| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|

|

krisluke

Supreme |

09-Nov-2012 16:25

|

|

x 0

x 0 Alert Admin |

A Grand Bargain: 8 Factors That Could Drive A Surprise On The DeficitThe conventional wisdom is that the re-election of President Barack Obama presages four more years of legislative deadlock on fiscal matters. At best, consensus opinion is bracing for more feckless " can kicking" and an indefinite extension of America's deficit and debt crisis at worse, it is feared that the US could fall off of a " fiscal cliff" in the short term. The rationale for this pessimism is not difficult to comprehend: The US has reelected the same president, and essentially the same personnel in the House of Representative and Senate that produced the sovereign debt crisis in mid 2011. Given this almost identical political configuration, why should the outcome be any different than it was in mid 2011? In the context of the very understandable pessimism regarding the US's long-term fiscal health, I believe that the real possibilities of a " Grand Bargain" being achieved in the next few weeks / months are perhaps being overlooked. In this regard, it is important to remember that in July of 2011, a Grand Bargain that would have done a great deal to rectify the US's deficit and debt situation was almost reached. I believe that today, while the players may be the same, the historical circumstances are different - and in my view more favorable for achieving a Grand Bargain than they were in July of 2011. Eight Reasons Why A Grand Bargain May Be Reached There are eight reasons why I believe that a Grand Bargain could surprise financial markets and the public at large. 1. Historical perception. History is driven by context. Context, in turn, is driven by historical perception. In this regard, the breakdown of negotiations to achieve a Grand Bargain in July 2011 is widely perceived today by the public as having been a tragic historical " missed opportunity." As a result, is a profound and broad built-in consensus for a " do over." I believe it would be a mistake to underestimate the power of this profound public longing to " right this wrong" to drive events in the coming weeks and months. 2. It's perceived as fair. I believe that more than 80% of the citizens of the US would be reasonably happy to support the Grand Bargain as nearly agreed to in July 2011. Virtually all would prefer another deal. But 80% would prefer this deal to none at all. To review, these were roughly the terms: roughly $4 trillion in deficit reduction over 10 years roughly $3 of cuts for $1 of new revenue. Most of deficit reductions on the spending side are obtained from controlling the growth of entitlements such as Social Security and Medicare. The rest of the spending restraints are broad-based and politically feasible. On the revenue side, most of the new revenue would come from eliminating various deductions and tax loopholes. This method of raising revenues has three advantages: 1) It avoids raising tax rates, which is a politically sensitive issue 2) It is more economically efficient than raising tax rates 3) It is actually more progressive in terms of distributional impact since it is the rich that disproportionately benefit from deductions and loopholes. 3. It's familiar. In part, the deal in July of 2011 failed because of mistrust not so much in each other but in themselves. The deal was so complex and its effects so difficult to predict that both sides actually seemed to mistrust whether they fully comprehended what they were signing onto. There has been a year and a half for both sides to get more comfortable with the details of the deal and exorcise fears of " Trojan Horses." 4. It's the only game in town. The Grand Bargain is based on the same principles as the Simpson-Bowles Commission plan and the plan put forth by the so-called Gang of Six. There are simply no other viable ideas out there. Most importantly, it is absolutely clear that it is not possible to balance the budget - of the sort of government that the vast majority of Americans want - without enacting both spending cuts and raising revenue. Anybody that says otherwise is lying or is misinformed. Americans have become resigned to this reality. Once it is generally accepted that any possible deal must contain both spending restraint and revenue increases then the precise details are of relatively little concern to the public at large. The vast majority of the public want a deal - any deal - and today, informed by a shared perception of history, they do not believe that any deal substantially different from the Grand Bargain is possible. This is a major factoring favoring a deal. 5. Obama needs it for his legacy he no longer needs his electoral base. Obama is not running for president ever again, so he no longer needs to remain " loyal" to his hard core left wing " base." Historical legacy is now Obama's goal not reelection. Most importantly, I believe Obama understands that no positive historical legacy for him is possible without a " Grand Deal" on the budget. Obama knows that history will not remember the names of any Republican " obstructionists" as the culprits of a fiscal crisis all historical blame will be placed squarely on him if a deal is not done. 6. Republicans need a new image Tea Party to be marginalized. The Tea Party was a huge loser in the 2012 elections: It is widely perceived as having been directly responsible for the loss of at least 5-7 Republican senate seats and for having squandered a clear opportunity for Republicans to achieve a majority in the Senate. The Tea Party also boxed the GOP presidential candidate into positions on issues (e.g. immigration) that hurt him in the general election. The net result of this is that it is likely that Tea Party clout within the GOP will be substantially diminished. This will give Speaker Boehner and other Republican leaders more leeway to distance themselves from the anti-government ideology of the Tea Party and compromise revenue raising measures, something that they were loathe to do when the Tea Party was on the ascendant right after the 2010 mid-term elections. In 2010 anti-government fundamentalism was in vogue today it's anathema. 7. Self-interest and ego. Obama wants a positive historical legacy Boehner wants one. A Grand Bargain is the way for both of them to do it - nay, it is the only way for them to achieve it. In this quest, perfection is their enemy. Ten years from now, nobody will care about the details that will tend to bog down negotiations in the present. Political legacy rests on large historical happenings, not details. Perhaps Obama and Boehner are smart enough to realize that. 8. Polarization. If the election on November 6th proved anything it is that the US electorate is polarized. The conventional wisdom is that polarization makes compromise impossible. This view is wrong. The US constitutional system is designed to produce actionable compromise from political polarization. In the US political system, polarization can ironically help passage of a Grand Bargain. In a polarized polity, voters' preferences are more or less fixed there is very little chance the voters will switch their votes from one party to another based on a candidate's position regarding one or a few issues. In particular, in the current political climate, virtually nothing that the politicians do in terms of moving to the center will cost them a substantial number of votes in the next election. With the electorate polarized, the vast majority of voters on both sides are positioned in such a way that they have nowhere to go if their parties' candidates move to the center. Will the right wing all of the sudden vote Democrat or abstain if Republicans sign off on a grand bargain that raises revenues? No. If they will turn out for Moderate Mitt, they will turn out for anybody with a blue elephant pinned on their lapel. Will Obama's core coalition of progressives abandon him or abstain from voting if he agrees to a compromise with $3 of cuts to $1 in revenue raises versus a deal based on $2 to $1? No. If Democrats have deified Bill Clinton who cut welfare, signed NAFTA and balanced budgets, they will vote for anybody that has a red donkey pinned on their lapel. If anything, with a polarized electorate split down the middle, the voices of voters at the extremes of the political spectrum make much noise, but they possess little actual clout precisely because their votes are not really in play. Therefore, the overwhelming incentive in such a polity becomes moving to the center to try to pick off the very few folks that are truly on the fence. In sum, with an evenly divided and polarized electorate, politicians risk little in moving to the center whereas the potential incremental gains from moving to the center can be perceived as a life or death matter in the context of tightly contested and polarized electorates. In the US political system, capturing the middle provides the only real delta to gain a marginal advantage and/or possibility to achieve political glory. Conclusion On the eve of President Barack Obama's re-election, the US stock market suffered a significant drop largely based on fears of a looming fiscal crisis. It is widely believed that given the reelection of President Obama and the return of an almost identically configured congress, a fiscal crisis is highly likely. Several hundreds of billions of dollars of market capitalization evaporated with stocks such as Apple (AAPL), Exxon (XOM), and Intel (INTC) all falling by more than 3.0% while all of the major indices represented in index ETFs such as (SPY), (DIA) and (QQQ) declined by more than 2.0% on the day. Contrary to the pervasive pessimism being reflected in Wednesday's market action, there are many logical paths that lead to a Grand Bargain in regards to the US fiscal crisis. Thus, while I believe that there are many reasons to remain extremely cautious regarding the US equity market, and cash remains my preferred asset of choice for the medium term, I believe that the prospects of a breakthrough on a Grand Bargain are being somewhat underestimated. Having said that, I should state that there is no contradiction between the fact that I am relatively sanguine about the prospects for a Grand Bargain and my defensive investment stance. A Grand Bargain is no panacea - it necessarily implies a major drag on the economy via fiscal policy and attendant sub-par economic growth for a very long time. Europe has proven that in highly developed and highly indebted economies, when it comes to austerity there are no free lunches. Therefore, there is really no way around the fact that, with or without a Grand Bargain, US economic growth and corporate earnings growth in the next decade will be slower than in the prior three decades. For US policy makers, it is really a matter of choosing the poison. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

