| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

|||

|

Cross_Stitch

Member |

02-Dec-2009 21:56

|

||

|

x 0

x 0 Alert Admin |

So your guess is that tonight Dow will be up again but like dow futures down

|

||

| Useful To Me Not Useful To Me | |||

|

smartrader

Elite |

02-Dec-2009 21:51

|

||

|

x 0

x 0 Alert Admin |

yes... STI has to trade above 2800 , need to play catch-up ... | ||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Cross_Stitch

Member |

02-Dec-2009 21:30

|

||

|

x 0

x 0 Alert Admin |

Hi so if Dow can hit 10.5 than we shd hit 2800 tomorrow right?

|

||

| Useful To Me Not Useful To Me | |||

|

smartrader

Elite |

02-Dec-2009 21:21

|

||

|

x 0

x 0 Alert Admin |

when AIG share price rises due to good profits, they can start issuing more shares or bonds to repay... in today's context a billion is nothing liao... Dow will test 10500 again tonight... |

||

| Useful To Me Not Useful To Me | |||

|

teeth53

Supreme |

02-Dec-2009 21:19

Yells: "don't learn through life, learn to grow with life " |

||

|

x 0

x 0 Alert Admin |

What about this.....federal government’s $180 billion effort to prop up American International Group has worked, averting an even bigger financial catastrophe. And the report says it’s “unclear” whether AIG will ever pay back the $121 billion in government assistance that’s still coursing through its balance sheet. http://blogs.reuters.com/commentaries/2009/09/22/time-to-junk-aig/ They oredi start to pay back $25 billion to US govt. I mean R they going to breakup AIG into smaller one, instead of too big to fail. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

02-Dec-2009 11:55

|

||

|

x 0

x 0 Alert Admin |

Asian shares mostly higherTOKYO Japanese shares fell 0.17 per cent in morning trade on Wednesday, despite upbeat economic news in the United States and easing fears over the Dubai debt crisis. The benchmark Nikkei-225 index dropped 16.18 points to 9,556.02 by the lunch break. The broader Topix index of all first-section shares fell 2.43 points or 0.28 per cent to 855.33. HONG KONG Hong Kong shares opened 1.10 per cent higher in the first few minutes of trade on Wednesday, with the benchmark Hang Seng Index up 243.14 points at 22,356.29. SHANGHAI Chinese shares rose 0.56 per cent on Wednesday morning led by banks after reassurances from Beijing that its stimulus policies would continue into next year, dealers said. The Shanghai Composite Index, which covers both A and B shares, was up 18.20 points at 3,253.57. The Shanghai A-share index added 19.04 points or 0.56 per cent, to 3,412.44, while the Shenzhen A-share index gained 3.30 points, or 0.26 per cent, to 1,276.59. KUALA LUMPUR At 10.30am on Wednesday, there were 271 gainers, 115 losers and 173 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,272.19 up 5.48 points, the FBMACE was at 4,308.77 up 10.37 points, and the FBMEmas was at 8,458.74 up 42.16 points. Turnover was at 254.467 million shares valued at RM252.516 million. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

02-Dec-2009 08:35

|

||

|

x 0

x 0 Alert Admin |

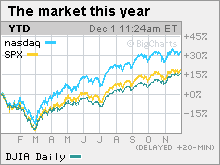

Dow at 14-month highWall Street advances on Dubai debt relief, better-than-expected housing and construction readings, and talk of a GE-Comcast deal.  The Dow Jones industrial average (INDU) added 127 points, or 1.2%, closing at the highest point since Oct. 2, 2008. The S&P 500 (SPX) index gained 13 points, or 1.2%, and closed just short of a 14-month high. The Nasdaq composite (COMP) rose 31 points, or 1.5%, and remained short of a 14-month high hit a week ago. Bets that Dubai's debt problems won't have a major impact on U.S. institutions lifted stocks late Monday and through Tuesday's session. Stocks also reacted to the day's better-than-expected economic readings on construction spending and pending home sales. "The market is treating Dubai like a non-event and continuing to trade on momentum," said Joe Clark, market analyst at Financial Enhancement Group. He said that the momentum is likely to keep stocks aloft or even push them higher through year-end, despite the already substantial run up since the March lows. Since bottoming at a 12-year low March 9, the Dow has gained nearly 60%, the S&P 500 has gained 64% and the Nasdaq has gained 72%. Investors also kept an eye on auto sales, which were down from October but mostly higher from a year ago. After the close, GM said CEO Fritz Henderson has resigned and will be temporarily replaced by Chairman Ed Whitacre, until a successor is found. The weak dollar also played a role in the day's advance, boosting commodity prices and stocks, continuing a trend that's been in place all year. Gold touches $1,200: COMEX gold for December delivery rallied $18 to settle at $1,199.10 an ounce, after rising as high as $1,202.70. It's the first time the precious metal has ever traded at this level. Company news: AIG (AIG, Fortune 500) said it is wiping out $25 billion of its government debt by selling stakes in two of its life insurance subsidiaries to the Federal Reserve Bank of New York. Shares gained 8.6%. General Electric (GE, Fortune 500) has reportedly reached a deal to buy Vivendi SA's 20% stake in NBC Universal for about $5.8 billion, moving GE closer to its goal of partnering with Comcast (CMCSA, Fortune 500) to create one of the largest U.S. media companies. GE is looking to sell a 51% stake in NBC Universal to Comcast, while retaining a 49% stake in the company that is valued at around $30 billion. Dubai and world markets: Dubai World, the city-state's main investment arm, said it is in talks to restructure $26 billion in debt, cooling worries that it might go into default and wipe out the investment of its creditors. Global markets slumped last week after the Dubai government asked to defer payments for at least six months on $60 billion in debt owed by Dubai World and Nakheel, its real estate arm. Overseas markets surged, with London's FTSE 100, Germany's DAX and France's CAC 40 all closing with gains of more than 2%. Asian markets rallied too, with Japan's Nikkei ending 2.4% higher. Autos: Major automakers reported sales in November that met or topped expectations. But any improvements year-over-year were easy, given the dismal results in November 2008. On a monthly basis, sales slumped from October levels. Among the standouts: General Motors reported a 1.8% drop in November sales from a year ago, versus forecasts for a drop of 1.3%. But sales were down 15% from October levels. Ford Motor's sales were little changed from a year ago and down 10% from October. ISM index: The November manufacturing index from the Institute for Supply Management fell to 53.6 from 55.7 in October, surprising economists who were looking for ISM to fall to 55. However, any reading over 50 implies expansion in the sector. Pending home sales: Signed contracts to buy homes rose 3.7% in October, the ninth monthly increase in a row, according to a National Association of Realtors report released Tuesday. Pending home sales were expected to have fallen 1% after rising 6% previously. Other economic news: Construction spending in October was unchanged, the government reported. Spending fell 1.6% in September and was expected to have fallen 0.5% in October, according to analysts' estimates. President Obama is due to announce his strategy on Afghanistan in a speech Tuesday night from West Point. The dollar and oil: The dollar fell versus the euro and gained against the yen. U.S. light crude oil for January delivery rose $1.47 to $78.75 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.27%, from 3.20% late Monday. Treasury prices and yields move in opposite directions. Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.13 billion shares. On the Nasdaq, advancers topped decliners by two to one on volume of 2.20 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

