3Q results

? Cumulative revenue grew 31.9% to $58.21 million

? Cumulative net profit surged 71.7% to $28.47 million

Results next Tuesday

illiquid stock with good fundamentals. wondering is the price rise because of upcoming results and hopefully dividend..?

any comments anyone? haha, hard to find ppl vested in this stock

limkt009 ( Date: 23-Oct-2013 16:57) Posted:

|

Straco is 29 cents but worth at least 45 cents.

From NextInsight. Post it here so that the info here will be more complete for tracking purpose.

|

STRACO CORP: After another solid year and a bigger cashpile, will there be M& A? |

This article is republished with permission from NextInsight.

04-Apr

Screenshot of Shanghai Ocean Aquarium website www.sh-aquarium.com/en

Screenshot of Shanghai Ocean Aquarium website www.sh-aquarium.com/enWHILE STRACO CORPORATION has a track record of strong business performance, investors are now asking: When will it make another good acquisition? What is the next project that will take the business to another level?

But first, a brief rundown on Straco as it is not exactly a high-profile company on the Singapore Exchange despite the high quality of its business.

Straco started life as a public company in 2004 with just one key asset -- the Shanghai Ocean Aquarium that it developed from scratch. It also had a cable car operation in Xi'an but that was not a key revenue contributor.

Then in 2007, Straco struck gold with the acquisition of the Xiamen Underwater World, turning the aquarium around remarkably. To date, the Xiamen aquarium has generated cash of around 4X the effective acquisition cost of about S$9 million (S$12.5 million transacted price minus S$3 million cash in the business then).

Collectively, the 3 assets have gone on to lift the performance of Straco, the latest result being a 20% rise in revenue in 2012 to S$55.2 million.

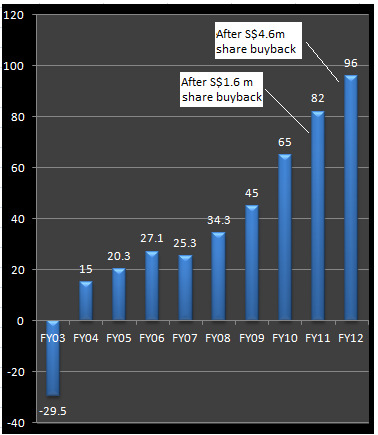

Straco's net cash (above) has soared to S$96 million as it generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of that, the company extracted a net profit of S$19.73 million, up 19% year on year.

Straco's net cash (above) has soared to S$96 million as it generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of that, the company extracted a net profit of S$19.73 million, up 19% year on year. The net margin was 35.7%, which firmly places Straco among a small number of Singapore-listed companies with such wonderful profit margins.

Straco's business also generates a powerful flow of cash.

As at end-2012, it had net cash of S$96 million or about 11.3 cents per share. That means a third of its share price of 31 cents is cash.

Its cash builds up in part because its capex doesn't suck up cash.

Capex was just about S$1.1 million last year, covering repair and maintenance, and replacement of fish stock, etc.

The capex was more than covered by the S$2.7 million in interest income from its cash pile.

This year, Straco's cash pile will effortlessly shoot past the $100 million mark -- after taking into account a S$10.5 million dividend payout (1.25 cent a share for FY2012) and possibly some share buyback versus over S$20 million of free cashflow from its business.

When will Straco deploy its cash into M& A action which could boost its earnings even more? That question was one of the more compelling ones from analysts during a meeting with CFO Amos Ng last week.

Amos Ng, CFO of Straco Corp for 13 years already. NextInsight file photoConstantly sizing up opportunities

Amos Ng, CFO of Straco Corp for 13 years already. NextInsight file photoConstantly sizing up opportunitiesStraco, Amos replied, has evaluated many proposals and opportunities. It, however, has not found one that it would seize.

Some time back, for example, an aquarium in China became available for a fraction of the owner's investment cost.

Straco decided against buying because it figured that the aquarium would continue to be loss-making for at least a few more years. And the asset would require significant management resources to turn it around, leading to opportunity costs.

Neither is starting a greenfield project a walk in the park in China, said Amos. The Chinese will approach many potential business partners to bid for projects.

Straco, in turn, has stringent criteria about the profitability potential of what it wants to venture into.

But it does have a project that it will soon embark on. It has been deferred for some 10 years already owing to land acquisition issues.

