| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

|||||

|

Blastoff

Elite |

16-Nov-2009 15:35

|

||||

|

x 0

x 0 Alert Admin |

TOKYO Japanese shares got off to a sluggish start in morning trade on Monday as investors reacted cautiously to much stronger than expected domestic economic growth figures. The benchmark Nikkei-225 index rose 12.38 points, or 0.13 per cent, to 9,782.69 by the lunch break. The broader Topix index of all first-section shares slipped 4.05 points, or 0.47 per cent, to 862.75. Shortly before the start of trade, the government reported that Japan's economy grew at a 1.2 per cent quarter-on-quarter pace in July-September - about twice as fast as expected. HONG KONG Hong Kong shares were 1.46 per cent higher in morning trade on Monday, in line with regional gains following a strong finish on Wall Street Friday, dealers said. The benchmark Hang Seng Index rose 330.08 points to 22,883.71. SHANGHAI Chinese shares rose 0.88 per cent in early trade on Monday, led by renewable energy firms as US President Barack Obama began his three-day visit to China, dealers said. Climate change, as well as trade tensions and the value of the Chinese yuan are among the issues on top of the agenda during Obama's visit, which began in earnest in Shanghai on Monday. The Shanghai Composite Index, which covers both A and B shares, was up 27.92 points at 3,215.57. The Shanghai A-share index rose 28.78 points, or 0.86 per cent, to 3,372.01, while the Shenzhen A-share index gained 13.63 points, or 1.13 per cent, to 1,222.92. KUALA LUMPUR At 12.30pm on Monday, there were 345 gainers, 229 losers and 229 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,276.14 up 5.18 points, the FBMACE was at 4,503.61 down 20.26 points, and the FBMEmas was at 8,530.13 up 41.30 points. Turnover was at 572.166 million shares valued at RM512.065 million. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

16-Nov-2009 15:34

|

||||

|

x 0

x 0 Alert Admin |

SINGAPORE shares were higher at mid-day on Monday with the Straits Times Index (STI) up 45.97 points, or 1.69 per cent, at 2,773.20. About 1.01 billion shares exchanged hands. Gainers beat losers 372 to 102. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

cyjjerry85

Elite |

16-Nov-2009 09:26

|

||||

|

x 0

x 0 Alert Admin |

its technical errors on SGX server currently tt is affecting the 'live' feeds...see Yahoo Finance or www.liveindices.com also showing error of the indexes now the only way to get the 'live' feed of prices is through ur own stock platform (e.g. Saxo, POEMS)

|

||||

| Useful To Me Not Useful To Me | |||||

|

bennykusman

Veteran |

16-Nov-2009 09:19

|

||||

|

x 0

x 0 Alert Admin |

any other website that i can refer to ?

|

||||

| Useful To Me Not Useful To Me | |||||

|

cyjjerry85

Elite |

16-Nov-2009 09:18

|

||||

|

x 0

x 0 Alert Admin |

something wrong with the SGX server today...see the website - volume not updated nor is the price list

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

bennykusman

Veteran |

16-Nov-2009 09:09

|

||||

|

x 0

x 0 Alert Admin |

STI not yet open ? |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

16-Nov-2009 07:52

|

||||

|

x 0

x 0 Alert Admin |

Wall Street: All eyes on the consumerAfter two strong weeks of gains, investors will zero in on further signs that the economy is indeed on the road to recovery. Retail sales will set the tone. NEW YORK (CNNMoney.com) -- Investors will brace for a spate of economic reports this week with their fingers crossed that there is more good news than bad since that will set the tone for the remaining seven weeks of the year. With Black Friday less than two weeks away, retailers are hoping consumers will be willing to open their wallets during the all-important holiday sales period, helping fuel the economic recovery. Kicking off the week will be the government's monthly retail sales report, which investors hope will shed light on how much consumers will be willing to spend. "Next week is all about consumer spending and the holiday," said Burt White, chief investment officer at LPL Financial. Retail sales have shown some improvement recently, suggesting that consumers are suffering from "frugal fatigue" and may be more willing to splurge this holiday season, White said. A rebound in consumer spending, which accounts for the bulk of U.S. economic activity, could help fuel bets that a recovery is firmly underway. The outlook for consumer spending remains murky with the national unemployment rate at a 26-year high of 10.2%. "In this environment, anything associated with jobs is probably the most important thing," said Quincy Krosby, market strategist at Prudential Financial. To that end, investors will likely pay close attention to Thursday's report on the number of Americans filing first-time claims for state unemployment benefits. Investors will also focus on the plight of the U.S. dollar, which wallowed near a 15-month low against the euro for most of last week. The dollar has been taking a beating recently as investors take advantage of rock-bottom interest rates in the United States to bulk up on more risky assets. "For now, it's still sell the dollar and buy risk," White said. "It's a crowded trade, but a good one." Stocks ended the week on a high note, logging the second consecutive week of gains as optimism about the recovery gained momentum. The question on investors' minds this week will be 'can that momentum be sustained?' Eyes on Bernanke

