Q& M made an acquisition of dental chain in China.

Good for long term.

Entry price 0.30 or below.

Anyone shareholder of Q& M ?

This few days I backside itchy blur blur load some at 0.300...

Look like a dead fish to me, I think had to hold for some times liao. Unless something boot up :)

|

look out for the developments in china when they announced results in coming week ! Q & M Dental obtains $38-47m investment from Chinese private equity firm |

| Written by The Edge |

| Monday, 13 August 2012 08:50 |

|

Q & M Dental Group (Singapore), through its two 100%-owned subsidiaries in China, has signed a non-binding memorandum of understanding (MOU) with Kunwu Jiuding Capital for the Chinese private equity firm to invest a total of RMB 192 million to RMB 240 million ($38 million to $47 million) for up to a 20% equity stake in Shanghai Q & M Investment Management and Consulting (SQM).

The MOU was entered today between Q & M Dental Holdings (China) (QDHC), SQM and Kunwu Jiuding Capital. Headquartered in Beijing, Kunwu Jiuding Capital is a leading Chinese private equity investment company with more than 50 branches and agencies across China. The groundbreaking deal signifies Q & M as the first Singaporean listed healthcare company to receive funding from a Chinese private equity firm at a subsidiary level. The injection of funds in renminbi denomination will support Q & M’s expansion plans in China, as QDHC and SQM are eyeing to acquire various dental clinics, hospitals and laboratories. In addition, Q & M stands to benefit from Kunwu Jiuding Capital’s professionalism and strong local knowledge in China to support Q & M’s expansion plans. |

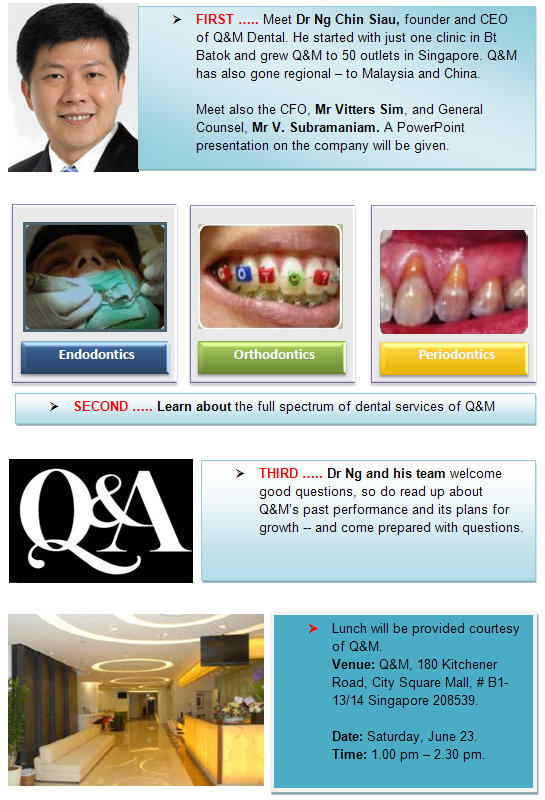

Perhaps many people have already noticed a fast growing dental healthcare group that has been sprouting island wide in the recent years. Not limiting to the 46 dental clinics, four dental centres and one mobile dental clinic located strategically across our sunny island, Q& M Dental Group (Singapore) has also expanded its footprint in the region to Malaysia and China.

Q& M’s founder and chief executive officer, Dr Ng Chin Siau, shared with Shares Investment in an exclusive interview that its successful growth in the region thus far has been nothing short of commendable in spite of the uncertain global economy outlook due to the resilient nature of its business as a pure dental play.

“Reflecting the resilience of our business, Q& M has shown progressive growth and a proven track record since its humble beginnings in 1996 having weathered the various troughs and crises the economy had faced,” Dr Ng said. Testimony to his words, Q& M had posted consistent growth in its top line pre-listing and recorded a compounded annual growth rate of 25.5 percent since its initial public offering in 2009.

Notably, Q& M also reported a 23 percent jump in revenue of $13 million for its first quarter ended 31 March 2012 from $10.6 million in the previous corresponding quarter on the back of higher contribution from its existing and new dental outlets in the region, including its dental equipment and supplies distribution business as well as a slight increase in services prices. Despite the margins squeeze from the rising expenditure costs such as manpower and rental, 1Q12 earnings increased 6 percent year-on-year from $1 million to $1.1 million.

A Solid Market Position

Standard & Poor’s noted that Singapore, where Q& M derives the bulk of its revenue, has a significant scope for growth in the dental health sector given the country’s rising affluence, increasing awareness of dental health and its reputation as a medical hub that has boosted a growing medical tourism market.

While a clear leader in the local private dental industry, Q& M is not resting on its laurels and is continuously building a larger customer base. By 2015, Q& M targets to have 60 dental outlets in Singapore.