This is the Chao Yuan Ge project in Xi'an for which Straco has earmarked an initial US$8 million for development. When ready, the project located on Mt Lishan will boost the number of users of Straco's cable car operation there.

It will showcase the culture and unique architectural features from the Tang Dynasty through reconstructed replicas of its major buildings.

The project, due to be completed in 2015/2016, will rank among the most important attractions in Xi'an along with the Terracotta Warriors Museum and the Qing Shihuang Mausoleum.

Not bad, the yield is 4% based on 30cts share price yesterday.

01-Mar

a) revenue for 2012 rose 20% toS$55.2mn b) net attributable profit rose 19% to S$19.73mn c) balance sheet very healthy with net cash of S$95.9mn or about 11.3 cents per share d) EPS for 2012 was 2.32 cents e) NAV for 2012 was 15.6 cents f) DPS for 2012 totaled 1.25 cents comprising a final dividend of 0.75 cents (same as 2011) and a special dividend of 0.5 cents The company gave a very positive outlook for 2013 in its forward looking statement in item 10 In 2012, Straco's high cashflow aquarium business has added further to its net cash, which now totals S$96 million. Above: Screenshot of Shanghai Ocean aquarium website www.sh-aquarium.com/en

In 2012, Straco's high cashflow aquarium business has added further to its net cash, which now totals S$96 million. Above: Screenshot of Shanghai Ocean aquarium website www.sh-aquarium.com/en

The following was published today on www.nracapital.com and is reproduced with permission

Straco Corporation reported its full year FY2012 results yesterday. No major surprises at the operating level with the company delivering revenue and profit growth of about 20%.

I was however pleasantly surprised by the dividend which total 1.25 cents compared to 0.75 cents in 2011 comprising a final dividend of 0.75 cents and a special dividend of 0.5 cents.

" The National Bureau of Statistics reported that China?s gross domestic product (?GDP?) rose by 7.9% in the fourth quarter of 2012 from a year earlier, confirming that the Chinese economy had rebound after seven consecutive quarters of slowdown, due to a confluence of factors including slow down in Chinese exports and targeted government policies to control inflation and economic overheating." For the full year 2012, the China economy grew 7.8%, its slowest pace since 1999 and substantially down from 9.3% growth in 2011.

" Going forward, the Chinese government is expected to fine tune its policies with focus on stability and controlling financial and inflation risk rather than boosting growth. At the Group level, we expect our business to remain robust in view of the fast-growing domestic tourism market in China and the government?s initiatives to boost the tourism industry."  Straco's market capitalisation currently is about S$252 million. It has net cash of S$96 million.Chart: Yahoo

Straco's market capitalisation currently is about S$252 million. It has net cash of S$96 million.Chart: Yahoo

Commentary

I am happy with the results and the better than expected dividend. Straco is a strong domestic China tourism play with very strong cashflow through its two aquariums and cable car businesses.

The organic growth in this business is usually about 10% and I am comforted by the management's positive forward looking statement of robust growth - It remains in My Stock Picks Yield list.

I have raised the fair value using my dcf and cash calculation but the stock like Cerebos is likely to see slow and steady gains supported by its reasonable yields and strong cash backing. Definitely worth keeping for the medium term.

I was impressed by the story in the article below. When I was in Beijing few mths back, every tourist attractions I went, there were big crowds queuing to buy tickets. A local Chinese friend told me, the potention of tourism in China is huge.

I am now vested after reading this article. Anyone else? Would like to share your view?

___________________________________________________

Written by Kevin Scully (NRA Capital)

|

This article was recently published on www.nracapital.com and is reproduced with permission Adding Straco Corporation to my Yield Stock Picks to replace.......Cerebos which is being privatised Monday

Kevin Scully, executive chairman, NRA Capital. NextInsight file photo

With the privatisation and delisting of Cerebos, I was looking for a yield stock replacement that was in a defensive industry and which had a strong balance sheet to weather any storm that might suddenly surface from the EU, Middle East or even Asia. The latter two are likely to more conflict related than economic. Straco Corporation is one such company and I am adding it today to my Yield Stock list. About Straco Corporation Straco Corporation Ltd is in the tourism industry in China where it owns and runs the Shanghai Ocean Aquarium (SOA), Underwater World in Xiamen (UWX) and also a cable car service in Xian. Although all its businesses are in China, Straco Corporation is not an “S” chip in the sense that its major shareholder Mr Wu Hsioh Kwang, who owns 54.6% of the company is a Singaporean. Business