01-Dec-2009 12:11

|

||

|

x 0

x 0 Alert Admin |

Asian shares mostly higherTOKYO Japanese shares fell 0.95 per cent in morning trade on Tuesday, failing to follow an overnight rebound on Wall Street as exporters continued to suffer from a strong yen. The benchmark Nikkei-225 index fell 88.88 points to 9,256.67 by the lunch break. The broader Topix index of all first-section shares dropped 8.57 points or 1.02 per cent to 831.37. HONG KONG Hong Kong shares edged 0.11 per cent higher in the first few minutes of trade on Tuesday, with the benchmark Hang Seng Index up 24.1 points to 21,845.60. KUALA LUMPUR At 11.30am on Tuesday, there were 228 gainers, 227 losers and 219 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,263.92 up 4.81 points, the FBMACE was at 4,337.08 up 27.04 points, and the FBMEmas was at 8,405.68 up 23.04 points. Turnover was at 322.518 million shares valued at RM316.518 million. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

01-Dec-2009 07:56

|

||

|

x 0

x 0 Alert Admin |

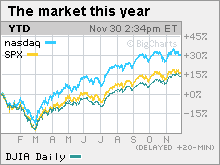

Bank shares boost marketA late-session rally in the financial sector helps Wall Street trim losses as Dubai contagion fears ease. The tepid holiday sales and weak dollar were also in focus. NEW YORK (CNNMoney.com) -- A rally in bank shares helped take Wall Street higher Monday, at the end of a choppy session, as investors bet that the fallout from Dubai's debt problems won't have a major impact on U.S. institutions.

A weak dollar, rising commodity prices and the first wave of holiday retail sales reports were also in play during a tumultuous session on Wall Street. The Dow Jones industrial average (INDU) added 35 points, or 0.3%. The S&P 500 (SPX) index gained 4 points, or 0.4%. The Nasdaq composite (COMP) rose 6 points, or 0.3%. Stocks were flat to weaker through most of the session, but managed a late-day run up, led by financials. The bank sector as a whole was taken down late last week on Dubai worries. But bets that any damage will be contained gave those stocks a lift late Monday. "The market is really showing resilience," said Dave Hinnenkamp, CEO at KDV Wealth Management. "It's amazing that even with the Dubai situation, stocks are managing to rise." The KBW Bank (BKX) sector index jumped 3.4%, thanks to a rally in components JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Wells Fargo (WFC, Fortune 500) and Fifth Third Bancorp (FITB, Fortune 500). Monday marked the first full trading session in five days, with all financial markets closed for Thanksgiving and stocks only trading in a half-session Friday. Stocks tumbled in Friday's shortened session on the problems in Dubai. The major indexes were also vulnerable to a selloff after touching 13-month highs in the previous session. That vulnerability stuck around through most of Monday's session, until the last-hour run up. Stocks are likely to remain range-bound for the time being, said Dean Barber, president at Barber Financial Group. "I wouldn't be surprised if we are talking about the Dow 10,000 for a while." Retail: The first wave of reports for the critical Thanksgiving holiday weekend indicate that more Americans turned out this year to take advantage of deals, but the shoppers spent less than a year ago, on average. According to the National Retail Federation, around 195 million people shopped in stores and online between Thanksgiving and Sunday, versus 172 million a year ago. But average spending per person dropped to $343.31 from $372.57 a year ago. Total spending for the holiday was $41.2 billion, up around 0.5% from the $41 billion spent last year. On Monday, the retail focus turned to the Internet, for a day called Cyber Monday, when shoppers at home and at work take to the Web to scour for further deals. Dubai and global markets: The United Arab Emirates said Sunday that it will provide emergency support for banks in Dubai, cooling some worries that a debt default in the city-state could challenge the global economic recovery. Stocks around the globe slumped last week after the Dubai government asked to defer payments on $60 billion in debt owed by Dubai World and Nakheel. Dubai World is the city-state's main investment arm and Nakheel is its real estate arm. Dubai's construction boom has helped turn the Emirate into a world financial center and tourist hot spot. But Dubai has suffered from the same sort of real estate collapse that battered the U.S. economy, with values plummeting even as pricey projects continue to get underway. Dubai stocks plummeted Monday, the first trading day in the region after a 4-day religious holiday. Asian markets managed gains Monday, after tumbling last week. European markets tumbled, with London's FTSE 100, Germany's DAX and France's CAC 40 all losing at least 1%. "What's happening in Dubai right now is another verification that the mountain of debt we've accrued in the world is unsustainable," Barber said. AIG: AIG bucked the trend, missing out on the financial sector stock advance after an analyst at Sanford Bernstein cut its price target on the stock, saying that the insurer's loss reserves are too low. Economy: The Chicago PMI, a regional read on manufacturing, rose to 56.1 in November from 54.2 in October. Economists surveyed by Briefing.com thought the index would fall to 53.3. Any reading over 50 indicates expansion. Mortgage regulation: In other news, the Obama administration said it will up the pressure on mortgage companies that aren't doing enough to help borrowers who are at risk of foreclosure -- including imposing fines and sanctions. Currency and commodities: The dollar gained versus the euro and fell against the yen. COMEX gold for December delivery rose $6.90 to settle at $1181.10 an ounce, not far from an all-time high of $1,187 an ounce hit last week. U.S. light crude oil for January delivery rose $1.23 to settle at $77.28 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices rose modestly, with the yield on the 10-year note holding steady at 3.20%, unchanged from Friday. Treasury prices and yields move in opposite directions. Market breadth was negative. On the New York Stock Exchange, advancers beat decliners four to three on volume of 1.35 billion shares. On the Nasdaq, winners topped losers by a narrow margin on volume of 2.03 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Nov-2009 14:14

