| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

||||||

|

Blastoff

Elite |

07-Oct-2009 13:14

|

|||||

|

x 0

x 0 Alert Admin |

SINGAPORE shares were higher at midday on Wednesday, with the STI up 27.75 points or 1.06 per cent to 2,639.64. About 1.2b shares were traded. Gainers beat losers 374 to 88. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

Blastoff

Elite |

07-Oct-2009 07:16

|

|||||

|

x 0

x 0 Alert Admin |

Stocks jump againWeaker dollar and Australian rate hike spur investors, with the Dow posting a triple-digit gain for the second straight day.   The Dow Jones industrial average (INDU) rose 132 points, or 1.4%. The S&P 500 (SPX) index gained 14 points, or 1.4%, and the Nasdaq composite (COMP) rose 35 points, or 1.7%. The runup had been stronger through midday, but lost some steam as the dollar cut losses and financial shares turned mixed to negative. Gains were broad-based, with 29 of 30 Dow stocks rising as investors piled into a variety of stocks battered in a two-week selloff. Worries that the rally had gotten ahead of the recovery caused the selloff at the end of the third quarter and start of the fourth. But that decline of just over 4% on the S&P 500 seemed to give investors the entry point they were looking for to jump back into stocks. "I think most people believe that stocks are going to generally keep drifting higher for the next few months," said Gary Webb, CEO at Webb Financial Group. "So while nothing fundamental has changed this week, investors are taking opportunities to buy on the lows." "We've seen a lot of these elevator moments over the last month, these short, sharp pullbacks that ended up bringing people back in," said Fred Dickson, chief market strategist at D.A. Davidson & Co. "That's what we're seeing here." Investors also welcomed reports that Australia became the first major economy to lift interest rates since the start of the financial crisis. Meanwhile, the falling dollar boosted gold to an all-time high of $1,045 an ounce during the session and $1,039.70 at the close. The weak U.S. currency was also good for the stocks of multi-national companies that benefit from a weaker dollar. A weaker-than-expected response to a government debt auction dulled some of the shine on the rally. Economy: An upbeat reading on the services sector helped spark Monday's advance, but there was little else on the docket until Wednesday when readings on consumer credit and the Treasury budget are due. Seven months and counting: A rally in U.S. stocks that started in March, petered out late September at the end of an otherwise upbeat third quarter. In the July-September period, the Dow and S&P 500 both jumped 15%, their best quarter in a decade, while the Nasdaq rose 15.7%, its best quarter in six years. But the September selloff was modest amid the broader rally that's been in place since last March. Since bottoming at a 12-year low March 9, the S&P 500 has gained 56%, and the Dow has gained 49% as of Tuesday's close. After hitting a six-year low, the Nasdaq has gained nearly 68%. On the move: The broad advance benefited a number of stocks and sectors. Materials and commodities stocks surged, including Dow components Alcoa (AA, Fortune 500), DuPont (DD, Fortune 500), Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500). The Dow's other biggest gainers were Caterpillar (CAT, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), IBM (IBM, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and United Technologies (UTX, Fortune 500). Market breadth was positive. On the New York Stock Exchange, winners topped losers by almost four to one on volume of 1.23 billion shares. On the Nasdaq, advancers topped decliners by almost three to one on volume of 2.42 billion shares. Results due to begin: The third-quarter earnings reporting period unofficially kicks off Wednesday with Dow compenent Alcoa, as is typical. The aluminum maker is expected to post a loss versus a profit a year ago, demonstrating the weak quarter expected for the materials sector. S&P 500 profits are expected to have dropped almost 25% from the third quarter of 2008. Profit warnings: Ahead of the first big batch of results, a few companies issued warnings about their just-completed quarter. Dow component Boeing (BA, Fortune 500) said it will take a $1 billion charge in the third quarter because of higher costs to produce its 747-8 airplanes amid rough market conditions. The stock was little changed. St. Jude Medical (STJ) warned Tuesday that third-quarter results would miss earlier forecasts because hospitals bought fewer of its medical devices. Shares fell nearly 13% in unusually active New York Stock Exchange trading. World markets: Global markets rallied after Australia became the first major economy to boost interest rates since the financial crisis began. Australia's central bank boosted its overnight lending rate by a quarter percentage point to 3.25%, saying it was time to start taking away the stimulus of low rates as the economy is no longer weakening. In Europe, London's FTSE 100 gained 2.2%, France's CAC 40 gained 2.5% and Germany's DAX gained 2.7%. Asian markets ended higher. Currency and commodities: The dollar tumbled versus the euro and the yen, resuming its recent plunge against a basket of currencies. U.S. light crude oil for November delivery settled up 47 cents to $70.88 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery rose $21.90 to settle at a record $1,039.70 an ounce, after rising as high as $1,045, an intraday record. The previous record close of $1,020.20 was set two weeks ago. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.25% from 3.22% late Monday. Treasury prices and yields move in opposite directions. The government saw good, but not great, demand for its auction of $39 billion in 3-year notes. Treasury said the bid-to-cover ratio, which measures demand, was 2.76, short of the 3.02 ratio seen the last time it sold 3-year notes. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

