Another O& G gem, backed by Temasek, that has been neglected by the market..

MENCAST HOLDINGS LTD.

42E Penjuru Road, Mencast Central

Singapore 609161

www.mencast.com.sg

Company Registration No: 200802235C

Mencast revenue and earnings grew by 26% and 16% respectively for the nine months ended 30 September 2013

Revenue increased 26% to $71.2 million, mainly on higher contributions from Offshore and Engineering segment and contribution from the new segment, Energy Services

Gross profit margin of 33% for FY2013 (nine months) remained comparable with that of FY2012 (nine months) of 32%

Components in place to embark on the next growth phase near term growth catalyst is the new production facility at Penjuru (TOP for the workshop obtained in April 2013)

Singapore, 5 November 2013 ? Mencast Holdings Ltd. and its subsidiaries (" Mencast" or the " Group" ), a Mainboard listed and Singapore-based maintenance, repair and overhaul (" MRO" ) provider comprising Marine, Offshore & Engineering and Energy Services, is pleased to report a 16% increase in net profit after tax to $9.5 million for the nine months ended 30 September 2013. A table on the financial highlights is provided below: FINANCIAL HIGHLIGHTS

2013

2012

chg

$?000

$?000

%

Revenue

71,238

56,324

26

Gross Profit

23,432

18,260

28

Gross Profit Margin

33%

32%

3%

Administrative Expenses

(13,052)

(9,827)

33

Net Profit After Tax

9,483

8,196

16

Net Profit Margin

13%

15%

(13)

Mencast Holdings has won contracts worth a total of

approximately S$6m from a Singapore based refinery.

Effective from mid-2013 to June 2016, these contracts

cover work such as maintenance, waste treatment,

cleaning and operations.

source DBS

Mencast Holdings has entered into a non-binding

Memorandum of Understanding (MOU) with Takamul

Investment Company, to co-operate in analysing

downstream ventures within the Sultanate of Oman. The

first potential project being examined under the MOU is

the engineering, procurement, installation and

commissioning (EPIC) of a downstream treatment plant.

Source: DBS

Mencast Subsea will provide maintenance, repair and overhaul (MRO) services to Keppel Singmarine and Keppel Shipyard, both susidiaries of Keppel Offshore & Marine Ltd. The MRO services include underwater inspection and maintenance works, seabed survey inspection, hydrographic survey and side scan sonar survey.

Both contracts extend to December 31, 2015 and include a one-year option to renew.

" These long term contracts affirm our growing leadership in providing MRO services to the offshore industry," said Glenndle Sim, Mencast's executive chairman and chief executive officer.

Mencast Holdings is re-evaluating the basis for the proposed

(1) Bonus Share for every one (1) Share held as one of the

listing rule (Rule 838 of the SGX-ST Listing Manual) requires

the company to ensure that its daily weighted average price,

adjusted for a bonus issue, is not less than S$0.50.

jump 9% today to 67..wow!

gd luck dyodd

chart genie

Time: 4:52PM

Exchange: SGX

Stock: Mencast(5NF)

Signal: Resistance - Breakout with High Volume

Last Done: $0.61

this baby bucked the downtrend for the overall market today..

KIV this gem..

gd luck dyodd

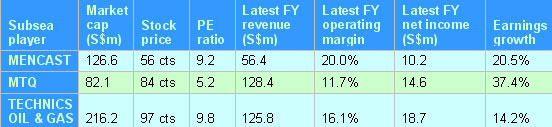

Mencast has the highest operating margin of 20%.. think it has more room to grow with it recent acquisition.. gd luck dyodd

Here we feature three players with strong earnings growth in the past year.

Mencast – MRO player for offshore

Take Mencast for example. From being a vessel sterngear manufacturer and solutions provider, its top line has leaped with its transformation into maintenance, repair and overhaul solutions provider that also caters to the offshore sector.

Just a year after acquiring three businesses for its offshore & engineering segment, the segment's 1H2012 revenue doubled year-on-year to S$22.4 million and contributed 64.6% to top line.

Group net profit attributable to shareholders rose 27.7% to S$6.9 million.

The acquired businesses includes services such as:

* Top Great Engineering & Marine - Inspection, maintenance and fabrication of offshore structures as well as engineering and other services related to onshore structures, provided by the newly acquired.

* Unidive - Diving services for subsea inspection, repair and maintenance

* Team International Development and Team Precision Engineering - Manufacturing of metal precision components

Its offshore & engineering order book as at 30 June 2012 was S$17.8 million, compared to S$10.2 million a year prior to this.

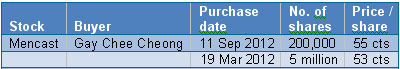

Gay Chee Yong up his stake in this gem..

gd luck dyodd :)

Gay Chee Cheong builds up stake in Mencast

Smart money is grabbing the opportunity to accumulate shares in sterngear equipment manufacturer Mencast Holdings.

