| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

|||

|

Blastoff

Elite |

05-Nov-2009 08:14

|

||

|

x 0

x 0 Alert Admin |

Stocks give up gains after FedWall Street abandons the rally late in the session as investors consider weak banking sector, the central bank's decision to hold rates steady. The Dow Jones industrial average (INDU) gained 30 points, or 0.3%. The Dow had gained as much as 156 points in the afternoon, but couldn't sustain those gains through the close. The S&P 500 (SPX) gained 1 point, or 0.1%, and the Nasdaq composite (COMP) lost 2 points, or 0.1%. Stocks rose through the early afternoon as investors welcomed a pair of labor market reports that signaled the pace of layoffs is slowing. But markets were volatile in the afternoon, cutting gains after the Fed announcement, recharging the advance in the late afternoon, and then abandoning most of the gains by the close. Although the market pretty much got what it wanted from the Fed, trading is typically volatile on Fed days, said Michael Sheldon, chief market strategist at RDM Financial Group. He said that the late-day selloff could be attributed to both a bearish banking call by influential analyst Meredith Whitney -- and the S&P 500's inability to hang on above a key technical level. "I think investors are getting a little nervous, and that's reflected by the fact that the market has pulled back a bit over the last few weeks," Sheldon said. Since hitting a 2009 closing high of 1097.91 on Oct. 19, the S&P 500 has lost just short of 5% as of Wednesday's close. That retreat followed a massive rally that saw the broad index gain 63% after bouncing off a 12-year low. Oil prices spiked past $80 a barrel and gold prices flirted with all-time highs just close to $1,100 an ounce. The dollar slipped versus the euro and strengthened against the yen. Bond prices slipped, boosting the corresponding yields. After the close, Cisco Systems (CSCO, Fortune 500) reported weaker quarterly earnings and revenue that beat estimates. Chief Executive John Chambers said current-quarter revenue would top estimates and that business conditions had bottomed at least six months ago. Cisco shares gained 4% in extended-hours trading. Federal Reserve: The central bank opted to hold interest rates steady at historic lows near zero, as expected, following its two-day policy meeting. In its closely watched statement, the bankers said economic activity is likely to remain weak for some time. As a result, "the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability." This provided some reassurance to investors who were concerned about how and when the Fed plans to unwind the billions of dollars in stimulus it has pumped into the economy in the wake of the financial crisis. "The statement was unsurprising," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. "It was more optimistic, but that was in line with the recent data." He said that at whatever point the Fed does began preparing to raise rates, it will begin preparing the market well in advance. Jobs: Two reports Wednesday morning suggested the pace of job losses is slowing, raising hopes that Friday's big monthly report will continue that trend. Payroll services firm ADP said Wednesday that employers in the private sector cut 203,000 jobs from their payrolls in October after cutting 227,000 in September. A consensus of economists surveyed by Briefing.com expected 198,000 job cuts. A separate report, from outplacement firm Challenger, Gray & Christmas, showed the number of planned layoffs slowed to 55,679 in October, down 16% from September. In other economic news, the Institute for Supply Management's reading on the services sector of the economy fell to 50.6 in October from 50.9 in September. Economists thought it would rise to 51.5. Company news: Time Warner (TWX, Fortune 500), the parent of CNNMoney.com, reported weaker quarterly sales and earnings that topped forecasts. The company also boosted its full-year 2009 forecast and said that its outlook has improved, although it expects to take a $100 million charge in the quarter as it restructures its Time Inc. division. Dow component Kraft Foods (KFT, Fortune 500) reported weaker quarterly earnings that topped estimates on weaker revenue that missed estimates. The company also boosted its 2009 earnings forecast and cut its revenue outlook. Shares fell 3%. Merck (MRK, Fortune 500) rallied after it said it expects annual earnings growth of nearly 10% until 2013. Comcast (CMCSA, Fortune 500) reported higher quarterly earnings that topped forecasts. Election: Investors also digested results from Tuesday's elections, including Republican victories in two highly competitive races for governor in both New Jersey and Virginia. CNN exit polls suggest that worries about the economy and growing joblessness led to the victories. World markets: European and Asian markets ended higher. Bearish news from European banks dragged on markets around the world Tuesday. But Wednesday's new was more upbeat. Société Générale, France's no. 2 bank, said earnings more than doubled from a year ago. Currency and commodities: The dollar fell versus the yen and gained against the euro. U.S. light crude oil for December delivery rose cents 80 cents to settle at $80.40 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $2.40 to settle at $1,087.30 an ounce and hit an intraday record high of $1,098.50 an ounce in electronic trading. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.49% from 3.47% Tuesday. Treasury prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

aircraft

Veteran |

02-Nov-2009 08:31

|

||

|

x 0

x 0 Alert Admin |

Thanks Blastoff, for the updates. | ||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

02-Nov-2009 07:29

|

||

|

x 0

x 0 Alert Admin |

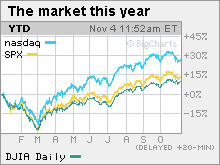

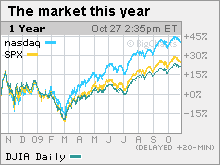

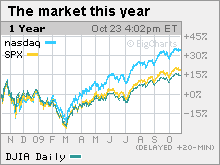

Wall Street's broken rallyA seven-month advance came to a halt in October as investors turned cautious. Can November recharge the run?  NEW YORK (CNNMoney) -- Last week's big selloff did more than just rattle investors: it put an end to a seven-month win streak that had pushed the S&P 500 more than 60% above the March lows.