|

||||||

|

wongmx6

Veteran |

06-Oct-2009 21:24

|

|||||

|

x 0

x 0 Alert Admin |

Volume was not impressive, only 1.8B. | |||||

| Useful To Me Not Useful To Me | ||||||

|

Blastoff

Elite |

06-Oct-2009 13:49

|

|||||

|

x 0

x 0 Alert Admin |

SINGAPORE shares were higher at midday on Tues, with the STI up 32.54 points or 1.26 per cent to 2,616.27. About 971.3m shares were traded. Gainers beat losers 317 to 102. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

niuyear

Supreme |

06-Oct-2009 09:31

|

|||||

|

x 0

x 0 Alert Admin |

I think is Friday.

|

|||||

| Useful To Me Not Useful To Me | ||||||

|

|

||||||

|

Blastoff

Elite |

06-Oct-2009 09:30

|

|||||

|

x 0

x 0 Alert Admin |

Anyone knows when Shanghai will resume trading? | |||||

| Useful To Me Not Useful To Me | ||||||

|

Blastoff

Elite |

06-Oct-2009 07:03

|

|||||

|

x 0

x 0 Alert Admin |

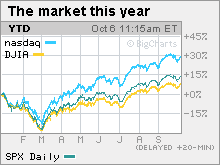

Stocks recharge the runWall Street manages gains after a two-week selloff, as investors propel financial, energy and technology shares. NEW YORK (CNNMoney.com) -- Stocks rallied Monday, with the Dow, S&P 500 and Nasdaq all gaining at least 1%, as investors used a two-week selloff as an opportunity to jump back into the market.

A better-than-expected reading on the services sector of the economy and strong demand for Treasury's first bond auction of the week bolstered the broad-based gains. The Dow Jones industrial average (INDU) rose 112 points, or 1.2%. The S&P 500 (SPX) index gained 15 points, or 1.5% and the Nasdaq composite (COMP) rose 20 points, or 1%. Bank stocks led the advance, with Bank of America (BAC, Fortune 500) up 3.8%, JPMorgan Chase (JPM, Fortune 500) up 4.6% and Wells Fargo (WFC, Fortune 500) up 6.9%. The KBW Banking (BKX) index added 3.2%. A roughly seven-month-long rally hit a roadblock at the end of September, with stocks falling for two straight weeks, and the major gauges losing around 5%. The declines were driven by a series of weaker-than-expected economic reports on housing, manufacturing, consumer confidence and employment. The weak batch of reports marked a reversal after a period of steadily improving economic news. That raised more worries that the rally has gotten ahead of the recovery. Still, the declines over the last two weeks were pretty minimal, considering the runup that preceded them. "I think the underlying trend of the market is still positive, despite the last two weeks," said Ted Weisberg, NYSE Floor Trader at Seaport Securities. "You're seeing that start to reassert itself today." He said that the last two weeks of the old quarter and first two of the new one are typically something of a Never Never Land for the market, as investors await results and focus 100% on economic news. He said that this was true in the month surrounding the end of the second quarter and start of the third in July and it appears to be true again now. "The risk, as we've seen over the last few weeks, is that the news can be less than terrific, making markets vulnerable," he said. "That's particularly the case after the kind of rally we've seen." Since bottoming at a 12-year low March 9, the S&P 500 has gained 51.2%, and the Dow has gained 45% as of Monday's close. After hitting a six-year low, the Nasdaq has gained nearly 61%. In the third quarter alone, the S&P 500 index and the Dow both jumped 15%, the best quarterly performance in a decade. The Nasdaq jumped 15.7%, its best quarterly performance since 2003. Results on tap: The wave of third-quarter earnings reports due in the week ahead will determine whether the selloff continues or proves to be an entry point for more buyers. Alcoa unofficially begins the third-quarter reporting period Wednesday, as it usually does. The Dow aluminum maker is due to report a quarterly loss versus a profit a year ago, reflecting a weak materials sector. Overall, S&P 500 profits are expected to have dropped almost 25% from the third quarter of 2008. On the move: In addition to financials, the Dow's other big gainers included Boeing (BA, Fortune 500), United Technologies (UTX, Fortune 500), 3M (MMM, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Hewlett-Packard (HPQ, Fortune 500). Of the 30 Dow components, 25 gained. Among stock movers, Brocade Communications (BRCD) rallied 18.8% in unusually active trading on reports that it has put itself up for sale. Both Hewlett-Packard and Oracle (ORCL, Fortune 500) were cited as potential buyers, according to the Wall Street Journal. Economy: The Institute for Supply Management's services sector index rose to 50.9 in September from 48.4 in August. Economists surveyed by Briefing.com thought it would rise to 50.0. World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all gained around 0.7%. Asian markets were mixed, with the Hong Kong Hang Seng higher and the Japanese Nikkei lower. Currency and commodities: The dollar tumbled versus the euro and the yen, resuming its recent plunge against a basket of currencies. U.S. light crude oil for October delivery rose 46 cents to $70.41 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery rose $13.50 to settle at $1,017.80 an ounce. Gold closed at a record high of $1,020.20 two weeks ago. Bonds: Treasury prices fell late Monday, with the yield on the 10-year note sticking at 3.22%. Treasury prices and yields move in opposite directions. The government's sale of $7 billion in 10-year Treasury Inflation Protected Securities (TIPS) saw strong demand, a good sign at the start of a week that brings $78 billion in debt auctions. Market breadth was positive. On the New York Stock Exchange, winners beat losers five to one on volume of 1.12 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.21 billion shares. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