Demand for riskier assets, like equities, could hit a speed bump Monday afternoon with Federal Reserve chairman Ben Bernanke scheduled to deliver an economic outlook speech at the Economic Club of New York. While the central bank is not responsible for managing currency fluctuations, some analysts think Bernanke may strike a more hawkish tone given the severity of the greenback's recent weakness. Others expect Bernanke to echo recent official policy statements that interest rates will remain "exceptionally low" for an "extended period" of time. On the docket

Monday: The week starts with a closely watched report on October retail sales before the opening bell. Economists expect the Commerce Department to report that sales rose 0.9% last month after 1.5% drop, according to consensus estimates gathered by Briefing.com. Also due Monday morning, a report on manufacturing activity in the mid-Atlantic region and business inventory data from September. Federal Reserve chairman Ben Bernanke will speak about the outlook for the U.S. economy in New York at midday. Tuesday: The government's producer price index comes out before the market opens. Analysts think prices at the wholesale level ticked up 0.5% in October. Excluding volatile energy prices, the index is forecast to rise 0.1%. Government figures on capacity utilization and industrial production in October are due out at 9:15 a.m. ET. The market will also digest quarterly financial results from Home Depot (HD, Fortune 500), Target (TGT, Fortune 500) and TJX Companies (TJX, Fortune 500) before the opening bell. Wednesday: The housing market will be in focus with reports on housing starts and building permits released before the market opens. Also before the opening bell, the government's closely-watched inflation gauge is expected to show that consumer prices were flat in October. Excluding food and energy, prices are expected to have risen 0.1% last month after a 0.2% increase the month before. Thursday: The Labor Department reports on the number of Americans filing new claims for unemployment benefits at 8:30 a.m. ET. Jobless claims fell to 502,000 filings last week and analysts say a figure below 500,000 this week could help push the market higher. A report on leading economic indicators comes out after the market opens. Sears Holdings (SHLD, Fortune 500) will report quarterly earnings in the morning, while PC giant HP (HPQ, Fortune 500) and apparel-maker Gap (GAP, Fortune 500) will post earnings after the closing bell. Friday: No economic reports are on the docket. |

||||

| Useful To Me Not Useful To Me | |||||

|

erictkw

Veteran |

12-Nov-2009 17:47

|

||||

|

x 0

x 0 Alert Admin |

=DJ U.S. Says Won't Be More Big U.S. Bankruptcies - APEC Source By William Mallard Of DOW JONES NEWSWIRES SINGAPORE (Dow Jones)--The U.S. reiterated its strong-dollar policy to its Pacific Rim trading partners Thursday but offered little sign Washington can boost its flagging currency, given low U.S. interest rates and large government debt, a person familiar with the situation said. As Asia-Pacific Economic Cooperation forum ministers met ahead of the group's annual summit in Singapore, the U.S. side said Washington understands the concerns of export-reliant Asian economies about the weak dollar, the person, who was briefed on the meetings, told Dow Jones Newswires. But the American side, in discussing the dollar, mentioned that it is a low-yielding currency that's likely to remain so, while the U.S. government has also piled up debt from stimulus spending and corporate bailouts, the person said. The U.S. side said the Federal Reserve was unlikely to raise interest rates soon and that some APEC central banks may precede the U.S. central bank in tightening policy, the source said. The U.S. also said China wasn't likely to let the yuan float freely anytime soon, the person said. In addition, the American side told APEC there wouldn't be any more big corporate failures in the U.S., the person said. -By William Mallard, Dow Jones Newswires; 65-6415-4031; billy.mallard@dowjones.com |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

11-Nov-2009 08:03

|

||||

|

x 0

x 0 Alert Admin |

Stocks lose steamDow pared gains, ending slightly higher with other indexes lower. Trading stayed in a tight range on investor caution after previous day's rally.NEW YORK (CNNMoney.com) -- Stocks ended mixed Tuesday, giving up some gains, as the market faltered after a triple-digit rally in the previous session.