|

||

|

x 0

x 0 Alert Admin |

SINGAPORE'S manufacturing output rebounded in October, as as electronics companies ramped up production to meet increased demand, boosting recovery efforts. Although the output fell by a seasonally adjusted 6.7 per cent from September, it was 3.6 per cent higher than a year ago, following a revised 6.3 per cent drop in September 2008, according to figures released by the Economic Development Board on Thursday. For the first 10 months, cumulative output contracted by 5.1 per cent, compared to the same period last year, according to figures released by the Economic Development Board on Thursday. The electronics cluster was a star performer, surging by 17.7 per cent last month from a year ago, when it shrank a revised 8.7 per cent. The computer peripherals segment continued to power ahead, growing 83 per cent, building on its strong performance in September. The semiconductor segment also grew 15.7 per cent, thanks to stronger demand for chips used in consumer electronics. Output in the biomedical manufacturing cluster rose 0.8 per cent year-on-year, with the growth mainly due to the medical technology segment, which saw output going up by 14.5 per cent. But the pharmaceuticals segment fell by a marginal 0.7 per cent after contracting a revised 15.6 per cent in the previous month. Excluding biomedical manufacturing, production gained 4.3 per cent in October. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Nov-2009 14:11

|

||

|

x 0

x 0 Alert Admin |

TOKYO Japanese stocks edged up 0.04 per cent in morning trade on Thursday, recovering from early losses on concerns about the strong yen which could harm earnings of Japanese exporters. The benchmark Nikkei-225 index gained 3.72 points to 9,445.36 by the lunch break, after opening down 1.00 per cent. The broader Topix index of all first-section shares edged up 0.44 points, or 0.05 per cent, to 833.73. HONG KONG Hong Kong shares were down 1.07 per cent after Thursday's morning session as selling pressure on Chinese banks continued amid concerns Beijing will tighten monetary policy. The benchmark Hang Seng Index fell 242.19 points to 22,369.61. Turnover was 40.29 billion Hong Kong dollars (5.20 billion US). SHANGHAI Chinese shares fell 1.02 per cent by midday on Thursday, weighed by uncertainties over the possible direction of China's monetary policy next year, dealers said. The Shanghai Composite Index, which covers both A and B shares, was down 33.56 points at 3,256.61. Senior Chinese leaders are expected to meet soon to map out the country's economic blueprint in 2010, traders said. 'Speculation over how and when China will exit its stimulus package and moderately easy monetary policy will weigh on stocks,' Southwest Securities analyst Zhang Gang told Dow Jones Newswires. The Shanghai A-share index fell 35.10 points, or 1.02 per cent, to 3,415.97, while the Shenzhen A-share index lost 9.87 points, or 0.77 per cent, to 1,265.22. KUALA LUMPUR At 12.30pm on Thursday, there were 220 gainers, 282 losers and 255 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,273.04 up 2.04 points, the FBMACE was at 4,313.76 down 16.24 points, and the FBMEmas was at 8,477.73 up 2.01 points. Turnover was at 391.906 million shares valued at RM427.054 million. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Nov-2009 08:40