While the monthly decline was small -- less than 2% -- it emerged after a tumultuous week dictated by a stronger dollar, sliding energy and financial issues, and a variety of quarterly financial reports. A stronger-than-expected rise in third-quarter GDP growth -- the strongest sign yet that the recession is over -- provoked a one-day rally and nothing more. "The underlying fundamentals look good," said David Chalupnik, head of equities at First American Funds. "But there's still a lot of worry in this market, which we saw this week." He said the week ahead should be better, but it may be muted as investors wait for Friday's big jobs report. "Right now the market is all about jobs and the consumer," said Kelli Hill, portfolio manager at Ashfield Capital Partners. "While GDP is growing, the consumer is hurting." Weak consumer confidence, sluggish spending and the still-deteriorating labor market are all creating worries about what a recovery will look like beyond the near term. Government stimulus programs such as Cash for Clunkers and the tax breaks for first-time home buyers have helped, but are short term fixes. Investors are concerned about what a recovery will look like without the help. "There's growth and resilience in productivity, but people are still losing their jobs," she said. Jobs: The state of the labor market moves front and center on Wall Street in the week ahead, with a number of reports on joblessness in October on tap. The government's non-farm payrolls report on Friday is likely the highlight. Employers are expected to have cut 166,000 from their payrolls after cutting 263,000 in September, according to a consensus of economists surveyed by Briefing.com. The unemployment rate is expected to drift ever closer to 10%, hitting 9.9%. On Wednesday, the Senate is expected to vote to extend unemployment benefits. Other economic events to keep an eye on during the week include October auto and truck sales, due Tuesday, and the weekly jobless claims and October chain store sales, both due Thursday. For a more detailed look at this week's economic news, see the chart. Federal Reserve: The central bank meets Tuesday and Wednesday with a decision on interest rates and a statement due out Wednesday afternoon. The Fed is widely expected to hold the fed funds rate, a key overnight bank lending rate, at historic lows near zero, as a means of supporting a still-tentative economic recovery. In its closely watched statement, the Fed could provide hints as to when, later this year or early next, it plans to start removing the trillions in stimulus it put into the system as the financial crisis took hold. The bankers are not expected to lift interest rates until sometime next year. Quarterly results: With roughly 344 companies, or 69% of the S&P 500 having reported results, profits are currently on track to have fallen 17.5% versus a year ago, according to Thomson Reuters. That makes the third quarter the ninth consecutive quarter of declining profits, the longest stretch since Thomson began calculating the information a decade ago. However, the percentage of companies reporting upside surprises is at an all-time high of 80%, with just 6% meeting forecasts and 13% missing forecasts. Revenue is currently on track to have fallen about 10.7% versus a year ago. Next week brings a smaller number of market-moving quarterly results, including Dow components Cisco Systems (CSCO, Fortune 500) and Kraft Foods (KFT, Fortune 500). Ford Motor (F, Fortune 500), due out Monday morning, is expected to have lost 13 cents per share, after losing $1.31 a year ago, according to Thomson Reuters estimates. Kraft Foods, due out after the close Tuesday, is expected to have earned 48 cents per share, versus 44 cents a year ago. Time Warner (TWX, Fortune 500) reports results Wednesday morning. The media company (and parent of CNNMoney.com) is expected to have earned 53 cents a share versus 30 cents a year ago. Cisco Systems, due out after the close Wednesday, is expected to have earned 31 cents per share, down from 42 cents a year ago. CIT: One cloud hanging over the markets to start the week is the bankruptcy filing of CIT Group (CIT, Fortune 500), one of the leading providers of funding for small and medium-sized business. The company said it has already worked out a reorganization plan with bondholders that it expects to speed the Chapter 11 process and reduce CIT's debt by $10 billion. But the filing means that common and preferred shareholders, which include the federal government to the tune of $2.3 billion in Troubled Asset Relief Program funds, will be wiped out. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