The pullback after a day of choppy trade showed investors were cautious after a Monday jump that pushed the blue-chip Dow to its highest level in 13 months. After reversing several times, the Dow Jones industrial average (INDU) closed up 20 points, or 0.2%, to close at 10,246.97. The S&P 500 (SPX) slipped less than 1 point, or less than 0.1%, to end at 1,093.01, and the Nasdaq composite (COMP) fell 3 points, or 0.1%, to settle at 2,151.08. David Babbs, head of trading at MF Global in London, said the lack of news this week means the market is "going to go sideways and wait for its next cue." The market will likely remain in a tight band until the next Federal Reserve policy-setting meeting Dec. 16, said Don Humphreys, president of Voyager Wealth Management. "After a rally like Monday's, there's always a chance for a pullback, but I think we'll tread water," Humphreys said. "Overall, the trend continues to be higher." Tuesday could not sustain momentum from the rally Monday, which came after the Group of 20 said over the weekend that it would keep economic stimulus in place. "We see that stimulus is still needed," said Peter Cardillo, chief market economist at Avalon Partners. "And as long as money is cheap, people will continue to invest." A falling dollar boosted prices for gold, oil and other commodities, and Cardillo said investors will focus on those markets in absence of major reports -- as well as corporate news including earnings from Applied Materials (AMAT, Fortune 500), Wal-Mart (WMT, Fortune 500) and Walt Disney (DIS, Fortune 500). Long-term focus. The Dow has soared 56% after hitting a 12-year low in March, and the blue-chip index is up 16.5% for all of 2009. The Nasdaq has jumped 36.6% this year. Monday's rally was the Dow's third gain of more than 199 points in the past eight trading days. But despite roaring back from its March nadir the Dow is still 28% below the record high set in October 2007. Analysts and investors alike have struggled to determine whether the recent rally is justified. Voyager Wealth's Humphreys says it depends on the timeline. "Maybe the fundamentals aren't there for a quick kill, but that's a short-term basis," Humphreys said. "I think for longer-term investors, the fundamentals are there -- we are out of the worst of this recession." Barring a change in federal interest rate policy, Humphreys said he expects a "flat to higher trend" in the market for the remainder of 2009 with the Dow ending the year above 10,000. Economy: Most U.S. cities saw gains in the median price of single-family homes sold last quarter, said a report from the National Association of Realtors. The national median home price was $177,900 in the third quarter, up $7,000 from the previous quarter. In other housing news, the Treasury Department said 650,000 troubled borrowers have been put into trial loan modifications under the Obama administration's foreclosure rescue plan. Companies: Sprint Nextel (S, Fortune 500) said Monday that it plans to cut between 2,000 and 2,500 jobs in an attempt to reduce costs. The European Commission has objected to Oracle's (ORCL, Fortune 500) proposed takeover of Sun Microsystems (JAVA, Fortune 500), which could threaten the deal. Other markets: Global markets were mixed. Asian shares finished the session in positive territory, and European stocks ended slightly lower. The dollar rose off 15-month lows, jumping slightly against the euro and the British pound. The greenback inched up on the Japanese yen. The price of U.S. crude oil fell 38 cents to settle at $79.05 a barrel. Treasurys were steady Tuesday, after a record $25 billion offering of 10-year notes attracted strong demand. The 10-year yield fell to 3.47% from 3.48% late Monday. The government is selling $81 billion worth of debt this week in a quarterly refunding. Treasury will auction $16 billion in 30-year bonds later in the week. Market breadth was negative. On the New York Stock Exchange, losers topped winners by three to two on volume of 900 million shares. On the Nasdaq, decliners topped advancers almost nine to four on volume of 1.9 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

10-Nov-2009 07:36

|

||||

|

x 0

x 0 Alert Admin |

Dow surges to 13-month highSigns of continued global recovery and talk about deals boost to investor confidence. Dow gains 200 points; Nasdaq and S&P 500 jump 2%.   NEW YORK (CNNMoney.com) -- Stocks rallied Monday, with the Dow industrials surging to a 13-month high, as investor optimism gained momentum.