|

||

|

x 0

x 0 Alert Admin |

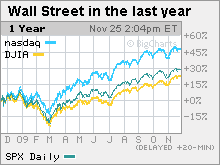

Dow hits new '09 high ahead of holidayBoth the blue-chip average and the S&P 500 end at 13-month peaks after reports show improvement in labor market, new home sales and consumer spending. All financial markets are closed Thursday for the holiday, while Friday brings an abbreviated session for stocks. Some market pros will make a five-day weekend of the period. The Dow Jones industrial average (INDU) rose 31 points, or 0.3%, ending at a fresh 13-month high. The S&P 500 (SPX) rose 5 points, or 0.5%, and also finished at a fresh 13-month high. The Nasdaq composite (COMP) rose 7 points, or 0.3%, closing short of a 13-month high. Because of the holiday, all the week's news was jammed into the first three days, with nothing on the docket Friday. The combination of a three-day onslaught of economic news and some pre-holiday wariness was keeping investors from moving much Wednesday, said John Canally, economist at LPL Financial. "If we had gotten the jobless claims report only, stocks would be up more," said Canally. "But investors are in a data overload this week and it's only going to continue next week." Next week is a doozy, with reports due on manufacturing, auto sales, housing and the labor market. Monday's trading will be heavily influenced by how the holiday shopping period kicks off. Black Friday, the day after Thanksgiving, and Cyber Monday, the first work day after the holiday, are critical barometers for the health of the consumer at the start of the biggest shopping period of the year. Most economists believe the recession is over. Yet rampant joblessness, lower household income and personal wealth, and a still-tight lending environment should temper the benefit of retailers' discounts. Overall spending is expected to hit a range of between 1% lower than a year ago and 1.5% higher. Canally said that it's likely to hit the higher end of that range. Wall Street ended Tuesday's choppy session lower as investors retreated from 13-month highs hit the day before. Jobs: New claims for unemployment posted a surprisingly large tumble last week, falling to 466,000, a 14-month low. Economists surveyed by Briefing.com thought claims would drop to 500,000 from a revised 501,000 the previous week. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 5,423,000 from a revised 5,613,000 the previous week. Economists expected 5,565,000 claims. New home sales: Sales rose to a 430,000 annual unit rate in October from a 405,000 unit rate in September. Economists expected sales to dip to a 404,000 annual unit rate. Income and spending: Personal income and spending climbed in October, according to a Commerce Department report released in the morning. Income rose 0.2% after rising 0.2% in September. Economists thought it would rise 0.1%, according to Briefing.com estimates. Spending was up 0.7% after falling 0.6% in the previous month. A separate report showed that orders for durable goods fell 0.6% in October, surprising economists who were expecting orders to rise 0.5%. Orders for goods meant to last three years or more gained 2% in September. World markets: Global markets advanced. In Europe, London's FTSE 100, Germany's DAX and France's CAC 40 all gained modestly. Asian markets ended higher. Currency and commodities: The dollar slipped against the euro and gained versus the yen. The weaker dollar boosted dollar-traded gold, which hit a new record. COMEX gold for December delivery rose $21.20 to a record settlement of $1,187 an ounce. Gold hit $1192.80 during the session, moving ever closer to the $1200 mark. U.S. light crude oil for January delivery rose $1.94 to settle at $77.96 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.26% from 3.30% Tuesday. Treasury prices and yields move in opposite directions. Market breadth was positive and volume was light. On the New York Stock Exchange, winners topped losers two to one on volume of 800 million shares. On the Nasdaq, decliners beat advancers seven to six on volume of 1.42 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

24-Nov-2009 08:30

|

||

|

x 0

x 0 Alert Admin |

Dow spikes to 13-month highA better-than-expected housing market report, a weak dollar and a surge in commodities are pushing the market to new 2009 highs.  The dollar's initial weakness versus the euro helped lift gold to another record, putting the precious metal within $36 of $1,200 an ounce. However, the dollar staged a comeback by the early evening. The Dow Jones industrial average (INDU) gained 133 points, or 1.2%, closing at 10,450.95, its highest point since October 2, 2008. The Dow rose as much as 177 points in the morning, hitting 10,495.61 -- the highest trading level since Oct. 3, 2008. The Nasdaq composite (COMP) climbed 30 points, or 1.4%, closing short of a 13-month high hit last week. The S&P 500 (SPX) jumped 15 points, or 1.4% but ended short of its 13-month high hit last week. Stocks had slipped for the last three sessions, ending last week mixed, as investors pulled back a bit after pushing the Dow to a 13-month high. But Monday's news brought a new wave of buying. "The market is still in the euphoric state, with people coming to the realization that they can't keep much, if anything in money markets or cash," said Matt King, chief investment officer at Bell Investment Advisors. "Investors are trying to pick up riskier assets and get some yield on those assets." He said that after October's slight pullback, November has clearly been another up month for investors, with the S&P 500 climbing around 6%. And, King added, there is little on tap between now and year end to disrupt the flow, although the pace of gains is likely to slow. Since bottoming at a 12-year low on March 9, the Dow has gained 60% as of Monday's close. In that same period, the Nasdaq gained 69% and the S&P 500 gained nearly 64%. Trading was light Monday and is expected to keep getting lighter in the day's leading up is expected to lighten up in each session leading up to Thursday's Thanksgiving holiday. All financial markets will be closed Thursday and stocks will close early on Friday. After the close, Hewlett-Packard (HPQ, Fortune 500) reported higher quarterly earnings of $1.14 per share, in line with its raised forecast that was released last week. The company also reported a drop in revenue. Earnings grew thanks to strength in China and better profit margins, a key measure of profitability. HP also said that it was tripling its share repurchase program to $12 billion. Shares fell after the close after rising during the session. Tuesday brings reports on housing and consumer confidence in the morning, as well as the latest revision of third-quarter GDP growth. The minutes from the last Fed meeting will be released in the afternoon. Housing: Existing home sales in October surged to the highest level since February 2007, according to a National Association of Realtors report released Monday morning. Sales rose 10.1% in October to a seasonally adjusted annual rate of 6.1 million units, verses a revised 5.54 million units in September. Economists expected sales of 5.7 million units, on average. The strong sales were largely driven by buyers trying to tax advantage of the government's first-time homebuyer tax credit, which was initially due to expire at the end of November. The credit has now been extended to the end of April and includes a broader range of buyers. Investors have been looking for the economic news to confirm what many economists say: The recession, which began in December 2007, is over. In particular, a recovery in the housing market is critical as the credit crisis and housing market collapse deepened the economic crisis. On the move: Stock gains were broad based Monday, with 28 of 30 Dow issues rising, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), IBM (IBM, Fortune 500), 3M (MMM, Fortune 500), Procter & Gamble (PG, Fortune 500) and Exxon Mobil (XOM, Fortune 500). The Dow's financial shares rallied, too, including American Express (AXP, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). Market breadth Monday was positive and trading volume was light. On the New York Stock Exchange, winners beat losers by more than three to one on volume of 980 million shares. On the Nasdaq, advancers beat decliners by more than two to one on volume of 1.86 billion shares. World markets: Strong markets overseas helped boost U.S. markets. In Europe, London's FTSE 100, the German DAX and France's CAC 40 all surged more than 2%. Asian markets rallied as well. Currency and commodities: The dollar gained against the euro, recovering from earlier weakness and also gained against the yen. The dollar's weakness versus the euro had given a boost to dollar-traded oil and gold prices through most of the session, but oil trimmed most of those gains by the close. U.S. light crude oil for January delivery rose 9 cents to settle at $77.56 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $18 to settle at $1,164.70 an ounce after touching a record high of $1,174 earlier in the session. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.35% from 3.34% Friday. Treasury prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