30-Oct-2009 07:24

|

||

|

x 0

x 0 Alert Admin |

Dow's best day in 3 monthsA better-than-expected jump in third-quarter economic growth fired up the bulls, putting the blue-chip indicator and the S&P 500 at 3-month highs.  The Dow Jones industrial average (INDU) gained just shy of 200 points, or 2%, closing at 9962.58. It was the Dow's biggest one-day percentage gain since July 15, and came exactly 80 years after Wall Street's darkest day, the Crash of 1929. The S&P 500 (SPX) index added 23 points, or 2.3%, managing its biggest one-day percentage gain since July 23. The Nasdaq composite (COMP) climbed 38 points, or 1.8%, its biggest one-day percentage gain in about a month. "The market sold off Wednesday in expectation of a lower number and today it got a positive surprise," said Karl Mills, president and chief investment officer at Jurika Mills & Keifer. "This shows the economy is continuing to recover and heal," he said. "It's just not clear what that recovery is going to look like." Gains were broad based, with 29 of 30 Dow issues rising, led by Boeing (BA, Fortune 500), Chevron (CVX, Fortune 500), Caterpillar (CAT, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), IBM (IBM, Fortune 500) JPMorgan Chase (JPM, Fortune 500), 3M (MMM, Fortune 500), Travelers (TRV, Fortune 500), Wal-Mart Stores (WMT, Fortune 500) and Procter & Gamble (PG, Fortune 500), which reported a better-than-expected profit. The rally in the financial sector boosted the KBW Bank (BKX) index by 4%. Commodity shares spiked, with the Morgan Stanley Commodity (CSX, Fortune 500) index up 5%. The Dow and S&P ended three of the last four sessions lower, and the Nasdaq declined in all four, as investors turned cautious after a seven-month stock rally. Early enthusiasm about better-than-expected third-quarter profit gave way to questions about the strength of the economy, causing investors to pull back. The S&P 500 lost 5% between the rally peak on Oct. 19 and Wednesday's close. Both the better-than-expected GDP report and the preceding sharp, short selloff gave stocks a boost Thursday. Since bottoming at a 12-year low on March 9, the S&P 500 has gained 57.6% as of Thursday's close. Reports on personal income and spending, consumer sentiment and manufacturing are all due Friday morning. Dow component Chevron (CVX, Fortune 500), Duke Energy (DUK, Fortune 500), Alcatel-Lucent (ALA) and Sony (SNE) are among the corporations reporting quarterly results in the morning. Economy: GDP grew at a 3.5% annualized rate in the third quarter, the government reported Thursday. That was better than the 3.2% rate economists surveyed by Briefing.com had predicted and also marked the first quarter of growth in a year. GDP fell at a 0.7% rate in the second quarter. Some organic factors fueled the advance, including a slowdown in the pace of businesses reducing inventories. But other short-term factors played a role too, including the impact of government stimulus programs such as Cash for Clunkers. Yet some economists are concerned that when those short-term factors are removed, any recovery could be pretty flimsy. "It was a little better than expected, but you have to wonder how much of the growth was pulled from another quarter, with the stimulus driving so much of it," said Drew Kanaly, chairman and CEO at Kanaly Trust. "As you look to quarters down the road, you have to wonder how sustainable this level of GDP is," he said. "Can the government take away all the stimulus and make that handoff to the private sector?" A separate government report showed that the number of Americans filing new claims for unemployment fell to 530,000 last week from 531,000 the previous week. Economists thought it would drop to 525,000. Continuing claims, a measure of Americans receiving benefits for a week or more, fell to 5,797,000 from 5,945,000 the week before. Economists thought claims would fall to 5,905,000. Results: Exxon Mobil (XOM, Fortune 500) said quarterly earnings plunged 68% in the quarter due to lower oil and natural gas prices. The No. 1 U.S. oil company reported weaker quarterly revenue as well. Both earnings and revenue missed estimates. Shares of the Dow component ended little changed. Dow component Procter & Gamble (PG, Fortune 500) reported weaker quarterly earnings and revenue that topped estimates. The consumer products maker also boosted the low end of its fiscal 2010 earnings forecast. Shares gained 4%. With 302 companies, or 60% of the S&P 500 having already reported results, profits are on track to have fallen 17.9% from a year ago, according to the latest results from Thomson Reuters. Currency and commodities: The dollar fell versus the euro, resuming its slide after a few up days and moving closer to a 14-month low hit last week. The greenback gained versus the yen. U.S. light crude oil for December delivery rallied $2.44 to settle at $79.87 a barrel on the New York Mercantile Exchange, a gain of 3%. COMEX gold for December delivery rallied $16.60 to settle at $1,047.10 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all gained over 1%. Asian markets ended lower, with Japan's Nikkei losing 1.8%. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.49% from 3.41% Wednesday. Treasury prices and yields move in opposite directions. Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.45 billion shares. On the Nasdaq, advancers topped decliners nine to four on 2.33 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

29-Oct-2009 07:03

|

||

|

x 1

x 0 Alert Admin |

Stocks slammedA surprise drop in new home sales sends market lower, with the Nasdaq sliding for the fourth straight session, as investors question strength of the economic recovery.   NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday, led by the tech-fueled Nasdaq, as a weaker-than-expected new home sales report added to questions about the strength of the economic recovery. The Dow Jones industrial average (INDU) lost 119 points, or 1.2%, to close at 9,762.69. The S&P 500 (SPX) index dropped 21 points, or 2%, to close at 1,042.63. The Nasdaq composite (COMP) tumbled 56 points, or 2.7%, to close at 2,059.61. The Dow and S&P have fallen for three of the last four sessions, and the Nasdaq for all three, as investors have turned cautious following a seven-month stock rally. Since bottoming at a 12-year low in March, the S&P 500 gained 63% through its peak on Oct. 19. But since then, it's lost 5%, as of Wednesday's close. Enthusiasm about the largely better-than-expected quarterly earnings reports has been tempered recently by concerns about the still-burgeoning economic recovery. "There's been some nervousness over the last week, and today the worry is that the weaker new home sales report means the consumer is still flat on its back," said Alan Gayle, senior investment strategist at RidgeWorth Investments. Gayle said Wednesday's action shows investors are feeling less willing to take on risk at the moment, a factor made clear by the sector movement. In particular, the weakness in areas such as retail, financial and technology - and strength in defensive sectors like consumer staples and healthcare. GDP: Thursday's reading on gross domestic product growth is the key economic event of the week. GDP is expected to have grown at a 3.2% annualized rate in the third quarter after shrinking at an 0.7% annualized rate in the second quarter. GDP has declined steadily for four straight quarters, as Americans have contended with the worst recession since the Great Depression. But the end of the recession doesn't necessarily mean a return to a period of robust growth, particularly amid rising joblessness and still-sluggish consumer spending. Government stimulus programs have played a big role in the recovery, and there are concerns about the strength of the system once that support winds down. The weekly jobless claims report from the Labor Department is also due in the morning. Housing: New home sales fell to a 402,000 unit annualized rate in September from a revised 417,000 unit annualized rate in August, the Commerce Department reported. Sales were expected to rise to a 440,000 unit annualized rate, according to a consensus of analysts surveyed by Briefing.com. Durable goods: Orders for manufactured goods meant to last three years or more rose 1% in September, after falling 2.6% in the previous month. The rise was in line with estimates. Goods excluding transportation rose 0.9% after falling 0.4% in August. Economists thought they would rise 0.7%. Another report showed that fewer metro areas reported jobless rates above 10% in September than in the previous month. GMAC seeks bailout: GMAC Financial Services is looking for a third bailout from the Treasury Department, according to a Wall Street Journal report. The lender is seeking between $2.8 billion and $5.6 billion, according to the Journal. The U.S. owns a 35% stake in GMAC and has given it $13.4 billion since December 2008. On the move: Financial and technology shares were among the hardest hit stocks Wednesday. Dow financial components American Express (AXP, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) all declined. Wells Fargo (WFC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) were among the other big bank shares sliding. The KBW Bank index slid 3.3%. On the tech side, Intel (INTC, Fortune 500), Dell (DELL, Fortune 500), Apple (AAPL, Fortune 500) and Oracle (ORCL, Fortune 500) were among the big losers. Telecom stocks gained, including Qwest Communications (Q, Fortune 500), which posted a higher-than-expected quarterly profit and lifted its full-year earnings forecast. Shares gained 2.6%. Dow stock Verizon Communications (VZ, Fortune 500) rallied 3% after releasing more details about its iPhone challenging Droid smart phone - due for release next week. The phone uses Google's Android operating system, has a mini-keyboard and can run several applications at once. It is expected to retail for $199. Fellow Dow telecom AT&T (T, Fortune 500) also gained, rising just short of 2%. Currency and commodities: The dollar fell versus the euro, resuming its slide after a few up days and moving closer to a 14-month low hit last week. The greenback fell versus the yen. U.S. light crude oil for December delivery fell $2.09 to settle at $77.46 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $4.90 to settle at $1,030.50 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets tumbled. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all lost over 2%. Asian markets ended lower. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.41% from 3.44% Tuesday. Treasury prices and yields move in opposite directions. Prices held on to gains after the government sold $41 billion in five-year notes. Market breadth was negative. On the New York Stock Exchange, losers beat winners nearly 9 to one on volume of 1.68 billion shares. On the Nasdaq, decliners topped advancers almost six to one on volume of 2.81 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