Co-founder of 2G Capital Gay Chee Cheong first invested in Mencast in 2010. He bought another 200,000 shares from the open market on 11 September, raising his interest to 9.03%.

He paid 55 cents apiece, 57% higher than what he paid way back in 2010.

Tuesday's open market purchase follows his purchase of placement shares in March this year.

His investment is making progress --- Mencast’s aggressive growth strategy via M& A has more than doubled its revenue from S$26.3 million to S$56.4 million over FY2009 to FY2011.

FY2011 EPS was 6 cents, 20% higher than the 5 cents in FY2009.

To expand business, it has embarked on the following acquisitions over the past two years:

* Unidive Marine Services - topside (Rope Access) and subsea (diving) services for the offshore and inshore marine industry

* Top Great Group - engineering design, procurement, fabrication and installation of structural and precision engineering systems and plants

* Fabrication plant and machinery of a metal precision components manufacturer

* Vac-Tech - industrial and environmental cleaning services provider

Mencast Holdings Ltd on Monday reported a 27.7 per cent increase in year on year earnings to $6.91 million for the fiscal half year ended June 30, 2012.

Turnover rose 41.9 per cent year on year to $34.64 million, on contribution of approximately S$11.0 million in aggregate from the newly acquired subsidiaries, Top Great Engineering & Marine, Unidive Marine Services Pte Ltd and Team for six months in HY2012 compared to one month and two months revenue contribution for Unidive and TGEM respectively in HY2011.

However, the increase was offset by the decrease in revenue of approximately S$0.8 million from the marine services segment due to the slow down in activities in the ship building and ship repairing industry.

Earnings per share for the half year ended June 30, 2012 was 3.49 cents, up from 3.17 cents a year ago.

MENCAST HOLDINGS LTD. |

Sim Soon Ngee Glenndle |

51.14 |

45.75 |

|

Mencast Holdings attracts new investors, including Temasek-linked fund

Glenndle Sim, exec chairman & CEO, Mencast. NextInsight file photo

MENCAST HOLDINGS has just attracted a host of investors to take up 22.5 million new shares. The most striking name in the list announced yesterday is SME Co-Investment Fund Limited Partnership, which has agreed to take up 7 million new shares, or a 3.7% stake in Mencast, for S$3.7 million. SME is a private equity fund managed by Heliconia Capital Management, an investment firm wholly-owned by Temasek. Temasek is of course, in turn, an Asia investment company headquartered in Singapore. SME Co-Investment Fund Limited Partnership provides growth capital to Singapore-headquartered SMEs, with a view to develop them into globally competitive companies. In all, 22.5 million new shares will be issued at S$0.53 apiece to raise net proceeds of S$11.895 million for M& As, expansion and general working capital. For information on other investors and details of the share placement, see Mencast’s announcement on SGX website.  Mencast listed on the SGX in 2008 and has evolved a business model from being a manufacturer of sterngear to a MRO (maintenance, repair and overhaul) player in the oil & gas industry. Its shares have done well, rising 56% from 38.52 cents a year ago to close at 60 cents yesterday. It tracks the rise in its net profit, from $4.8 million in FY2007 to $10.2 million last year, thanks in part to M& As. Revenue grew from $18.9 million to $56.3 million in the corresponding period. The stock is currently at a trailing PE of 10.4X and Mencast has a market value of S$115 million. |

A month after its transfer to the Main Board, Mencast’s stock price has gained 14.6%. (It closed at 48 cents before its transfer on 14 Dec.)

In its report dated 13 Jan, UOB Kayhian analyst Tan Junda gave Mencast a ‘Buy’ recommendation, with a target price of 71 cents. The valuation is pegged to 8.6x 2012 PE, at a 6.2% premium to peers’ average of 8.1x.

The sterngear equipment services provider is on target to becoming a maintenance, repair and overhaul (MRO) player for the offshore and marine vessels via M& A.

Its latest proposed acquisition is the fabrication plant and machinery of Team Precision Engineering and Team International Development for S$4.5m.

Also, the completion of Mencast’s waterfront facility at Tanjong Penjuru Road will allow the group to move up the value chain to serve larger, more complex vessels. Its facility will be expanded to 40,000 sqm, more than four times the size of its previous workshop.

More good news!!

August 5, 2011, 5.27 pm (Singapore time)

By

TEO SI JIA

Mencast

Holdings Ltd announced on Friday that its wholly owned subsidiary

Unidive Marine Services Pte Ltd has secured a contract from Shell

Eastern Petroleum for the provision of underwater inspection, repair and

maintenance services.

The one-year contract took effect from Aug 1 and will last until

July 31 next year, with a renewal option for a further four years.