They know times will be bad that's why increase costs. Then, costs never go down when times are better....haha

Shirleyfong88888 ( Date: 22-Nov-2013 14:05) Posted:

|

2014 is a Horse year.

Let e Horse brings Luck & Wealth to all! Huat Huat Arh!!!🐎 🐎 🐎

Let e Horse brings Luck & Wealth to all! Huat Huat Arh!!!🐎 🐎 🐎

risktaker ( Date: 22-Nov-2013 11:12) Posted:

|

Pilot lands 'Dreamlifter' at wrong airport

http://www.bangkokpost.com/news/world/381164/boeing-747-dreamlifter-lands-at-wrong-kansas-airport

must be dreaming....

Three women rescued in London 'after 30 years in slavery'

A man and a woman, both aged 67 and described as non-British, were arrested at their home on Thursday as part of an investigation into slavery and domestic servitude, Scotland Yard said.

The victims are a 69-year-old Malaysian woman, a 57-year-old Irish woman and a 30-year-old Briton who were released after one of them called a charity.

http://au.news.yahoo.com/world/a/19958786/london-police-rescue-three-women-held-captive-for-30-years/

hlfoo2010 ( Date: 22-Nov-2013 12:40) Posted:

|

ALL living ............ face the future except those friend ............

...future is unpredictable...we must be courageous enough to face the future...

aporcarliptic feeling they all..

Jim Rogers: The One Lie That Will Bring Down America

" I don't trust the data from any government, including the U.S., Rogers said. " We know that governments lie to us. Everybody's printing money, but it cannot go on. This is all artificial."

But in reality, he says, " we're living in a fool's paradise."

Source: http://moneymorning.com/ob-article/jim-rogers-major-crash-ahead-2.php

Market is terrible especially funds get ready for christmas..... market scene will not improved .....

1) The MAS has to release its investigation report of the 3 famous amos stock by dec.

2) The uncertainty is killing the market sentiment.

3) The circuit breaker that will trigger a trading halt in both ways. For how long and what is the percentage that will trigger it? I would say 30-40% and 15 mins will be nice...

4) Funds are going for holiday and penny stock hit by losses that many have not seen in years...i see gloomy days coming for singapore 2014....

Becareful.... 2014 will not be easy....

I hope PAP will do something about it.... times will be bad but cost keep on raising....

God bless Singapore..... huat ah.....

2014

1) The MAS has to release its investigation report of the 3 famous amos stock by dec.

2) The uncertainty is killing the market sentiment.

3) The circuit breaker that will trigger a trading halt in both ways. For how long and what is the percentage that will trigger it? I would say 30-40% and 15 mins will be nice...

4) Funds are going for holiday and penny stock hit by losses that many have not seen in years...i see gloomy days coming for singapore 2014....

Becareful.... 2014 will not be easy....

I hope PAP will do something about it.... times will be bad but cost keep on raising....

God bless Singapore..... huat ah.....

2014

Simple. Just print it, who cares literally? It has been like this for ages, lol..

Octavia ( Date: 22-Nov-2013 08:47) Posted:

|

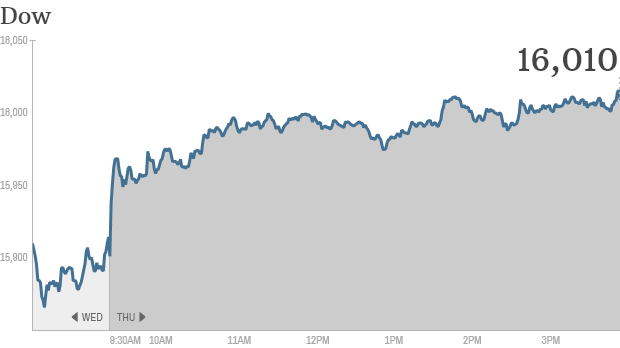

The Dow industrials closed above 16,000 on Thursday for the first time and other major indexes also ended higher after economic data pointed to a slowly improving labor market and subdued inflation.

US could run out of cash in March under debt ceiling: CBO

The United States could start missing payments on its obligations some time between March and June if lawmakers don't raise a legal limit on borrowing by early February, congressional analysts said on Wednesday.

The Obama administration was able to bump against the government's debt ceiling for five months this year before it came to the brink of default.

Mr Obama signed into law a bill last month that suspended a US$16.7 trillion cap on the national debt until Feb 7, when it will reset to whatever level the debt has reached.

The Obama administration was able to bump against the government's debt ceiling for five months this year before it came to the brink of default.

Mr Obama signed into law a bill last month that suspended a US$16.7 trillion cap on the national debt until Feb 7, when it will reset to whatever level the debt has reached.

indeed..