28-Oct-2009 10:59

|

||

|

x 0

x 0 Alert Admin |

TOKYO Japanese share prices fell 0.66 per cent in morning trade on Wednesday as investors refrained from buying ahead of another batch of corporate earnings results. The benchmark Nikkei-225 index slipped 67.91 points to 10,144.55 by the lunch break. The broader Topix index of all first section shares lost 2.24 points, or 0.25 per cent, to 893.24. HONG KONG Hong Kong share prices were 0.17 per cent lower in early trade on Wednesday, with the benchmark Hang Seng Index falling 36.77 points to 22,132.82. SHANGHAI Chinese shares rose 0.20 per cent in early trade on Wednesday on a technical rebound after the key index shed nearly three per cent in the previous session, dealers said. The Shanghai Composite Index, which covers both A and B shares, was up 5.96 points at 3,027.42. The Shanghai A-share index added 6.22 points, or 0.20 per cent, to 3,177.16, while the Shenzhen A-share index gained 4.49 points, or 0.41 per cent, to 1,113.30. -- AFP KUALA LUMPUR At 9.30 a.m. on Wednesday, there were 131 gainers, 101 losers and 133 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,256.22 down 4.08 points, the FBMACE was at 4,423.35 down 11.29 points, and the FBMEmas was at 8,428.18 down 28.57 points. Turnover was at 150.809 million shares valued at RM113.976 million. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

28-Oct-2009 07:18

|

||

|

x 0

x 0 Alert Admin |

Nasdaq slumps, Dow snaps slideA surprisingly weak reading on consumer confidence and selling in banks, techs and retailers weigh on the composite. Strong energy sector gives the blue-chip indicator a lift.   NEW YORK (CNNMoney.com) -- The Nasdaq slumped and the Dow managed a slim gain Tuesday, as investors weighed a selloff in tech, a rally in energy and a surprise drop in consumer confidence.

A better-than-expected housing market report and a strong response to the government's latest debt auction were also in the mix. The Dow Jones industrial average (INDU) gained 14 points, or 0.1%. The S&P 500 (SPX) index rose 3 points, or 0.3%. But the Nasdaq composite (COMP) lost 26 points, or 1.2%. Since peaking at rally highs a week ago, the Dow has lost 2.3%, the S&P 500 has lost 3.4% and the Nasdaq has lost 3.4% through Tuesday's close. "In the last few days, the market hasn't been looking very friendly, but the overall picture hasn't changed much," said Will Hepburn, president at Hepburn Capital Management. "The upward momentum is still significant." Hepburn said that there's still plenty of fuel to keep the advance going. He cited the improving economic and corporate news, the massive amounts of government stimulus and the trillions sitting in money-market funds in cash or low-yielding bonds. He noted that although the S&P 500 is up 57% from the March bottom, when it hit a 12-year low, the broad average is still down 32% from its all-time high of October 2007. Tuesday's market: Weakness in banks, techs, retailers and transportation stocks dragged down the Nasdaq and limited the rest of the market from moving much. Cisco (CSCO, Fortune 500), Dell (DELL, Fortune 500), Amazon.com (AMZN, Fortune 500) and Yahoo (YHOO, Fortune 500) were among the Nasdaq's biggest decliners. A rally in heavily weighted Dow components Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), DuPont (DD, Fortune 500) and American Express (AXP, Fortune 500) kept the Dow afloat. Stocks tumbled Monday, with the Dow dropping 100 points for the second day in the row. A spiking dollar dragged on commodity shares and other stocks that benefit from a weak U.S. currency. The dollar and commodity prices remained in focus Tuesday. But investors also looked to the economic news ahead of Thursday's highly anticipated GDP (gross domestic product) growth report. Energy: Energy was the strongest sector on the day, as investors reacted to a smattering of financial reports and the impact of the U.S. dollar. European oil behemoth BP (BP) reported weaker quarterly earnings and revenue due to lower oil prices, but the results topped analysts' estimates. BP's U.S.-traded shares rose 4%. Valero Energy (VLO, Fortune 500), the largest U.S. oil refiner, reported a bigger-than-expected quarterly loss Tuesday, with fuel demand suffering amid the sluggish economy. Shares fell 4.3%. Nonetheless, a variety of energy stocks rallied, including Dow components Chevron and Exxon Mobil. Raw commodity prices were higher as well, despite a mixed dollar. Typically a weak dollar boosts dollar-traded commodity prices and a strong dollar pressures prices. Confidence: Consumer sentiment took a plunge in October, according to a Conference Board report released after the start of trading. The Consumer Confidence index fell to 47.7 in October from a revised 53.4 in September, reflecting the impact of rising joblessness and shrinking household wealth. Economists surveyed by Briefing.com thought the index would rise to 53.5. The part of the index that measures how consumers rate the present economic situation fell to 20.7 in October from 23 in September. It was the lowest level since February 1983, when it stood at 17.5. Housing: Home prices rose for the fourth month in a row in August, according to the S&P Case-Shiller Home Price index of the 20 largest metropolitan areas. Prices also showed the smallest year-over-year declines in nearly 2 years. Prices rose 1.2% in August after climbing 1.6% in July. Versus a year ago, prices were down 11.3%, but that was shy of the 11.9% drop economists were expecting. Financial results: With 230 companies, or 46%, of the S&P 500 having already reported results, profits are on track to have fallen 18.1% from a year ago, according to the latest from Thomson Reuters. Results have largely topped forecasts, with 80% of companies beating earnings' estimates, 6% meeting expectations and 13% missing forecasts. Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. But the greenback fell versus the yen. U.S. light crude oil for December delivery rose 87 cents to settle at $79.55 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $7.40 to settle at $1,035.40 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets were mixed. In Europe, London's FTSE 100 added 0.2%, France's CAC 40 was barely changed and Germany's DAX lost 0.1%. Asian markets ended lower. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.47% from 3.55% late Monday. Treasury prices and yields move in opposite directions. Gains accelerated after the government saw strong demand for its sale of $44 billion in 2-year notes. Market breadth was negative. On the New York Stock Exchange, losers beat winners by almost two to one on volume of 1.39 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.42 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