09-Nov-2012 16:24

|

|

x 0

x 0 Alert Admin |

What If Apple Wasn't A Tech Stock? Introduction: The Current Mispricing of Technology At the risk of jumping on the everybody's-writing-articles-on-Apple-bandwagon, this article is offered at the request of a loyal reader. Our objective is to put not only Apple's (AAPL) valuation into perspective, but also what we believe to be the current undervaluation of technology stocks in general. If looking at how the stock market has historically priced technology stocks doesn't convince you that the market is not only not efficient, but in fact totally irrational much of the time-then nothing will. It was approximately 15 years ago that the market was telling us that technology stocks had almost unlimited value. Mr. Market was placing literally insanely high valuations on everything tech that made no economic or even mathematical sense. During this era, the simple Treasury bond was throwing off riskless interest that was many times greater than even the most optimistic expectations of what technology stocks earnings would be. To be clear, you could earn Treasury bond interest payments that were many times greater than the total earnings being generated by technology stocks. Today, we find Mr. Market treating anything tech, in an exact opposite manner. In 2012, and as we head into 2013, technology is being priced at some of the lowest valuations it ever has. In fact, the valuations on technology are actually less than those on the average company as measured by the S& P 500. This is true notwithstanding the fact that technology has historical growth rates much greater than the average company, and continues to have forecast growth that is expected to be much greater than the average company. Mathematically, this is simply not rational. Logic would dictate that technology should command valuations that are much higher than the market, or at least equal to the market. It makes absolutely no sense that technology should be being priced below the average company. The following table looks at 10 of the most prominent high profile technology stocks on the planet. The first three columns on the table are the most important supporting the thesis of this introduction. When you compare the current PE ratio on each technology stock in the table to its historical normal PE ratio since 1998, it is clear that technology is being priced at an abnormally low valuation. But perhaps even more importantly, the earnings yield available from these technology stalwarts is remarkably high, especially when contrasted to the current interest yields available from fixed income. Moreover, when you consider that technology is on the threshold of achieving exponential future growth, today's low valuations seem even more absurd. The only explanation that makes any sense to us is that investors' exaggerated levels of fear, coupled with the unknown nature of this rapidly-evolving industry is generating pessimistic valuations. Therefore, the thesis of this article is to illustrate that not just the technology sector itself, but more specifically that Apple Inc. is an absurdly undervalued strong business today. Moreover, based on the fundamentals underpinning Apple, we believe that this company should be rationally trading at a PE ratio somewhere between 20 to 25 times earnings. This would be justified not only on its historical record, but more importantly based on reasonable projections of future growth. If expected growth does occur, then the fair value earnings justified price for Apple Inc. is approximately $900 to $1200 per share, and increasing every quarter. We arrive at these numbers by applying a PEG ratio (PE=Growth Rate) valuation to Apple Inc.'s current and near future earnings expectations. We will develop this in greater detail later in the article. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

