| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

05-Jul-2013 14:54

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future +153 points now.... | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Jun-2013 21:15

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

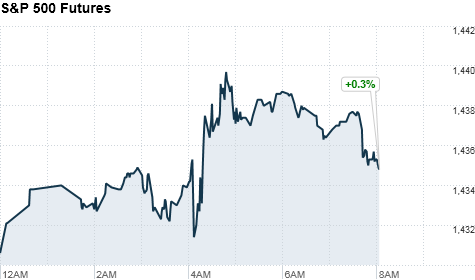

U.S. stocks set for a rebound@CNNMoneyInvest June 25, 2013: 9:10 AM ET Wall Street was set for a rebound Tuesday thanks to more good news about the housing market in the U.S. and an ease in concerns about China's credit problems.U.S. stock futures rose by more than 0.5%. The S& P/Case-Shiller home price index was up 12.1% in April compared to a year ago for the 20 top real estate markets across the nation. It was the biggest annual jump in prices in seven years and the 2.5% jump from March was the biggest one-month rise in the 12-year history of the index. A report on durable goods came in better than expected. The Census Bureau said new orders for big-ticket items rose 3.6% in May. Economists had forecast a 3% rise, according to Briefing.com. Still to come, the government's report on new-home sales for May is due at 10 a.m. ET. The Conference Board also releases its monthly reading of consumer confidence at 10 a.m. The markets are coming off a sell-off Monday, driven by continued uncertainty about China and when the Federal Reserve will ease its stimulus. The double whammy of uncertainty has caused volatility to spike. So far this month, the CBOE Market Volatility Index (VIX) has risen 25%. And CNNMoney's Fear & Greed Index is deep in extreme fear. The markets have been taking their cue this week from China, where stocks have tumbled on concerns about tighter credit conditions. But comments attributed to a People's Bank of China official helped ease some jitters. The official reportedly said the bank will keep interest rates in check, and that seasonal forces that have driven them higher recently will fade. Following his comments, the Shanghai Composite, which was down as much as 5.6%, recovered to close just 0.2% lower. Still, the ups and downs have analysts worried. " Volatility is very pronounced," Carter Worth, chief market technician at Oppenheimer, told CNNMoney in an interview. Earlier he sent around an amusing note that simply said " We have no new thoughts. Sell." " If this kind of volatility is taking place, there is a change in the wind. That doesn't mean we are going to see a bear market or a crash, but upside is limited and downside is unknown, but very real," he told CNNMoney. On the corporate front, shares of Walgreen (WAG, Fortune 500) sank nearly 5% after the drugstore chain missed earnings and revenue forecasts. Barnes & Noble (BKS, Fortune 500) shares plunged after the bookseller said it will stop making the NOOK in-house and will partner with a third party to manufacture the eReading device. Sales in the NOOK segment fell 34% in the quarter to $108 million. Carnival (CCL) said earnings fell 55% to 9 cents per share in the second quarter. The beleaguered cruise ship operator warned in May that earnings would suffer this year due to price cuts following the Carnival Triumph mishap. But Carnival's stock rose in pre-market trading since earnings were better than expected. Gunmaker Smith & Wesson (SWHC) will release fourth-quarter results after the market closes. European markets were making significant gains in morning trading after taking a big fall Monday. Germany's DAX index took the lead, rising by just over 1.5%. Asian markets ended with mixed results after a volatile day. Like the Shanghai index, Hong Kong's Hang Seng also dropped during the day, but closed with a 0.2% gain. The Nikkei in Japan ended with a 0.7% loss. |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Jun-2013 17:17

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now +84 points....

|

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Jun-2013 16:24

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future +51 points. | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

31-Oct-2012 16:24

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Wall Street bracing for volume surge@CNNMoneyInvestOctober 30, 2012: 5:24 PM ET

