Others

REITS and Trust continue to drop

Post Reply

1-20 of 23

Post Reply

1-20 of 23

Well, at end of the day no. Only those oversea ones except Lippo Mapple are holding up. Weird unh?

Today, all doing well.

I think it's normal with bad timing. My saving of $150K now valued at $60K only

ilovebull ( Date: 16-Oct-2008 17:46) Posted:

| I know of someone who bought Cityspring at $1.50 and the price is now only $0.50.... |

|

Those reits who have strong background or do not require any financing

for the next few years are safer. For example like CMT, Suntec Reit and Mapletree Logistics. Hold on tight..................

I know of someone who bought Cityspring at $1.50 and the price is now only $0.50....

Yes, agree all underwater, but if one still stubborn want to buy then blue is still the safest. it wont go down and out..unlikely...

Sgx , Semb marine , Singtel ..... lot more also under water !!

I think if one still want to buy...i think the safest is Singapor blue..even those stock listed blue but not Singapore own dont buy..

I think these are the safest.

comfortdel, SMRT, SIA, SPH...in fact many under "S"

knightbridge ( Date: 15-Oct-2008 17:48) Posted:

REIT are generally safe. But if you are still getting yield of 10% no need to worry. What i am saying is to guage the value of this asset also by other means. Not just on the yield.

I dun think there will be many new malls for the next 5 years. In land scare Singapore, how many mall can developer build. But looking back, when the economie in singapore turn bad last 10 years. Like Asian crisis and SAR crisis rental is very cheap.

If you are buying good asset not to worry as they will recover very fast when things are good again |

|

I am sorry, but the yield is taken as that latest one and divide by the share px..so going forward in this market the sh px keep dropping and the yield keep increasing..

What if next result most likely be bad and dividend declare is lesser and worse the px is even lower...

What i am saying is that the dividend u get is coming from your share px..u are paying yourslf dividend..

Do u really make $..if bank refuse to their loan when time is up, they will have to refinance by selling asset,, and how to sell at a down market..at a good px.

That why all those stock that have hugh gearing is worse hit.

I think we shoudl not be stubborn, hold all buying..wait for market to ottom..before buying.

Sorry if anything i post is wrong..thanks.

left_bug ( Date: 15-Oct-2008 17:35) Posted:

| Oh my! Oh my! My portfolio of REITS and trusts is now at around 60% loss. If all goes well, my portfolio should earn me 10% annually. If share price stay at current pace and disregard the inflation, it will take me six years just to get back to my original capital.

|

|

REIT are generally safe. But if you are still getting yield of 10% no need to worry. What i am saying is to guage the value of this asset also by other means. Not just on the yield.

I dun think there will be many new malls for the next 5 years. In land scare Singapore, how many mall can developer build. But looking back, when the economie in singapore turn bad last 10 years. Like Asian crisis and SAR crisis rental is very cheap.

If you are buying good asset not to worry as they will recover very fast when things are good again

Oh my! Oh my! My portfolio of REITS and trusts is now at around 60% loss. If all goes well, my portfolio should earn me 10% annually. If share price stay at current pace and disregard the inflation, it will take me six years just to get back to my original capital.

Your van story confuses me. I like high yield stock and I like REIT and trusts especially. It's impossible for an average man like me to own a property to collect rental, but with REIT I am able. After this credit crisis, maybe more companies are willing to lease an asset so we will see more REITs and trusts coming. Imagine SIA without airplanes. If one day, all Singapore utilities form under a trust, maybe the general public cum unit holder would be happy to see rising utility bill.

Ask yourself this question why to Company wants to set up REIT when they have in under their companies Asset?

Maybe to free up its capital, so that they can have more cash to invest or grow the company.

To realise the value of the property based on yield return immediately and not need to put depreciation in its accounting book.

What the difference when the property is in the company book and a listed as a REIT in exchange?

Why do reit price fall. The market expected the asset price for this class of property to fall or expecting the yield to fall.

It like buying a van for 10k that made income for 2k per annum for 10 years. If the van on the 5th year made 4k for the next 5year. It is mean the van is worth 15k. Or the van didnt make any income in yr 9, means it is worthless. Remember that is a old van. REIT will misled u into valuing the asset according to yield and not the market price of the property

A Reit balking the trend?

source : www.sgdividends.blogspot.com

Thanks to

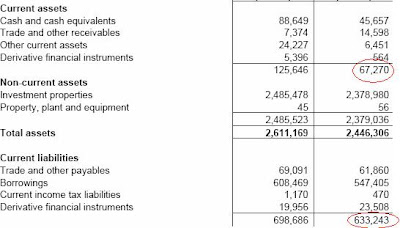

zhuangzi (A reader) she did mention a very good point that since REITS are required to give out a bulk of their income as dividends, this results in a low cash position...resulting in REITS generally having low current assets (CA ). See my previous

post.

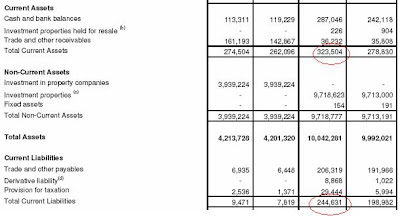

So good ol' "kaypoh" SGDividends decided to comb the SGX REIT Realm and true enough most indeed have their CA lower than their current liabilities CL. But we did find one REIT which balks the trend. Its Fortune Reit. See chart below! Its CA is higher than its CL.

And guess what my friends..who do you think has some shares in it too? (hint hint..the splendid folks who invested in Merill Lynch)

SGDividends : Eh if you buy then something go awry dont blame us ok....we are just stating facts and being unbiased ..pls read up carefully before investing. Steady Bom pi pi boh..

With most of the reits having to pay out more liabilities within a year than they can receive within a year means they have to borrow during this time and its a credit crunch. No wonder reits doing so badly.

MapleLog (Current Assets lesser than Current Liabilities)

Macarther reit (Current Assets lesser than Current Liabilities)

Macarther reit (Current Assets lesser than Current Liabilities)

hyflux water trust is another good trust. water will soon become a commodity. non-cyclical.

Don't own MMP. Do have LMIR and MIIF which you offload at 0.49.

Cyjerry85, you may goto this site to check it out. Also you might want to check out the other blogs provided by the site owner.

http://sreit.blogspot.com/

Can a kind soul list down all the REIT and Trusts? thanks!

Agree. Let's go in and support our reits now. Which one to begin with? How about MMP?

LMIR has really low gearing and it still heading south. Parkway Life and Capital Mall are the most defensive but their dividend yields are also the lowest. Shopping and get sick are part of urban life and we can not live without it.