GorgeousOng ( Date: 21-Nov-2013 19:40) Posted:

|

Dow Closes Above 16,000 on Jobless Claims, Buybacks

Click the chart for more stock market data.

U.S. stocks rose, sending the Dow Jones Industrial Average to its first close above 16,000, as data showed improvement in the job market and companies including Union Pacific Corp., Johnson Controls Inc. and Ace Ltd. said they would repurchase shares.

The Standard & Poor?s 500 Index increased 0.8 percent to 1,795.85 at 4 p.m. in New York, erasing most of the decline from the past three days. The Dow average rose 109.17 points, or 0.7 percent, to a record 16,009.60.

?After three consecutive negative days it?s reasonable to expect a breather at least in the beginning of the day,? Lawrence Creatura, a Rochester, New York-based fund manager at Federated Investors Inc., which oversees about $364 billion, said in a phone interview. ?There is some good news in the labor report too in that it does indicate a degree of improvement.?

Investors are pouring more money into stock mutual funds in the U.S. than they have in 13 years, attracted by a market near record highs and stung by bond losses that would deepen if interest rates keep rising. Stock funds won $172 billion in the year?s first 10 months, the largest amount since they got $272 billion in all of 2000, according to Morningstar Inc. estimates.

Fund Flows

The move marks a reversal from the four years through 2012, when investors put $1 trillion into fixed income as the financial crisis drove many to redeem from stocks and miss out as the S& P 500 almost tripled from its low. The U.S. equity benchmark traded for about 17 times its companies? reported earnings at its last record on Nov. 15, the highest valuation since May 2010.

The S& P 500 rose above 1,800 for the first time on Nov. 18 before erasing the advance. The equity benchmark dropped during the first three days of the week after forecasts from Best Buy Co. and Campbell Soup Co. disappointed investors and minutes from a Federal Reserve meeting indicated the central bank may reduce monetary stimulus in coming months.

Jobless Claims

U.S. jobless claims in the week ended Nov. 16 dropped by 21,000 to 323,000, the fewest since the week ended Sept. 28, from a revised 344,000 the previous week, the Labor Department said today in Washington. The median forecast of 47 economists surveyed by Bloomberg called for a drop to 335,000.

American consumers became less pessimistic in November about the economic outlook as the effect of last month?s partial government shutdown dissipated, according to data from the Bloomberg Consumer Comfort Index released. The gap between positive and negative expectations for the economy shrank to minus 14 from a two-year low of minus 31 in October.

Financial stocks in the S& P 500 (SPX) collectively climbed 1.5 percent, the most among 10 main groups. Ace, an insurer with operations in more than 50 nations, led gains in the industry with a 3.8 percent advance to $101.53. The company said that it is targeting $1.5 billion in share repurchases through the end of next year.

European markets closed mixed. The CAC 40 in Paris slipped after new data showed a contraction in French private sector output in November.

Asian markets were also mixed. Hong Kong and Shanghai's indexes fell after Chinese manufacturing stumbled for the first time in four months. But Japan's Nikkei surged almost 2% as the Bank of Japan expressed optimism about the country's recovery and said it would make no changes to its stimulus program

World Markets

North and South American markets finished mixed as of the most recent closing prices. The S& P 500 gained 0.81% and the IPC rose 0.50%. The Bovespa lost 0.65%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

| Dow Jones Industrial Average | United States | +109.17 | +0.69% | 16,009.99 | 4:32pm ET |

| S& P 500 Index | United States | +14.48 | +0.81% | 1,795.85 | 4:32pm ET |

| Brazil Bovespa Stock Index | Brazil | -344.89 | -0.65% | 52,688.02 | 2:16pm ET |

| Canada S& P/TSX 60 | Canada | +2.55 | +0.33% | 777.51 | 4:20pm ET |

| Santiago Index IPSA | Chile | -42.13 | -1.32% | 3,151.42 | 3:10pm ET |

| IPC | Mexico | +202.81 | +0.50% | 40,998.37 | 4:06pm ET |

Short sell orders executed on 21 November 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131121.txt

Buying-in Executed on 21 November 2013

http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/

borrow securities 21 November 2013

https://www1.cdp.sgx.com/scdcint/sbl/viewLendingPool.do#

Heheee!

Peter_Pan ( Date: 21-Nov-2013 19:24) Posted:

|

Wall Street-Fighter looks set to chup siao early tapering by the Feds. Sian liao..bah pee liao...

Bloodletting across the board today. I can feel the resurgence of the bear. Wonder how all those analyse come out with the bullish sentiments. @_@

Fed's Bullard: December taper 'definitely on the table'