erictkw

Veteran |

27-Oct-2009 16:10

|

||

|

x 0

x 0 Alert Admin |

Daryl Guppy: China cup shows breakout target near 3,400

THERE WERE THREE important features for the China markets last week. The first was the confirmation of growth powered by domestic demand. The second was the continuation of the chart pattern breakout identified two weeks ago. The third was the role the China market plays in terms of global market leadership. THERE WERE THREE important features for the China markets last week. The first was the confirmation of growth powered by domestic demand. The second was the continuation of the chart pattern breakout identified two weeks ago. The third was the role the China market plays in terms of global market leadership.

The announcement last week of y-o-y growth figures at 8.9% confirms the strong trending activity that has been evident in the market since last October. Markets lead economic activity. It also confirms the strength of domestic demand that is independent of the stimulus package. Unlike other economies, the rebound in the China market developed before the stimulus package was announced. The trend was already well developed before stimulus money started to hit the ground.

The current trend correction must be put into the context of a return to historical levels of growth. The fast economic rise will slow as growth stabilises around 8%. The market trend continuation and sideways movement reflects this economic reality prior to the official announcement. Trend continuation from these levels will be less spectacular, but also more sustainable.

The Shanghai index continues to develop a China cup chart pattern. The activity of the market starting in August is best defined with a curved trend line, which creates a cup pattern. The China cup pattern develops after a temporary retreat from an uptrend — a midtrend correction and uptrend continuation pattern.

A cup chart pattern may develop a handle, which is created by a price retreat near the resistance level that forms the lip of the cup. The current breakout activity may develop a handle pattern. A retreat to near 2,950 is compatible with a handle pattern and does not indicate a failure of the breakout rally.

A China cup pattern does not have a handle. The breakout activity continues in a new uptrend. The character of the breakout trend will change as the breakout develops. The new trend may be defined with a trend line, or the new trend may be more erratic and include rally and retreat behaviour. There is a high probability the breakout will use Trend line 1 as a support area. Traders wait to see how this breakout develops before deciding the best trend-definition method.

The China cup pattern is used to calculate a breakout target. The distance between the bottom of the cup and the lip of the cup is measured. This distance is then projected upwards from the lip of the cup pattern, giving the target near 3,400.

When the trading band between 2,600 and 3,000 is measured and projected upwards, this also gives 3,400 as a target level. The China cup pattern target level confirms the trading band projection target.

This combination of features suggests that 3,400 is the minimum upside target. There is a higher probability the market will consolidate near this level and establish a trading band between 3,400 and 3,700. A feature of markets in 2009 has been the way trading-band breakouts are multiplied. This method of a double trading-band breakout gives a long-term breakout target near 3,800 to 3,900.

The Shanghai market behaviour is providing global market leadership. The Dow Jones Industrial Average is following the behavioural leadership of the China market. The 10,000 on the Dow is the equivalent of 3,000 for the Shanghai index. The Shanghai market reached this level and briefly powered above it before developing a trend correction. The Shanghai Index remains in trend correction and is using price and time corrections. The price trend correction is the sudden index fall of between 15% and 20% from 3,480 to 2,750. The time correction for the trend is the extended sideways movement over the past 10 weeks. The important relationship is the comparative behaviour.

This behaviour is best seen when we combine the Dow and Shanghai index charts in a single chart display. The Dow chart display is shifted to the left so the US market low of March is directly above the market low in the Shanghai index last October. This type of timeshifted display clearly shows which market is a leader and which market is a follower.

This combined chart display confirms that 2009 has seen the most important change in global market dynamics in more than 50 years. China leads the behaviour of world financial markets by about four months. The Dow follows the behaviour of the China market, suggesting that the former will also experience a market fall of 10% to 15%.

