Source:http://www.thestar.com.my/Business/Business-News/2013/09/19/Alam-Maritim-secures-RM45m-contract.aspx

KUALA LUMPUR: Alam Maritim Resources Bhd has bagged a RM45mil contract to provide an anchor handling tug supply vessel for an oil and gas company.

It said on Thursday the contract was for a firm period of three years with an extension option for another one year. The contract started in September.

Alam Maritim said the risks associated with the contract were mainly operational risks such as accidents and unexpected breakdown of vessels.

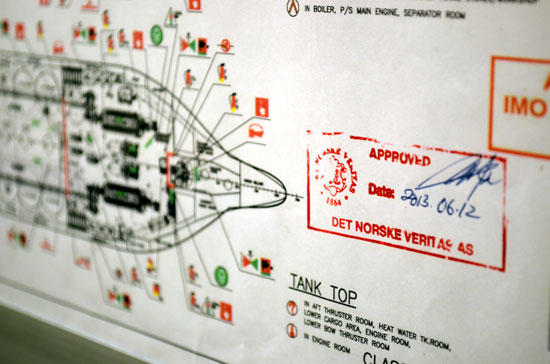

However, to mitigate the risks, it had developed a programmed maintenance schedule under the International Safety Management (ISM) Standards to maintain performance and seaworthiness of all vessels.

Good Luck !

moneyplant ( Date: 25-Sep-2013 18:19) Posted:

|

http://www.nextinsight.net/index.php/archive/911-flash-news-2010/7357-otto-marine-christens-ultra-large-ahts-go-pheonix

Photos by Sim Kih

Otto Marine acquired 55% in Go Marine Group in 2011, resulting in a near doubling of the Group's vessel chartering gross profit that financial year. Hampered by delays in vessel construction, the Group suffered net losses in FY2011 and FY2012 but reversed its losses in 1H2013 after a management restructure this year. Go Marine's managing director, Mr Garrick Stanley, was also appointed as Otto Marine's Group CEO on 6 August, whilst remaining as Go Marine's managing director.

|

Very nice closing after days of gathering strength at 68/69.

Off we go from here!

0.05 cents interval rumour with supportive evidence brewing

RTO target. 200 Million Capitalisation is bite size.

Peter_Pan ( Date: 20-Sep-2013 22:25) Posted:

|

Can enter 0.068 0.067.. sell 0.070 0.071..

Just a recommendation.. do your due diligence... huaaaatt ah loll..

oldflyingfox ( Date: 24-Sep-2013 23:38) Posted:

|

Requires vested stakeholders to act in unison to ensure sustainable Px.

dodobird ( Date: 24-Sep-2013 15:37) Posted:

|

Invisible hands supporting at 68.

Charts forming up.

Looks like more actions are coming soon! Wheee!

Today very quiet.

Low volume and queues volumes doesn't look like in play.

Should be able to hold resistance of 68 unless BB action comes in later.