Screenshot of Shanghai Ocean Aquarium website www.sh-aquarium.com/en

Straco owns and operates the Shanghai Ocean Aquarium which is sited near to the landmark Oriental Pearl Tower in Shanghai. Photo: Internet

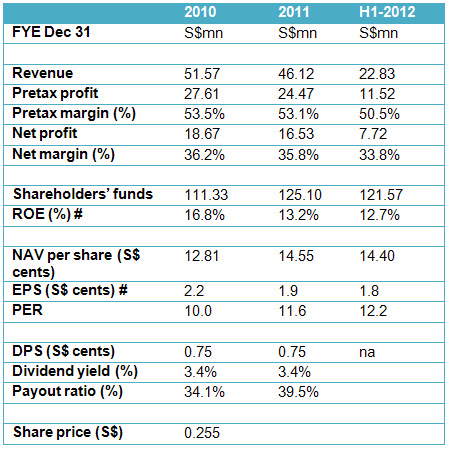

About two thirds of Straco’s revenue comes from SOA which is located next the the Pearl Tower in Shanghai and the balance from UWX and its cable car business. 95% of the customers or visitors to SOA and UWX are domestic tourists. This will insulate Straco’s revenue from the fluctuations in the global economy and its impact on tourist arrivals into China. The average number of visitors to SOA and UWX in 2009 was 1.8mn. This figures rose to 2.35mn in 2010 because of the World Expo in Shanghai while UWX saw its visitor growth expand by about 10%. 2011 saw the visitor number normalise to 2.3mn removing the one off effect of the World Expo. Both locations are likely to see sustainable organic growth in visitors of about 10% per annum. Entrance fees for each location SOA now charges RMB160 for an adult with RMB110 for children. This fee was increased in November 2011. The blended yield for SOA is about RMB140 per person. For UWX, the entrance fee for adults is RMB90 and RMB50 for children giving a blended figure of RMB68. The entrance fees were last increased in March 2010. Financials

# annualised figures for FY12

Straco has a strong balance sheet with net cash of about S$80mn or about S$ 9.4 cents per share. Company has been buying back its own shares and now has about 24.8mn Treasury shares which are currently used for the directors and employee share option scheme. Recommendation

Kevin Scully: " If you are looking for a defensive play, with a strong balance sheet, a decent dividend yield which is likely to grow at 5-10% per year matching earnings growth, Straco can offer these unique features."

Straco Corporation offers direct exposure to the China tourism market but as a domestic play with more than 95% of its current visitors being mainland Chinese. This figure has been growing steadily at between 5-10% per annum and given China’s total population of more than 1.4bn is likely to see domestic visitors remaining the main customer group over the next five to ten years. This unique positioning makes its earnings fairly defensive against the economic slowdown in the EU and the US. Earnings could take a quantum leap if Straco acquires new assets or businesses in the same tourism industry space such as its acquisition of UWX. It is able to do this given its strong cash position and absence of any debt. The Group has a strong balance sheet with about S$80mn in cash or about 9.4 S cents per share. Over the last few years, Straco has consistently paid about 40% of net earnings as a dividend – but there is scope for this figure to rise given the large cash position as well as its strong free cashflow. Don’t expect huge capital gains but if you are looking for a defensive play, with a strong balance sheet, a decent dividend yield which is likely to grow at 5-10% per year matching earnings growth, Straco can offer these unique features. The Company has embarked on a share buyback scheme and has to date purchased about 24-25mn Treasury shares. This should provide downside support on the shares for those investing for the yield. It's not an “S-Chip” even though its businesses are in China with the major shareholder Mr Wu owning more than 54% of the issued shares. For more on the intrinsic value of Straco read my commentary in my Yield portfolio. On a cashflow basis, Straco is generating about S$24mn in cashflow per year over the last two to three years – which works out to about 2.8 cents per share giving a price to cashflow of 9.1 times. |

Straco Corporation is benefiting from the rise of domestic tourism in China.

Starting to move, good china-play stock.

So many china shares have moved today, anyone wishing to comment on Straco rding this wave?