U.S. financial markets will reopen Wednesday, after being shuttered for two days to deal with the devastating impact of Superstorm Sandy. NEW YORK (CNNMoney) -- Trading volume is expected to surge when U.S. financial markets reopen Wednesday, two days after Superstorm Sandy prompted an unexpected shutdown on Wall Street. Throughout much of the month, an average of 3.5 billion shares have been exchanging hands each day, but experts say that could double on Wednesday. " It's hard to say which direction stocks will move, but we're expecting to see a whole lot of trading volume -- three days worth of trading all in one," said Fred Dickson, chief market strategist at D.A. Davidson & Co. Wednesday will be particularly busy for investors since it also happens to be the last day of the month, a time when traders, hedge funds and mutual funds often square up their positions. And for some, the day also marks the last day of the fiscal year. It's a day when many mutual fund managers will try to offset their capital gains with their losses to minimize the distributions paid out to shareholders, said Dickson. Related: U.S. stock markets to reopen Wednesday Home improvement stocks like Home Depot (HD, Fortune 500) and Lowe's (LOW, Fortune 500) will likely be big movers, as well as insurance stocks, such as Allstate (ALL, Fortune 500), AIG (AIG, Fortune 500) and Hartford Financial (HIG, Fortune 500). Retailers, airlines and hotels that have been affected by the storm will also be in focus. Wednesday also marks the first day investors have to react to non-storm related news. Apple (AAPL, Fortune 500) kicked off the week with a management shake-up, announcing that two of its top executives had been shown the door. Scott Forstall -- responsible for the iOS software running iPhones and iPads, and often considered an heir-in-waiting to CEO Tim Cook -- is the most prominent executive departing Apple. Late Tuesday, the Walt Disney Company (DIS, Fortune 500) agreed to buy Lucasfilm in a stock-and-cash deal valued at $4 billion, gaining control of the blockbuster Star Wars franchise. Related: NYC flights still grounded Also, many Facebook (FB) employees will finally get a chance to sell their shares for the first time, after a lock-up on their so called " restricted stock units" expired. With the market finally open, a total of 234 million Faebook shares will be newly eligible for sale Wednesday. The storm also prompted many companies to postpone their quarterly earnings reports, but others, including Ford (F, Fortune 500), Archer Daniels Midland (ADM, Fortune 500) and TD Ameritrade Holding Corp (AMTD) still issued their results so those stocks may be active Wednesday. Hertz (HTZ, Fortune 500), Mastercard (MA, Fortune 500), Visa (V, Fortune 500), First Solar (FSLR) and Metlife (MET, Fortune 500) are among the firms on tap to post results Wednesday. While investors will have quite a bit of corporate news to get through, economic data that has come out over the last two days in the United States or abroad hasn't been " earth-shattering," said Peter Tuz, president of Chase Investment Counsel. But investors will also be gearing up for the crucial October jobs report, which is scheduled to come out Friday. It will be the final reading on the health of the job market before the presidential election next week. While there has been some concern about the report being delayed, the Bureau of Labor Statistics says it is working hard to stay on schedule. |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

|

yabbest

Senior |

12-Sep-2012 22:30

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

can see some profit taking and cautious in DJ...may close flat or turn red slightly...of cos still early | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

yabbest

Senior |

12-Sep-2012 21:17

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

look out for AMD, NAVB & PMET - this coy just rejected a takeover offer... |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

iPunter

Supreme |

12-Sep-2012 21:12

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Tomorrow should be a day of Ooooooooooomph!!! for the STI... Many who havel onged will " tarn tio" ...  |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

12-Sep-2012 21:08

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks to rise on German court ruling@CNNMoneyInvestSeptember 12, 2012: 8:39 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were headed for a higher open Wednesday after a German court backed Europe's latest rescue fund. Germany's Constitutional Court dismissed complaints on the legality of the European Stability Mechanism, a permanent bailout fund that's expected to have a maximum lending capacity of €500 billion. Markets around the world initially rose on the news, but European stocks turned mixed in afternoon trading. Britain's FTSE 100 lost 0.1%, while the DAX in Germany jumped 1.9% and France's CAC 40 rose 1.2%. Asian markets, which closed ahead of the German court decision, ended higher. Investors were anxious about how the ruling would impact the European Central Bank's plans to preserve the euro, which remained at its highest level against the U.S. dollar in four months early Wednesday. " This is good news for the EU and has certainly been reflected in the value of the euro across the board," said Chris Towner, director of foreign exchange advisory services at HiFX. " This gives a foundation for the EU leaders to start to put a proper framework in place for further integration." As stocks around the globe reacted, investors bailed out of U.S. Treasuries, sending the yield on the benchmark 10-year note up to 1.74% from 1.69% late Tuesday. In corporate news, Apple (AAPL, Fortune 500) is expected to unveil the iPhone 5 at an event later Wednesday . Shares of the company were higher as investors awaited the announcement. U.S. stocks advanced Tuesday, rebounding from the previous day's pullback. Fear & Greed Index Economy: Government reports are due Wednesday on import and export prices for August and on wholesale inventories for July. Companies: Facebook (FB) shares rose 4% in premarket trading, a day after CEO Mark Zuckerberg made his first public interview since the company's IPO. Speaking at TechCrunch Disrupt in San Francisco, Zuckerberg said he was disappointed by the stock's performance and pledged to stick to Facebook's mission. Chesapeake Energy (CHK, Fortune 500)agreed to sell most of its properties in the Permian Basin in West Texas for roughly $6.9 billion, sending shares up nearly 4% in premarket trading. The oil company will sell the Delaware Basin portion to Royal Dutch Shell in a deal valued just below $2 billion. Chevron (CVX, Fortune 500) and Global Infrastructure Partners will also buy portions of the acreage. Commodities: Oil for October delivery rose 24 cents to $97.41 a barrel. Gold futures for December delivery gained $10.50 to $1,745.40 an ounce. First Published: September 12, 2012: 5:12 AM ET |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