“Having a wide network of dental outlets in Singapore makes us an ideal partner for corporate clients seeking a convenient healthcare programme for their employees,” Dr Ng said. Recently, Q& M signed a framework agreement with the National Taxi Association to provide affordable dental care to its 11,000 taxi drivers and their immediate family members. SIAS Research noted that assuming an average household size of 3.5, the potential patients from just this crowd is estimated to be 38,500.

“Particularly, the enhanced Community Health Assist Scheme (CHAS) introduced by the government, will be able to bring in even more patients for the dental group as it allows patients to seek subsidised treatment at private dental clinics,” Dr Ng pointed out. Highlighting the potential growth this has for Q& M, he remarked that about half of the workforce in Singapore is eligible under the scheme and all 50 outlets of Q& M, as well as its mobile clinic, are among the current 200 clinics accredited with the CHAS. This growing client base is indeed promising for Q& M, however, its continuous pursuit for growth does not end here.

Adding Growth Wings

Expanding upstream last year, Q& M has also ventured into the dental equipment and supplies distribution business with a focus in the dental healthcare sector. “The segment’s results jumped by a remarkable 579 percent in 1Q12, considering it is only in the second year of operation and has gained a market share of about 10 percent in Singapore,” Dr Ng proudly acclaimed.

Dr Ng shared enthusiastically that the segment will continue to add more product distributorships to its account and aspires to have its own dental laboratories and supply and manufacturing facilities in China going forward. Such a move will bring substantial cost savings as the company will have control over the value chain that would translate to a bottom line growth.

Although the bulk of Q& M’s operations and revenue currently comes from Singapore, Dr Ng opined that the main thrust of the company’s growth engine will come from the successful penetration into the China market.

“The investments Q& M has made in China promises a sustainable growth pillar that can yield a long term value due to the large untapped market potential from the huge population there,” Dr Ng commented. He went on to say that although only about 8 percent of the population in China visit the dentist once a year, the growing affluence of the people in China will see this figure increase in time.

“We are aiming to achieve a combined annual profit of Rmb80 million [$16 million] from China’s operations and plan for a potential listing in the China market in the next five years,” Dr Ng remarked. While noting the risks involved in expanding to China, he pointed out that the company has been laying its foundation over the past year in China and is optimistic on its developments, much as it appears challenging.

Currently, Q& M has already completed two collaboration deals with Aiyashi Dental Group and Dan-De Dental Group in China and has another five partnership deals that are in the midst of discussions.

The successful implementation of its array of expansion plans that are already rolling out would undoubtedly add more value to its shareholders. SIAS Research has maintained ‘Increase Exposure’ on the stock, on expectations that its newly-opened and underutilised clinics would perform better as business ramps up.

Building on its strong foundation as a pure dental play, the Q& M growth story is certainly one that we would turn our eyes on as it sets the stage for a stronger showing in the long term.

hopefully on some developments on china mkts when they announced their q3 results in coming weeks..cheap px now......

huge potential with vast network spidering in spore, hk and now expanding in china.

dont erase this off ur watchlist. niche industry with a good reputable name....and expanding in overseas markets...........

TalkMkt ( Date: 10-Jul-2012 10:35) Posted:

|

Investment Highlights

in Singapore:

Developments boos� � ng demand for Q& M Dental’s services

(CHAS):

(mee

subsidized medical and dental care. The scheme is e

from 15 Jan 2012, and we expect this to increase demand for

Q& M’s basic dental services in Singapore, strengthening its

recurrent income base.

Benefi� � ng from the Community Health Assist SchemeQ& M par� � cipates in CHAS, where Singaporeans� � ng certain age and income criteria) benefit fromffec� � ve

Q& M signed MOUs with the Na

and the NTUC’s A

Union (AREU) to provide dental healthcare to its members at

a discount. The former has 11,000 taxi members and the

la

be part of CHAS.)

Growing list of 300‐ strong corporate clients: Just this year,� � onal Taxi Associa� � on (NTA)� � rac� � ons, Resorts and Entertainment� � er about 400 tour guides. (The members may or may not

lesser extent in Malaysia:

outlets in Singapore by 2015 2) add 50 outlets and 20 dental

labs in China by 2015 and 3) add 15 outlets in Malaysia by

2015. There is also a plan to list its China dental business in 5

years—a de

aims to raise funds from the equi

plans.

Aggressive expansion plans in Singapore, China and to aQ& M aims to 1) add 60 dentalfined strategy to realize shareholder value. Q& M� � es market to fund these

guarantee from its partners:

Q& M requires its JV partners to guarantee a minimum

amount of income each year for 10 years, in exchange for

the capital investment and exper

could provide some earnings visibility to Q& M’s China

opera

Safety feature in China JV investments ‐ a minimum incomeIn its JV investments in China,� � se Q& M provides. This� � ons.

Q& M has a dividend yield of 3.6% based on last close.

For full report and other reports of other companies, please email to tplim1975@gmail.com?

Ok! I will try their services and compared the standard of service.