The Dow Jones industrial average (INDU) soared 204 points, or 2%, to close at 10,226.94 -- its highest level since Oct. 3, 2008. The gains were broad-based, with all but 1 of the 30 components in the blue-chip index closing higher. Financial and commodity-related shares led the advance. The S&P 500 (SPX) gained 24 points, or 2.2%, to settle at 1,093.07 and the Nasdaq composite (COMP) rose 42 points, or 2%, to close at 2,154.06. Stocks rallied right out of the gate Monday after the Group of 20 said over the weekend that it would keep economic stimulus in place. With little news on tap for this week, "psychological factors and technical levels are driving 70%-80% of this market," said Financial Enhancement Group analyst Joe Clark. "The market does create its own psychology," he added. "You would never go to the grocery store and pay a higher price because someone else did, but that's what happens in stocks -- the momentum that's happening today after G-20." Finance ministers of the G-20 met over the weekend and pledged to continue government aid. The dollar fell sharply against the euro and British pound, while commodities and commodity-linked stocks rose. In "a bit of a dead week" in terms of economic reports, investors will take their cues from other news events, Clark said. "People are reading the news and pondering all of it," Clark said. "Some stories might be enough for a quick boost, but as far as overall recovery most people are saying, 'We'll believe it when we see it.'" Oil, gold and the dollar. U.S. oil for December delivery rose $2 to settle at $79.43 a barrel, after sinking almost 3% on Friday's mostly negative labor market report. COMEX gold for December delivery rose to an intraday record of $1,109.90 Monday before it pared gains to settle up $5.70 at $1,101.40 per ounce. "The story's all about gold and the dollar," said Charles Smith, chief investment officer at Fort Pitt Capital Group. With the dollar back at $1.50 against the euro for the first time in a few weeks, "the dollar scare has started again, with people piling into gold," Smith said. "I don't believe inflation is a valid concern, but that's what's moving investors." Stocks had bounced back last week, with the Dow reclaiming the 10,000 mark. So far in 2009, the Dow is up about 15% and the Nasdaq composite has soared 35%. S&P and technical trading. Financial Enhancement analyst Clark said more investors have "moved into the technical trading world." Clark said professional investors had been holding out for the S&P 500 to cross 1,060, viewing the level as a signal it was safe to re-enter the market. Still others are holding out for when the S&P crosses 1,100 and remains steady above that mark, he said. "There are people on the sideline viewing this as an opportunity to get in," Clark said. "Personally, I'll be be happy when I see the S&P holding above 1,100 -- even though it's psychological rather than technical." Eyeing corporate deals. With no significant economic indicators on Monday's docket, investors focused on corporate news, particularly talk about deals -- possible and completed. Kraft (KFT, Fortune 500) launched a $16.3 billion hostile takeover bid Monday for British candymaker Cadbury after the deadline for the initial bid passed without a deal. Cadbury rejected Kraft's initial $16.7 billion offer in early September and again turned it down. Comcast (CMCSA, Fortune 500) and GE (GE, Fortune 500) have reportedly agreed on the worth of NBC Universal. The agreement is a major hurdle cleared for Comcast as it aims to gain control of NBC Universal. Northrop Grumman (NOC, Fortune 500) has sold its consulting arm to two private equity firms. The $1.65 billion deal was announced Sunday. "Most of these deals have been viewed as positive for the market," said Paul Radeke, wealth advisor at KDV Wealth Management. "It's a view of consolidating domestic opportunity, rather than the transfer of American wealth to the international market." World markets and bonds: Asian shares closed higher, with Japan's Nikkei adding a modest 0.2% and the Hang Seng in Hong Kong jumping 1.7%. Major European indexes closed almost 2% higher, with the German DAX leading the way at a 2.4% gain. Bond prices were mostly lower, with the 10-year note holding modest gains, as the government began selling $81 billion worth of debt this week in a quarterly refunding. Treasury auctioned $40 billion in 3-year notes Monday, with $25 billion in 10-year notes and $16 billion in 30-year bonds being offered later in the week. Market breadth was positive. On the New York Stock Exchange, winners topped losers by five to one on volume of 909 million shares. On the Nasdaq, advancers topped decliners almost two to one on volume of 1.2 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

09-Nov-2009 12:07

|

||||

|

x 0

x 0 Alert Admin |

TOKYO Japanese share prices opened lower on Monday, with the benchmark Nikkei-225 index falling 23.47 points, or 0.24 per cent, to 9,765.88 in the first minutes of trading. HONG KONG Hong Kong share prices were 0.85 per cent higher in early trade on Monday, with the benchmark Hang Seng Index up 185.87 points at 22,015.59. SHANGHAI Chinese shares fell 0.53 per cent on Monday morning led by coal producers due to worries over falling coal prices, dealers said. The Shanghai Composite Index, which covers both A and B shares, was down 16.91 points at 3,147.12. The Shanghai A-share index fell 17.81 points, or 0.54 per cent, to 3,302.53, while the Shenzhen A-share index dropped 2.44 points, or 0.21 per cent, to 1,178.26. KUALA LUMPUR At 9.30am on Monday, there were 155 gainers, 74 losers and 122 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,261.61 up 0.85 of a point, the FBMACE was at 4,677.99 down 9.66 points, and the FBMEmas was at 8,431.46 up 8.63 points. Turnover was at 125.058 million shares valued at RM81.624 million. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

