Post Reply

1-20 of 51

Post Reply

1-20 of 51

cat is out of the bag..substantial shareholder is Salim group - Indofood's owner that is taking Minzhong private @ $1.12

Singapore, 22 August 2006

Empire? or " the Group?), a leading food and beverage group best known for its

MacCoffee range of instant coffee products which are sold in Russia, Eastern

Europe and other emerging markets, today announced it had placed 39,200,000

shares at S$0.57 to Universal Integrated Corporation Consumer Products Pte Ltd

(?UICCP?). The placement is equivalent to approximately 10% of the Group?s

existing share capital. Substantial shareholders of Food Empire have also

agreed to sell an additional 54,000,000 shares to UICCP. At the completion of

the transactions, UICCP will be Food Empire?s second largest shareholder with a

21.6% stake in the Group.

UICCP is a company incorporated in Singapore and is ultimately owned by the

Salim Group. The Salim Group is one of the largest conglomerates in Asia with

interests in the food processing industry including, among other areas, the

manufacturing of instant noodles.

? Mainboard-listed Food Empire Holdings (?Foodozone2002 ( Date: 10-Apr-2013 10:11) Posted:

i'm compelled to buy even more of Food Empire after i found out who's the biggest stakeholder in Food Empire!

gd luck dyodd |

|

clue: food company owner from Indonesia........

tea444u ( Date: 16-Apr-2013 15:40) Posted:

WHo is it? m interested too in collecting this oen...end of the year can see 75 cents?

ozone2002 ( Date: 10-Apr-2013 10:11) Posted:

i'm compelled to buy even more of Food Empire after i found out who's the biggest stakeholder in Food Empire!

gd luck dyodd |

|

|

|

OSK-DMG maintains 'BUY" with 84 cents target for Food Empire.

Food Empire reported an 11% growth in 1Q13 earnings of USD5.6m. Results are in-line with expectations, accounting for 25% of our full year estimates.

Sales in Russia grew at a stronger pace of 18% y-o-y vs our forecast of 15% due to a change in business model.

...

Sales for the quarter were also boosted by a raising of average selling prices (ASPs) for products last year. We also note an expansion in gross margins by 5ppt for the quarter.

We maintain our estimates and BUY call with TP of SGD0.84, pegged to 16x FY13F P/E.

Food Empire trades at a sharply lower valuation than Super Group (PE ratio of 13.9 for Food Empire vs 32 for Super Group).

Hi rbg..i went to the site...does it work really? haf u tried it before? more or less accurate ah?

rbgmauq ( Date: 08-May-2013 20:13) Posted:

| The technical indicator shows a strong buying signal. Six months target: 0.81. http://sgx.stoxline.com/quote.php?s=f03 |

|

thank you rbg..i go check out the link u gafe.

rbgmauq ( Date: 08-May-2013 20:13) Posted:

| The technical indicator shows a strong buying signal. Six months target: 0.81. http://sgx.stoxline.com/quote.php?s=f03 |

|

The technical indicator shows a strong buying signal. Six months target: 0.81. http://sgx.stoxline.com/quote.php?s=f03

hi anyone else here keen on this stock? can this be another super group in a year or two???

WHo is it? m interested too in collecting this oen...end of the year can see 75 cents?

ozone2002 ( Date: 10-Apr-2013 10:11) Posted:

i'm compelled to buy even more of Food Empire after i found out who's the biggest stakeholder in Food Empire!

gd luck dyodd |

|

i'm compelled to buy even more of Food Empire after i found out who's the biggest stakeholder in Food Empire!

gd luck dyodd

nice run up for this stock...

another one of my gems..

making its mark in Russia..

gd luck dyodd

Expecting good sales especially in the cold winter months, hence a good set of results. Will be looking to buy more on dips.

super fly again

Last:

0.65 Vol:

1218k  +0.055

+0.055 ozone2002 ( Date: 28-Nov-2012 19:44) Posted:

up 9% today.. excellent!