16-May-2012 16:51

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future turned from red to slightly green now.... | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

eurekaw

Master |

12-Apr-2012 16:49

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stock FuturesAmericas

|

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

12-Apr-2012 16:45

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

DOW future now +57 points.

|

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

12-Apr-2012 16:24

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now +52 points. | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

11-Apr-2012 16:41

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now +52 points. Moving up, good signs...

|

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

11-Apr-2012 16:33

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW Future now +42 points. | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

bishan22

Elite |

09-Apr-2012 18:00

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Apr-2012 17:45

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now -101 points. | ||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Apr-2012 17:44

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end mixed as euro debt fears return@CNNMoneyMarkets April 5, 2012: 5:12 PM ET

NEW YORK (CNNMoney) -- U.S. stocks closed mixed Thursday, with the broader market falling for a third day, amid renewed worries about the debt crisis in Europe. The Dow Jones industrial average (INDU) slid 12 points, or 0.4%, to end at 13,060. The S& P 500 (SPX) eased 1 point, or 0.1%, to 1,398. The Nasdaq (COMP) rose 13 points, or 0.4%, to 3,080. Traders said volumes were low Thursday with many market participants absent ahead of the holiday. U.S. markets will be closed Friday in observance of Good Friday, and bond markets will close early. The Dow and S& P 500 both fell for a third day, ending the four day week lower. Despite modest gains on Thursday, the Nasdaq also ended the week down. All three indexes suffered the largest weekly decline of 2012. Stocks opened lower Thursday as investors continued to digest Wednesday's lackluster auction of Spanish government bonds. The yield on 10-year Spanish bonds jumped to 5.8% Thursday amid worries about the government's budget deficit. " Credit concerns are flaring given the rise in Spanish bond yields," said Nick Kalivas, market strategist at Hadrian Partners. " It feels like the sovereign debt crisis is surfacing again." In addition, investors have been sidelined this week by concerns the Federal Reserve may not launch a third round of quantitative easing when the current program, known as Operation Twist, ends in June. " Traders may soon be forced to operate without a safety net for the first time since the 2008 collapse," said Karl Schamotta, senior market strategist Western Union Business Solutions. " The implications will be profound." Meanwhile, the U.S. job market has been in focus this week ahead of Friday's report on hiring and unemployment from the Labor Department. Two reports released Thursday pointed to continued improvement in the labor market. Stocks fell Wednesday after minutes from the Fed's latest policy meeting dashed hopes for additional stimulus from the central bank. Sell in April and hide under the table?Meanwhile, demand for U.S. Treasuries rebounded Thursday after prices fell sharply earlier in the week, said Guy LeBas, chief fixed-income analyst at Janney Capital Markets. But the gains came on low volume ahead of Friday's holiday. " The combination of the impending Good Friday holiday, prevalence of school spring breaks this week, and the start of the Masters Golf tournament Wednesday afternoon all conspired to keep volumes low," LeBas said. Economy: Initial jobless claims for the week ended March 31 totaled 357,000, the government reported before Thursday's opening bell, compared with analyst expectations of 355,000. Outplacement firm Challenger, Gray & Christmas said planned job cuts declined to roughly 38,000 in March, the lowest since May of last year. On Friday, the Labor Department will release the latest update on job growth and the unemployment rate. Economists surveyed by CNNMoney expect that report to show employers added 200,000 jobs in March and the unemployment rate fell to 8.2%. In February, the economy added 227,000 jobs. World markets: European stocks ended mixed. Britain's FTSE 100 (UKX) added 0.3% and France's CAC 40 (CAC40) rose 0.2%, but the DAX (DAX) in Germany lost 0.1%. In a widely expected move, the Bank of England's monetary policy committee voted to hold interest rates at 0.5% and maintain the size of its 325 billion pound asset-purchasing program. Meanwhile, the International Monetary Fund said Portugal has made " good progress" on its economic reform program and approved the disbursement of €5.2 billion in bailout funds. Asian markets ended mixed. Japan's Nikkei (N225) slid 0.5% and Hong Kong's Hang Seng (HSI) fell 1%, while the Shanghai Composite (SHCOMP) rose 1.7%. Wall Street needs a Republican - SurveyCompanies: Shares of wine company Constellation Brands (STZ) fell after the company reported a drop in revenue and weak guidance for the upcoming fiscal year. Pier 1 Imports (PIR) and Carmax (KMX, Fortune 500) reported earnings and revenue roughly in line with analyst expectations. Macy's (M, Fortune 500) shares rose after the company reported that its same-store sales for the month of March had increased 7%. Fellow retailer Bed Bath & Beyond (BBBY, Fortune 500) gained after announcing a 7% increase in quarterly same-store sales. Clothing sellers Gap Inc (GPS, Fortune 500) and TJX Companies Inc (TJX, Fortune 500) were up on strong same-store sales. Costco (COST, Fortune 500)'s March same-store sales in the U.S. increased by 6%. Limited (LTD, Fortune 500) said March same-store sales increased 8%. Obama: How to get to 6% unemploymentCurrencies and commodities: The dollar gained against the euro and British pound, but slipped against the Japanese yen. Oil for May delivery rose $1.84 to end the day at $103.31 a barrel. Gold futures for April delivery rose $16.20 to settle at $1,628.50 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.19% from 2.23% late Wednesday. |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

04-Apr-2012 20:18

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Premarkets: Stocks to fall after Fed's comments@CNNMoneyMarkets April 4, 2012: 7:24 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were poised to open lower Wednesday, with anxiety lingering after Federal Reserve policy makers indicated that no new stimulus is likely. Some investors had been hoping the Fed would move toward another round of quantitative easing, a prospect that now appears dim following Tuesday's release of minutes from last month's meeting. " It certainly has taken people by surprise," said Chris Beauchamp, an analyst at IG Markets in the United Kingdom. " Markets don't like living in a world where they don't have an active Fed to support them." Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET. Investors will have a healthy amount of economic data to chew on Wednesday morning, with reports on the labor market, crude inventories and growth in the non-manufacturing sector on tap. U.S. stocks closed lower Tuesday, with momentum stalling after the Fed minutes were released. Looking ahead, attention will focus to the jobs report for March, which is due out Friday. However, U.S. markets will be closed in observance of Good Friday and bond markets will close early. Unemployment rate: How low can it go?Economy: Analysts expect that private-sector employers added 217,000 workers in March. The latest data from payroll processing firm ADP will be released at 8:15 a.m. ET. Reports on ISM Services and crude oil inventories will be released mid-morning. World markets: European stocks were lower in midday trading. Britain's FTSE 100 (UKX) dropped 1.1%, the DAX (DAX) in Germany fell 1.7%, and France's CAC 40 (CAC40) shed 1.3%. In Asia, Japan's Nikkei (N225) tumbled 2.3%. Markets in Hong Kong and China were closed for the Tomb Sweeping holiday. Companies: Rating agency Moody's announced Wednesday that it had downgraded the debt of General Electric (GE, Fortune 500) due to risks associated with its finance subsidiary, GE Capital Corporation. Before the opening bell, agricultural biotech firm Monsanto reports results, while retailer Bed Bath & Beyond reports after the close. Analysts surveyed by Thomson Reuters expect Monsanto (MON,Fortune 500) to report earnings of $2.12 per share on $4.5 billion in revenue. Bed Bath & Beyond (BBY, Fortune 500) is expected to report quarterly results after the market close that show earnings per share of $1.33 per share on $2.7 billion in revenue. Burger King announced Tuesday that it planned to re-list on the New York Stock Exchange within 90 days after a deal in which its owners sold 29% of the company to a U.K. investment fund. IBM (IBM, Fortune 500) fell 1.5% and cruise ship operator Carnival Corp (CCL) eased 2.1% on reports of analyst downgrades. Why Obama shouldn't tap U.S. oil reservesCurrencies and commodities: The dollar gained against the euro and the British pound, but fell against the Japanese yen. Oil for May delivery slipped 68 cents to $103.33 a barrel. Gold futures for April delivery fell $35.20 to $1,634.80 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.24%. |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

03-Apr-2012 10:21

|

||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Singapore shares opened higher on Tuesday, with the benchmark Straits Times Index at 3,029.93, up 0.46 per cent, or 13.86 points. About 415 million shares exchanged hands. Gainers beat losers 126 to 44. |

||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||