09-Nov-2009 07:37

|

||||

|

x 0

x 0 Alert Admin |

Stocks: Buyers 'swooping back in'Wall Street lost a mere 6% in the fall selloff before bouncing back last week. Can it keep the ball rolling in a challenging week ahead?NEW YORK (CNNMoney.com) -- So was that it? Is the so-called market correction over? Stocks rallied last week, with the Dow reclaiming 10,000, as the major indexes erased most of the losses of the previous two weeks. With the week ahead light on economic and corporate news, market direction will be fueled mostly by momentum and emotion. "For a while, it looked like we were having a buyer's strike, but then the buyers came swooping back in at the end of the week," said Timothy Ghriskey, chief investment officer at Solaris Asset Management. After rallying 63% from its 12-year low hit in March, the S&P 500 shed nearly 6% in the last two weeks of October. Some feared the pullback would extend to 15%. Instead, buyers jumped back in. "The looming issue is whether we've seen enough of a correction to bring out even more buyers or whether we need to see a bigger leg down first," Ghriskey said. A combination of trillions still sitting in money market funds in either cash or low-yielding cash equivalents makes the case for another run up. Slowly improving economic and corporate news should help as well. But as Friday's labor market report made clear, the economic recovering is still in its infancy. Jobs and the consumer: Last week's run was fueled by better-than-expected profit and economic reports, the government's decision to extend unemployment benefits and the homebuyer tax credit -- and news that Warren Buffett's Berkshire Hathaway (BRKA, Fortune 500) bought railroad Burlington Northern Santa Fe (BNI, Fortune 500). But even bad or mixed news on the jobs front got rewarded last week, most notably on Friday, when stocks managed to gain despite a government report showing unemployment hit a 26-year high of 10.2% last month. The knowledge that the labor market is the last area to turn in a recovery and that the unemployment rate would eventually top 10% may have taken the sting out of the report, Ghriskey said. Or there may be the perception that the 10.2% rate was as bad as its going to get. Either way, the willingness of investors to respond to both good and bad news by jumping in and buying suggests the mood has turned more positive again -- whether it should or shouldn't. Wall Street saw its biggest one-day rally in three months after the weekly jobless claims dropped to 512,000, a level not seen since January. Yet, the decline could mean people are running out of benefits, rather than finding jobs. And unemployed or underemployed consumers don't spend aggressively -- problematic for a recovery. "At some point soon we need to start seeing improvement rather than just better-than-expected news," said Mike Stanfield, chief investment officer at VSR Financial Services. "Even if the news continues to improve it's reasonable that stocks will seesaw for the next few months until the economic news starts to show stronger growth," he said. On the docket

Monday: This week brings the quarterly refunding from the Treasury Department. Treasury issues $40 billion in 3-year notes Monday, $25 billion in ten-year notes Tuesday and $16 billion in 30-year bonds Thursday. Tuesday: The Senate Budget Committee holds a hearing on bi-partisan efforts needed to cut the deficit. Bank of America's financial services conference begins in the morning, with outgoing CEO Ken Lewis due to speak. Wednesday: Treasury bond markets, government offices and some banks are closed for Veterans Day, but all other financial markets are open. After the close of trading, Applied Materials (AMAT, Fortune 500) reports quarterly results. The chip gear maker is expected to have earned 11 cents per share versus 55 cents a year ago, according to analysts surveyed by Thomson Reuters. Thursday: Wal-Mart Stores (WMT, Fortune 500) reports results before the start of trading. The Dow component is expected to have earned 81 cents per share versus 77 cents a year ago, according to forecasts. Walt Disney (DIS, Fortune 500) reports quarterly earnings after the close. The media company is expected to have earned 40 cents per share versus 43 cents a year ago. Government readings on weekly jobless claims, weekly crude oil inventories and the October Treasury budget are also due in the morning, but forecasts weren't available in advance. Friday: The September trade balance is due out before start of trading. The trade gap is expected to have widened to $31.9 billion from $30.7 billion in the previous month, according to a consensus of economists surveyed by Briefing.com. The University of Michigan's consumer sentiment index for November is expected to have risen to 71.8 from 70.6 in the previous month. JC Penney (JCP, Fortune 500) is due to report results before the start of trading. The retailer is expected to have earned 11 cents per share versus 55 cents a year ago. Abercrombie & Fitch (ANF) reports results before the start of trading. The retailer is expected to have earned 21 cents per share versus 72 cents a year earlier. Government readings on October import and export prices are also due in the morning, but forecasts were not available in advance. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

06-Nov-2009 13:46

|

||||

|

x 0

x 0 Alert Admin |

SINGAPORE shares were higher at midday on Friday, with the benchmark Straits Times Index at 2,660.08, up 1.17 per cent, or 30.73 points. About 706.7 million shares exchanged hands. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