Blastoff

Elite |

05-Oct-2009 16:39

|

|||||

|

x 0

x 0 Alert Admin |

DOW future positive.... | |||||

| Useful To Me Not Useful To Me | ||||||

|

|

||||||

|

teeth53

Supreme |

02-Oct-2009 21:02

Yells: "don't learn through life, learn to grow with life " |

|||||

|

x 0

x 0 Alert Admin |

http://money.cnn.com/ Bad news: Jobs market getting worse 8:42am: More jobs were lost in September than expected and unemployment rate hits 26-year high of 9.8%. More. Stocks set to fall on jobs report | Track futures Job hunt: 862 days, no offers |

|||||

| Useful To Me Not Useful To Me | ||||||

|

lookcc

Master |

01-Oct-2009 21:19

|

|||||

|

x 0

x 0 Alert Admin |

ism mfg indx, at d next hr, is show time. | |||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

01-Oct-2009 20:38

|

|||||

|

x 0

x 0 Alert Admin |

U.S. Consumer Spending Jumps by the Most in Almost Eight Years By Shobhana Chandra Oct. 1 (Bloomberg) -- Spending by U.S. consumers climbed in August by the most in almost eight years, indicating the biggest part of the economy is starting to rebound from the worst slump in almost three decades. The 1.3 percent increase in purchases was larger than forecast and followed a 0.3 percent gain in the prior month that was bigger than previously estimated, Commerce Department figures showed today in Washington. Incomes climbed 0.2 percent for a second month and inflation decelerated. Automakers including General Motors Co. benefited from the Obama administration’s $3 billion “cash-for-clunkers” incentives. A projected drop in auto purchases last month is a reminder that such gains will be hard to sustain as the stimulus programs expire and households grapple with rising joblessness and stagnant incomes. “We’re seeing sparks of life in the consumer, which is very important at this stage of the economic recovery,” Lindsey Piegza, an economist at FTN Financial in New York, said before the report. Even so, “spending is not going to be as robust as we’d like. Income growth will remain constrained for some time, and consumers’ burden of debt is not something that can be fixed quickly.” Economists forecast spending would rise 1.1 percent, after an originally reported increase of 0.2 percent the prior month, according to the median of 80 estimates in a Bloomberg News survey. Projections ranged from gains of 0.1 percent to 1.6 percent. Most Since 2001 The August increase in spending was the biggest since October 2001 and reflected broad-based increases in goods and services. “Economic activity has picked up,” the Federal Reserve said last week. At the same time, household spending “remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit.” Fed policy makers, who also said they’d keep the benchmark lending rate near zero “for an extended period,” are trying to secure an economic recovery while withdrawing fiscal and monetary stimulus in time to avoid driving inflation and borrowing costs higher. The tame inflation readings in today’s report indicate policy makers need not rush to remove the trillions of dollars they’ve pumped into financial markets. The price gauge tied to spending patterns was down 0.5 percent from August 2008. Less Inflation The Fed’s preferred price measure, which excludes food and fuel, climbed 0.1 percent from the previous month and was up 1.3 percent from a year earlier, the smallest year-over-year gain since September 2001. A report yesterday showed the worst U.S. recession since the Great Depression eased more than anticipated in the second quarter. Consumer spending, which accounts for about 70 percent of the economy, fell at a 0.9 percent pace, less than the government previously estimated. Adjusted for inflation, spending increased 0.9 percent, following a 0.2 percent gain the prior month. Because the increase in spending was bigger than the gain in incomes, the savings rate fell to 3 percent from 4 percent the prior month. Inflation-adjusted spending on durable goods, such as autos, furniture, and other long-lasting items, jumped 5.8 percent in August after rising 1.8 percent in the prior month. Cash for ‘Clunkers’ Buyers responded to the government offer of as much as $4,500 to trade in older, less fuel-efficient cars and trucks in August. Industry figures showed auto sales climbed to a one-year high in August. Auto sales last month, due later today, probably fell to the second-lowest pace this year, according to the median estimate of analysts surveyed by Bloomberg News. Consumer purchases of non-durable goods increased 1 percent, today’s report showed, and spending on services, which account for almost 60 percent of all outlays, rose 0.2 percent. Best Buy Co., the world’s largest electronics retailer, yesterday said it plans to hire more seasonal holiday workers this year to help meet demand for flat-panel televisions and mobile phones. The Richfield, Minnesota-based company expects to sell more merchandise this holiday season than last, Chief Executive Officer Brian Dunn said at a briefing. A report from the Labor Department tomorrow may show payrolls fell by 175,000 workers in September after a 216,000 drop the prior month, according to the survey median. The jobless rate will probably climb to 10 percent by year-end, the highest level since 1983. It reached 9.7 percent in August. To contact the reporter on this story: Shobhana Chandra in Washington at schandra1@bloomberg.net Last Updated: October 1, 2009 08:30 EDT |