23-Nov-2009 07:26

|

||

|

x 0

x 0 Alert Admin |

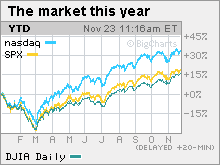

Wall Street buckles in for a bumpy rideStock market stumbles after hitting 13-month highs earlier in the week. Stocks may bounce around with low trading volume next week, but will likely trend higher for the rest of 2009. NEW YORK (CNNMoney.com) -- Stocks hit a bit of a snag over the past few days, and the holiday-shortened week to come won't likely help them bounce back. "We're going to see the market get pushed around on very little volume, like a tumbleweed on the prairie," said Jack Ablin, chief investment officer at Harris Private Bank. With only three and a half trading days next week, and with many traders away on vacation, volumes are expected to be much lower. Low trading volumes often means stocks become more volatile. That won't be a good thing if next week's economic data is as bad as economists think it will be. Though three housing reports are expected to show very moderate improvement in sales and prices, a revised reading on the nation's gross domestic product will likely show the economy didn't grow nearly as much as the initial estimate. "That GDP number may catch people by surprise," said Art Hogan, chief market strategist at Jefferies & Co. "It's probably going to be revised lower, and it will be very interesting to see how the market reacts to that." The market had been taking sour economic news in stride, even surging to 13-month highs earlier in the week. Investors continued to pour money into stocks as the dollar weakened. Federal Reserve Chairman Ben Bernanke said on Monday that he was concerned about the dollar getting hammered, but he maintained that the Fed will continue to keep interest rates low in an effort to spur economic growth. A lower dollar pushed stocks higher Monday and Tuesday, as the S&P 500 soared above the 1,100 level and the Dow Jones industrial average neared 10,500 points. But the trend reversed on Wednesday, Thursday and Friday, as economic woes sent investors moving back into the dollar and stocks headed lower. The S&P 500 sank below 1,100 and the Dow closed just above 10,300, eking out a meager 0.5% gain for the week. Still, experts think this recent rough patch will be just a temporary glitch, and the steep climb that has continued almost unabated since March will likely continue for the rest of 2009. "The correlation with the dollar has been very tight over the past week," said Hogan. Hogan also said investors have been counting out consumers from the economic recovery, and any positive surprise in the holiday shopping season could be a huge boon for stocks. "The consumer has gotten written off really quickly in this environment," he said. "There have been some very conservative expectations for Black Friday, and there's a real possibility for an upside surprise that will give markets a healthy boost." The week ahead

Monday: The National Association of Realtors reports existing home sales for October at 10:00 a.m. ET. Sales of homes by homeowners are expected to have increased to 5.65 million last month from 5.57 million in September. After the closing bell, Hewlett-Packard (HPQ, Fortune 500) will formally announce its quarterly financial results. Last week, the tech giant pre-announced those results, saying it earned $1.14 per share, excluding charges, on revenue of $30.8 billion. Tuesday: The Commerce Department reports a revised reading of Gross Domestic Product, the broadest view of the nation's economy, at 8:30 a.m. ET. After last month's advanced GDP estimate showed the economy returned to growth at a 3.5% annual rate in the third quarter, economists believe the revised reading will show the economy grew at a rate of 3% last quarter. Also on Tuesday, Case Schiller will report its home price index at 9 a.m ET. Economists expect the report to show prices in the 20-city index to have fallen 9.1% in September after tumbling 11.3% in August. And a reading on the Conference Board's consumer confidence index at 10 a.m. ET is expected to show consumer sentiment slipped slightly this month to a reading of 47.5, down from 47.7 in October. Finally, at 2 p.m. ET, the Federal Reserve will release the minutes from its Nov. 3-4 meeting, in which the central bank opted to keep interest rates steady. The minutes will also include the Fed's economic forecasts for the coming quarters and its long-term projections. Wednesday: The day before Thanksgiving will be jam-packed with economic data reports, beginning with the Commerce Department's report on personal income and spending at 8:30 a.m. ET. Spending is expected to have risen 0.5% in October, compared to a 0.5% decrease in September. Economists predict income rose 0.2% last month after remaining flat in the previous month. Usually announced on Thursday, the government's weekly unemployment insurance claims report will be released on Wednesday at 8:30 a.m. ET next week because of the Thanksgiving holiday. The Census Bureau will release its monthly report on durable goods orders at 8:30 a.m. ET. Economists expect goods orders to tick up 0.5% after growing 1% in September. A report on new home sales will also be released by the Census Bureau at 10 a.m. ET. Like existing home sales, sales of new homes are expected to have risen in October, with 414,000 sales. In September, 402,000 new homes were sold. The government will report on crude oil inventories at 10:30 a.m. ET. Economists believe the nation's oil reserves fell by 887,000 barrels this week. Thursday: The markets are closed on Thursday for Thanksgiving. Friday: The stock market will close early at 1:00 p.m. ET. Economists will be keeping a close eye on retail sales Friday. Known as "Black Friday" the day after Thanksgiving is traditionally the biggest shopping day of the year. -- CNNMoney.com staff writer Benjamin Rooney contributed to this report |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Nov-2009 08:51