09-Nov-2012 16:12

|

|

x 0

x 0 Alert Admin |

FTSE 100 steady after recent falls amid macro worries

The London Stock Exchange logo is seen outside the exchange

By 0803 GMT, London's blue chip was down 1.51 points at 5,777.56 having fallen 1.9 percent over the last two trading sessions dented by weak earnings and global economic concerns. " Technicals are looking tired, earnings-based valuations are pushing the upper barriers of their recent ranges and there are some decent profits to bank (post summer gains). A spell of retesting support levels may help to build a base for the next upward leg," Ian Williams, strategist at Peel Hunt, said. International Airlines and engine maker Rolls Royce were the top fallers on London's blue chip index after their respective updates failed to boost investor sentiment. (Reporting by David Brett) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

09-Nov-2012 16:11

|

|

x 0

x 0 Alert Admin |

Gold hits 3-week high on US fiscal concern

Gold bullion on a chart

* Spot gold may rise to $1,749/oz - technicals * Coming up: China, industrial output, retail sales, Oct 0530 GMT (Updates prices) By Rujun Shen SINGAPORE, Nov 9 (Reuters) - Gold rose to a three-week high on Friday, on track for its first weekly gain in four, as hopes U.S. monetary policy would remain loose after President Barack Obama's re-election and worries about looming fiscal woes boosted bullion's appeal. Investor appetite for safe-haven assets such as gold has increased along with concerns about the U.S. " fiscal cliff" , an automatic tax hike and spending cuts amounting to $600 billion due to take effect early next year that could send the U.S. economy back to recession. " Investors have shifted their focus to the fiscal cliff after the election," said Chen Min, an analyst at Jinrui Futures in the southern Chinese city of Shenzhen. " They believe the Fed will further ease the monetary policy to offset whatever impact that will have on the economy, which will be an incentive for gold and silver prices to climb up." Spot gold rose to a three-week high of $1,737.60 an ounce, and traded at $1,731.77 by 0739 GMT. It jumped above the 20-day moving average at $1,718.20 for the first time in a month. The precious metal was on course for a weekly rise of 3.4 percent, its biggest one-week gain since late August. U.S. gold was up 0.4 percent to $1,731.90. Technical analysis suggested that spot gold could climb to $1,749 an ounce during the day, said Reuters market analyst Wang Tao. China's factory output quickened more than expected in October and inflation eased to its slowest pace in nearly three years, giving policymakers scope to further loosen monetary policy if needed to support growth. Other safe-haven assets, such as the dollar and U.S. Treasuries, also firmed. The dollar hit a two-month high against a basket of currencies in the previous session, while U.S. Treasuries jumped after a strong sale of 30-year debt. But some analysts argued that the rise in these assets and commodities was a result of investors relocating their money after having moved into equities before the U.S. election on hopes Republican candidate Mitt Romney would win. " The strength in commodities and a 3 percent fall in the VIX volatility index in light of weak equities and rising bonds stands out," said ANZ in a research note. " It looks like we are seeing repositioning of portfolios after the U.S. election rather than a broader risk-off move. It remains to be seen whether commodities will play catch up with the losses elsewhere." The euro zone risk still lurks in the background, as the European Central Bank refrained from further stimulus measures and said it cannot do much more to help Greece and gave Spain none of the assurance it wants that ECB bond buying will lower its borrowing costs. The Greek government is expected to push through the 2013 budget law on Sunday, after it voted by a razor thin margin to approve an austerity package needed to unlock vital aid and avert bankruptcy. Echoing firming gold prices, holdings of gold-backed exchange-traded funds rose to a record high of 75.133 million ounces by Nov. 7. China's vehicle sales climbed 5.3 percent in October from a year earlier, rebounding after a decline in the previous month due to sluggish sales by Japanese carmakers amid a territorial dispute between the two countries. Steady growth in the world's No.1 car market will support prices of platinum group metals, widely used in producing autocatalysts to clean up vehicle exhaust. Spot platinum traded up half a percent to $1,547.74 an ounce, on course for a 0.6-percent weekly rise, snapping four sessions of losses. Spot palladium was down 0.2 percent to $610.49 an ounce, headed for its second weekly rise. Precious metals prices 0739 GMT Metal Last Change Pct chg YTD pct chg Volume Spot Gold 1731.77 1.78 +0.10 10.74 Spot Silver 32.24 -0.08 -0.25 16.43 Spot Platinum 1547.74 6.99 +0.45 11.11 Spot Palladium 610.49 -1.48 -0.24 -6.44 COMEX GOLD DEC2 1731.90 5.90 +0.34 10.54 19245 COMEX SILVER DEC2 32.26 0.02 +0.06 15.57 5915 Euro/Dollar 1.2763 Dollar/Yen 79.48 COMEX gold and silver contracts show the most active months (Editing by Miral Fahmy) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

09-Nov-2012 16:00

|

|

x 0

x 0 Alert Admin |

2:57 AM Chinese retail sales +14.5% in October vs 14.2% in September and +14% consensus. Non-rural fixed-asset investment, an indicator of spending on construction, plant equipment and other projects, +20.7% in January-October vs +20.5% in January-September and consensus of +20.6%. [Global & FX, Top Stories] Comment!

2:55 AM Chinese industrial production +9.2% Y/Y in October vs +9.2% in September and vs consensus of +9.4%. Nomura economist Zhang Zhiwei says the data indicates that GDP growth could top 8% in Q4 vs 7.4% in Q3. [Global & FX, Top Stories] Comment!