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

27-Oct-2009 12:36

|

||

|

x 0

x 0 Alert Admin |

TOKYO JAPANESE shares fell 1.46 per cent in morning trade on Tuesday after US stocks suffered a second straight daily loss overnight amid concerns about a stronger dollar. The benchmark Nikkei-225 index dropped 151.77 points to 10,210.85 by the lunch break. The broader Topix index of all first section shares lost 17.37 points, or 1.91 per cent, to 893.35. KUALA LUMPUR AT 9.30AM on Tuesday, there were 71 gainers, 266 losers and 114 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,248.50 down 11.42 points, the FBMACE was at 4,341.46 up 8.71 points, and the FBMEmas was at 8,388.00 down 67.79 points. Turnover was at 145.228 million shares valued at RM159.220 million. -- BERNAMA HONG KONG HONG Kong share prices were 2.19 per cent lower in early trade on Tuesday, with the benchmark Hang Seng Index falling 494.31 points to 22,095.42. The market was closed on Monday for a public holiday. SHANGHAI CHINESE shares fell 1.57 per cent on Tuesday morning with banks leading the decline on profit taking, dealers said. The Shanghai Composite Index, which covers both A and B shares, was down 48.75 points at 3,060.81. The Shanghai A-share index slid 51.27 points, or 1.57 percent, to 3,212.28, while the Shenzhen A-share index dropped 15.83 points, or 1.39 percent, to 1,125.80. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

27-Oct-2009 06:59

|

||

|

x 0

x 0 Alert Admin |

Stocks slump as dollar spikesWall Street tumbles after the Dow briefly hits the 10,000 level, as investors sell into the advance. NEW YORK (CNNMoney.com) -- Stocks tumbled Monday, retreating after the Dow crossed the 10,000 level again, as a stronger dollar battered commodity shares, and the financial sector tumbled.

The Dow Jones industrial average (INDU) lost 104 points, or 1%, after having gained as much as 100 points in the morning. The S&P 500 (SPX) index fell 13 points, or 1.2%. The Nasdaq composite (COMP) fell 13 points, or 0.6%. Stocks had risen in the morning but did an about-face as the greenback firmed up. Financials spearheaded a broad-based selloff, with 27 of 30 issues falling, including Bank of America, JPMorgan Chase (JPM, Fortune 500), Chevron (CVX, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), Caterpillar (CAT, Fortune 500), Boeing (BA, Fortune 500) and United Technologies (UTX, Fortune 500). The dollar turned higher on the back of a stronger-than-expected bond auction, pressuring dollar-traded commodities and big multi-nationals that benefit from the weak dollar, said Richard Campagna, chief investment officer at 300 North Capital. The financial sector was hit by reports over the weekend that Bank of America (BAC, Fortune 500)'s plans to repay federal bailout money may have hit some roadblocks. Regional banks Fifth Third Bancorp and SunTrust were both downgraded to "sell" by Richard X. Bove of Rochdale Securities. But the selloff was also a continuation of last week, Campagna said. "I think people are very nervous short term even though the prospects are positive long term." Stocks ended last week lower, with investors not impressed by the latest spate of better-than-expected quarterly results, including Microsoft and Amazon.com late in the week. After that selloff, stocks managed to gain through most of Monday morning. But the early weakness in the financial sector grew as the session wore on, and the dollar reversed course, dragging on commodities. Since bottoming at a 12-year low on March 9, the S&P 500 has gained nearly 60%, with any modest selloff being met with renewed buying interest. But in the last week that trend has changed a little, with the buyers sitting out. "The market got a little overextended through mid-month and some people are waiting for an opportunity to jump back in," Campagna said. "Meanwhile, the short-term guys want to cash out, so you're seeing some weakness. Tuesday brings quarterly results from BP and Valero Energy and economic reports on durable goods orders, the Case Shiller Home Price index and the October Consumer Confidence index. Quarterly results: Dow component Verizon Communications (VZ, Fortune 500) said profit tumbled 30% as higher costs countered an increase in revenue thanks to its strong wireless business. Nonetheless, earnings topped expectations. The company also reported higher quarterly revenue. But shares slipped, getting dragged down in the bigger selloff. Just shy of 140 components of the S&P 500 are due to report quarterly results this week. With 206 companies, or 41% of the S&P 500 having already reported, profits are currently on track to have fallen 18.3% from a year ago, according to Thomson Reuters. So far, results have been soundly above forecasts, with 81% of companies topping expectations, 7% meeting and 12% missing. Company news: Capmark Financial, one of the country's largest commercial real estate lenders, filed for bankruptcy protection Sunday, reflecting the major problems in the business property sector. Dutch financial services firm ING (ING) said Monday it plans to spin off its insurance business and sell $11.3 billion of stock to pay back some of what it took in bailout money from the government last year. World markets: Global markets were negative. In Europe, London's FTSE 100 lost 0.8%, France's CAC 40 lost 1.2% and Germany's DAX gave up 1.3%. Asian markets ended lower. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.54% from 3.48% late Friday. Treasury prices and yields move in opposite directions. Yields jumped as the government completed the first few auctions in a record week for debt sales. Treasury sold $30 billion in six-month notes, $29 billion in 3-month notes and $7 billion in five-month Treasury Inflation Protected Securities, or TIPS. All three saw strong demand. Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. The dollar gained versus the yen as well. The stronger dollar pressured dollar-traded commodity prices. U.S. light crude oil for December delivery fell $1.82 to settle at $78.68 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $13.60 to settle at $1,042.80 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. Market breadth was negative. On the New York Stock Exchange, losers beat winners thee to one on volume of 1.39 billion shares. On the Nasdaq, decliners beat advancers two to one on volume of 2.34 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Oct-2009 15:03