|

||

|

x 0

x 0 Alert Admin |

Stocks drop for second straight dayMajor indexes decline as nervousness about the economy puts the brakes on a recent rally. The dollar firms; tech sector hurt by downgrade. The Dow Jones industrial average (INDU) fell 94 points, or 0.9%, to 10,332.4. The S&P 500 (SPX) sank 1.3% to end below the key 1,100 point level. The Nasdaq composite (COMP) lost 36 points, or 1.6%, to close at 2,156.82. Tech shares led decliners after analysts at Bank of America Merrill Lynch downgraded the semiconductor industry. Chip makers Intel (INTC, Fortune 500) and AMD (AMD, Fortune 500) both fell more than 3%. The downgrade came one day after two key software companies issued bearish profit outlooks. After the closing bell, Dell Inc. reported third-quarter results that fell far short of analysts' expectations. "The market is rethinking its outlook for technology growth," said Nick Kalivas, vice president of financial research at MF Global. Meanwhile, the dollar firmed against rival currencies and prices for U.S. Treasurys rose as investors flocked to assets that are considered safe havens. The stronger dollar weighed on the oil market, which undermined shares of energy producers Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500). Gold prices recovered from earlier losses to close at a fresh all-time high. "I think people are playing defense," Kalivas said. "The economic data we've seen recently doesn't encourage people to take on more risk in their portfolios." Analysts said a move lower was not surprising after stocks surged to a 13-month high earlier in the week. "I think a lot of people are concerned that we've come too far, too fast," said Russell Lundeberg Jr., chief investment officer at Barrett Capital Management. Meanwhile, investors continued to focus on the the plight of the dollar, which has shown some signs of strength recently after Federal Reserve officials -- including chairman Ben Bernanke -- indicated that the central bank is monitoring the currency's decline. "The market has definitely been trading off the dollar recently," said Ron Kiddoo, chief investment officer at Kozad Asset Management. "I think the stronger dollar is a bigger factor than the jobless claims." A weekly government report showed the number of Americans filing first-time claims for unemployment benefits was unchanged from the preceding week. Stocks ended lower Wednesday after government data showed a drop in new home construction. The surprisingly weak housing report was the latest in a string of less-than-stellar economic indicators that have put many market participants on edge. Investors are now looking for more concrete evidence of improvement in the job market, retail sales and corporate profits. "Overall, it's not surprising that people are getting nervous," said Lundeberg. "We still have a long way to go in the recovery." Analysts said the volume of shares trading hands recently has been low, suggesting that many big investment funds have moved to the sidelines to protect gains before publishing their year-end reports. Economy: The Labor Department released its weekly report on initial jobless claims, showing that the number of claims was unchanged from the prior week. The government said that jobless claims totaled 505,000 in the week ended Nov. 14. This was very close to the forecast of 504,000 claims, according to a consensus of economist opinion compiled by Briefing.com. A report on leading economic indicators showed an increase of 0.3% in October, below the 0.4% forecast and the 1% rise in September. The Philadelphia Federal Reserve survey, a reading on regional manufacturing, rose slightly. Companies: Dell (DELL, Fortune 500) said net income fell 54% to $337 million, or 17 cents per share, for the quarter ended Oct. 30. Results included charges of 6 cents per share for cost cutting and other one-time expenses. Without the charges, the PC maker said it earned 23 cents per share. Analysts polled by Thomson Reuters had forecasted adjusted earnings of 28 cents per share. Retail apparel maker Gap Inc. (GAP, Fortune 500) reported quarterly results that were in line with analysts' expectations. The company said after the closing bell that net income rose by 25% in the quarter on improved profit margins and strong sales at its discount chain Old Navy. Sears Holdings (SHLD, Fortune 500) posted a narrower-than-expected quarterly loss of $127 million, or $1.09 a share, an improvement from the loss of $146 million, or $1.16 a share, a year earlier. Results were helped by the first increase in same-store sales at its Kmart unit in four years. JPMorgan Chase (JPM, Fortune 500) said Thursday it was buying the half of U.K. broker Cazenove that it does not already own for about $1.67 billion. World markets: Asian shares mostly fell. Japan's Nikkei tumbled 1.3%. Major European indexes were also closed lower, with the CAC-40 in Paris falling 1.8%. The price of oil fell $2.12 to settle at $77.46 a barrel. The price of gold recovered from earlier losses to settle at a record high of $1,141.90 per ounce, up 70 cents from the previous day's closing price. Bonds. Treasury prices rose. The yield on the benchmark 10-year note, which moves inversely to its price, fell to 3.34% from 3.36% late Wednesday. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

19-Nov-2009 13:26

|

||

|

x 0

x 0 Alert Admin |

Asian shares lowerTOKYO Japanese stocks fell 0.96 per cent in morning trade on Thursday, depressed by a weak performance overnight on Wall Street and worries about domestic firms' plans to issue new shares. The benchmark Nikkei-225 index fell 92.79 points to 9,584.01 by the lunch break. The broader Topix index of all first-section shares lost 11.45 points, or 1.35 per cent, to 838.61. HONG KONG Hong Kong shares were 0.60 per cent lower in early trade on Thursday, with the benchmark Hang Seng Index losing 136.41 points to 22,703.92. SHANGHAI Chinese shares were flat by midday on Thursday as declines in banking issues offset gains in pharmaceutical makers, which were boosted by expectations of strong flu season sales, dealers said. The Shanghai Composite Index, which covers both A and B shares, was down 0.09 per cent, or 2.85 points, at 3,300.38. 'The stock market is digesting its recent gains,' Wu Dazhong, an analyst with Shenyin Wanguo Securities told Dow Jones Newswires, noting the benchmark index had jumped 19 percent since the end of September. The Shanghai A-share index fell 2.9 points, or 0.08 percent, to 3,461.50, while the Shenzhen A-share index gained 4.49 points, or 0.36 per cent, to 1,251.61. KUALA LUMPUR At 12.30pm on Thursday, there were 191 gainers, 375 losers and 240 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,275.45 up 0.35 of a point, the FBMACE was at 4,413.78 down 54.80 points, and the FBMEmas was at 8,515.31 down 6.05 points. Turnover was at 849.399 million shares valued at RM1.749 billion. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