06-Nov-2009 13:44

|

||||

|

x 0

x 0 Alert Admin |

TOKYO Japanese share prices rose 1.14 per cent in morning trade on Friday after US stocks soared overnight on the back of better-than-expected economic data. The benchmark Nikkei-225 index climbed 110.44 points to 9,827.88 by the lunch break, a day after ending at a one-month low. The broader Topix index of all first-section shares added 1.39 points, or 0.16 per cent, to 876.35. SHANGHAI Chinese shares rose 0.69 per cent in early trade on Friday, led by railway and pharmaceutical stocks as the market extended recent gains, dealers said. The Shanghai Composite Index, which covers both A and B shares, was up 21.68 points at 3,176.73. The Shanghai A-share index rose 21.79 points, or 0.66 per cent, to 3,332.72, while the Shenzhen A-share index gained 9.86 points, or 0.84 per cent, to 1,183.64. -- AFP KUALA LUMPUR At 11.30 a.m. on Friday, there were 359 gainers, 157 losers and 234 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,262.14 up 8.18 points, the FBMACE was at 4,687.51 up 88.90 points, and the FBMEmas was at 8,432.48 up 44.09 points. Turnover was at 750.656 million shares valued at RM670.119 million. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

06-Nov-2009 07:44

|

||||

|

x 0

x 0 Alert Admin |

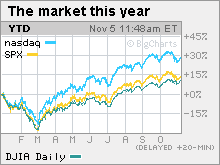

Dow reclaims 10,000Stocks surge after reports on jobless claims and productivity provide reassurance. Cisco's report and outlook helps techs. Big jobs report on tap for Friday.  The Dow Jones industrial average (INDU) gained 205 points, or 2.1%, closing at 10,005.96. The Nasdaq composite (COMP) climbed nearly 50 points, or 2.4%. Both the Dow and Nasdaq saw the biggest one-day percentage gains since July 23. The S&P 500 (SPX) gained 20 points, or 1.9%. "Today's big news was that we saw fewer claims for unemployment benefits," said Mike Stanfield, chief investment officer at VSR Financial Services. "That suggests that the underlying economics are continuing to improve." He said that this was reassuring to investors following several weeks of concerns about the pace of the recovery. It was also encouraging for investors ahead of Friday's monthly employment report. Stocks have been volatile over the past three weeks, with the S&P 500 losing 5% through Wednesday's close on worries that the rally has gotten ahead of the recovery. Between March 9 and the peak on Oct. 19, the S&P 500 gained 63%. Stocks ended mixed on Wednesday after the Federal Reserve held interest rates steady at historic lows near zero -- and said it will keep them low for an extended period. The issue for markets is whether there have been enough positive developments of late to give stocks another leg up, Stanfield said. He said he thinks that the next leg up could be delayed, and that stocks are likely to churn in a range for the next six months or so. After that point, investors will have a better sense of how the economy is doing without the benefit of trillions of dollars in government stimulus, which many credit for the 3.5% rise in GDP in the third quarter. Gains were broad based, with all 30 Dow issues rising, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), IBM (IBM, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Procter & Gamble (PG, Fortune 500), 3M (MMM, Fortune 500), United Technologies (UTX, Fortune 500) and Wal-Mart Stores (WMT, Fortune 500). Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.3 billion shares. On the Nasdaq, advancers topped decliners by over three to one on volume of 2.25 billion shares. Jobs: The government's weekly jobless claims report and third-quarter productivity report showed that the pace of layoffs is slowing, but also that employers are still not creating jobs. The number of Americans filing new claims for unemployment fell to 512,000 last week from 532,000 the previous week, the lowest level since January. Economists surveyed by Briefing.com expected 522,000 claims, on average. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 5.749 million from 5.817 million the week before. Economists thought it would fall to 5.750 million. It was the eighth decline in nine weeks. Although the decline could mean people are running out of benefits -- not that they are finding jobs. Separately, the Senate and House both voted Wednesday to extend unemployment benefits by up to 20 weeks -- and extend the homebuyer tax credit. President Obama is expected to sign the bill into law Friday. Another economic report showed that worker productivity is up, a good sign for corporate profits, but also further evidence that companies aren't hiring. Third-quarter productivity rose by 9.5% after rising 6.6% in the previous quarter. Economists thought it would fall to 6.5%. "The productivity and jobless claims show a rapidly improving economy," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. But the key report this week is the October unemployment report from the Labor Department, due Friday, Detrick said. Due before the start of trading, employers are expected to have cut 175,000 jobs from their payrolls after eliminating 263,000 in the prior month. The unemployment rate, generated by a separate survey, is expected to rise to 9.9% from 9.8% in September. Retail: Shoppers remained cautious with their spending last month, with discounters and warehouse clubs seeing the best October retail sales. On the upside, Costco (COST, Fortune 500) said sales at stores open a year or more rose 5% during the month, topping forecasts for a rise of 4.7%. Shares gained around 1%. Gap (GPS, Fortune 500) reported sales rose a better-than-expected 4%, sending shares higher in morning trading. Shares gained 3.5%. On the downside, American Eagle Outfitters (AEO) said sales fell 5% versus forecasts for a rise of 1.7%. Shares fell 11.6% in active New York Stock Exchange trading. Company news: After the close Wednesday, Cisco Systems (CSCO, Fortune 500) reported weaker quarterly earnings and revenue that beat estimates. The company's CEO, John Chambers, said current-quarter revenue would top estimates and that business conditions had bottomed at least six months ago. Cisco shares gained 2.8% Thursday. Automaker Toyota (TM) reported a surprise quarterly profit Thursday and cut its annual loss forecast by over 50% Shares of CVS Caremark (CVS, Fortune 500) slumped 21% in active trading after the company warned that 2010 profits at Caremark, its pharmacy benefits management division, are likely to slump by 10% to 12%. The company also said Caremark's CEO is stepping down. Drugstore CVS bought Caremark in March 2007 The news overshadowed the company's bigger-than-expected jump in quarterly profit. World markets: European markets gained, reversing early losses. Asian markets tumbled. Currency and commodities: The dollar fell versus the euro and gained against the yen. U.S. light crude oil for December delivery fell 62 cents to settle at $79.78 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $2 to settle at $1,089.30 an ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.53% from 3.52% Wednesday. Treasury prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