12:00 AM Friday's economic calendar:

8:30 Import/Export Prices 9:55 Reuters/UofM Consumer Sentiment 10:00 Wholesale Trade Comment! |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

09-Nov-2012 15:12

|

|

x 0

x 0 Alert Admin |

Nikkei falls to 4-week closing low on U.S. fiscal worries

Tokyo Stock Exchange building

* 60 pct of Nikkei firms miss results expectations so far By Dominic Lau TOKYO, Nov 9 (Reuters) - Japan's Nikkei fell a four-week closing low on Friday, led by exporter shares, as a looming U.S. fiscal crisis threatened to tip the world's largest economy into recession and as uncertainty over a Greek bailout rekindled worries about the euro zone. Exporters, which already face slowing demand for their products due to sluggish global growth, would suffer further hardship should the U.S. fall into recession on the back of the 'fiscal cliff'. Some $600 billion worth of spending cuts and tax hikes would take effect in the new year if U.S. President Barack Obama and Congress failed to agree a deal. These concerns weighed on the dollar against the yen, which traded at 79.55 yen to the greenback, not far from Thursday's high of 79.32, a double-whammy to exporters. Among the exporters that headed lower were construction machinery maker Komatsu Ltd, camera and printer maker Canon Inc, camera maker Nikon Corp and automaker Suzuki Motor Corp, down between 0.8 and 2 percent. The Nikkei ended 0.9 percent lower at 8,757.60, falling for the fifth straight session, and was down 3.2 percent this week, its worst weekly performance in four weeks. But the benchmark is still up 3.6 percent this year. The U.S. fiscal issue " is a major concern for investors and the market may fall further next week when Congress reconvenes on November 13," said Eiji Kinouchi, chief technical analyst at Daiwa Securities. He said Japan's stock market could face further pressure and volatility next week as U.S. markets are likely to fall as some companies go ex-dividend, adding that investors should watch U.S. stocks with high dividend yields. The re-emergence of macro-economic concerns, including the uncertainty whether Greece will get more international aid and weak German exports data, comes amid a weak quarterly earnings season that has seen 60 percent of the 134 Nikkei companies that have reported so far undershoot market expectations. That compared with 54 percent in the previous quarter, according to Thomson Reuters StarMine. Software maker Trend Micro Inc dropped 4.5 percent on expectations that its fourth-quarter earnings would remain weak after it posted a 17.2 percent year-on-year decline in third-quarter operating profit. The broader Topix index lost 0.6 percent to 730.74 in light trade, with 1.17 billion shares changing hands, down from Thursday's 1.57 billion and last week's average of 1.8 billion. NEXON, SUMITOMO RUBBER PUNISHED Many companies have cut their earnings outlooks. Among them were online game provider Nexon Co Ltd, Sumitomo Rubber Industries Ltd and consumer credit firm Credit Saison Co Ltd. Nexon slid 16.4 percent to a record closing low, Sumitomo Rubber sank 6.7 percent and Credit Saison lost 2.5 percent. " Investors were overly optimistic that they had thought that the market would price in the U.S. election result and would buy Japanese stocks whose valuations are cheap," said Masatoshi Sato, a senior strategist at Mizuho Investors Securities. " It's too early to price in all the negative factors. The market may not pick up unless the index hits bottom around the psychological support level of 8,500." The Topix index carries a 12-month forward price-to-earnings ratio of 11.3, cheaper than the U.S. S& P 500's 13 but slightly more expensive than the pan-European STOXX Europe 600's 11, data from Thomson Reuters Datastream showed. Nippon Telegraph and Telephone Corp climbed 4.2 percent after the fixed-line operator unveiled its midterm management plan, even though it had also cut its operating profit forecast for the business year. A Tokyo-based analyst who declined to be named said investors had to dig deep to find the companies that are still performing well. " It's not easy time but there are companies doing relatively better ... It's stock-picker central," he said. Among them was mobile games developer Gungho Online Entertainment Inc, which reported a 150 percent year-on-year increase in operating profit for the nine months ended September. The stock jumped 12.7 percent on Friday, and has surged nearly 170 percent so far this year. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