19-Nov-2009 11:20

|

||

|

x 0

x 0 Alert Admin |

Asian shares higherTOKYO Japanese stocks fell 0.96 per cent in morning trade on Thursday, depressed by a weak performance overnight on Wall Street and worries about domestic firms' plans to issue new shares. The benchmark Nikkei-225 index fell 92.79 points to 9,584.01 by the lunch break. The broader Topix index of all first-section shares lost 11.45 points, or 1.35 per cent, to 838.61. SHANGHAI Chinese shares rose 0.58 per cent in early trade on Thursday, led by oil companies as oil prices rose overnight after key data showed a steeper-than-expected drop in US stockpiles, dealers said. The Shanghai Composite Index, which covers both A and B shares, was up 19.25 points at 3,322.49. The Shanghai A-share index rose 20.21 points, or 0.58 per cent, to 3,484.61, while the Shenzhen A-share index gained 5.41 points, or 0.43 per cent, to 1,252.53. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

19-Nov-2009 08:06

|

||

|

x 0

x 0 Alert Admin |

Stocks hit a roadblockMajor indexes retreat from 13-month highs after a surprise drop in new home construction fuels concern about the strength of the economic recovery. NEW YORK (CNNMoney.com) -- Stocks closed slightly lower Wednesday, paring deeper losses, after a drop in new home construction made investors jittery about the economic recovery and wary profit outlooks weighed on the technology sector. The Dow Jones industrial average (INDU) was down 11 points, or 0.1%, to close at 10,426.3. The S&P 500 (SPX) fell less than one point to 1,109.8. The tech-heavy Nasdaq composite fell (COMP) 10 points, or 0.5%, to 2,193.1. Stocks opened lower and struggled for most of the day before moving off session lows in the last 30 minutes of trade. The modest retreat, which came one day after the major indexes closed at their highest levels in 13-months, was sparked by government data that showed initial construction of new single-family homes fell to a six-month low in October. The unexpected drop came despite government efforts to stimulate the battered housing industry, and highlighted fears that stocks may have gotten ahead of economic reality. "A lot of people were betting on a housing recovery," said Abigail Doolittle, a portfolio manager at Johnson Illington Advisors. "The decline in construction starts is probably making some people nervous." Investors were also focused on the outlook for the technology sector after Salesforce.com and Autodesk offered cautious earnings guidance for the fourth quarter. Tech giant Hewlett-Packard (HPQ, Fortune 500) was among leading decliners on the Dow, while Microsoft (MSFT, Fortune 500) bucked the trend. Shares of Bank of America (BAC, Fortune 500) rose 3.68% after hedge-fund guru John Paulson reportedly told investors that he expects the stock price to almost double in the next two years. Meanwhile, the dollar fell broadly against rival currencies, with the euro climbing near $1.50 at one point. The weak dollar helped push gold prices to another all-time high, while oil prices closed above $79 a barrel. Investors have looked to the dollar for direction in recent weeks, with a softer greenback normally reflecting a stronger appetite for risky assets such as commodities and stocks. But with the major indexes up some 30% from the lows of early March, many investors have become reluctant to push the market higher until they see more concrete signs that an economic recovery is underway. "At the margin, the economic data has been stabilizing," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors. "It's been 'less bad' and that has been enough for investors up to now. Whether 'less bad' continues to be enough remains to be seen." Analysts said the volume of shares trading hands recently has been low, suggesting that many big investment funds have moved to the sidelines to avoid jeopardizing gains before publishing year-end results. On the New York Stock Exchange, losers topped winners 3-to-1 on volume of 858 million shares. On the Nasdaq, decliners toped advancers almost 2-to-1 on volume of 1.8 billion shares. Economy: The government reported that housing starts fell more than 10% to an annual rate of 529,000 in October, the lowest level in six months. An annual rate of 600,000 housing starts was expected, according to a forecast from Briefing.com consensus. The revised rate for September was 592,000. The government reported that the annual rate of housing permits fell 4% to 552,000 in October, from the revised September rate of 575,000. This was lower than the 580,000 permits expected for October, according to Briefing.com consensus. . The government also reported its Consumer Price Index, a key measure of inflation, rose 0.3%. The CPI was expected to rise 0.2% in October, according to a consensus of economists surveyed by Briefing.com. The core CPI, which excludes volatile food and energy prices, rose 0.2% in October. That was slightly more than the 0.1% increase expected for October, according to Briefing.com consensus. Companies: Salesforce.com (CRM), which makes Web-based business software, reported third-quarter earnings that were in line with analyst expectations. But the results also showed a slowdown in contracts for new business, which sent shares down more than 3%. Shares of Autodesk (ADSK) plunged 10% after the maker of computer-aided drafting software forecast fourth-quarter earnings that were below Wall Street's consensus view. On Tuesday, Goldman Sachs (GS, Fortune 500) said that it is launching a $500 million initiative aimed at propping up small businesses. Obama administration officials, including Treasury Secretary Tim Geithner, are due to meet Wednesday to address the small business lending drought. World markets: Japan's Nikkei index finished the session 0.6% lower. Major indexes in Europe closed mixed. Currency and commodities: The dollar, which has suffered from recent weakness, was down versus all major currencies. The dollar index (DXY), which measures the U.S. currency's value against a basket of rivals, was down 0.3% to 75.14 The price of oil rose 56 cents to end at $79.58 per barrel after hitting a high of $80.33 earlier in the session. Gold rose $1.80 to settle at another all-time high of $1141.20 an ounce. It also hit a record trading high of $1,149.40 an ounce. Bonds: Treasury prices fell as investors focused on Wednesday's inflation report. The yield on the benchmark 10-year note, which moves opposite its price, rose to 3.36% from 3.32% late Tuesday. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