erictkw

Veteran |

05-Nov-2009 13:46

|

||||

|

x 0

x 0 Alert Admin |

World Need for Oil Expected to EaseInternational Energy Agency Says Conservation Efforts Will Trump Any Global Economic RecoveryBy SPENCER SWARTZThe International Energy Agency next week will make a "substantial" downward revision to its long-term forecast for global oil demand, a person familiar with the matter said, marking the second year running the group has slashed its view of the world's thirst for oil. The forecast of slower growth in oil demand puts the IEA increasingly in a camp of contrarians bucking the popular view that crude demand will grow briskly in a postrecession world. That view holds that long-term demand will grow at a fast clip because of rising emerging-market wealth and consumption in places like China and India. The IEA, which advises rich nations, such as the U.S., on energy matters, is set to use its closely watched annual World Energy Outlook report to forecast that improved energy-efficiency measures in developed nations, as well as climate-change legislation, will help to slow the rate of global oil consumption. A person familiar with the Paris-based IEA's plans said "demand-management policies" are having more impact than previously expected in the developed world, which accounts for about 55% of world oil consumption. The IEA outlook, a guidepost for industry trends, is scheduled to be released Nov. 10. A drop in industrial activity from the recession is also a big factor in the revision. Baseline assumptions used in the previous long-term outlook have to be adjusted down to account for the tough economic conditions of the past year. Last year, the IEA shaved 10 million barrels a day off its long-term forecast and projected consumption in 2030 would hit 106 million barrels a day, or about 25% above current levels. It isn't clear how that compares with the cuts expected in this year's forecast by the IEA. In the past, the IEA has been criticized for being too optimistic in its projections. Its current stance puts it in line with a growing list of industry analysts taking a more bearish view on future demand. Philip Verleger, a veteran independent energy economist based in Colorado, thinks consumers will keep a tight leash on oil demand over the next decade, in part as a result of policy makers battling climate change by mandating new energy-efficiency standards for everything from vehicles to building codes. "The rise in global oil consumption over the next 10 years could be minimal," says Mr. Verleger. If demand pessimists are correct, future increases in the price of crude could be damped as weaker consumption stretches world oil supply by billions of barrels. Various analyst estimates maintain that the roughly 2% a year average growth rate in world oil consumption seen earlier this decade -- the biggest reason for crude prices hitting a record $147 a barrel last year -- may turn out to be an anomaly and that annual growth in the neighborhood of 0.5% to 1% is more the norm. Still, a lot more energy, including nuclear power and raw crude, will be needed to power rising economic activity in China, the world's second-biggest oil consumer after the U.S., and other markets. Cost savings gleaned from more-efficient products and processes may yield more commerce and, thus, more demand for oil. And there is this: The world has seen previous periods of energy-efficiency gains almost vanish after new oil supply hits the market and pressure prices lower, as happened in the 1990s. Some analysts believe crude could rise to $200 a barrel within a few years from today's $79 level. They say a speedier-than-expected economic recovery could make open consumers' wallets to higher crude prices. Still, price increases are bound to reinforce conservation. "There is a market assumption today that we will head back to the old days of rapid oil demand, but we think we are heading into new days," in which the growth in consumption will be more subdued, said Dan Yergin, chairman of IHS Cambridge Energy Research Associates. Mr. Yergin says several factors are prompting companies and consumers to make the most of their energy dollars. Among them: the sting of record oil prices in recent years, the threat that political obstacles in many oil-producing states will slow delivery of new barrels to the market, and the battle against climate change. The energy-research group said last month it thinks oil consumption in the industrialized world peaked in 2005. Mr. Yergin believes the same will probably happen globally in two decades. Deutsche Bank says global demand will peak by 2016 as consumption reaches around 90 million barrels a day, versus about 85 million currently, due to efficiency gains and technology improvements in electric vehicles. Write to Spencer Swartz at spencer.swartz@dowjones.com |