Last:0.59 Vol:531k  +0.05 +0.05

gd luck dyodd |

|

Food Empire is setting its eyes on the Chinese and India market which, historically, have always been tea drinkers. However, in recent years, there has been an increase in coffee drinkers in these big markets. So much so that Starbucks has also jumped on the bandwagon and set up operations in these countries. Starbucks established cafes in the region have maintained double-digit sales growth over the past couple of months (reported in Wall Street Journal on 6 December 2012).

http://blogs.wsj.com/chinarealtime/2012/12/06/starbucks-china-will-be-second-largest-market-by-2014/

Starbucks opened its first cafe in India in October 2012 (reported in Wall Street Journal in October2012). http://online.wsj.com/article/SB10000872396390444734804578066323962597316.html

Food Empire has incorporated subsidiaries in China and India to bring its products into China and to manufacture instant coffee in India. Therefore, I think that there is tremendous potential in this stock. [Vested]

AFTER GROWING its brands for the past 15 years in Ukraine, Singapore-headquartered Food Empire has opened its first manufacturing facility there.

Located in Zolotonosha in the Cherkasy region, and occupying 5.4 hectares (the equivalent of 8 football fields), the factory was officially opened on Nov 22.

The event was attended by Mr Simon Tensing de Cruz, the Singapore Ambassador to Ukraine.

Other VIPs included Mr Sergei Tulub, head of the Cherkasy Regional State Administration, and Mr Vitaly Wojciechowski, Mayor of Zolotonosha.

Singapore-listed Food Empire has invested an initial amount of 93 million hryvnia (USD$11.4 million) in the facility, which will manufacture for local customers who have taken to its MacCoffee and Petrovskya Sloboda brands of coffee.

Tan Wang Cheow, executive chairman and founder of Food Empire. Photo by Sim Kih

Mr Tan Wang Cheow, Executive Chairman of Food Empire, said Ukraine is the Group’s second largest market in terms of revenue, and the Group’s products currently command a market share of more than 40 per cent of the 3-in-1 instant coffee market.

“This new facility shows the importance of the Ukraine market to Food Empire. Production from the new factory will be sold in the Ukrainian market, as well as exported to neighboring countries in Eastern Europe.”

The Singapore Ambassador to Ukraine, Mr Simon Tensing de Cruz, said the opening of the factory is a step forward in the relationship between Singapore and Ukraine.

" The construction and launch of the new plant is not only a significant investment by a Singapore company in the Ukraine economy, it is also an example to other Singapore companies on how to do business in Ukraine,” he said.

The head of the Cherkasy Regional State Administration, Mr Sergey Tulub, said Food Empire is a significant contributor to the region’s economy.

“The new factory creates jobs in direct manufacturing as well as associated industries such as sugar, which is supplied by sugar plants in the region," he said.

up 9% today.. excellent!

Last:

0.59 Vol:

531k  +0.05

+0.05

gd luck dyodd

great set of results profit surge 90%

continue to accumulate on dip

gd luck dyodd

ozone2002 ( Date: 23-Aug-2012 11:14) Posted:

gd biz, market leader in russia, undervalued relative to peers and most important neglected by investors..

FOOD EMPIRE: Net profit up 25% to US$8.7 m in 1H2012

|

|

Written by Sim Kih

Thursday, 23 August 2012 07:10

Food Empire's successful marketing campaigns has made its flagship MacCoffee Russia's no.1 brand for 3-in-1 instant coffeemix.

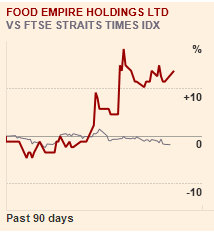

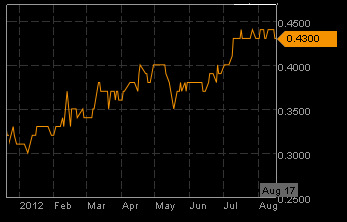

Food Empire stock has risen steadily this year. Chart: Bloomberg

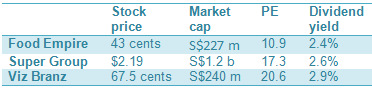

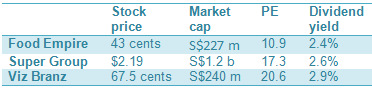

SUPER GROUP has done superbly, its shares rising from $1.29 at the start of this year to $2.19 this week.

