| Latest Forum Topics / Others |

|

|

DOW

|

|||||||||

|

risktaker

Supreme |

16-Oct-2009 07:55

Yells: "Sometimes you think you know, but in fact you dont" |

||||||||

|

x 0

x 0 Alert Admin |

Mega funds still BUY IN HUGE -- Rally will substain at least till end of next week. Overseas Funds have entered SG market too. Watch out for some real action next couple of days HUAT AH

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

aleoleo

Master |

16-Oct-2009 07:09

|

||||||||

|

x 0

x 0 Alert Admin |

oh uh....... DJ close up well, hope handon is allrite, if not got to "ta pao" again ...

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

|

|||||||||

|

risktaker

Supreme |

16-Oct-2009 04:43

Yells: "Sometimes you think you know, but in fact you dont" |

||||||||

|

x 0

x 0 Alert Admin |

DJ will test 11k range EOY. Mega Funds Supporting it :) enjoyed the ride | ||||||||

| Useful To Me Not Useful To Me | |||||||||

|

chewwl88

Member |

16-Oct-2009 02:49

|

||||||||

|

x 0

x 0 Alert Admin |

UP UP UP |

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

equitypassion

Member |

15-Oct-2009 23:41

|

||||||||

|

x 0

x 0 Alert Admin |

15 Oct 2009 Forgive me if I am wrong :) Below is how i feel STI has been running for quite sometime and he is getting tired. STI (presently 2712) is forcing himself to continue running because Dow Jone (presently 9999) is taking a cane chasing after him. ( It is like a parent taking a cane chasing after their naughty child ). If Dow slow down , STI will take opportunity to catch some Rest between STI 2400 to 2500. Be alert when investing at this moment of time. Cheap Stock has become expensive (eg Jiutian, I manage to purchase some at 0.035 but now it is 0.21 (I sold off my last piece at 0.18), I also manage to purchase China farm at 0.055 but now is 0.26 (I sold off my last piece at 0.21). I believe there are a lot of fund manager and investor who bought at high two years back are waiting to get out if something is not right. As for Dow Jone index, lets hope it can stable and move forward at reasonable pace because unemployment rate is still high and recently it is often to come across news or comments that US citizens start to save. If US citizen start to "enjoy saving"..... Thanks for Reading :) Invest Happily :) God Bless U :) |

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

|

|||||||||

|

williamyeo

Senior |

15-Oct-2009 23:00

|

||||||||

|

x 0

x 0 Alert Admin |

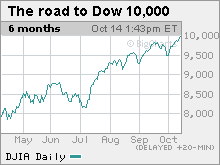

Don't trust Dow 10,000The stock market is supposed to be a leading indicator, predicting what happens next. But the rally doesn't mean the nation's economic woes are over.NEW YORK (CNNMoney.com) -- As the Dow closed above 10,000 for the first time in more than a year Wednesday, economists cautioned that the blue-chip average shouldn't be seen as giving a green light to the economy. The stock market is what is known as a leading economic indicator, as investors place bets on how strong they believe company results and the broader economy will be in the near future. Lately, there has been a growing consensus among both investors and economists that the battered U.S. economy hit bottom and turned around earlier this year, and is now in a recovery. The Federal Reserve said economic activity has "picked up" in its statement after its Sept. 23 meeting, and about 80% of leading economists surveyed by the National Association for Business Economics agreed in a survey earlier this month that the recovery has begun. But even economists who agree the economy is in recovery say that growth will be slow and difficult, with continued job losses, tight credit and further declines in home prices. And even some who believe that the current Dow 10,000 level is justified say there's still a significant risk that the economy will take a step backward. "One of the great challenges is whether consumers and small businesses come along with this recovery," said John Silvia, chief economist with Wells Fargo. "If they don't, you either sit at 10,000 or slip back to 9,500. To sustain another double-digit (percentage) gain to Dow 11,000 is asking too much from this economy and the risks we still see out there." There are also economists who question whether the economy is truly in recovery, given that it continues to lose about a quarter-million jobs a month. They say the more than 50% rally in the Dow since it closed at a low of 6,594.44 on March 5 is only a reflection that the fear of the economy toppling into a full-fledged depression has abated. "We're not at Armageddon anymore, so of course you should have some kind of rally," said Rich Yamarone, director of economic research at Argus Research. "But I think there's a bubble-like atmosphere going on here in the rush back to 10,000. Caution should rule the day. We're not out of the woods yet." Several experts point out than many of the relatively strong earnings reports helping to lift the markets in recent days are being driven by cost cuts, rather than strong revenue growth that would be a better indicator of consumers and businesses being willing to spend again. If businesses keep cutting costs to make the numbers that Wall Street wants to see, that can only put more downward pressure on jobs and wages, and result in weaker economic growth or another downturn. "The companies are cutting fat, and in many cases cutting bone and muscle. There's no organic economic growth there," said Yamarone. Barry Ritholtz, CEO and director of equity research at Fusion IQ, said that despite their reputation as a leading indicator, the stock markets do a terrible job forecasting the economy. "Beware of economists pointing to the stock market," he said. "The rallies tend to be false starts because it's a reaction to what came before. The sell-offs tend to be overdone because, as they gain momentum, they lead to panics." Ritholtz said comparisons of current earnings to those of a year ago or stock levels to the lows of earlier this year greatly exaggerate the strength even the market sees in the economic outlook. "It's like saying the Detroit Lions have better year-over-year comparisons because they're no longer winless," he said about the football team that went 0-16 in 2008, but has won one of five games so far this year. "But they're still in last place and they're not winning the Super Bowl." Another reason that comparisons to Dow levels of a year ago are risky is that two of the more troubled components -- General Motors and Citigroup (C, Fortune 500) -- were dropped and replaced by stronger companies such as Cisco Systems (CSCO, Fortune 500) and Travelers Cos. (TRV, Fortune 500) in June. Without those changes the Dow would be almost 100 points lower now than it is with the stronger companies, although precise comparisons are difficult since GM shares are no longer traded on the New York Stock Exchange. "You take out the worst, put in the best, and by definition you'll get better numbers," said Yamarone. |

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

williamyeo

Senior |

15-Oct-2009 22:50

|

||||||||

|

x 0

x 0 Alert Admin |

Sure make (a profit or a loss)?

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

handon

Master |

15-Oct-2009 22:38

|

||||||||

|

x 0

x 0 Alert Admin |

think not difficult to pocket 80 pts... hehe...

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

|

|||||||||

|

idesa168

Elite |

15-Oct-2009 22:31

|

||||||||

|

x 0

x 0 Alert Admin |

I don;t think I will like to short now. Market is on uptrend now. Chnaces of going down is slimmer than going up. I am going to sit through this gyration where many will think 10,000 is the finishing line. I feel that 10,500 before any downturn. Good luck to you handon! If you win I will lose...hahaha!

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

handon

Master |

15-Oct-2009 22:29

|

||||||||

|

x 0

x 1 Alert Admin |

today oreli like tat.... tomolo sure got Friday Effect.... short form is FE... hehe....  short got better advantage...  |

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

ozone2002

Supreme |

15-Oct-2009 22:10

|

||||||||

|

x 0

x 0 Alert Admin |

Don't trust Dow 10,000The stock market is supposed to be a leading indicator, predicting what happens next. But the rally doesn't mean the nation's economic woes are over. NEW YORK (CNNMoney.com) -- As the Dow closed above 10,000 for the first time in more than a year Wednesday, economists cautioned that the blue-chip average shouldn't be seen as giving a green light to the economy. The stock market is what is known as a leading economic indicator, as investors place bets on how strong they believe company results and the broader economy will be in the near future. Lately, there has been a growing consensus among both investors and economists that the battered U.S. economy hit bottom and turned around earlier this year, and is now in a recovery. The Federal Reserve said economic activity has "picked up" in its statement after its Sept. 23 meeting, and about 80% of leading economists surveyed by the National Association for Business Economics agreed in a survey earlier this month that the recovery has begun. But even economists who agree the economy is in recovery say that growth will be slow and difficult, with continued job losses, tight credit and further declines in home prices. And even some who believe that the current Dow 10,000 level is justified say there's still a significant risk that the economy will take a step backward. "One of the great challenges is whether consumers and small businesses come along with this recovery," said John Silvia, chief economist with Wells Fargo. "If they don't, you either sit at 10,000 or slip back to 9,500. To sustain another double-digit (percentage) gain to Dow 11,000 is asking too much from this economy and the risks we still see out there." There are also economists who question whether the economy is truly in recovery, given that it continues to lose about a quarter-million jobs a month. They say the more than 50% rally in the Dow since it closed at a low of 6,594.44 on March 5 is only a reflection that the fear of the economy toppling into a full-fledged depression has abated. "We're not at Armageddon anymore, so of course you should have some kind of rally," said Rich Yamarone, director of economic research at Argus Research. "But I think there's a bubble-like atmosphere going on here in the rush back to 10,000. Caution should rule the day. We're not out of the woods yet." Several experts point out than many of the relatively strong earnings reports helping to lift the markets in recent days are being driven by cost cuts, rather than strong revenue growth that would be a better indicator of consumers and businesses being willing to spend again. If businesses keep cutting costs to make the numbers that Wall Street wants to see, that can only put more downward pressure on jobs and wages, and result in weaker economic growth or another downturn. "The companies are cutting fat, and