09-Nov-2012 12:52

|

|

x 0

x 0 Alert Admin |

U.S. economy improving, Operation Twist may not be extended -Bullard

* US economy continues to improve, " fiscal cliff" needs tackling

* Fed unlikely to extend Operation Twist, could take other action * Research signals Fed policy may be much easier than commonly thought (Adds more Bullard comment on fiscal cliff, outlook) By Alister Bull ST. LOUIS, Nov 8 (Reuters) - The U.S. economy is strengthening but leaders must tackle a looming " fiscal cliff," a top Federal Reserve official said on Thursday, adding that he doubted the central bank would extend a bond maturity extension program that expires at end-2012. " It is of critical importance that the president and Congress get together and get to a solution on this," St. Louis Federal Reserve President James Bullard told reporters. " This could cause tremendous damage to the U.S. economy if it is not addressed in an appropriate way." Bullard, who is not currently a voting member of the Fed's policy-setting committee but will be next year, stuck to a forecast for U.S. growth accelerating to 3.5 percent next year, but said this was only because he believes the cliff will be avoided. " I don't think that the Fed can take additional action that would be powerful enough to offset the complete failure to address the fiscal cliff," he said. President Barack Obama, re-elected to a second White House term on Tuesday and whose Democrats strengthened their hold on the U.S. Senate, must deal with a Republican-controlled House of Representatives to avoid expiring tax cuts and deep reductions in spending from potentially tipping the United States into recession. The Fed has cut interest rates to almost zero and bought over $2.3 trillion worth of bonds to spur the recovery and bring unemployment down from 7.9 percent, its level last month. Bullard said that improvements in the housing market and recent stability in Europe, after months of volatility caused by the region's sovereign debt crisis, were easing headwinds that had been holding back a more robust U.S. recovery. As a result, he projects unemployment will drop to 7.2 percent by end-2013. OPERATION TWIST The Fed meets again on Dec. 11-12 and must decide what to do about a program of buying $45 billion worth of longer-dated Treasuries every month with the proceeds from the sale of shorter-dated Treasuries, dubbed Operation Twist, which expires at the end of the year. Bullard did not think there was sufficient " space" left from the Fed's short-term holdings to extend Operation Twist. " My sense is it is unlikely that we'd extend Operation Twist because there is only so much balance sheet that we can really use to sell short and buy long." But he argued that policy-makers could consider replacing it with other purchases if they want to prevent policy from tightening when the program comes to an end, and indicated an openness to considering further bond purchases if needed. " One of the advantages of the approach that we took with QE3 is that it is an adjustable amount and so we could adjust that in order to make up for any perceived tightening from the ending of the Twist program. It is definitely an option on the table." The Fed in September announced a third round of so-called quantitative easing, dubbed QE3, saying it would buy $40 billion of mortgage-backed bonds each month until it saw a substantial improvement in the outlook for the U.S. labor market. Bullard, viewed as an anti-inflation hawk who has previously said he would not have voted in favor of QE3, said it was still too early to gauge the impact of the program. MORE EASY However, he did say that he felt that Fed policy may be much more stimulative than commonly thought, and cited research that calculated a " shadow" estimate for U.S. short-term interest rates of minus-5 percent that, in nominal terms, are currently being held near zero by the U.S. central bank. The Fed has slashed rates to spur a faster U.S. economic recovery, and bought over $2.3 trillion of U.S. government and mortgage-backed bonds to drive down longer-term borrowing costs. Because interest rates cannot fall below zero, the Fed has used its bond purchase program to coax more economic activity, achieving stimulus when economic models call for negative interest rates that cannot be created in the real world. Bullard highlighted research by Leo Krippner, an economist at the Reserve Bank of New Zealand, who studied the option value of cash when interest rates are zero, to illustrate just how accommodative U.S. policy may be at the moment. The Fed has been sharply criticized for its aggressive action to encourage economic activity and bring down the high level of U.S. unemployment by economists who fear that it is stoking up dangerous inflationary pressures in the future. Economists already use various rules to estimate where the Fed should hold rates based on goals for inflation and output. The best known, named after economist John Taylor, has been adapted by others, and the Fed is providing even more stimulus to the economy than recommended by this rule, Bullard said. " According to these estimates, the shadow policy rate is currently more than 300 basis points lower than the rate recommended by the Taylor (1999) rule," Bullard told a corporate finance conference at the Olin Business School at Washington University in St. Louis in earlier remarks. (Editing by Eric Walsh) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

09-Nov-2012 11:57

|

|

x 0

x 0 Alert Admin |

Chinese consumer price data showed inflation rising by just 1.7% in October, suggesting more room for the People's Bank of China to ease policy further. Analysts had been projecting a rise of 1.9%, just as it did in September. The producer price index fell 2.8% Y/Y, slightly more than a 2.7% drop projected, but slowing quite a bit from the previous month's 3.6% tumble. [Global & FX] Comment! |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

09-Nov-2012 11:53

|

|

x 0

x 0 Alert Admin |

SHORT TERM: correction continues, DOW -121 Overnight the Asian markets dropped 1.4%. Europe opened higher, but lost 0.3%. US index futures were higher overnight. At 8:30 weekly Jobless claims were reported improving: 355K vs 363K, and the Trade deficit declined: -$41.5 bln vs -$44.2 bln. The market opened unchanged at SPX 1395, and rallied to 1401 in the opening minutes. Then, just as suddenly it started to pullback. The pullback continued into the afternoon, without hardly a 4 point bounce, and hit SPX 1381 by 1:30. Then with a positive short term divergence in place the market tried to rally. At 2:00 the SPX hit 1388, but then began to pullback again. Heading into the close the SPX dropped below 1381, and closed at 1377. For the day the SPX/DOW were -1.10%, and the NDX/NAZ were -1.50%. Bonds gained 12 ticks, Crude added 55 cents, Gold rallied $14, and the USD was flat. Medium term support drops at the 1372 and 1363 pivots, with resistance now at the 1386 and 1440 pivots. Tomorrow: Export/Import prices at 8:30, then Consumer sentiment and Wholesale inventories around 10:00. The market opened flat today, rallied to within 2 points of yesterday’s rebound high at SPX 1403, then rolled over and took out yesterday’s low at SPX 1388. At 1:30 the hit SPX 1381, within the OEW 1386 pivot range, and the market displayed a short term positive divergence. The market did rally to SPX 1388, but again headed lower breaking through the OEW 1386 pivot range at the close. This downtrend has now covered nearly 100 SPX points. The typical downtrend, for this degree of wave, is about 100 SPX points. Short term support is now at the 1372 and 1363 pivots, with resistance at the 1386 and SPX 1396/98. Short term momentum is nearing extremely oversold. The short term OEW charts remain negative with the swing level now around SPX 1411. Best to your trading! MEDIUM TERM: downtrend continues LONG TERM: bull market |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 18:12

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 18:09

|

|

x 0

x 0 Alert Admin |

more on: http://seekingalpha.com/ |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 18:08

|

|

x 0

x 0 Alert Admin |

Debunking The 100% Recession ChartNote to readers - It was either this topic or the fiscal cliff. Since I have explained for many weeks that we will not be doing any cliff diving, I am choosing to take up the recession chart. So much misleading commentary, and so little time! This chart is making the rounds, confirmation bias for those who are convinced that below-trend growth equals a recession. There are several leading sources pointing to the chart and suggesting that it implies a 100% chance of a recession. There are so many things wrong with this that I hardly know where to begin. Here is the commentary from non-economist talk-show guy Lance Roberts:

Try this. Suppose that your favorite football team has not lost a game in the last three years in which it has scored 24 points or more. Then they lose 27-24. You simply revise the proposition to say that they have never lost when scoring 27 or more points. This is what many amateurs do in interpreting data like the chart above. Look at the chart above and pretend that we were going back to the future in 2005. You could have drawn the line at 15% and said everything that Lance says now. You would have been completely wrong. This " never before" style commentary keeps coming up. It has no solid basis in research methods, but it seems convincing to anyone who has not studied research methods. A Novel Idea - Read the Research! D'oh Here is a novel idea for the economic bloggers - count to 10. Maybe you should actually read the research and consult with the authors before rushing to publish. If you actually read the cited paper you would see the following points:

At a minimum, if you are going to use your pulpit on the Internet to scare the daylights out of people, wouldn't it be a good idea to confirm with the authors first? This is the downside of a world where no confirmation is required before publishing. Why the Average Investor is Getting Bamboozled - Again This is interesting research. My strong recommendation is that interpreting a complex economic paper should involve the opinion of the authors. I strongly doubt that any of the pundits writing about this could speak coherently for thirty seconds about Markov models. So why should we listen to them? I called Prof. Piger Wednesday afternoon (voicemail), and I'll try again. Meanwhile, I am accepting his work at face value. It is a tiny and preliminary recession warning. I will be quite surprised if he agrees with the Lance interpretation of his work. About eighteen months ago, I initiated a challenge to the ECRI as the top recession forecaster. At the time, they were not forecasting a recession, but I was concerned about the methodology. I invited nominations from everyone, and regularly highlight those with the best records. (Anyone who has followed my approach has done well in the market over the last eighteen months). My highly visible search has helped me to discover an expert community in recession forecasting. We have regular discussions. I frequently highlight the excellent articles by these colleagues. I want to preserve the privacy of these emails, while still giving credit. To this end, let me say that Dwaine Van Vuuren of RecessionAlert, one of my regular featured sources, suggested to me that the published chart does not reflect original data. That got me thinking, so I checked out Prof. Chauvet's site. Sure enough, the data from last year shows a spike which apparently was later revised away if you believe Prof. Piger's site. Note the serious discrepancy with Piger. Here is the supporting data: Dwaine tells me that this is common with Markov models and revisions. I hope that he will write on this topic, and that he will gain the wide visibility he deserves. Investment Conclusion Wednesday's market was a combination of the following:

When there is excessive fear, it is an opportunity for long-term investors. If you disagree with the recession forecast, the key choices are cyclical companies and technology - all on sale via your favorite broker. Regular readers know that I like CAT, AAPL, and ORCL, and I am buying them all. I'll try to cover the fiscal cliff issues soon, but you already know my conclusion. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

08-Nov-2012 18:06

|

|

x 0

x 0 Alert Admin |

How Oil Really Gets PricedMost investors think of oil in terms of spot and futures price. Commodities, by definition, describe a class of goods for which there is demand, but no qualitative differentiation. Silver is silver and it costs what it costs, as do pork bellies, oranges, peanuts and gold. Of course, the reality is a little more complex than that. And when it comes to the price of oil? It's a lot more complex than that. Big Oil When you hear the words " Big Oil," companies like Exxon-Mobil (XOM), BP (BP), and Chevron (CVX) usually come to mind. But everything about oil is big. The value of annual crude oil production is double that of natural gas and coal, 4.5x that of rice, wheat, and corn put together, and 23x that of gold. In its natural state, oil is one of the most diverse products on the planet. More than 300 different types of crude are produced around the world. Oil can be found at every depth, from shallow pits only a few feet deep to over to a vertical depth of 35,000 feet below sea level. Oil comes in a variety of colors and - if the industrial terms were taken literally - tastes. In color, " black gold" runs the gamut from nearly colorless to pitch black, with viscosity ranging from that of water to nearly solid. In terms of price, the two most important characteristics are viscosity and sulfur content. The highest-value fractions of oil - gasoline, diesel and jet fuel - are most cost-effectively derived from the low density (" light" ) and low sulfur content (" sweet" ) crude, and are usually more expensive than their heavy and sour counterparts, as sulfur is a harmful pollutant that must be extracted. Fig. 1: Crude Oils By Density, Sulfur Content

Fig. 2: (SOURCE: EIA) Benchmarks There is no single benchmark of oil, and therefore, no one price for any barrel of oil. Instead, oil is priced via a method known as " formula pricing." Formula pricing works by first assigning a benchmark price - such as Brent or West Texas Intermediate (WTI) - to a contracted amount oil, then adding or subtracting a number of assorted price differentials according to a checklist of criteria ranging from quality and transportation costs, to things like refining costs. For example, a barrel of light, sweet WTI is usually worth more than a barrel of sour Dubai Crude. However, the actual spread in price depends upon the supply and demand dynamics of the oil market at the time, as well as the location, the spare capacity of the refineries, and whether the refineries are capable of processing lower quality oil into higher quality petroleum products. (click to enlarge)

Oil companies often reference more than one benchmark price depending on the destination. In addition, the methods used by the PRAs to calculate WTI and Brent prices are different. WTI Historically, the prices for Western Texas Intermediate and Brent moved in tandem. That changed when oil volumes from Canada and North Dakota began to pick up, leading to bottlenecks in the refining hub of Cushing, Oklahoma. Unfortunately, the Cushing hub is asymmetric: more pipelines lead into Cushing than lead out. The closing of Valero Energy Corp.'s (VLO) McKee refinery has led to increased inventories in Cushing and significant downward pressure on WTI prices. Cushing is the southernmost hub of the proposed Keystone pipeline.