||||

| Useful To Me Not Useful To Me | |||||

|

erictkw

Veteran |

05-Nov-2009 13:19

|

||||

|

x 0

x 0 Alert Admin |

Nov. 4, 2009, 12:44 p.m. EST · Roubini warns "party" in risk assets may end badlyBy Nick Godt, MarketWatch NEW YORK (MarketWatch) -- Markets, be they stocks, emerging markets or commodities, have rallied too far, too fast because the global economy will experience an anemic recovery rather than the hoped-for V-shaped recovery, New York University economist Nouriel Roubini said on Wednesday.

Exit strategiesConsumption, especially in the U.S., has remained anemic and the return to growth seen in the third quarter was mostly due to the government's stimulus measures, the NYU economist said. Those measures can continue to boost growth through early next year. But unless consumption is suddenly revived to take the place of government spending, markets are facing a growing risk centered around the removal of accommodative monetary policies in the U.S. and around the world. Exiting too quickly risks a double-dip recession "like we saw in Japan or in the U.S. in 1937," Roubini said. "If we take too long, it would risk creating a fiscal trainwreck and lift inflation." In the meantime, the Federal Reserve is destabilizing global financial markets by feeding another massive asset bubble by keeping interest rates near zero. The Fed kept rates near zero Wednesday after its two-day policy setting meeting. Over the past year, the dollar has increasingly been at the center of a so-called carry trade. With interest rates effectively at zero in the U.S., global investors seeking risks and higher returns are increasingly borrowing risk-free dollars to invest in higher-yielding currencies and assets, such as stocks, commodities, and emerging markets. These trades have kept putting pressure on the dollar as investors short the currency to invest elsewhere. The big rally seen over the past year in stocks, commodities and other risky assets, are all the same trade, Roubini said. And it's been exacerbated not just by the Fed keeping rates near zero but also with the Fed buying Treasurys, keeping rates low not just at the short end but also at the long end, thereby reducing volatility. "When it unravels, it's going to get ugly," Roubini said. "Everyone that's shorting dollars will try to get out of those positions at the same time, and we'd have a stampede." The dollar will have to snap back eventually, the NYU economist said. The Fed will eventually stop buying Treasury debt, and the possibility of higher interest rates will boost both volatility and the dollar. "If the market is right, and there is a V-shaped recovery, then the Fed raises interest rates and the dollar snaps back. Another risk is if markets fear a double dip [recession], then the dollar would strengthen sharply on safe haven demand." "There are a good number of reasons that we could see a dollar snapback and a market crash," Roubini said. Nick Godt is MarketWatch's markets editor, based in New York.

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

05-Nov-2009 09:29

|

||||

|

x 0

x 0 Alert Admin |

Precisely... :) If no one 'collects', then there'll be no stock market to play... hehehe...

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

05-Nov-2009 09:27

|

||||

|

x 0

x 0 Alert Admin |

The only thing that will cause a bull market is when consumers (USA) are willing to or, more importantly, are able to afford to spend like previously, like as though there's no tomorrow to come. If that does not happen, what "boomz!" bull market is there to expect? In the meantime big market rallies are just that - rallys to be taken advantage of...  |

||||

| Useful To Me Not Useful To Me | |||||

|

risktaker

Supreme |

05-Nov-2009 09:23

Yells: "Sometimes you think you know, but in fact you dont" |

||||

|

x 0

x 0 Alert Admin |

when people are selling :) i will collect | ||||

| Useful To Me Not Useful To Me | |||||

![[demand]](http://s.wsj.net/public/resources/images/AI-AY498_DEMAND_NS_20091103125559.jpg) Associated Press

Associated Press