent in December 2010, identical to the growth in the previous month.

On a y-o-y basis, electronic NORX increased by 12 per cent in December 2010, following the 4.4 per cent rise in the previous month.

The expansion in electronic NORX was due to parts of PCs (+37 per cent), disk drives (+183 per cent) and ICs (+4.2 per cent).

On a y-o-y basis, non-electronic NORX increased by 16 per cent in December 2010, after the 23 per cent rise in the previous month.

The expansion in non-electronic NORX was due to petrochemicals (+59 per cent), aircraft parts (+34 per cent) and non-monetary gold (+27 per cent).

NORX to all of the top 10 NORX markets, except Malaysia, increased in December 2010. The top three contributors to the NORX rise in December 2010 were India (+75 per cent), Indonesia (+18 per cent) and China (+15 per cent).

Non-Oil Domestic Export Markets

All growth rates quoted in the following analysis refer to year-on-year growth rates unless otherwise stated.

On a y-o-y basis, NODX to all of the top 10 NODX markets rose in December 2010, except Malaysia, the US and South Korea.

The top three contributors to the NODX rise in December 2010 were the EU 27, Hong Kong and China.

2/16/2011 7:15:22 PM Singapore gross domestic product expanded by a seasonally adjusted 3.9 percent in the fourth quarter of 2010 compared to the previous three months, the Ministry of Trade and Industry said on Thursday. That was below last month's preliminary reading for a 6.9 percent quarterly rise, and the revision also missed forecasts for a gain of 5.3 percent.

On an annual basis, GDP rose 12.0 percent - again shy of expectations for a revised 12.2 percent increase following the preliminary report for a 12.5 percent gain.

In the third quarter, GDP had contracted 16.7 percent on quarter and climbed 10.5 percent on year.

For all of 2010, the Singapore economy expanded by a revised 14.5 percent - down from the 14.7 reported last month but still well in line with MTI's growth forecast of 13 to 15 percent for the year.

Thu 17 Feb: Sípore Non-oil Domestic Exports (Jan), Time? ?? Sípore 4Q GDP, Time ? ?? U.S CPI, 2130hrs U.S Philadelphia Fed Survey, 2300hrs(Feb)

* All above in singapore time and date

Whats the number likely to come out? Are you an expert in Toto?

yummygd ( Date: 15-Feb-2011 20:12) Posted:

|