Pricing WTI The pricing for West Texas Intermediate crude is refreshingly simple when compared to Brent. WTI is priced using a single instrument: the NYMEX Light Sweet Oil futures contract. The WTI futures contract allows for physical delivery when left open at expiry, specifying 1,000 barrels of WTI to be delivered to Cushing, Oklahoma - although it also allows for the delivery of several other domestic and foreign light sweet crudes against the futures contract. However, only a very small proportion of WTI futures contracts are actually physically settled. Reflecting the absence of a significant forward market, the PRAs' assessed physical 'spot' price for WTI is determined differently to that for Dated Brent. The 'spot' price for WTI reported by the PRAs is typically the most recent and representative NYMEX WTI front-month. At contract expiry, the PRAs' reported price reflects the new front-month futures price plus the 'cash roll' - the cost of rolling a NYMEX futures contract forward into the next month without delivering on it. Ta-da! You now have the price of a barrel of WTI. Brent Now here's where it gets complicated. The Brent benchmark owes its existence to favorable tax regulations for oil producers in the U.K. (The name " Brent" itself is the result of the naming policy of Shell UK Exploration and Production, which named all of its fields after birds.) Brent was originally traded on the open outcry International Petroleum Exchange in London, but since 2005 has been traded on the electronic IntercontinentalExchange, or ICE. One contract equals 1,000 barrels (159 m3). Contracts are quoted in U.S. dollars. Each tick lost or gained equals $10. Being a seaborne crude, the forward contract for Brent involves trading in large volumes of oil (a standard Brent shipment is 600,000 barrels), which is beyond the capability of most small traders as a result, very few traders participate in this market, with between 4 and 12 traders participating each day. In contrast, WTI is a pipeline crude with much smaller trading lots and a correspondingly greater number of participants in the physical market. The volume of Brent crude has declined over time, resulting in three other North Sea crudes being added to the benchmark over the past decade in order to replace lost volume. If enough volume is lost, the usefulness of the benchmark is forfeit. (Incidentally, this is what happened to the Malaysian-Tapis benchmark.) The Brent benchmark now includes Brent, Forties, Oseberg and Ekofisk. Fig. 3: Brent Production Volumes Over Time (click to enlarge)

Pricing Brent Oil is priced according to both the financial and physical framework which surrounds it. Of the two crudes - Brent and WTI - Brent is by far the more difficult to price, which is one of the major reasons underpinning OPEC's preference for it. Pricing Brent crude involves multiple variables, including Dated Brent, ICE Brent futures and Brent forwards prices. The matter is further complicated by the fact that Brent crude is priced differently, depending on the liquidity of the market. Dated Brent - sometimes referred to as the 'spot' price for Brent - is the most commonly used reference price for the physical sale of oil by tanker. Dated Brent represents the price of a cargo of Brent crude oil that has been assigned a date, between 10-25 days ahead, for when it will be loaded and shipped to the purchaser. Dated Brent pricing begins with the forward market. Brent forwards - known as 25-day BFOE - represent a physically deliverable over-the-counter contract, specifying the month (but not the actual date) in which the oil will be loaded onto a tanker for delivery. Buyers are notified of the loading date within 25 days of delivery. PRAs, like Platts, typically assess three Brent forward prices for a period of three months ahead. The PRAs then calculate the contract-for-difference, or CFD prices. The CFD price is a short-term swap between the floating price of Dated Brent on any given day and the fixed Brent forward price. By assessing weekly CFD values for eight weeks and combining the result with the second month Brent forward price, the PRAs construct a table of implied future Dated Brent prices for up to 8 weeks in the future. (i.e. Forward Dated Brent Curve) Using this curve, the implied Dated Brent prices for the period 10 to 25 days ahead can be calculated - the average of which is known as the North Sea Dated Strip. Combining this with the grade differentials for each of the four crudes in the Brent basket gives an outright price for each of Brent, Forties, Oseberg and Ekofisk. The cheapest of which then becomes the final published daily quote for Dated Brent. This is typically Forties as it is the lowest quality of the four crudes in the Brent basket. The linking of a Brent Futures contract with a Physical delivery converts the transaction to a 25 Day BFO Forward, which is an OTC settlement transaction. This 'conversion' is registered with the IPE and London Clearing House (LCH). After this registration the LCH no longer guarantees the settlement, and the contract does not 'cash settle' two days after trading ceases for such contracts. Pricing Brent When Liquid (click to enlarge)

Pricing Brent When Illiquid Occasionally, however, there is insufficient liquidity in the Brent forward market to use this as the starting point. In that case, the assessment instead starts in the futures market. As shown in Figure 2, a synthetic Brent forward price is derived by combining the ICE Brent futures prices with 'exchange of futures for physicals' (EFPs) values. The ICE Brent futures contract specifies the delivery of 1,000 barrels of Brent crude oil at some determined future date. The contract is settled in cash, with an option for delivery via an EFP contract. Whereas futures contracts are highly standardized and traded on exchanges, EFPs are a more flexible contract that allow traders to convert a futures position into physical delivery, enabling traders to choose delivery location, grade type and trading partner. EFPs take place off-exchange, at a price agreed to by both parties. Once a price for Brent forwards has been derived, the Dated Brent price can then be determined as before. While Dated Brent has traditionally been the most commonly used price in physical contracts, an increasing number of producers - including Saudi Arabia, Kuwait and Iran - have begun to adopt Brent futures prices as their preferred benchmark. The most likely reason for this preference is the complexity of the Brent pricing system itself. By increasing the number of variables, a complex system invites uninformed speculators to mis-price the market, while the average movement over time of the price differentials allows OPEC to claim that the general trend is more or less consistent with physical supply/demand dynamics. Conclusion Many traders piled into oil futures recently on speculation that the post-Hurricane Sandy refinery shutdowns and increased uncertainty would put a premium on oil in fact, the opposite occurred. The closing of the refineries increased oil inventories, which resulted in a plunge in the price of oil. In Sandy's case, the demand that oil traders were concerned about was that near term demand had taken a hit from the closure of the refineries. A refinery's demand for crude is not the same as consumer demand for fuel. There's even a " fuel crunch" in New York, but oil prices are still falling due to impact that all the damages caused by the Hurricane will reduce the amount the total miles driven. Investors who are considering adding oil futures to their portfolio should make certain that they have a working understanding all the variables, pricing systems and methodologies involved in determining the price of a barrel of oil. Those variables include supply, chemical composition, demand curves, geopolitical tension, refinery closings, new pipelines being put in, new discoveries, depleted fields, " official" OPEC figures on proven reserves, analysts guesstimates on what those reserves may actually be, the weather, the liquidity of the Brent market, the price of Natural Gas, the survival or unstable regimes, the Cushing backlog, extraction technology, spill cleanup, and a host of other interlocking variables, all of which amount to the price per barrel of the most important and controversial energy source on the planet, without which the lights would go out, the V6 engines would lock up, hundreds of millions of people would starve or freeze, and civilization itself would grind to a sudden halt. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 18:05