in many cases cutting bone and muscle. There's no organic economic growth there," said Yamarone. Barry Ritholtz, CEO and director of equity research at Fusion IQ, said that despite their reputation as a leading indicator, the stock markets do a terrible job forecasting the economy. "Beware of economists pointing to the stock market," he said. "The rallies tend to be false starts because it's a reaction to what came before. The sell-offs tend to be overdone because, as they gain momentum, they lead to panics." Ritholtz said comparisons of current earnings to those of a year ago or stock levels to the lows of earlier this year greatly exaggerate the strength even the market sees in the economic outlook. "It's like saying the Detroit Lions have better year-over-year comparisons because they're no longer winless," he said about the football team that went 0-16 in 2008, but has won one of five games so far this year. "But they're still in last place and they're not winning the Super Bowl." Another reason that comparisons to Dow levels of a year ago are risky is that two of the more troubled components -- General Motors and Citigroup (C, Fortune 500) -- were dropped and replaced by stronger companies such as Cisco Systems (CSCO, Fortune 500) and Travelers Cos. (TRV, Fortune 500) in June. Without those changes the Dow would be almost 100 points lower now than it is with the stronger companies, although precise comparisons are difficult since GM shares are no longer traded on the New York Stock Exchange. "You take out the worst, put in the best, and by definition you'll get better numbers," said Yamarone. |

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

handon

Master |

15-Oct-2009 22:01

|

||||||||

|

x 0

x 0 Alert Admin |

time to short.... sure make.... hehe....

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

|

|||||||||

|

williamyeo

Senior |

15-Oct-2009 20:37

|

||||||||

|

x 0

x 0 Alert Admin |

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

risktaker

Supreme |

15-Oct-2009 19:51

Yells: "Sometimes you think you know, but in fact you dont" |

||||||||

|

x 0

x 0 Alert Admin |

dont worry about DOW :) Being Supported | ||||||||

| Useful To Me Not Useful To Me | |||||||||

|

niuyear

Supreme |

15-Oct-2009 12:56

|

||||||||

|

x 0

x 0 Alert Admin |

I think China is now very worried of the US dollars sliding daily....after buying more and more US bad debt since last year, China has become 'primary holder' of US treasury.......

China needs to diversify its foreign exchange reserves basket," said Zhang Ming, economist with the Institute of Finance and Banking at the Chinese Academy of Social Sciences. "Its holdings of these treasuries face the danger of a price drop as the US is expected to issue more bonds to stimulate its economy," he told China Daily. With US interest rates at near-zero levels, the dollar's value may slide, and its recent strong rally may not sustain, economists said. The sliding dollar will push down treasury debt prices, economists said.

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

risktaker

Supreme |

15-Oct-2009 06:20

Yells: "Sometimes you think you know, but in fact you dont" |

||||||||

|

x 0

x 0 Alert Admin |

There we go 10,000 mark :) Good luck guys Huat ah :P

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

richtan

Supreme |

15-Oct-2009 01:28

|

||||||||

|

x 0

x 0 Alert Admin |

Still remember my this post way back in July, materialised:

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

handon

Master |

15-Oct-2009 00:06

|

||||||||

|

x 0

x 0 Alert Admin |

win liao... keep under the pillow... Fat FAT..... hehe....

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

richtan

Supreme |

14-Oct-2009 23:20

|

||||||||

|

x 0

x 0 Alert Admin |

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

|

qwertyuiop00

Veteran |

14-Oct-2009 23:17

|

||||||||

|

x 0

x 0 Alert Admin |

only 15 more points to go!

|

||||||||

| Useful To Me Not Useful To Me | |||||||||

x 1

x 1  x 0

x 0