|||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

01-Oct-2009 16:02

|

|||||

|

x 0

x 0 Alert Admin |

European Stocks Advance as Tandberg Rallies; Asian Shares Drop By Sarah Jones Oct. 1 (Bloomberg) -- European stocks gained after the International Monetary Fund increased its forecast for global growth and Cisco Systems Inc. agreed to buy Tandberg ASA. Asian shares retreated. Tandberg, the world’s biggest videoconferencing-equipment maker, jumped 12 percent after agreeing to be bought by Cisco for about $3 billion. Munich Re climbed 2 percent after the world’s biggest reinsurer announced the resumption of its share- buyback program. Europe’s Dow Jones Stoxx 600 Index added 0.5 percent to 243.74 at 8:20 a.m. in London as the IMF raised its forecast for global growth next year to 3.1 percent from 2.5 percent as more than $2 trillion in stimulus packages and demand in Asia pull the world economy out of its worst recession since World War II. The Stoxx 600 surged 18 percent in the past three months, the biggest quarterly gain since 1999, as the European Central Bank kept interest rates at a record low and the French and German economies unexpectedly exited recessions. The rebound has sent price-earnings valuations on the index to the highest levels since 2003. The MSCI Asia Pacific Index fell 1.1 percent today as the Bank of Japan’s Tankan survey showed companies plan to deepen investment cuts. Markets in Hong Kong and China were closed for holidays. Futures on the Standard & Poor’s 500 Index were little changed before reports on U.S. manufacturing and consumer spending that may add to evidence the worst recession since the 1930s is easing. Greenspan Former Federal Reserve Chairman Alan Greenspan yesterday said the U.S. will have to both tighten credit and raise taxes as the world’s largest economy recovers. “The presumption that we’re going to be able to resolve this without significant increases in taxes is unrealistic,” Greenspan said in a Bloomberg Television interview. The economy will grow at a 3 percent to 4 percent annual pace in the next six months before slowing in 2010, Greenspan predicted. Growth will be aided by a surge in the stock market and inventory restocking by companies. Share prices are likely to “flatten out, even though earnings are doing very well.” Tandberg rallied 12 percent to 154.5 kroner as Cisco, the world’s largest maker of networking equipment, agreed to buy the Norwegian company for 17.2 billion kroner ($2.96 billion) to expand its video-conferencing products. Cisco will pay 153.50 kroner a share in cash, 11 percent more than Tandberg’s closing price yesterday. Munich Re Rises Munich Re advanced 2 percent to 111.18 euros. The reinsurer said it will repurchase shares with a volume of as much as 1 billion euros ($1.5 billion) by the time the company holds its 2010 annual general meeting. Michelin & Cie. fell 1.4 percent to 52.87 euros. The Wall Street Journal reported that Jean-Dominique Senard, chief financial officer of the world’s second-largest tiremaker, said the economic recovery is shaky and may soon fade. The newspaper cited an interview. France Telecom SA declined 1.1 percent to 18 euros after Citigroup Inc. lowered its recommendation to “sell” from “hold,” saying the company may suffer from fibre-communication regulation and a new mobile-phone operator in its home market. Reports today may show U.S. manufacturing expanded last month at the fastest pace in more than three years and consumer spending in August grew the most since 2003. The Institute for Supply Management’s factory gauge rose to 54 in September from 52.9 the month before, according to a Bloomberg News survey of economists. Fifty is the dividing line between expansion and contraction. To contact the reporter on this story: Sarah Jones in London at sjones35@bloomberg.net. Last Updated: October 1, 2009 03:22 EDT |