Now, consider another instant coffee player listed on the Singapore Exchange -- Food Empire.

Its stock started the year at 31 cents and ended last week at 43 cents.

We checked out its story, and found things to like about it.

Its revenue for the first half year was US$110.7 million, an increase of 3.4% year on year.

Profit after tax jumped 24.6% to US$8.7 million on improved margins and a tax write back.

The improved margins arose from decreases in the prices of the raw materials it used for its coffee products - coffee, sugar and creamer.

Unlike Super Group which focuses on markets such as Singapore and the region, Food Empire is big on Russia, where its sales stood at US$64.9 million in 1H.

Food Empire's other key markets are Eastern Europe and Central Asia (comprising Ukraine, Kazakhstan and the CIS Countries) where sales rose by 4.4% to US$33.1 million

Historically, people in Russia, Middle East, China and India have not consumed vast quantities of coffee.

But in the recent decade, coffee cultures have been developing in these regions at rates that beat economic growth.

For example, China’s annual coffee consumption is growing rapidly at around 15% a year.

Coffee drinking is still at an infancy stage in China, where per-capita consumption is about 3 cups a year, versus 3.5 cups a day in the US.

Which is why Food Empire wants to penetrate the Chinese and India market.

Last month, it incorporated subsidiaries in China and India to bring its products into China and to manufacture instant coffee in India.

Right place right time

Founder Tan Wang Cheow has been featured in Forbes magazine.

Food empire founder Tan Wang Cheow did not start out in F& B, but was exporting personal computers and related peripherals to Eastern Europe and Central Asia in the late eighties.

Some of these countries had freezing winters with temperates dropping below 30 degrees Celcius. People drank Vodka and bought hot coffee beverages from street side stalls to keep warm.

He decided to provide a convenient solution to help people keep warm and the group started distributing third party brands of 3-in-1 instant coffee in Kazakhstan and Russia in 1993.

When Soviet Union disbanded in 1991, Mr Tan’s F& B products sold like hot cakes to pent-up demand for all manner of capitalist goods.

About 57% of Group revenue in FY2011 was from Russia, where its flagship MacCoffee has been consistently ranked as the leading 3-in-1 coffeemix brand.

William Fong, CFO of Food Empire.

Other than Russia, MacCoffee is also the no.1 coffee brand in Ukraine and Kazakhstan. Food Empire products are exported to over 60 countries, especially Central Asia and the Middle East.

It markets over 400 types of products under its proprietary brands, which also include MacChocolate, MacTea, FesAroma, MacCandy, Zinties, Melosa, Petrovskaya Sloboda, Klassno, OrienBites and Kracks.

Like everyone else, Food Empire wants a piece of the China pie, but its F& B market is known to be the toughest in the whole world.

Singapore F& B players have a track record of success there.

Food Empire looks relatively undervalued. Bloomberg data

Viz Branz, which owns Gold Roast, BenCafe, Café 21, CappaRoma and Jaffa Juice, derives half of group revenue from China.

In FY2011, its sales from China grew 10.5% year-on-year to reach S$83.4 million.

Super, Southeast Asia's leading 3-in-1 coffeemix player, has also made headway in China with non-diary creamer ingredient sales.

Its brands include Super, Café Nova, Super Power, Owl, Yé Yé, Coffee King, Gold Eagle, Negresco, Eagle King, Liang Bao and Superkids.

Food Empire has been very successful employing sophisticated brand-building activities, after the style of the world's top brands.

It is so good at marketing that in spite of the runaway success of its own brand, 18.6% its FY2011 revenue was from marketing and packaging services for third party brands.

The company invests in creative advertisements and promotions, as well as sponsorships to ensure high brand cognition when consumers shop.

The question is, will it be able to export its successful branding and marketing campaigns to new markets like China and India?

|

|

|

+0.055

+0.055

+0.05

+0.05