|

||

|

x 0

x 0 Alert Admin |

TOKYO JAPANESE stocks ended up 0.77 per cent on Monday as a weaker yen boosted exporters and strong South Korean growth figures raised optimism about Asia's economic outlook, dealers said. The benchmark Nikkei-225 index rose 79.63 points to 10,362.62. The broader Topix index of all first section shares gained 8.69 points, or 0.96 per cent, to 910.72. KUALA LUMPUR AT 12.30OPM on Monday, there were 124 gainers, 433 losers and 183 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,262.08 down 5.02 points, the FBMACE was at 4,305.67 down 36.20 points, and the FBMEmas was at 8,469.53 down 46.05 points. Turnover was at 286.871 million shares valued at RM398.262 million (S$164 million). -- BERNAMA HONG KONG HONG Kong's financial markets are closed on Monday for a public holiday. Trading will resume on Tuesday, October 27. SHANGHAI CHINESE shares edged up 0.06 per cent by midday on Monday amid hopes for stronger third-quarter corporate earnings reports, dealers said. The Shanghai Composite Index, which covers both A and B shares, was up 1.89 points to 3,109.74. 'Corporate earnings will be the main focus this week - the earnings reports that have already been released look quite good and this is keeping sentiment buoyant,' Huatai Securities analyst Chen Huiqin told Dow Jones Newswires. The Shanghai A-share index added 2.07 points, or 0.06 per cent, to 3,263.69, while the Shenzhen A-share index gained 0.27 points, or 0.02 percent, to 1,140.51. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Oct-2009 11:01

|

||

|

x 0

x 0 Alert Admin |

TOKYO JAPANESE stocks climbed 0.97 per cent in morning trade on Monday as a weaker yen boosted exporters and strong South Korean growth figures raised optimism about Asia's economic outlook. The benchmark Nikkei-225 index rose 99.90 points to 10,382.89 by the lunch break. The broader Topix index of all first section shares gained 11.26 points, or 1.25 percent, to 913.29. KUALA LUMPUR AT 9.30AM on Monday, there were 77 gainers, 168 losers and 128 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,263.63 down 3.47 points, the FBMACE was at 4,329.55 down 12.32 points, and the FBMEmas was at 8,490.87 down 24.71 points. Turnover was at 67.259 million shares valued at RM73.970 million (S$30.5 million) -- BERNAMA HONG KONG HONG Kong's financial markets are closed on Monday for a public holiday. Trading will resume on Tuesday, October 27. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

26-Oct-2009 07:02

|

||

|

x 0

x 0 Alert Admin |

Stocks: Trying to recharge the rallyBetter-than-expected earnings have reassured investors, but last week, the market stalled. Can this next big batch of results get the engine going again?   NEW YORK (CNNMoney.com) -- The quarterly reporting period has gotten off to a bang-up start, with 81% of companies outshining analysts' forecasts. But with expectations now raised, the latest crop of strong results has had little impact on the broad market.

Stocks ended last week lower, breaking a two-week run that was in itself part of a longer multi-month rally. After falling to 12-year lows in March, the S&P 500 has risen 60% as of Friday's close, thanks to a mix of signs of an improving economy and trillions in fiscal and monetary stimulus. "We've had this massive 60% rise off the March bottom because of all the excess liquidity," said Timothy Holland, co-portfolio manager of the Aston/TAMRO Diversified Equity Fund (ATLVX). "Short term I'm optimistic it can continue, but longer term, I'm wary," he said. He said that assuming third-quarter results continue to impress, the S&P 500 will have registered three straight quarters of better-than-expected earnings, even if it's mostly been driven by cost cutting and no growth in revenues. The improving quarterly results and better economic data should help stocks keep rising, he said. Also helping: ongoing impact of the government stimulus and the eventual point at which some of the trillions sitting in money market funds get put to work. "I think we're likely to build on the gains from here, but it's not going to be at the same rapid pace we've seen," said Gary Webb, CEO at Webb Financial Group. Longer term, stocks could be vulnerable, particularly amid a lack of clarity about the economic outlook a year from now. "Getting into next year, we could have problems as we move past the liquidity and cost cutting and improved sentiment that's been driving the advance," Holland said. "No one is clear on what the economy is going to look like when all that is removed." Last week stocks declined. And while the selloff was minimal, it was a surprise considering that it happened in a week that brought better-than-expected profits from Apple (AAPL, Fortune 500), Microsoft (MSFT, Fortune 500), Amazon.com (AMZN, Fortune 500), 3M (MMM, Fortune 500), AT&T (T, Fortune 500), McDonald's (MCD, Fortune 500) and others. The week ahead: The week ahead is equally busy for quarterly reports and also brings key readings on housing, jobs, income and - most notably - the first reading on whether third-quarter gross domestic product grew. GDP is expected to have risen at a 3.1% annualized rate, after sliding in the previous quarter. On the earnings front, 137 of the S&P 500 are due to report this week. While it's the biggest number yet in terms of sheer volume, it's lighter in terms of the kinds of companies that drive the market. Standouts include Dow components Verizon (VZ, Fortune 500), Procter & Gamble (PG, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500). So far, 199 companies, or 40% of the S&P 500, have reported results. Profits are currently on track to have fallen 18.2% versus a year earlier, according to the latest from Thomson Reuters. Revenue is expected to have dropped more than 10% from a year ago. Of the companies that have reported, 81% have beat expectations, 7% have met and 12% have missed. Economy