|||||

| Useful To Me Not Useful To Me | ||||||

|

|

||||||

|

Blastoff

Elite |

01-Oct-2009 11:57

|

|||||

|

x 0

x 0 Alert Admin |

TOKYO TOKYO share prices fell 1.41 per cent in morning trade on Thursday, hit by overnight losses on Wall Street and a Japanese business survey that signalled weak capital expenditure ahead, brokers said. The benchmark Nikkei-225 index dropped 143.20 points to 9,990.03 by the lunch break. The broader Topix index of all first section shares fell 14.40 points, or 1.58 percent, to 895.44. The Bank of Japan's closely watched Tankan business confidence survey showed on Thursday that sentiment among major manufacturers improved for a second straight quarter. But they plan to slash their spending on plants and equipment by 25.6 per cent in the year through March 2010 compared with the previous year, according to the survey. -- AFP HONG KONG HONG Kong's financial markets are closed Thursday for a public holiday. Trading will resume on Friday. -- AFP SHANGHAI - CHINESE stock markets are closed for the week-long National Day public holiday. Trading will resume on October 9. KUALA LUMPUR AT 9.30am today, there were 117 gainers, 80 losers and 104 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,206.29 up 4.21 points, the FBMACE was at 4,042.31 down 25.36 points, and the FBMEmas was at 8,121.29 up 22.42 points. Turnover was at 50.396 million shares valued at RM44.504 million (S$18.14 million). |

|||||

| Useful To Me Not Useful To Me | ||||||

|

Blastoff

Elite |

01-Oct-2009 07:09

|

|||||

|

x 0

x 0 Alert Admin |

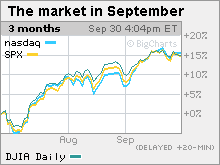

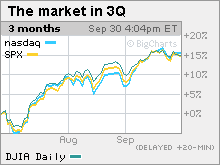

Stocks struggle at quarter endThe Dow, Nasdaq and S&P 500 waver in final moments of the third quarter, but still end 15% higher. Weaker-than-expected reports on employment and manufacturing are in focus.The Dow Jones industrial average (INDU) fell 30 points, or 0.3%. The S&P 500 (SPX) index lost 3 points, or 0.3%. The Nasdaq composite (COMP) lost just over 1 point, or 0.1%. Stocks were volatile throughout the session as investors considered the economic news, a weaker dollar and a 6% spike in oil prices. End-of-quarter portfolio rebalancing on the part of investors and fund managers may have contributed to the volatility. Wednesday was the last day of the third quarter, during which the Dow, S&P 500 and Nasdaq all gained just over 15%. Stocks slipped Tuesday after a drop in consumer confidence added to worries about the sustainability of an economic recovery. Since bottoming at a 12-year low March 9, the S&P 500 has gained just shy of 57%, and the Dow has gained around 49% (as of Tuesday's close). After hitting a six-year low, the Nasdaq has gained nearly 68%. In addition, "there's still so much money on the sidelines that equity investors are using any selloffs to get back in," said Jane Caron, chief economic strategist at Dwight Asset Management. Bank of America (BAC, Fortune 500) said after the close that CEO and president Ken Lewis is retiring on Dec. 31 after 40 years with the company. Also after the close, General Motors said it is shutting down its Saturn division after a deal to sell it to Penske Automotive Group (PAG, Fortune 500) fell apart. Economy: The Chicago PMI fell to 46.1 in September from 50 in August. Economists surveyed by Briefing.com thought it would rise to 52. A reading below 50 signifies contraction in the manufacturing sector. Another report showed that employers in the private sector cut 254,000 jobs from their payrolls in September after cutting a revised 277,000 jobs in August. Economists expected 200,000 job cuts. The report, from payroll services firm ADP, is a lead up to Thursday's reading on announced jobs cuts and Friday's bigger government employment report. While the jobs report could be a harbinger of Friday's bigger government jobs report, the manufacturing report is not consistently accurate, Caron said. "We've seen a spate of reports over the last few weeks that have been disappointing relative to consensus, but it's been nothing that really alters the economic outlook," Caron said. She said that rather than suggesting that the recovery is losing steam, the reports suggest that after months of improving data, economists have started boosting estimates. A third report showed GDP shrank at a 0.7% annual rate in the second quarter versus the initially reported 1% and the 1.2% rate forecast by economists. Companies: CIT Group (CIT, Fortune 500) sank 45% on worries that it may not be able to avoid bankruptcy after all. The lender's shares rallied Tuesday on reports that it was negotiating a new credit facility that could total $10 billion. On Wednesday, the Wall Street Journal said that CIT was negotiating a deal with its creditors that would give control of the company to bondholders and wipe out common shareholders. That sent shares tumbling. Among other movers, shares of Discovery Laboratories (DSCO) surged 22.5% on renewed hopes that its treatment for certain respiratory illnesses affecting premature infants might get approval. The drug, Surfaxin, has already been rejected four times by the FDA. But on Wednesday, Discovery said that the FDA has agreed to its proposed plan for addressing those concerns. Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's losers. Chevron and Exxon dipped despite a rise in oil prices. Market breadth was negative. On the New York Stock Exchange, losers beat winners four to three on volume of 1.77 billion shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.75 billion shares. World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all ended lower. In Asia, the Hong Kong Hang Seng fell and the Japanese Nikkei rose. Currency and commodities: The dollar fell versus the euro and yen, resuming the selloff that has pushed the U.S. currency to one-year lows against a basket of currencies over the last few weeks. U.S. light crude oil for October delivery rose $3.90 to settle at $70.61 a barrel on the New York Mercantile Exchange after the government reported a surprise drop in inventories. COMEX gold for December delivery rose $14.90 to settle at $1009.30 an ounce. Gold closed at a record high of $1,020.20 two weeks ago. Bonds: Treasury prices slumped, raising the yield on the benchmark 10-year note to 3.30% from 3.29% late Tuesday. Treasury prices and yields move in opposite directions. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

30-Sep-2009 22:28

|

|||||

|

x 1

x 0 Alert Admin |

Fed Promises Easy Money for an Extended Period

Every few weeks the world’s most powerful and influential central bankers — those in charge of the world’s number one reserve currency, the U.S. dollar — come together in what’s called the Federal Open Market Committee (FOMC). They discuss the economy, interest rates, financial markets and whatever else they deem important. Then they decide to set the Federal Funds Rate at a level they think is appropriate. And last week was their week. So today I want to analyze what their decisions mean for the stock market and for you as an investor. The Fed Statement Reassures A Very Lax Monetary Policy … After each FOMC meeting, the Fed releases a statement. And the one for September 23, 2009, is very telling in my opinion. Here’s its most important part:

As you can see, the Fed is promising a continuation of its extremely lax monetary policy “for an extended period.” So all the recent media talk about a soon-to-begin exit strategy or a normalization of monetary policy was obviously premature. The Fed is reassuring us that there will be easy money for as far as the eye can see. Why? Two reasons come to mind: First, the Fed is still very concerned about the economy … the employment situation is dire … and a double-dip recession is a real possibility Second, and more important, is that they know how precarious the banking situation still is. They know that the bad debt problems have not been solved … that most banks would go bankrupt if they had to implement mark-to-market rules … and that the banking system is still on life support. This Is Important News For the Stock Market Since the Fed is confronted with two major problems — a shaky economy and an unstable banking system — it’s not worrying about a possible stock market bubble in the making. Why is this so important? Just look at the charts below. The stock market has rallied some 60 percent since the March low. But earnings are still very depressed. Hence the classic version of the P/E ratio — using twelve months trailing GAAP earnings — shot to the stratosphere!

Source: www.decisionpoint.com

Right now I can’t rule out either one. I do, however, lean towards the first. And in reading the Fed’s FOMC statement one thing becomes obvious: If we’re on our way to a new stock market bubble the Fed will not prick it any time soon. The September 23 statement that I cited earlier is as clear as you can expect from the Fed. Much clearer than anything Greenspan said during his long reign. His famous “irrational exuberance” speech, which was never followed by any action, is a perfect example. Bernanke is much different … From the very beginning of his career at the Fed he made it known that he’s a first class inflationist, and he strongly believes prosperity can be achieved by printing money. Now the Bernanke Fed is clearly reiterating this inflationary stance. By doing so the Fed is rubberstamping the current stock market rally and apparently not worrying about a possible bubble! There is an old Wall Street saying: “Don’t fight the Fed.” I think it’s wise to heed it in today’s environment. Best wishes, Claus |

|||||

| Useful To Me Not Useful To Me | ||||||

|

lookcc

Master |

30-Sep-2009 21:54

|

|||||

|

x 0

x 0 Alert Admin |

chicago sept's pmi 46.1%, forecast was 52%n aug pmi was 50%..tat's y dj now down 83 pts. |

|||||

| Useful To Me Not Useful To Me | ||||||

|

lookcc

Master |

30-Sep-2009 21:48

|

|||||

|

x 0

x 0 Alert Admin |

dj now down 60 pts.......???? | |||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

30-Sep-2009 21:38

|

|||||

|

x 0

x 0 Alert Admin |

U.S. Stock-Index Futures Climb; S&P 500 Set for Quarterly Gain By Elizabeth Stanton Sept. 30 (Bloomberg) -- U.S. stock futures rose, signaling the market may extend its biggest quarterly rally in a decade, as the government said the economy shrank less than estimated in April through June and earnings at Nike Inc. beat estimates. Nike, the largest athletic-shoe maker, jumped 6.8 percent after reporting higher profit on cost reductions and improving pricing. Alcoa Inc. climbed 1.7 percent and National Oilwell Varco Inc. jumped 1.4 percent as oil and metals rose. The Standard & Poor’s 500 Index was poised to extend its 15 percent quarterly advance after the Commerce Department said gross domestic product contracted at the slowest pace in a year. Futures on the S&P 500 expiring in December added 0.4 percent to 1,059.2 as of 8:50 a.m. in New York. Dow Jones Industrial Average futures rose 0.4 percent to 9,711 and Nasdaq- 100 Index futures increased 0.3 percent to 1,720.75. The S&P 500’s advance since the end of June is its steepest quarterly gain since 1998. The rally has sent price-earnings valuations in the index this month to the highest levels since 2004. The measure has rebounded 57 percent from a 12-year low in March. Alcoa will be the first company in the Dow average to release third-quarter earnings next week, set for Oct. 7. Analysts expect profits in the S&P 500 to drop 22 percent on average in the third quarter before rebounding 63 percent in the final three months of the year, according to estimates compiled by Bloomberg. The International Monetary Fund today cut its projection for global writedowns on loans and investments by 15 percent to $3.4 trillion, citing improvements in credit markets and initial signs of economic growth. Nike Results Nike rallied 6.8 percent to $64.17 in early New York trading as net income advanced to $1.04 a share in the three months ended Aug. 31 from $1.03 a share in the year-earlier period. Profit beat analysts’ estimates by 7 cents. Goldman Sachs Group Inc. lifted its recommendation on Nike shares to “buy” from “neutral.” Alcoa climbed 1.7 percent to $13.54. The company will turn around its negative cash flow caused by falling aluminum prices by the end of the year, the Sueddeutsche Zeitung reported, citing an interview with Chief Executive Officer Klaus Kleinfeld. Separately, the metal’s price rose in London. Exxon Mobil Corp. added 0.4 percent to $69.35 as crude oil rose above $67 a barrel in New York. Exxon, the largest U.S. energy company, sold stakes in an oil block and a gas area in Indonesia to a unit of Malaysia’s Petroliam Nasional Bhd. Micron Technology Inc., the biggest U.S. producer of computer-memory chips, reported a fourth-quarter net loss of 10 cents a share, compared with a loss of 45 cents a year ago. Micron shares added 0.7 percent to $8.46. Quarterly Rally All 10 of the main industry groups in the S&P 500 advanced in the third quarter, led by a 26 percent rally in financial shares and 22 percent gains in industrial and commodity producers. Gannett Co., the nation’s largest newspaper publisher, posted the steepest advance in the index, more than tripling in the quarter. Hartford Financial Services Group Inc., Wynn Resorts Ltd. and Tenet Healthcare Corp. more than doubled. The gains came amid speculation the economy was returning to growth following the worst recession in seven decades. Home prices stabilized, consumer confidence strengthened as job losses abated and the Institute for Supply Management said manufacturing activity ended an 18-month contraction in August. ‘Over Processed’ The performance of the U.S. economy is probably more sluggish than reflected in stock markets, risking a correction in equities, Nobel Prize-winning economist Michael Spence said. U.S. stock-market investors have “over processed” the stabilization of growth in the world’s largest economy, Spence said in an interview in Kuala Lumpur yesterday. The U.S. economy isn’t likely to experience a “double-dip” slowdown even as that remains a risk, said the professor emeritus of management in the Graduate School of Business at Stanford University. A report today showed mortgage applications in the U.S. fell last week from a four-month high, led by a decline in purchases. The Mortgage Bankers Association’s index of applications to buy a home or refinance a loan dropped 2.8 percent in the week ended Sept. 25. To contact the reporter on this story: Elizabeth Stanton in New York at estanton@bloomberg.net. Last Updated: September 30, 2009 08:52 EDT |