|

|

x 0

x 0 Alert Admin |

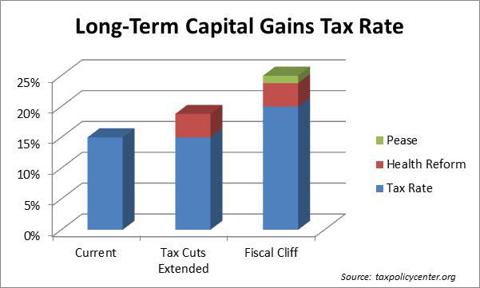

Invest Like A Jedi And Sell Before The Fiscal Cliff The election results are in and as expected Congress and the White House maintain status quo. As a result, certain tax codes like the capital gains and dividend and interest income tax rates are at risk of a significant increase. Of the two tax codes, the capital gains tax rate change will have the biggest impact on prices of stocks, bonds, housing, and any business venture that has been successful over recent years. As the law currently stands, the capital gains tax rate will see the largest year-over-year increase in history. Some intelligent investors didn't wait for election results to lock in the low capital gains tax rate. A good example is Star Wars creator George Lucas, who recently sold his Lucas Films empire to Disney for $4.05 billion. Lucas built his empire over many years and is sitting on a very large capital gain. Although Lucas has not publicly stated that tax policies had anything to do with the timing of the sale, there is speculation that it was a large factor. If outcomes from past tax policy changes are any indication of what will result this time around than be prepared for a lot more selling between now and year-end. In 1986, the maximum tax rate on long-term capital gains increased from 20% to 28%, a 40% increase. This was the largest year-over-year capital gains tax rate increase from 1954 through 1986 and remains the largest increase unless the rate goes up as it is currently written. As the law stands, the capital gains tax rate would increase from 15% to 25% which results in a 67% increase. The increase encompasses expiration of a 5% Bush-era tax cut, expiration of a 1.2% tax deduction nicknamed " Pease" after the congressman who introduced it, and the implementation of a 3.8% health reform tax. This is the worst case scenario and this outcome has a high probability of occurring. Even if the worst case scenario is avoided, the best case scenario would result in a rate increase by 25% from a rate of 15% to 18.8%, which only accounts for the health reform increase. (click to enlarge)

A look into the tax revenue section for total realized capital gains in 1986 shows a significant correlation between the increase in the capital gains tax rate and realization of capital gains. In the chart below, you can see that in 1986, total realized capital gains as a percent of GDP (green line) increased to 7.35% when the maximum tax rate on long-term capital gains (blue line) went up in 1987. This compares to a 30 year average of 2.65% from 1955 to 1985. (click to enlarge)

Digging into the 1986 capital gains sales further, you can see from the chart below that the majority of the capital gains that were realized in 1986 came from sales in December. (click to enlarge)

High-income earners will absorb the brunt of the capital gains tax rate increase. First, the health reform tax and the Pease deduction only apply to high-income earners. In addition, while most U.S. citizens receive close to 100% of their income from salary and wages, the top 400 income earners in the U.S. receive the majority of their income from capital gains. In fact, in 2007 only 7% of the top 400 tax filers' income in the U.S. came from salary and wages while 66% came from capital gains. One area that should be closely watched is the hedge fund industry. For starters, only accredited investors, defined as having a net worth of $1 million or income exceeding $200,000 in each of two most recent years, can invest in a hedge fund. Now that we've segmented the market, we need to look at the holdings of the hedge funds. It helps to look at stocks that have had a big run up in the past few years. As you read this on your iPad, MacBook, or iPhone, one stock may come to mind. Apple Inc. (AAPL) has seen a more than two-fold increase in price over the past five years which makes for some nice long-term capital gains. According to Hedge Fund Wisdom, a quarterly hedge fund activity report from marketfolly.com, Apple is held in 17 out of 25 widely followed hedge funds and is the top holding for six funds. In addition, since Apple is such a large component of many stock indices, look for the sell-off to influence the performance of many widely tracked benchmarks. For example, the Technology Sector ETF (XLK) is comprised of 18.5% Apple stock, compared to its next largest holding, International Business Machines (IBM) which comprises a modest 8.1%. More importantly, Apple is the highest weighted stock in both the S& P 500 Index (SPY) and the NASDAQ Composite Index (QQQ) and could drag down both indexes through the end of the year. Many factors point to selling assets that have seen a significant run up in price over the past few years. When selling an empire like Lucas did, it takes an army of legal and financial experts hundreds of man-hours to complete, which results in a very large transaction cost. Selling marketable securities on a liquid exchange has minimal transaction fees and can be conducted in your bath robe in the time it takes to brew a pot of coffee. The risk-reward is extremely high, especially for a high income investor. The risk is being in cash while the market rallies into the end of the year while the reward is avoiding a sell-off and locking in a low capital gains tax rate for any investors with unqualified investments. In December of 1986, the S& P 500 Index was down 2.83% and in January of 1987 it was up 13.18%. Invest like a Jedi and may the Force be with you. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 18:02

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 17:58

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 17:53

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 17:41

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 17:22

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

08-Nov-2012 16:58

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |