teeth53 ( Date: 22-Jan-2010 00:12) Posted:

|

Forget about this plane, likely to crash landing if hold too long

Only buy airline stock during a recession and best during a depression.

If you compare SIA to Tiger airways price, means it is likely to drop to half if there is a double dip recession, so why buy now? so buy when GDP crash landing.

Sorry for the party poper but not vested anyway.

This indicated BBs is watching. IF NOT oredi sub-mariner liao. Yes they (BBs) is supporting now, Tiger Air IPO size is small (manageable-controlled) and volume traded - not great, still there is alot of institute funded supporter around. So take your Q.

| TigerAir | CPF,M | 1.500 | 1.580 | 0.000 | 0.0 | Vol:93,583,000 | 340,000 | 1.580 | 1.590 | 1,048,000 | 1.610 | 1.490 |

teeth53 ( Date: 22-Jan-2010 00:21) Posted:

|

street81 ( Date: 22-Jan-2010 17:05) Posted:

|

The stock was up 2 cents from its IPO price of $1.50 at lunch break - and subsequently added another 6 cents to end the day at $1.58 as the overall market sentiment improved.

Market sentiment aside, many investors aren’t exactly inspired by its balance sheet, its earnings in the past and its prospects going forward.

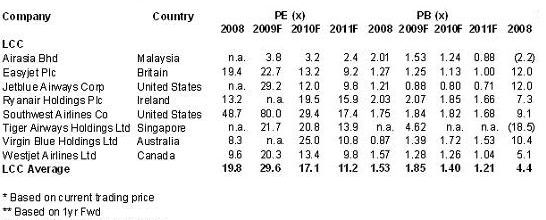

This morning, Esther Sim, an analyst at UOB Kay Hian Research, put together a peer comparison table for Low Cost Carriers.

She noted that Tiger Airways' closest listed competitor is Air Asia ( BUY/ Target:RM1.67), which trades at a substantially lower P/B multiple and EV/EBITDA multiple.

“Furthermore, the bulk of Air Asia's debt is in its books while Tiger Airways debt is mostly off-balance sheet.”

Note also that Air Asia has hardly budged. "Based on our preliminary estimates, Air Asia offers significantly better value," she wrote.

Many took this opportunities to STAG, have some kopi money, by looking at the married deal done, it can, but it can be uphill task to keep it beyond 1.65

| Last | Trades | Volume | Bid Volume | Mid | Ask Volume |

| 1.490 | 1 | 10,000 | 10,000 | 0 | 0 |

| 1.500 | 65 | 8,104,000 | 5,018,000 | 2,553,000 | 533,000 |

| 1.510 | 457 | 12,854,000 | 6,901,000 | 91,000 | 5,862,000 |

| 1.520 | 1,002 | 18,271,000 | 6,699,000 | 326,000 | 11,246,000 |

| 1.530 | 666 | 12,913,000 | 3,881,000 | 246,000 | 8,786,000 |

| 1.540 | 632 | 12,559,000 | 4,481,000 | 0 | 8,078,000 |

| 1.550 | 317 | 6,806,000 | 1,687,000 | 0 | 5,119,000 |

| 1.560 | 186 | 5,509,000 | 1,081,000 | 0 | 4,428,000 |

| 1.570 | 196 | 6,223,000 | 1,254,000 | 100,000 | 4,869,000 |

| 1.580 | 36 | 3,324,000 | 1,178,000 | 110,000 | 2,036,000 |

| 1.590 | 48 | 2,617,000 | 1,086,000 | 0 | 1,531,000 |

| 1.600 | 181 | 4,304,000 | 468,000 | 0 | 3,836,000 |

| 1.610 | 10 | 89,000 | 0 | 0 | 89,000 |

| TOTAL | 3,797 | 93,583,000 | 33,744,000 | 3,426,000 | 56,413,000 |

I will be submitting my drawing of 'Tiger suit' for their hostesses to wear on plan......sexy..... hahaha!

tanh2l ( Date: 22-Jan-2010 17:10) Posted:

|

des_khor ( Date: 22-Jan-2010 17:08) Posted:

|

haha! not bad, they make it 'nice' by closing 1.6 at least. sold few but still keeping 3 lots to test if monday can reach 1.65.......(since they first fixed it at 1.65 and logically, cld breach tat price)

knightrider ( Date: 22-Jan-2010 16:46) Posted:

|

nickyng ( Date: 22-Jan-2010 17:01) Posted:

|

knightrider ( Date: 22-Jan-2010 16:46) Posted:

|

1.60 can reach?

niuyear ( Date: 22-Jan-2010 15:03) Posted:

|

knightrider ( Date: 22-Jan-2010 14:58) Posted:

|

* Shares up as much as 5.3 pct

* Valued at 13 times forward earnings, vs 6.4x for AirAsia

* Credit Suisse, IATA predict recovery in airline industry

By Harry Suhartono

SINGAPORE, Jan 22 - Shares in Singapore budget carrier Tiger Airways <TAHL.SI> gained on their debut on Friday after the first Asian airline IPO in five years, with some investors betting the sector will rebound from a severe downturn.

Industry group IATA estimates global passenger numbers will rise 4.1 percent this year after falling 4 percent last year, but it still expects the air industry to lose $5.6 billion, around half last year's total industry losses.

Tiger, 49 percent-owned by Singapore Airlines <SIAL.SI> and part-owned by state investor Temasek [TEM.UL], raised $178 million, and will use the proceeds to buy planes, set up a new operating base, and pay off some debt.

The offering drew strong interest, with the retail tranche 20 times subscribed and the institutional portion drawing four bids for every available share.

By 0215 GMT, Tiger shares were traded at S$1.53, up 2 percent from its S$1.50 initial public offer price. The shares had traded as high as S$1.58.

Credit Suisse has said Asia's aviation sector is "in a sweet spot" as demand is recovering and load factors are on the rise, making 2010 a year of margin and earnings recovery.

Some, however, reckon Tiger is expensive, noting the shares trade at more than 13 times forecast earnings for the year to March 2011, versus 6.4 times 2010 earnings for its more established rival AirAsia <AIRA.KL>.

"Tiger enjoys better loads and higher fares than AirAsia," Credit Suisse wrote in a pre-IPO report. "However, AirAsia does have a superior cost and higher margins."

Tiger currently has 17 Airbus A-320 aircraft in service, with another 55 A-320s to be delivered by 2016.

The airline has grown rapidly since it began operations in Singapore in September 2004 and briefly turned profitable in its third year of service.

However, it posted a S$50.8 million loss for the year to March 2009 due to costs incurred in starting up operations in Australia, where it competes against Jetstar, the budget carrier business of Qantas Airways Ltd <QAN.AX>. (Additional reporting by Nopporn Wong-Anan, editing by Kevin Lim and Ian Geoghegan)