17-Nov-2009 07:42

|

||

|

x 0

x 0 Alert Admin |

S&P 500 shoots above 1,100Wall Street rallies as energy and commodity shares rise on weak dollar; Bernanke says economic recovery will be modest.The Dow Jones industrial average rose (INDU) 136 points, or 1.3%, to close at 10,406.96. That's the highest level for the blue-chip indicator since October 2008. The S&P 500 (SPX) gained 15.8 points, or 1.8%, to close above the psychologically important 1,100 level. The Nasdaq composite (COMP) rose 30 points, or 1.4%, to 2,197.5. Stocks followed overseas markets higher in early trade following strong economic data out of Japan. The market held gains after a closely watched report on retail sales came in mixed. Analysts said the main driver of Monday's rally was the weak U.S. dollar, which helped push gold prices to a record high and fueled a 3% gain in the oil market. The dollar has lost more than 7% this year against rival currencies as investors take advantage of U.S. interest rates near zero percent to fund bets in more risky stock and commodities markets. On Monday, the battered greenback fell 0.3% to touch a 15-month low against a basket of other currencies. Meanwhile, Bernanke said the U.S. central bank expects to keep interest rates "exceptionally low" for an "extended period" as the U.S. economy recovers at a modest pace. Art Hogan, chief market analyst at Jefferies & Co., said the market is focused on the anemic dollar. "As the dollar weakens, commodity prices go up," he said. "It's nothing new, but there's really nothing else driving the market right now." Stocks have soared over the past two weeks as investors have gained confidence in the pace of the economic recovery. The market has also been supported by signs that policy makers around the world will keep economic stimulus efforts in place for a prolonged period of time. Monday's rally reflects the "continuing resiliency of the market," said Richard Sparks, senior equities analyst at Schaeffer's Investment Research. He said stocks could continue higher as the market overcomes key technical levels and more investors are drawn in from the sidelines. With the Dow holding firmly above the psychologically important 10,000 level, investors are now turning their attention to another key high-water mark. Analysts say a sustained push above 1,100 points on the S&P 500 could pave the way for further gains in the weeks ahead. "The big news today was the S&P closing above 1,100," said David Levy, a portfolio manager at Kenjol Capital Management. "From a short-term perspective, that's very bullish for the market." After failing to close above 1,100 on three separate occasions over the last few months, the push above that key level suggests that the market is becoming more convinced that an economic recovery is under way, he said. "We see the market going higher into year end," Levy said. Bernanke. Speaking in New York, Bernanke said financial conditions are significantly better than they were a year ago as markets around the world have stabilized. But he warned that constrained bank lending and the weak job market "likely will prevent the expansion from being as robust as we would hope." Given the challenges facing the economy, interest rates will probably remain "exceptionally low" for "an extended period," he said. Bernanke also noted that the Federal Reserve, which is not responsible for managing currency fluctuations, is watching the decline of the U.S. dollar. "We are attentive to the implications of changes in the value of the dollar and will continue to formulate policy to guard against risks to our dual mandate to foster both maximum employment and price stability. Economy: Retail sales jumped 1.4% in October from the prior month, according to the Census Bureau, exceeding the increase of 0.9% expected by a consensus of economists surveyed by Briefing.com. Excluding automobiles, sales rose 0.2%, falling short of the 0.4% gain forecast by Briefing.com consensus. That's compared to an overall decline of 1.5%, or an increase of 0.5% without auto sales, the prior month. A report from the New York Federal Reserve Bank showed manufacturing activity in New York State slowed in November. The Empire State index fell to 23.51 in early November from 34.57 in October, which was a five-year high. Companies: Home improvement retailer Lowe's (LOW, Fortune 500) reported a 30% drop in quarterly profit, but offered an optimistic outlook for fourth-quarter earnings. General Motors (GM, Fortune 500), releasing its first financial results since emerging from bankruptcy in July, said it lost $1.2 billion in the third quarter. It also said it would begin repaying government loans in December. The U.S. government would receive $1 billion, with nearly $200 million going to the governments of Canada and Ontario. After the markets closed, troubled auto and mortgage lender GMAC shook up its executive suite, naming former Citigroup (C, Fortune 500) executive Michael Carpenter CEO. World markets: Stocks worldwide were lifted amid optimism that governments would keep up stimulus efforts. In Asia, Japan's Nikkei added 0.2% after finance ministers said the country's economy grew 1.2% in the third quarter. European shares also closed higher. Money, oil and gold: The dollar was lower versus major international currencies. The dollar index (DXY), which measures the U.S. currency's value against a basket of rivals, was down 0.3% to 74.94. Commodities continued to benefit from the weaker greenback. Oil for December delivery jumped $2.55 to close at $78.90 a barrel. And gold prices, which have been on a tear this month, surged $22.50 to end at a new record of $1,139.20 a troy ounce. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

16-Nov-2009 15:36

|

||

|

x 0

x 0 Alert Admin |

BEIJING - FOREIGN direct investment in China rose 5.7 per cent year-on-year in October for the third monthly increase in a row, the commerce ministry said on Monday. China attracted US$7.1 billion in foreign investment last month, ministry spokesman Yao Jian told reporters. The increase compared with an 18.9 per cent increase in September and a seven per cent jump in August, which ended 10 straight months of declines. Foreign direct investment in the first 10 months of 2009 fell 12.6 per cent over the same period last year to US$70.8 billion (S$98 billion). |

||

| Useful To Me Not Useful To Me | |||