|||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

30-Sep-2009 16:27

|

|||||

|

x 0

x 0 Alert Admin |

European Stocks Advance, Extending Best Quarter This Decade By Sarah Jones Sept. 30 (Bloomberg) -- European stocks rose for a third day, extending the Dow Jones Stoxx 600 Index’s biggest quarterly rally this decade. U.S. index futures and Asian shares gained. Infineon Technologies AG climbed 6.5 percent after Micron Technology Inc., the biggest U.S. producer of computer-memory chips, reported a smaller-than-estimated loss. Man Group Plc, the largest publicly traded hedge-fund manager, soared 6.2 percent after reporting an increase in assets under management. The Stoxx 600 rose 0.5 percent to 244.7 as of 8:28 a.m. in London, extending the advance since the end of June to 19 percent. The quarterly increase is the biggest since 1999, while the Standard & Poor’s 500 Index’s 15 percent surge is the steepest since 1998. The gains have sent price-earnings valuations on the indexes this month to the highest levels since 2003 and 2004, respectively. The market is “certainly pricing in quite a lot of recovery,” said David Crawford, a fund manager at Octopus Investments Ltd. in London. “We haven’t quite hit the buffers, but we don’t see certainly so much upside” as we have seen since March, he told Bloomberg Television. Futures on the S&P 500 added 0.3 percent before data on gross domestic product, employment and business activity that may show the worst U.S. recession since the Great Depression eased and the economy is probably now in the early stages of recovery. Asian Stocks, IMF The MSCI Asia Pacific Index climbed 0.8 percent today, led by automakers and technology companies, after NGK Insulators Ltd. raised its profit forecast and Micron posted a narrower loss. The International Monetary Fund today cut its projection for global writedowns on loans and investments by 15 percent to $3.4 trillion, citing improvements in credit markets and initial signs of economic growth. Germany’s Handelsblatt newspaper reported that the IMF has raised its global economic growth forecast for next year to 3.1 percent from 2.5 percent. Separate data from GfK NOP showed U.K. consumer confidence jumped in September by the most since 1995. Infineon Technologies, Europe’s second-largest maker of semiconductors, climbed 6.5 percent to 3.91 euros. Micron posted a fourth-quarter loss of $88 million, or 10 cents a share, after an industry glut eased and product prices rebounded. Analysts had estimated a loss of 19 cents, according to a Bloomberg survey. Separately, Exane BNP Paribas upgraded Infineon to “outperform” from “neutral,” citing “evidence of cash generation.” Man Group, Smiths Man Group advanced 6.2 percent to 327.3 pence. Funds under management rose to $43.8 billion in the fiscal second quarter from $43.3 billion at the end of June. Investors had expected $43.5 billion, according to three analysts surveyed by Bloomberg. Smiths Group Plc rallied 7.3 percent to 899 pence after the world’s biggest maker of airport scanners raised its savings target to at least 70 million pounds ($113 million) and reporting pretax profit before one-time items of 371 million pounds. The company also extended a revamp program to its detection-gear division. Marks & Spencer Group Plc slipped 1.6 percent to 368.7 pence after the U.K.’s largest clothing retailer reported a decline in same-store revenue. Sales at U.K. stores open at least a year fell 0.5 percent in the 13 weeks ended Sept. 26. Europe’s Stoxx 600 has added 3.7 percent in September, heading for a third straight monthly advance. The S&P 500 has gained 3.9 percent, leaving it poised for a seventh consecutive monthly increase, the longest streak since January 2007. Japan’s Topix index and the Nikkei 225 Stock Average are this month’s worst performers among 88 indexes tracked by Bloomberg, amid uncertainties over policies from the nation’s new government. To contact the reporter on this story: Sarah Jones in London at sjones35@bloomberg.net. Last Updated: September 30, 2009 03:30 EDT |

|||||

| Useful To Me Not Useful To Me | ||||||

|

richtan

Supreme |

30-Sep-2009 16:26

|

|||||

|

x 0

x 0 Alert Admin |

|

|||||

| Useful To Me Not Useful To Me | ||||||