Here's what else is on tap: Monday: No market-moving economic news is due Monday. Tuesday: Durable goods orders, from the Commerce Department report, are expected to have risen 0.7% in September, after falling 2.4% in the previous month, according to a consensus of economists surveyed by Briefing.com. Durable goods excluding transportation are expected to have risen 0.8% in September, versus no change in August. The Case Shiller Home Price index, which tracks 20 of the largest housing markets, is expected to show prices fell 11.45% in August after falling 13.3% in July. The October Consumer Confidence index, from the Conference Board, is expected to have risen to 54.0 in October from 53.1 in September. Wednesday: Sales of newly constructed homes are expected to have risen to a 440,000 unit annualized rate in September from a 429,000 unit annualized rate in August. The Commerce Department report is due out shortly after the start of trading. The government's weekly crude oil inventories report is also due in the morning. Thursday: The first reading on third-quarter Gross Domestic Product (GDP) growth is the dominant economic report of the week. Due for release in the morning, the government is expected to report that GDP grew 3.1% in the quarter after shrinking 0.7% in the previous quarter, with the economy emerging from a recession that began in December 2007. Also on tap: The weekly jobless claims report from the Department of Labor is due out in the morning. The House Oversight Committee holds a hearing on executive compensation that is likely to be widely watched on Wall Street. White House "pay czar" Kenneth Feinberg is set to testify. Last week, Feinberg called for the seven biggest recipients of federal bailout money to cut in half what they pay their top executives. Also last week, the Federal Reserve proposed a broad overhaul of pay policies at 28 of the largest U.S. banks. Thursday is also the 80-year anniversary of the 1929 market crash. Friday: September personal income and personal spending reports are due in the morning and are likely to draw considerable attention, amid worries about the hard-hit consumer. Income is expected to hold steady after rising 0.2% in the previous month. Spending is expected to have fallen 0.4% after rising 1.3% in August. Also slated: the Employment Cost Index, the revised reading on consumer sentiment from the University of Michigan and the Chicago PMI, a regional reading on manufacturing. |

||

| Useful To Me Not Useful To Me | |||

|

baby88

Member |

22-Oct-2009 15:42

|

||

|

x 0

x 0 Alert Admin |

Walow, DAX and CAC are very red... | ||

| Useful To Me Not Useful To Me | |||

|

eurekaw

Master |

22-Oct-2009 14:55

|

||

|

x 0

x 0 Alert Admin |

Seemed like the sell down is gone | ||

| Useful To Me Not Useful To Me | |||

|

michgemini

Member |

22-Oct-2009 14:38

|

||

|

x 0

x 0 Alert Admin |

Sigh, it's so depressing to see all the red....

|

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Oct-2009 14:26

|

||

|

x 0

x 0 Alert Admin |

TOKYO Japanese stocks ended down 0.64 per cent on Thursday following overnight losses on Wall Street where fresh jitters emerged about the health of US banks. The Tokyo Stock Exchange's benchmark Nikkei-225 index dropped 66.22 points to 10,267.17. The broader Topix index of all first section shares lost 5.10 points, or 0.56 per cent, to 908.60. HONG KONG Hong Kong shares ended the morning 1.06 per cent lower on Thursday following a steep loss on Wall Street. The benchmark Hang Seng Index finished the session down 235.82 points at 22,082.29. Turnover was HK$39.32 billion (S$7.1 billion). SHANGHAI Chinese shares were flat at midday on Thursday as third-quarter GDP data came in slightly lower than expected, dealers said. The Shanghai Composite Index, which covers both A and B shares, edged down 1.62 points, or 0.05 per cent, to 3,068.97. China said on Thursday economic growth in the three months to the end of September accelerated to 8.9 per cent, just off an expected 9.1 per cent. 'The index technically needs some correction as previous gains in stocks have mostly priced in the positive effect of this round of economic data,' Li Wenhui, an analyst at Huatai Securities, told Dow Jones Newswires. The Shanghai A-share index fell 1.78 points, or 0.06 per cent, to 3,220.78, while the Shenzhen A-share index gained 5.13 points, or 0.46 per cent, to 1,128.60. KUALA LUMPUR At 12.30pm on Thursday, there were 234 gainers, 334 losers and 242 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,260.58 up 0.52 of a point, the FBMACE was at 4,327.85 down 20.43 points, and the FBMEmas was at 8,473.83 up 2.19 points. Turnover was at 366.859 million shares valued at RM499.808 million. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Oct-2009 11:15

|

||

|

x 0

x 0 Alert Admin |

BEIJING - CHINA'S economy grew 8.9 per cent in the third quarter of 2009, the government said on Thursday, in a strong sign the world's third-largest economy was on the road to recovery. The Asian giant expanded at the fastest quarterly rate in a year after growing 7.9 per cent in the second quarter and 6.1 per cent in the first three months of the year, which was the slowest pace in more than a decade. China's gross domestic product grew by 7.7 per cent in the first nine months of 2009 compared with the same period a year ago, after growing by 7.1 per cent in the first half, the National Bureau of Statistics said. China's urban fixed asset investment, a measure of government spending on infrastructure and a key driver of the recovery, rose 33.3 per cent in the first nine months compared with a year earlier, the bureau said. The nation's consumer price index, the main gauge of inflation, fell 1.1 per cent in the first nine months compared with the same period a year earlier. Industrial output, which shows activity in the nation's millions of factories and workshops, expanded by 8.7 per cent in the January-September period, the bureau said. |

||

| Useful To Me Not Useful To Me | |||

|

risktaker

Supreme |

22-Oct-2009 10:51

Yells: "Sometimes you think you know, but in fact you dont" |

||

|

x 0

x 0 Alert Admin |

I will buy back in the afternoon session :) Ending my Shorting Session | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Oct-2009 10:42

|

||

|

x 0

x 0 Alert Admin |

SINGAPORE shares opened lower on Thursday, with the benchmark Straits Times Index (STI) down 7.14 points or 0.27 per cent to 2,685.41. About 45.7 million shares were traded. Losers beat gainers 96 to 22. |

||

| Useful To Me Not Useful To Me | |||